Subscribe to wiki

Share wiki

Bookmark

GMX

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

GMX

GMX is a decentralized exchange best known for its focus on perpetual futures trading. It was launched on the Ethereum Layer 2 network Arbitrum in late 2021 and has since been deployed to Avalanche. The platform became popular due to its high leverage options of up to 30 times the deposited collateral. [1][7][8]

Overview

GMX offers both decentralized exchange capabilities and leverage trading options. This combination merges the functionality of DeFi exchanges like Uniswap with the leverage offerings of exchanges like Binance. [7]

The protocol offers several key features, including leverage trading with up to 30x (50x in alpha), reduced liquidation risks through the use of price oracles, lower costs due to minimal spread and zero price impact on orders, a user-friendly interface without the complexity of margin, debt, and collateral, and a multi-chain presence on low-fee networks. [9]

The market prices are determined by Chainlink oracles, which gather data from major exchanges to form price feeds. This protects investments from being liquidated due to sudden fluctuations in a single automated market maker. [17]

GMX integrated with Chainlink's low-latency pricing oracles, which are tailored for faster price data delivery compared to standard oracles. This integration is a result of a governance proposal designed to furnish GMX v2 with enhanced real-time market data. It aims to bolster the functionality of GMX's derivatives and perpetual swap exchange. [20][21]

The voting process concluded on April 25, 2023, at 12:00 a.m. UTC, with 96% of participating GMX tokenholders voting in favor of the proposal. [20][21]

The introduction of the new Chainlink oracles, developed in collaboration with GMX core contributors, is intended to enhance the functionality of perpetual decentralized exchanges and trading activities sensitive to price fluctuations on GMX, as explained by the proposal's author. [20][21]

Trading

On GMX, trading is facilitated by a multi-asset liquidity pool instead of a single entity. This pool contains various assets such as BTC, ETH, USDC, DAI, USDT, FRAX, UNI and LINK. Traders have the option to take a long or short position or swap tokens on the platform. If a trader believes the value of an asset will increase, they take a long position. On the other hand, a short position is taken if they expect to buy the asset back at a lower price. GMX allows users to choose a minimum leverage of 1.1x their deposit and a maximum leverage of 30x for long and short trades. [7]

Swaps

Swaps are a type of financial transaction that can be executed at market price as determined by oracles. The use of oracles ensures that the market price is reliable and up-to-date. In addition to market price execution, limit orders are also available for users who want to set specific conditions for their trade. The fees associated with swaps vary, ranging from 0.2% to 0.8% depending on the composition of the GLP. [18]

Perpetual Trading

GMX offers traders the ability to speculate on price changes by going long or short on their chosen pair. Leverage, ranging from 1.1x to 30.5x, is available to traders and provides the possibility to enhance returns. The platform provides traders with multiple order types, including market, limit, take-profit, and stop-loss, for the execution of trades. A 0.1% fee is levied for the opening and closing of positions, and an hourly borrowing fee is calculated based on the proportion of assets borrowed to the total assets in the pool at a rate of 0.01%. [18]

GMX V2

In May 2023, GMX announced that GMX V2 Testnet was publicly available. Some of the features included the following: [22]

1. Standard Trading Functionalities: Users were able to explore standard trading options, including Market orders, Limit orders, and Trigger orders. Trigger orders encompassed both Stop-Loss and Take-Profit orders, providing flexibility in executing trades based on predefined conditions. [22]

2. Pools and Collaterals: the testnet allowed users to experiment with various combinations of Pools and Collaterals, which enabled users to tailor their trading strategies and manage their assets in a way that suits their preferences and risk tolerance. [22]

3. Funding Fees: To maintain balance within the Long:Short ratio, GMX V2 implemented Funding Fees. [22]

4. Price Impact Feature: GMX V2 introduced a Price Impact feature to safeguard the interests of Liquidity Providers. [22]

5. Liquidity Provision: Users were able to participate in liquidity provision on the platform's new Pools page. [22]

The beta of the service went live in August of 2023, being available on Arbitrum and Avalanche mainnet. [23]

For traders, new trading options were introduced, including SOL, XRP, LTC, DOGE, & ARB on Arbitrum, and SOL, XRP, LTC, and DOGE on Avalanche. Trading positions started supporting multiple collateral types, enabling cost-effective and low-leverage trading. The oracle system was updated, which enhanced execution speed and minimized slippage by signing prices for every block. Trading fees were reduced, with swaps incurring fees ranging from 5-7 basis points (0.05% to 0.07%), making it more cost-effective for traders to exchange between crypto assets. [23]

For liquidity providers, V2 introduced isolated GM (GMX Market) Pools, allowing liquidity providers to tailor their exposure to specific tokens of their choice. It also started offering increased incentives for maintaining equilibrium between long and short positions. [23]

On October 2, 2023, GMX announced GMX V2 was now using Chainlink Data Streams live on Arbitrum mainnet. [24]

"By integrating Data Streams, GMX can provide real-time pricing updates and quicker on-chain transactions. The result is strengthened protocol performance and data security, along with help with mitigating frontrunning risks. Execution speeds should also be noticeably faster"[24]

The integration of Chainlink Data Streams, Chainlink’s low-latency Oracle solution, is designed to address the latency-sensitivity of derivatives exchanges and other high-precision DeFi products, through an Oracle solution that aims to high-frequency market data in a pull-based manner. [24]

