Subscribe to wiki

Share wiki

Bookmark

Poolshark (FIN)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Poolshark (FIN)

FIN is the native cryptocurrency of Poolshark, a decentralized exchange where users can create directional positions to profit from volatility. Its developing company, Poolshark Labs, was founded in 2021 by alphaKΞY, while Poolshark was released in December 2023. FIN is used to reward users for providing liquidity, utilizing the platform, and DAO governance.[1]

Overview

FIN is the governance token of Poolshark. Users can stake their FIN tokens for serving roles in governance and utility, as the rewards are tied to the platform's performance. Users will need to stake the FIN token, which will be returned with a liquid version of FIN, called sFIN. sFIN can be further staked into rFIN. oFIN is given to liquidity providers as an incentive.[2]

sFIN

sFIN is the receipt token for FIN users, which represents the share within the Poolshark staking pool. These users will then get rewarded 100% of the trading fees on all pairs, and they will be rewarded with FIN tokens on a multiplicative basis. Users can be rewarded with rFIN and multiplier points for even more rewards and a share of the protocol revenue. sFIN will also be utilized for governance proposals.[2]

rFIN

rFIN is a reward token for sFIN stakers. They can stake rFIN for further token emissions and platform fees, or they can be vested over 12 months to receive FIN tokens. Each rFIN will earn the same amount of rewards as the FIN token.[2]

oFIN

oFIN is an ERC-20 token rewarded for providing liquidity to the protocol. When a user redeems this token they will be able to acquire FIN token at a discounted price to market (% discount subject to change via DAO governance). oFIN + WETH is directly convertible to FIN with no expiry date.[2]

Multiplier Points

By staking FIN, individuals receive multiplier points with a consistent annual percentage rate (APR) of 100%, and the maximum rewards are attained after one year of staking. These multiplier points can be staked for fee rewards at the same rate but at an increased rate of receiving rFIN.[2]

