Subscribe to wiki

Share wiki

Bookmark

Y2K Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Y2K Finance

Y2K Finance is a DeFi platform that operates on the Arbitrum chain, providing users the opportunity to speculate or hedge against the depeg of exotic pegged assets. This crypto-native structured product offers a unique way for users to protect or profit from assets that may deviate from their anchored value. [1][2]

Overview

Y2K Finance was officially launched on the Arbitrum Network on August 26, 2022. It provides a marketplace for buying and selling risks associated with stablecoin and token wrappers. Users can either choose to protect themselves against a possible depeg event by putting up a premium or take a speculative position by selling risk. There are different levels of risk to choose from, with higher-risk options offering greater rewards. [3][4]

The platform operates through epochs, which last one month each, and funds deposited into the risk vaults are locked until the end of each epoch. Once funds are locked, they are represented by a semi-fungible token, which can be traded for a portion of the depositor's collateral and rewards. Y2K also has two additional products, "Wildfire" and "Tsunami," which offer further liquidity options and exposure to earnings from liquidation events. The platform first launched on Arbitrum with support for various assets including DAI, USDC, and wBTC. [3][4]

Earthquake

Earthquake is a financial product that introduces a new approach to the traditional catastrophe bonds (CAT), providing users with a platform to hedge, speculate, and underwrite the volatility risk associated with various pegged assets. Unlike traditional CAT bonds that pay out in case of a predetermined disaster risk like an earthquake or hurricane, Earthquake focuses on de-peg events for stablecoins, liquid wrappers, and other DeFi derivatives. The platform allows users to protect themselves against the volatility of these assets by depositing ETH collateral into the Hedge vault and receiving Y2K tokens. The platform leverages Chainlink oracles to monitor the pegged asset prices and charges a 5% fee in case of a depeg event. [5][14]

Risk Vault

Earthquake provides a platform that allows users to participate in the de-peg risk market by depositing ETH into the Risk vault. By depositing ETH into the Risk vault, users act as underwriters of depeg insurance and are entitled to a pro-rata share of the premiums collected from the Hedge vault deposits. A semi-fungible ERC-1155 token is issued upon depositing into the Risk vault, which serves as a receipt of the deposit and is tradable after the Wildfire launch. In the event of a vault not de-pegging, Risk vault depositors will receive a pro-rata share of the Hedge vault deposits. If a vault de-pegs, Risk vault depositors will receive a pro-rata share of the Hedge vault deposits, in addition to the transfer of their principal to the Hedge vault depositors. [6][7]

Hedge Vault

Users who are looking to hedge against volatility in pegged assets can do so by depositing ETH into the Hedge vault. By depositing ETH into the Hedge vault, users act as insurance policyholders and are entitled to a pro-rata share of the Risk vault deposits in the event of a de-peg event. A semi-fungible ERC-1155 token is issued upon depositing into the Hedge vault, which serves as a receipt of the deposit and is tradable after the Wildfire launch. In the event of a vault not de-pegging, Hedge vault depositors will transfer their paid-up premiums to the Risk vault depositors. In the event of a vault de-pegging, Hedge vault depositors will transfer their paid-up premiums to the Risk vault depositors and receive a pro-rata share of the Risk vault deposits. [6][7]

Strike Prices

Earthquake employs Chainlink oracles to monitor the prices of supported pegged assets, including USDC, USDT, DAI, FRAX, and MIM. When the Chainlink oracle indicates that the strike price for a given vault has been reached, the epoch will end and the vault will be closed, thereby triggering a transfer of Risk vault deposits to the Hedge vault. The protocol collects a 5% fee in the following scenarios: 5% of Hedge vault deposits and 5% of Risk vault deposits in the event of a de-peg event. If a peg is maintained, no fee is charged. [7][8]

Tsunami

Tsunami is a platform focused on the development and management of Collateralized Debt Obligation (CDO) products. CDOs are financial instruments that use debt to back assets, with many debt holders also serving as owners of the underlying assets. Tsunami utilizes a unique approach to CDOs by pooling debt from multiple sources into a central host liquidity pool. This pooling creates a mechanism for aggregating debt positions and is represented by CDO Non-Fungible Tokens (NFTs). [9]

The platform provides exclusive access to its liquidation bot to users who provide liquidity to the CDO NFTs. In the event of a leveraged position being liquidated, the yield generated from the liquidation process is passed on to these users and added to the yield they are already receiving. Additionally, Tsunami employs a dedicated loan underwriter to monitor and facilitate loan positions, with ETH from the y2kTOKENS serving as a backstop to ensure collateral remains above 110% in the event of a liquidation. The platform's approach to CDOs, combined with the potential for returns from liquidation events, attracts users to borrow from Y2K rather than from providers directly. [9]

Wildfire

Wildfire is a secondary market platform being built on top of Earthquakes tokenized vaults that allow users to enter and exit positions in real-time via an on-chain RFQ order book. Transactions are processed using 0x Protocols contracts and trades are made using signed transactions from the taker. Wildfire provides ample liquidity and allows for rapid repricing of semi-fungible tokens, allowing traders to speculate on depegging sentiment without locking in their positions. This platform offers greater flexibility and options for managing risk and providing liquidity in the insurance market, enabling traders and depositors to hedge or underwrite positions outside of epoch times. [4][14][15]