Native Tokens

GMX

The platform operates using its native token called GMX, which serves as a utility and governance token. The value and utility of GMX are derived from the protocol's fees, including trading and swap fees, and token emissions. The value of the $GMX token is proportional to the fees generated on the platform, with 30% of the total protocol fees being distributed to $GMX stakers and 70% going to GLP holders. Staking rewards are paid out in either $ETH (on Arbitrum) or $AVAX (on Avalanche), offering added benefits to holders. [10]

Staking

Users who stake can receive three types of rewards: escrowed GMX, multiplier points, and ETH/AVAX rewards. [11]

Escrowed GMX tokens, also known as esGMX tokens, can be staked or vested. When a token holder decides to vest their tokens, they will be converted back into GMX tokens over a 12-month period. This conversion serves as a form of locked staking, as it prevents the holder from selling their tokens immediately and helps mitigate inflation. [12]

Multiplier points enhance yield and reward those who use the platform for an extended period of time, contributing to greater decentralization of ownership on the platform. These are rewarded to staked GMX holders at a rate of 100% annually. They also receive fees equivalent to staked GMX, just like staked esGMX. Upon unstaking GMX tokens, the MPs held will be burned in proportion to the unstaked amount and the total amount of MPs earned. [12][9]

30% of the fees generated from swap and leverage trading on GMX are converted to either ETH or AVAX and distributed among the holders of staked GMX tokens. The distribution is based on the number of staked tokens and after subtracting referral rewards and network costs of keepers, which typically amount to around 1% of the total fees. If a holder has staked their tokens on Arbitrum, they will receive ETH, while staking on Avalanche will result in receiving AVAX. [11]

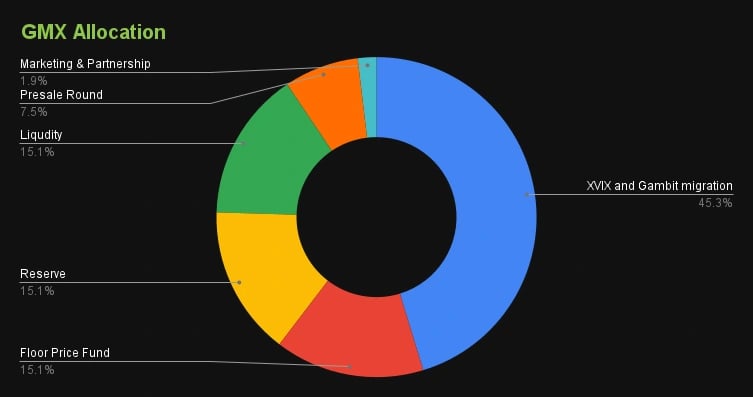

Token Distribution

The projected maximum supply of GMX tokens is 13.25 million, and the circulating supply of GMX tokens may increase due to the number of tokens being vested and the number of tokens allocated for marketing and partnerships. If a higher supply is needed for the launch of additional products or liquidity mining, a 28-day timelock will be in place to control minting beyond the maximum supply. However, such a change would require a governance vote to be conducted beforehand. [11][13]

The token distribution is as follows: [11]

- 6 million GMX from the XVIX and Gambit migration.

- 2 million GMX paired with ETH for liquidity on Uniswap.

- 2 million GMX reserved for vesting from Escrowed GMX rewards.

- 2 million GMX tokens to be managed by the floor price fund.

- 1 million GMX tokens reserved for marketing, partnerships and community developers.

- 250,000 GMX tokens distributed to contributors linearly over 2 years.

GLP

The GLP, or the Global Liquidity Protocol, is an index of assets used in the trading pool of the protocol. GLP tokens can be created by utilizing assets from the index, such as BTC or ETH, and can be redeemed for these assets by burning the tokens. Holders of GLP coins provide the liquidity required for traders to access leverage. [7]

GLP can be generated and redeemed using any of the index assets. The price of minting and redemption is determined based on the formula (total value of assets in the index, incorporating the profits and losses of open positions) divided by (GLP supply). [19]

Holders of the GLP token on the Arbitrum platform are eligible to receive Escrowed GMX rewards and a proportional distribution (70%) of platform fees, which are denominated in ETH. GLP token holders on the Avalanche network receive Escrowed GMX rewards and a 70% distribution of platform fees, expressed in AVAX. The fees distributed are determined after deducing the referral rewards and the network costs incurred by keepers, which are normally estimated to be around 1% of the total fees. [19]

GMX x Avalanche

GMX went live on Avalanche at the beginning of 2022. Through the integration of GMX and Avalanche, users have the ability to trade AVAX, BTC, and ETH with leverage of up to 30x, and have the assurance of lower-risk liquidation that can be verified directly from their Metamask Wallet. [14]

From January 2022 to March 2022, 50,000 esGMX tokens were distributed monthly to GLP holders on Avalanche as an incentive for liquidity. From April 2022 to December 2022, this amount was updated to 25,000 esGMX tokens per month. [14]

GMX Blueberry Club

The GMX Blueberry Club NFT collection, featuring over 130 unique, hand-drawn characteristics, has a total supply of 10,000 NFTs and is available on the Arbitrum platform. The "Blueberry" emblem was created specifically for the GMX trading community. The collection's proceeds are deposited in a communal Treasury, which has been improved with a transparent monitoring system for the community's benefit. [15][16]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)