Subscribe to wiki

Share wiki

Bookmark

Frax Price Index (FPI)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Frax Price Index (FPI)

The Frax Price Index (FPI) is the second stablecoin of the Frax Finance ecosystem which launched in April, 2022. FPI is the first stablecoin pegged to a basket of real-world consumer items as defined by the US CPI-U average.

Overview

The Frax Price Index (FPI) is the second stablecoin of the Frax Finance ecosystem. FPI is the first stablecoin pegged to a basket of real-world consumer items as defined by the US CPI-U average. The FPI stablecoin is intended to keep its price constant to the price of all items within the CPI basket and thus hold its purchasing power with on-chain stability mechanisms. Similar to Frax Finance’s first stablecoin FRAX, all FPI assets and market operations are on-chain and use Algorithmic Market Operations (AMOs) contracts. [4] [5]

Inflation & Peg Calculation

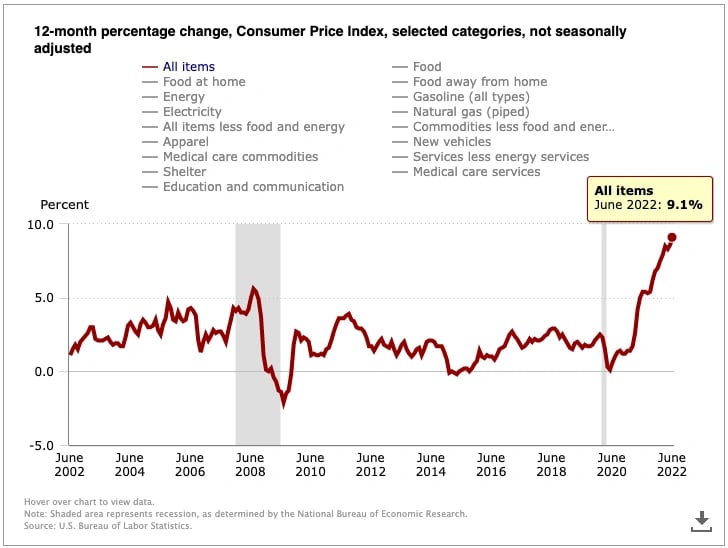

The FPI uses the CPI-U unadjusted 12 month inflation rate reported by the US Federal Government. [1] A Chainlink oracle commits this data on-chain immediately after it is publicly released. The oracle's reported inflation rate is then applied to the redemption price of FPI stablecoins in the system contract.

The redemption price grows per second on-chain (or declines in rare cases of deflation). The FPI peg calculation rate is updated once every 30 days when bls.gov [2] releases their monthly CPI price data. The FPI peg tracks the above 12 month inflation rate and pegs to it at all times from the FPI redemption contract.

FPI as a Unit of Account

Frax Finance protocol stated that FPI aims to be the first on-chain stablecoin to have its own unit of account derived from a basket of goods, both crypto and non-crypto. While FPI can be considered an inflation resistant yield asset, its primary motivation is to create a new stablecoin to denominate transactions, value, and debt. Denominating DAO treasuries and measuring revenue in FPI as well as benchmarking performance against an FPI trading pair helps better gauge if value accrual is actively growing against inflation in real terms. FPI also aims to help ground on-chain economics to baskets of real world assets.

As of now, FPI is comprised solely of FRAX. However, Frax Finance protocol plans to include other crypto-native assets such as bridged BTC, ETH, and non-crypto consumer goods and services.

FPI Stability Mechanism

FPI uses the same type of Algorithmic Market Operations (AMOs) as the FRAX stablecoin. However, it is modeled to keep a 100% collateral ratio (CR) at all times.

The collateral ratio stay at 100%, the protocol balance sheet must be growing at least at the rate of CPI inflation.

The AMO strategy contracts earns a yield proportional to CPI otherwise the CR will decrease to below 100%.

During times that AMO yield is under the CPI rate, the TWAMM AMO will sell FPIS tokens for FRAX stablecoins to keep the CR at 100% at all times. The FPIS TWAMMs isremoved when the CR returns to 100%.

The FPI Controller Pool [3] has various helper functions related to FPI and its peg.

- Mint / Redeeming: Users are able to mint FPI with FRAX or redeem FPI for FRAX. There is a small fee which is initially 0.30%.

- twammToPeg: The twammToPeg function is used by the protocol to introduce market pressure to bring the market price of FPI up (or down) to the target peg price.

- giveFRAXToAMO / receiveFRAXFromAMO: The contract lend FRAX collateral to various AMOs that earn yield (among other things).

FPI Staking

Frax Finance protocol allows FPI holders to lock up FPI tokens to generate yield on Fraxswap and Convex.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)