Token Utility

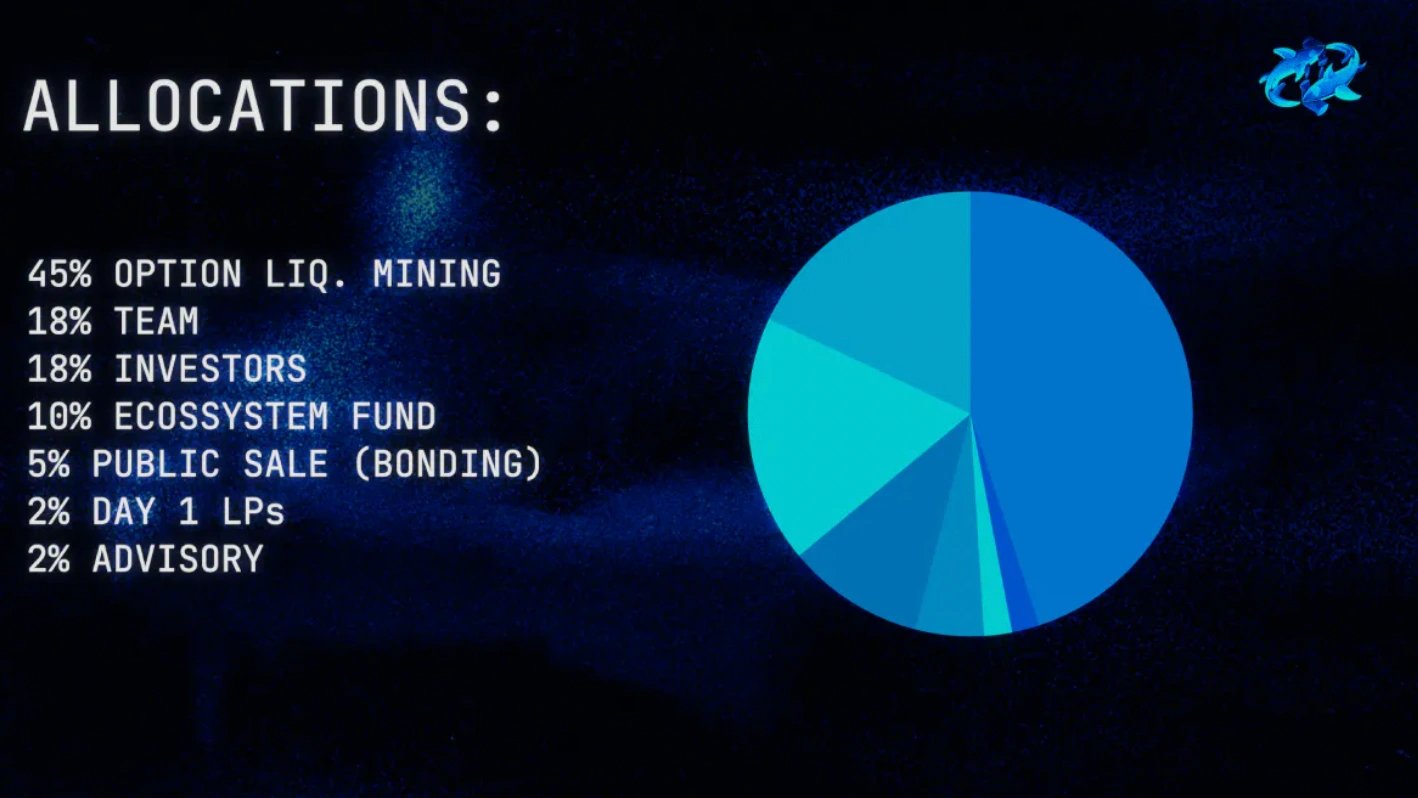

FIN's maximum supply is 20,000,000 tokens. Their token supply is distributed as follows.[3]

- 70% Community

- 45% Options liquidity mining

- 25% Ecosystem fund

- 10% POL bonding

- 5% Initial Liquidity

- 20% Team

- 18% team

- 5-year linear vesting; no cliff

- 2% advisors

- 3-year linear vesting; no cliff

- 18% team

- 10% Investors

- 3-year linear vesting; no cliff

Season Rewards Distribution

Tokens will be distributed on an ongoing season basis with Options Liquidity Mining (OLM). Options Liquidity Mining will be released continuously over around 8 years with 20 planned seasons as of January 29, 2024. The 8-year period was chosen to balance the need for incentivized rewards to early adopters, while not distributing all the tokens too early.[4]

It allows the protocol to capture revenue by issuing oFIN, an option to buy FIN at a discount and share token revenue with the Poolshark DAO treasury.[5] The following is Season 1's rewards distribution:

