Subscribe to wiki

Share wiki

Bookmark

Clipper SAIL

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Clipper SAIL

SAIL is the utility and governance token of the AdmiralDAO and Clipper DEX, a decentralized exchange that aims to minimize transaction costs and prioritize fairness for traders of all sizes. [1]

AdmiralDAO

AdmiralDAO, supported by Admiralty LLC, operates as a non-profit member-managed LLC registered in the Marshall Islands. The DAO oversees a multi-sig wallet with multiple signers. It is dedicated to decentralization, although its implementation is still in progress. The focus lies on ensuring technical security and operational efficiency. Members actively participate by proposing and voting on AdmiralDAO Proposals (APs) and ensuring their execution. AdmiralDAO is a hub for builders, managing various DeFi products tailored to different traders and communities. [2]

Tokenomics

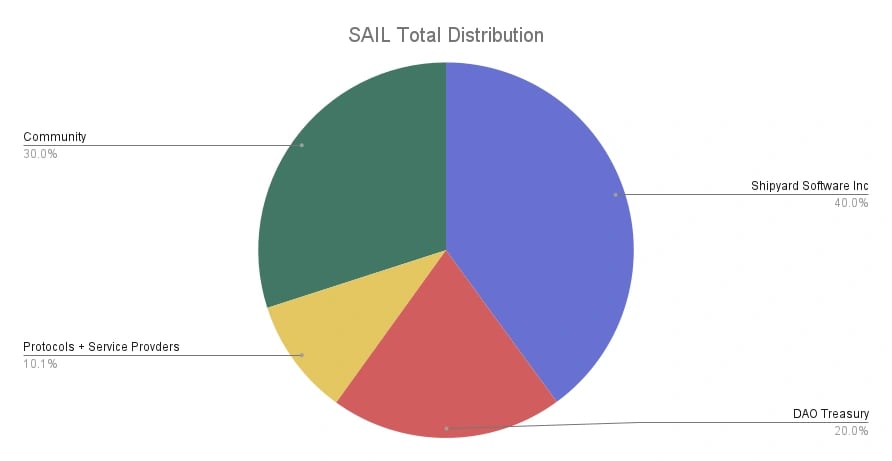

SAIL has a total supply of 1,000,000,000 tokens. 30% of the tokens were distributed via an airdrop on August 22, 2023, without any initial coin offering (ICO), presale, or private sale. The rest had the following distribution: [4][5]

- 40% to Shipyard Software Inc.

- 20% to the DAO Treasury

- 10.1% to protocols and service providers

SAIL Farming

SAIL Farming involves earning SAIL tokens through yield farming on Clipper. Participants stake liquidity in the SAIL farming pool, allow rewards to accumulate, and then harvest earned SAIL tokens. Due to Clipper's pool design, staking in the SAIL farming pool offers potentially higher rewards than other DEX pools, which eliminates impermanent loss. Clipper's farming pools are multi-asset liquidity pools consisting of Clipper Core Assets like BTC, ETH, USDC, and other prominent tokens and stablecoins. Although Clipper offers various farming pools with different reward tokens, these instructions focus solely on the SAIL farming pool. [3]

veSAIL

veSAIL, the vote escrowed token (veToken) within AdmiralDAO, enables SAIL holders to stake their tokens in an escrow account, earning additional SAIL and augmenting their governance influence. This system encourages active participation in DAO management by aligning incentives for governance participants. SAIL holders stake their tokens to receive veSAIL, which grants equivalent governance rights. Upon redemption, depositors burn veSAIL to convert it back to SAIL and claim rewards, with the exchange rate dynamically adjusting based on available SAIL for rewards in the redemption contract. [6]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)