Subscribe to wiki

Share wiki

Bookmark

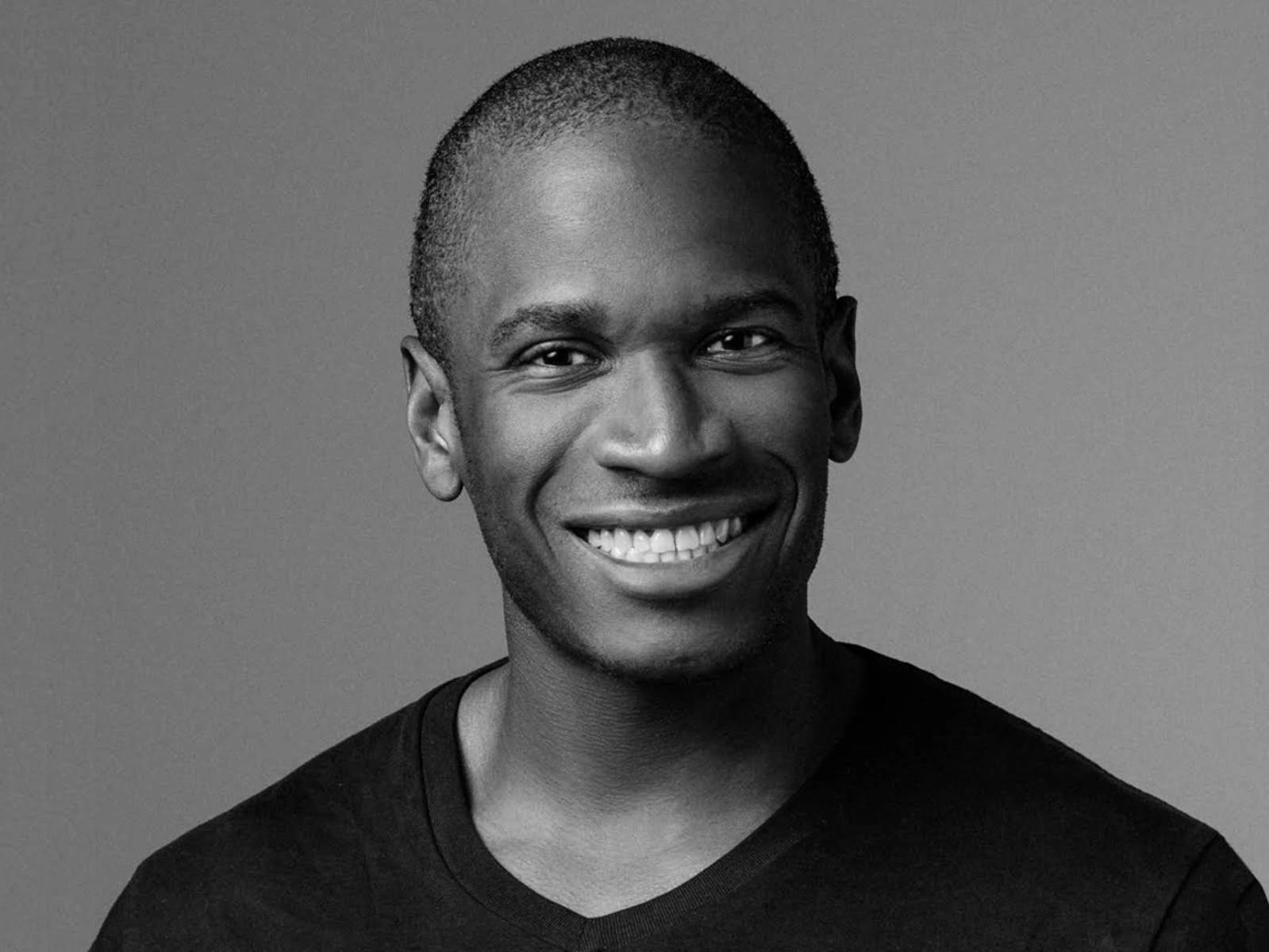

Arthur Hayes

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Arthur Hayes

Arthur Hayes (born 1985) is an American entrepreneur, co-founder, and former CEO of the cryptocurrency exchange BitMEX (Bitcoin Mercantile Exchange). He is also the Co-founder of 100x Group and a Chief Investment Officer at Maelstrom. He is based in Hong Kong. [1][2][6]

