Subscribe to wiki

Share wiki

Bookmark

rETH

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

rETH

Rocket Pool ETH (rETH) is Rocket Pool protocol's liquid staking token. The rETH token represents an amount of ETH that is being staked and earning rewards within Ethereum Proof-of-Stake. [1][4]

As Rocket Pool node operators stake Ethereum on Proof-of-Stake the resulting rewards increase the value of rETH relative to ETH. Rocket Pool's liquid staking token allows holders to benefit from the returns of the Ethereum Proof-of-Stake. [2][3]

Overview

A Rocket Pool staker's role is to deposit ETH into the deposit pool which enables a node operator to create a Beacon Chain validator. As a result, the staker is given rETH which represents how much ETH is deposited and when it was deposited. The ratio includes rewards that Rocket Pool node operators earn from:

- The Beacon Chain

- Priority fees from block proposals

- MEV rewards from block proposals

The value of rETH is determined by the following ratio:rETH:ETH ratio = (total rETH supply) / (total ETH staked + total rETH contract balance + total rETH share of priority fees + total rETH share of MEV rewards). [5]

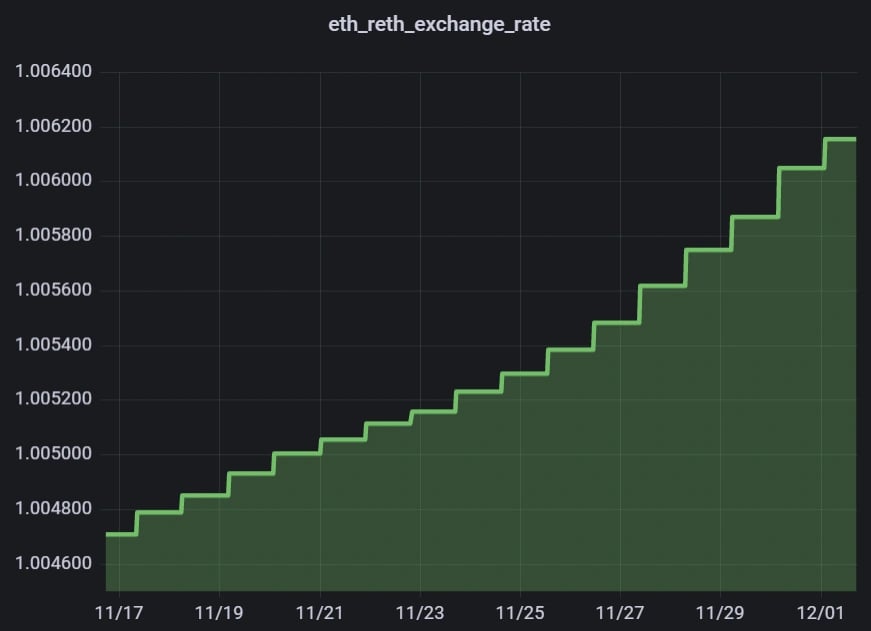

The value of rETH consistently rises compared to ETH due to the continuous accumulation of Beacon Chain rewards, priority fees, and MEV rewards. The rETH/ETH exchange rate is regularly updated, around every 24 hours, based on the Beacon Chain rewards earned by Rocket Pool node operators. [5]

Utility

As an alternative to holding onto and eventually returning rETH to the Rocket Pool, users can also use it in DeFi applications. rETH can be traded, used for lending, and collateral as rETH is a standard ERC20 token. [5]

DEX Staking

Staking via Layer 1

rETH can be acquired through decentralized exchanges on Ethereum's main network (Layer 1), such as Balancer and Uniswap, without using Rocket Pool’s official staking interface. Simply holding rETH provides exposure to Rocket Pool’s staking rewards, regardless of how it is obtained.

Balancer’s metastable pool is specifically designed for assets like rETH, aligning closely with the protocol’s oracle-reported exchange rate. This structure reduces slippage and trading fees compared to conventional pools, offering more favorable rates. Other Layer 1 exchanges may not reflect the oracle rate as accurately, potentially resulting in less optimal pricing.

Though Layer 1 gas fees are generally higher than those on Layer 2, decentralized exchanges can still offer lower transaction costs compared to direct staking through Rocket Pool. Users should compare exchange rates and fees across platforms before initiating a swap. [6]

Staking via Layer 2

Rocket Pool users can oalso btain rETH through decentralized exchanges on Layer 2 networks, such as Optimism and Arbitrum, without interacting directly with Rocket Pool's staking interface. Holding rETH entitles users to the benefits of decentralized staking, regardless of how it is acquired.

Layer 2 networks utilize rollup technology to aggregate multiple transactions off-chain before posting them to Ethereum, reducing execution and storage costs. This results in significantly lower gas fees, particularly beneficial for users staking smaller amounts of ETH.

Uniswap, a decentralized exchange protocol, is available on both Optimism and Arbitrum and facilitates ETH-to-rETH swaps. While this method offers cost efficiency, users may experience reduced liquidity and potential price impact on larger trades. It is advisable to compare rates and liquidity across platforms before proceeding with a Layer 2 swap. [7]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)