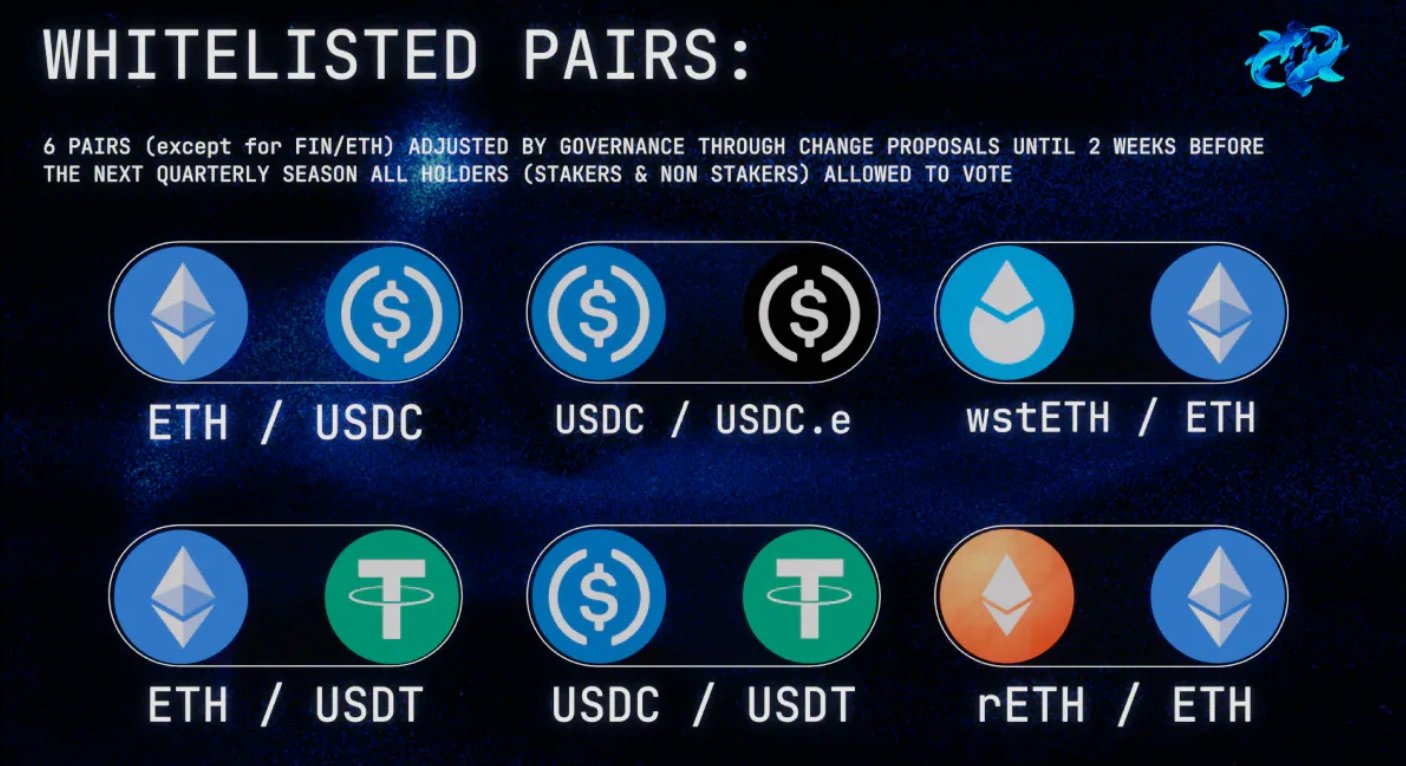

- 50% [4,500,000 FIN] was allocated to whitelisted liquidity pool pairs, which are the direct partners that the DAO has agreed upon with the Poolshark protocol. They will receive additional oFIN emissions as an incentive to maintain liquidity on their pair within the protocol. Pairs include:

- 22.5% [2,025,000 FIN] was allocated to non-whitelisted liquidity pool pairs. Due to the permissionless nature of Poolshark, any team or protocol can deploy on Poolshark without the need for whitelisting.

- 15% [1,350,000 FIN] was allocated to traders to incentivize them to utilize the full capabilities of the Poolshark Protocol.

- 10% [900,000 FIN] was allocated to stakers who stake FIN. They will be rewarded with both trading fees and FIN tokens to reward participation in the ecosystem.

- The remaining 2.5% will be allocated to a Mystery Category, to be revealed after Season 1 Rewards conclude.

Ecosystem Fund

- 13.76% [4,752,000 FIN] was allocated to the Growth Fund, given to the DAO for ecosystem growth. They can be used for initiatives such as marketing, referral programs, partnerships, and more.

- 10% [2,000,000 FIN] was allocated to POL bonding.

- 0.75% [150,000 FIN] was allocated to public bonding. These bonds mature on 02/09/2024.

- 0.26% [52,000 FIN] was allocated to the TGE Liquidity Pool.

Team

- 18% [3,920,000 FIN] was issued to founding team members and staffing members.

- 2% [400,00 FIN] was issued to advisors, who contributed outside of the core team to provide suggestions in various areas such as marketing, business development, and product management.

Investors

- 10% [2,000,000 FIN] was allocated to strategic partners.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)