Early Life & Education

Arthur Hayes was born in Detroit, Michigan, USA, to middle-class parents who worked for General Motors (GM). He attended Nichols School, a private preparatory school in Buffalo, New York, where he played varsity tennis and was a varsity cross-country runner. He graduated second in his class in 2004. His family relocated to Buffalo after searching for a school that they felt would provide the ideal learning environment for him as a student and an athlete. Hayes has since created scholarships for students to experience the same quality education he received at Nichols. His mother, Barbara Hayes, said, "Nichols gave him the setting, the stimulation, and at one point, the scholarship to thrive." [4][5]

In 2006, Hayes attended HKUST Business School in Hong Kong. He graduated from the University of Pennsylvania, Wharton School of Business in 2008 with a Bachelor of Science in Economics, Finance. [3][5]

Career

Hayes was awarded a graduate scheme contract at Deutsche Bank where he worked in the London office before moving to Hong Kong to continue his investment banking career. He worked for Deutsche Bank, from 2008-2011 as an equity derivatives trader and associate. In 2011, Hayes left Deutsche Bank and began working as a Delta One Trader for Citibank in Hong Kong until May 2013, which served as a basis for later work with cryptocurrencies. [2][5]

BitMEX

Arthur Hayes partnered with Oxford-educated mathematician/Software Developer Ben Delo and Programmer/Crypto enthusiast Samuel Reed to co-found the crypto exchange BitMEX in 2014. They looked to build "the best peer-to-peer trading platform to compete directly with Coinbase, Binance, and Coinmama". They built a complex system using leveraged contracts, quanto futures, and perpetual swaps. This allowed users to trade Bitcoin as they would be able to trade any other derivative, :

“I wanted to create a more professional exchange for people to trade [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin), when I started trading in 2013 there was nothing like this”. [5]

Bitmex operates as a market maker and holds Bitcoin on behalf of companies that are hesitant to accept the cryptocurrency on their balance sheet or as a method of payment due to the risk of price volatility. Bitmex has built one of the most complex trading systems which has attracted investors to its exchange. On its first day, the exchange made $50 million in trading, and in the first year of trading, it generated over $1 billion in income. [1][5]

“We’re moving from an [analog] - (https://iq.wiki/wiki/analog) society in terms of money transfer to a digital one, that’s going to be hugely disruptive. And I saw a chance with [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) and crypto to actually create a company that could benefit from this hugely chaotic transformation. And the great thing about [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) is it’s [permissionless] - (https://iq.wiki/wiki/permissionless). There’s a piece of software; me and my co-founders saw we had a business model; we didn’t have to ask permission to build this, and what other industry could three guys go and try to build an exchange that does billions of dollars a day turnover” – Hayes in an interview with the Forkast podcast in August, 2020. [7]

In December 2019, BitMEX and its CEO were sued for USD 300 million by Frank Amato, a former JPMorgan Chase commodity derivatives trader, and RGB Coin Ltd., who claimed to have been the first seed investor of BitMEX in 2015. According to the suit, the initial USD 30,000 investment was supposed to later be converted into equity, but they weren’t granted the equity, the report added. In January 2021, the lawsuit was closed, with one attorney claiming it was settled out of court. [8][9][10]

In October 2020, Hayes and his business partners were accused by the United States Commodity Futures Trading Commission (CFTC) of violating the Bank Secrecy Act by failing to implement and maintain an adequate anti-money laundering program. Six months later, in April 2021, Arthur Hayes surrendered to United States authorities in Hawaii. He was released after posting a $10-million bail bond pending future proceedings in New York. [11][12]

