Subscribe to wiki

Share wiki

Bookmark

Frax Bonds (FXB)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Frax Bonds (FXB)

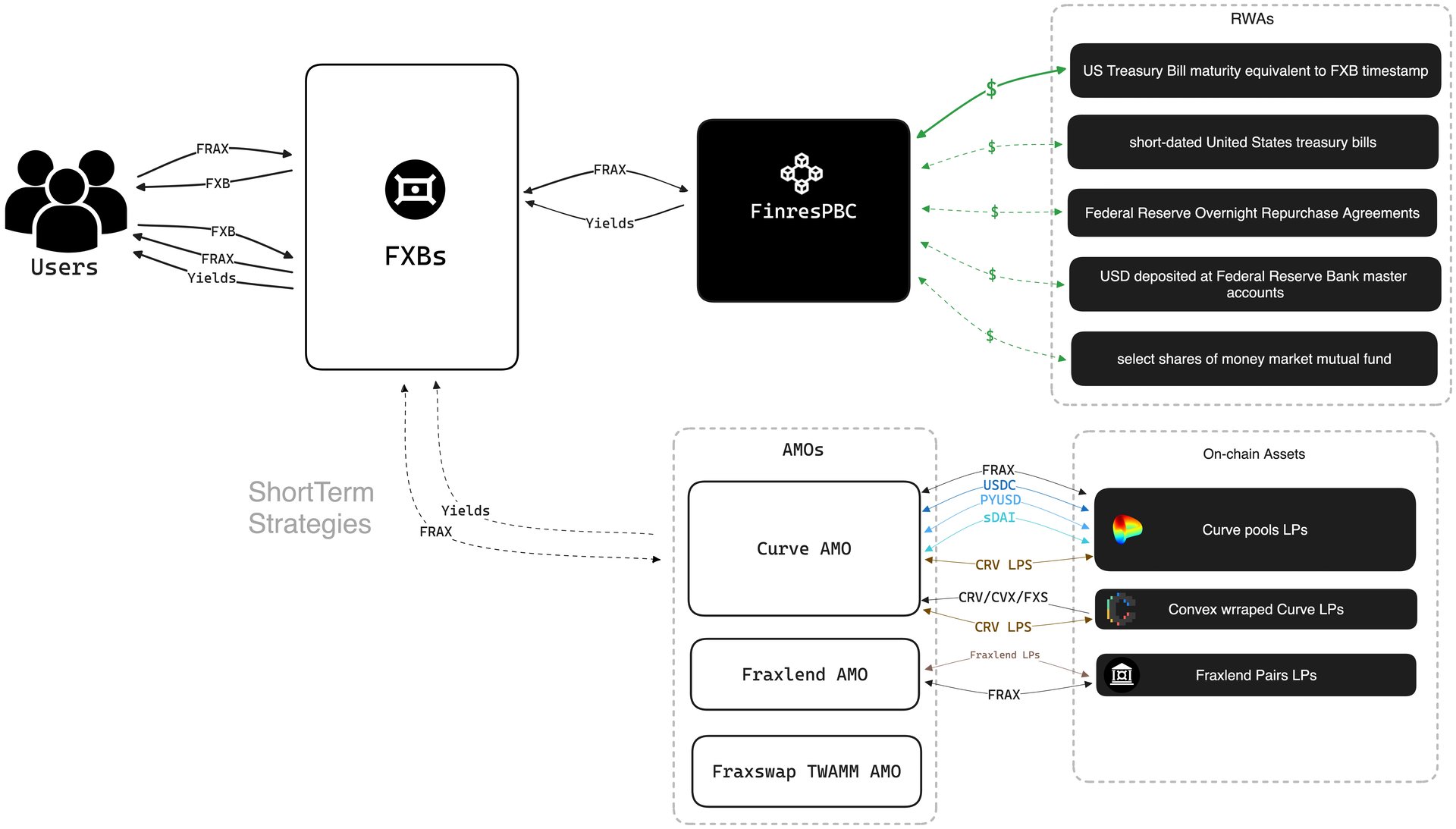

Frax Bonds (FXBs) are on-chain instruments designed to function similarly to zero-coupon bonds. Each FXB token converts into the FRAX stablecoin at face value upon reaching maturity. FXBs are issued at a discount through auction mechanisms managed by FXB Algorithmic Market Operations (AMOs). The discounted pricing offers a yield-like return without direct exposure to real-world asset (RWA) risks. [1][2]

Overview

Frax Bonds (FXBs) are ERC-20 debt tokens denominated exclusively in FRAX stablecoins. They are not claims on any collateral or external assets, and do not provide yield or redemption in any currency other than FRAX. FXBs are designed to convert to FRAX at a fixed one-to-one ratio upon reaching a predetermined maturity date set at issuance. They are not backed by or redeemable for real-world assets, including U.S. Treasury Bills, and do not serve functions beyond their programmed conversion to FRAX.

Each FXB is minted through a factory contract that locks the corresponding FRAX amount until maturity, ensuring the process remains fully on-chain and trustless. FXBs enable the development of a yield curve by allowing market-based pricing of time-locked FRAX, with no restrictions on the number of FXB series or their respective maturities.[2][3] [4]

Series Auctions

FXB series price discovery happens through a continuous gradual Dutch auction (GDA) auction system that has quantity and price limits set by frxGov. This guarantees that FXB tokens are not sold for prices lower than the floor limit. Auctions happen through the FXB AMO contract and are trustless, permissionless, and non-custodial. New auctions can happen at any time through frxGov and FXB AMO Timelock-initiated transactions.[2]

Minting & Redemption

Frax Bonds (FXBs) are categorized as either Origin or Bridged, depending on the chain where they were initially issued. FXBs minted on a chain such as Fraxtal are designated as Origin FXBs and are backed by FRAX deposited at the time of issuance. These FXBs can only be redeemed for FRAX on their origin chain after reaching maturity.

If an Origin FXB is transferred to another chain, it becomes a Bridged FXB. In such cases, the underlying FRAX remains on the original chain, and redemption must occur by bridging the FXB back to that chain. This is because the FXBFactory contract, used for minting on the origin chain, embeds the functionality for burning and redeeming FXBs. In contrast, bridged FXBs are instantiated via the bridge's ERC20Factory and rely on the bridge for minting and redemption, without direct access to the underlying FRAX. [2]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)