In August 2021, BitMEX agreed to pay up to $100 million to resolve the case from CFTC, and the Financial Crimes Enforcement Network (FinCEN). In the announcement, the CFTC said the U.S. District Court for the Southern District of New York had entered a consent order for HDR Global Trading Limited, 100x Holding Limited, ABS Global Trading Limited, Shine Effort Inc Limited, and HDR Global Services Limited to be charged with illegally operating the BitMEX platform. [13]

In February 2022, Hayes and BitMEX co-founders pleaded guilty to not having an anti-money laundering program. Being a first-time offender with a charitable history, Hayes received a sentence of six months of home confinement, two years of probation, and a $10 million fine, reflecting his gains from the offense. [14]

100x Group

Arthur Hayes co-founded the 100x Group in July 2020 and served as its CEO until October 2020. The 100x Group is a holding company that comprises HDR Global Trading, the parent company of BitMEX. The group was established with the mission of reshaping the digital financial system into a more inclusive one. [15]

Maelstrom

In December 2022, Arthur Hayes became a Chief Investment Officer (CIO) at Maelstrom, A Hayes family office fund, investing in products, infrastructure, and services. In March 2023, Hayes posted on Linkedin:

"I'm pleased to be more public about my family office Maelstrom. You will see our Head of Investments, Akshat Vaidya at conferences globally. Let's fuck some shit up!"[32][16]

On July 17, 2024, Maelstrom announced its grant program to support Bitcoin developers.

"[[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) is the bedrock asset in the crypto space and unlike other crypto projects, [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) never conducted an offering to raise funds for its technical development. Maelstrom, like other companies in the space, indirectly relies on the work of open-source [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) developers. We are therefore keen to give back and donate to the [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) technology, on which the crypto ecosystem depends." - the website stated[29]

The program's objective is to help with the technical development of Bitcoin and enhance its resilience, scalability, censorship resistance, and privacy characteristics. According to the website, the Grants can range from $50,000 up to $150,000 per developer. [29][30]

Covalent

On June 11, 2024, Arthur Hayes joined Covalent, a blockchain data infrastructure startup, as its strategic advisor. Hayes seeks to help Covalent become the leading data infrastructure startup, particularly within the Ethereum ecosystem, and to serve the artificial intelligence (AI) industry. [31]

"[[[Covalent] - (https://iq.wiki/wiki/covalent)] - (https://iq.wiki/wiki/covalent)] - (https://iq.wiki/wiki/covalent)'s [[[Ethereum] - (https://iq.wiki/wiki/ethereum)] - (https://iq.wiki/wiki/ethereum)] - (https://iq.wiki/wiki/ethereum) Wayback Machine (EWM) ensures persistent, long-term access to historical [blockchain] - (https://iq.wiki/wiki/blockchain) data, which will power the next generation of use cases — including for AI models in particular," Hayes told The [[[Block] - (https://iq.wiki/wiki/block)] - (https://iq.wiki/wiki/block)] - (https://iq.wiki/wiki/the-[block](https://iq.wiki/wiki/block)). [31]

When asked by The Block what motivated him to join Covalent as its advisor, Hayes said that Covalent's CQT token has been;

"undervalued relative to its competitor set (e.g. The Graph) for a while — investors outright missed that story. Now, with [[[Covalent] - (https://iq.wiki/wiki/covalent)] - (https://iq.wiki/wiki/covalent)] - (https://iq.wiki/wiki/covalent) expanding its offering further, that dissonance between traction and narrative has widened. As a storyteller, I aim to help narrow that gap."

Hayes is being compensated in CQT tokens, he said, because "as a general rule, we only take compensation in tokens, because we believe in aligning ourselves fully with the team, investors, customers, and retail. We're alongside everyone else for the same ride." [[32]] - (#cite-id-bx6f7krj01s)

Cryptocurrency Views

Binance

Arthur Hayes voiced concerns about the arbitrary nature of punishments in the United States, using the $4.3 billion settlement paid out by Binance as an example. In his blog post on November 28, 2023, Hayes argued that the treatment of Binance and its former CEO, Changpeng Zhao (CZ), underscores the system's unfairness. Hayes highlighted Binance’s role in allowing everyday people to own intermediaries and cryptocurrency assets without needing traditional players. [17][18]

"Never before had people been able to own a piece of an industrial revolution in under ten minutes via desktop and mobile trading apps"[17]

Hayes argued that the establishment’s financial and political powers felt threatened by intermediaries like Binance, which enabled individuals to bypass traditional institutions and participate directly in the crypto revolution. [18]

“Obviously, the treatment of CZ and [[[Binance] - (https://iq.wiki/wiki/binance)] - (https://iq.wiki/wiki/binance)] - (https://iq.wiki/wiki/binance) is absurd and only highlights the arbitrary nature of punishment at the hands of the state.”[17]

Hayes encourages readers to consider investing in cryptocurrencies, particularly Bitcoin (BTC), after witnessing the immense energy directed toward penalizing CZ and Binance.

"If you don’t want to get the fuck long [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) and other cryptos after seeing how much energy the state brought to bear on CZ and [[[Binance] - (https://iq.wiki/wiki/binance)] - (https://iq.wiki/wiki/binance)] - (https://iq.wiki/wiki/binance), I don’t know what else you need to see." - Hayes wrote in his blog[17]

Bitcoin

On December 1, 2023, Arthur Hayes tweeted:

"It’s December and I don’t know about you but I’m ready for an old white man to give me some gifts. JAYPOW cut the fucking rates and send $BTC 2 Da Moon!" - Arthur Hayes [19]

Hayes is eagerly anticipating Federal Reserve Chairman Jerome Powell's upcoming speech. He jokingly referred to it as a possible "gift" from an "old white man." Hayes is hopeful that Powell will make a bold move by slashing interest rates. He believes that such a decision could propel Bitcoin to unprecedented heights. [20]

Hayes has also previously expressed bullish views on Bitcoin. On November 25, 2023, he shared his thoughts on X (fka Twitter) alongside a chart depicting net reverse repurchase agreement (RRP) and treasury general account (TGA) balance changes, Hayes referred to United States Treasury Secretary Janet Yellen as “Bad Gurl Yellen”[23]. [21][22]

"Getting my feet did and observing how Bad Gurl Yellen is busy pumping financial assets. Don’t get distracted, $ liquidity is increasing and $BTC will go up as well. This is the chart of net RRP and TGA balance changes"[21]

In the X post, Hayes encouraged fellow Bitcoin enthusiasts to stay focused, highlighting a significant uptick in U.S. dollar liquidity. He suggested BTC will likely mirror the rise in dollar liquidity, leading to an increase in its price. [22]

In a December 22, 2023 blog post, Arthur Hayes shared his opinion on Spot Bitcoin ETFs. He explained that Bitcoin has value because “it moves.” However, spot Bitcoin ETFs are made to “vacuum up assets” and “store them in a metaphorical vault,” he said. [24][25]

"Imagine a future where the largest Western and Chinese asset managers hold all the [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) in circulation. This happens organically as people confuse a financial asset with a store of value. Because of their confusion and laziness, people purchase [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) ETF derivatives rather than buying and hodling [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) in self-custodied wallets. Now that a handful of firms hold all the [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin), and have no actual use for the [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) [blockchain] - (https://iq.wiki/wiki/blockchain), the coins never move again. The end result is miners turn off their machines as they can no longer pay for the energy required to run them. Bye-bye, [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)!"

Hayes imagined a scenario unfolding where a new cryptocurrency monetary network would take Bitcoin’s place and expand upon Satoshi Nakamoto’s original vision of peer-to-peer electronic money.

"It is beautiful when you think about it. If [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) becomes just another state-controlled financial asset, it dies because it isn’t used. The death of [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) then creates space for another crypto monetary network to grow in its place. This network could just be a reboot of [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin) or something different that is an improved adaptation of the original [[[Bitcoin] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin)] - (https://iq.wiki/wiki/bitcoin). Either way, the people will once again have a non-state-controlled monetary asset and financial system. Hopefully, the second time around, we will learn not to hand our private keys to the baldies." - he concluded [24]

Stablecoin

In a podcast with Laura Shin published on December 30, 2023, Arthur Hayes stated that he expects big banks to take over the stablecoin business, now dominated by Tether, the company behind USDT. [26]

Hayes explained that while Tether has configured itself to be a great product in the crypto market, it has only achieved its status due to the refusal of the U.S. banking system to offer a similar product. [26]

"The people who own Tether make something like $4 or $5 billion in free cash [flow] - (https://iq.wiki/wiki/flow) every year. It’s basically an interest rate: they basically take dollars, stuff it in a bank account, and then they go buy treasury bills and they earn the spread."[28]

He foresees a possible disruption, as banks might eventually enter the market with their digital currencies. Hayes predicted that once banks recognize the profit potential in this domain, they will quickly move to dominate it, leveraging their existing infrastructure and customer trust. He said that once banks are given the green light to engage with the digital assets sector, they have the necessary comprehensive financial networks and regulatory compliance frameworks to hit the ground running. [27]

Hayes predicts that banks like JPMorgan will replace Tether and other stablecoins companies if they launch their own stablecoin. [27]

“At the end of the day, they don’t have any defensible business because they rely on the banks to custody their funds and allow them to trade dead instruments,” - he concluded.[28]

Ethereum

In early August 2025, Arthur Hayes sold 2,373 ETH, worth approximately $8.32 million, when the token was trading near $3,500. The sale was part of a broader liquidation of over $13 million in crypto assets, which Hayes attributed to macroeconomic concerns, including potential U.S. tariffs and a weak July Non-Farm Payrolls report. He predicted these pressures could push Ether's price down to $3,000. [33][34][35]

However, just days later, Hayes reversed his position as Ethereum's price rallied. He bought back into the cryptocurrency, spending $10.5 million to acquire ETH at prices above $4,150, roughly 18% higher than his exit point. Hayes admitted his miscalculation on X (formerly Twitter), posting, "Had to buy it all back," and humorously added, "I pinky swear, I’ll never take profit again." This reversal occurred amid significant institutional accumulation of ETH, with whales and institutions acquiring over $4.17 billion worth of the asset since July 10, 2025. [33][34][36]

August 2025 Investments

In mid-August 2025, Hayes engaged in a significant buying spree, accumulating over $14 million in various cryptocurrencies over five days. This move signaled strong confidence in select tokens, particularly within the DeFi ecosystem. The purchases were executed across multiple wallets and platforms, including centralized exchanges like Binance and Kraken, as well as decentralized protocols. [37][38][39]

His acquisitions included a diverse range of assets focused on liquid staking, yield generation, and synthetic assets. The breakdown of his purchases included: [36][38]

- 1,750 ETH valued at approximately $7.43 million

- 58,631 HYPE (Hyperliquid) valued at $2.62 million

- 3.1 million ENA (Ethena) valued at $2.48 million

- 1.29 million LDO (Lido DAO) valued at $1.83 million

- 184,610 PENDLE valued at $1.02 million

- 420,000 ETHFI (Ether.fi) valued at $516,600

This investment strategy highlighted a blend of established assets like Ethereum with emerging projects in high-growth sectors. The selection of tokens such as LDO, ENA, PENDLE, and ETHFI indicated a targeted focus on innovative DeFi protocols. Market analysts noted that Hayes has a history of making bold, concentrated investments when market sentiment is mixed, often targeting assets with clear utility within the Web3 ecosystem. [37][40]

In his capacity as a strategic advisor to both Ethena and Hyperliquid, Hayes leveraged his significant holdings of ENA and HYPE tokens. In early September 2025, just ahead of the governance vote on USDH integration, Hayes purchased an additional 1.21 million ENA tokens, worth $995,000, over a 48-hour period, increasing his total holdings to 5.02 million tokens valued at approximately $3.91 million. He voted in favor of integrating USDH, a new decentralized, yield-bearing stablecoin, as a collateral asset on both Ethena's protocol and the Hyperliquid exchange. Hayes explained his rationale, stating, "More collateral types equals more users, which equals more fees for ENA and HYPE stakers." [41][42]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)