Tokenomics

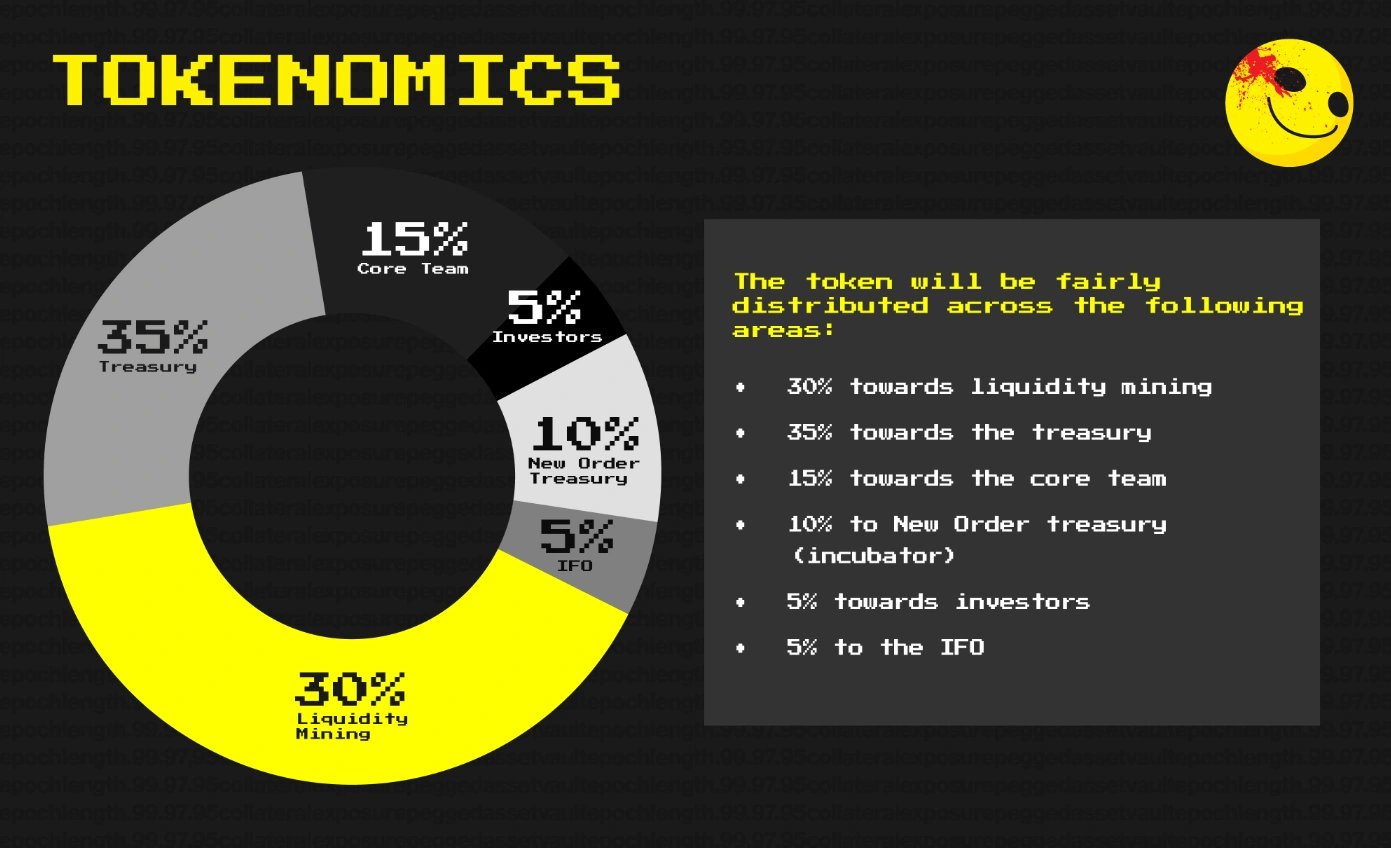

The tokens within the Y2K Finance ecosystem are distributed as follows: [10]

Y2K Token

The Y2K token is the utility token of the Y2K ecosystem, serving as the governing token for two flagship products, Earthquake and Wildfire. $Y2K can be traded in the Y2K : wETH Balancer Pool and is used to determine important parameters of the ecosystem through governance. [11]

vIY2K Token

vIY2K is a locked token obtained by locking Y2K in the 80Y2K:20wETH Balancer Pool. vIY2K holders have an increased share of governance power and are eligible for 50% of the protocol fees generated in the Y2K ecosystem. Locking periods can be 16 or 32 weeks with longer lockers receiving a greater share of protocol fees and governance power. vIY2K is non-transferable and can be obtained by participating in the IFO, providing liquidity in the Balancer pool, or buying Y2K on the Balancer Pool. [12]

Vault Token

The Y2K Vault tokens are ERC-1155 and represent a pro-rata share of vault ownership by the depositor. They are differentiated by the asset, type, and epoch and are non-transferable until Bond initiation and the release of vlY2K. Y2K tokens will be issued as rewards to vault depositors. The direction of Y2K emissions will be determined through a gauge system, with a portion of the liquidity mining emission direction being done via Snapshot votes, where vlY2K lockers can direct which markets to allocate emissions to. This decentralization of emissions allocations creates the potential for a bribe market to develop around the emissions. [13]

Y2K Bonds

On January 31, 2023, Y2K launched a $Y2K bond market with Bond Protocol. [16] $YSK Bonds will introduce a new market for the $Y2K token while growing protocol-owned liquidity (PoL) in the process. [17]

Token bonds are a concept where users can exchange certain crypto assets for native tokens at a discount. In exchange, users are emitted the discounted asset over a span of a few days. $Y2K bonds can also grow the Y2K treasury by offering users a way to purchase $Y2K at a discount. Only $USDC deposits are supported initially, and users can deposit on either the Y2K Finance or Bond Protocol frontends to participate. [17]

Y2K V2

On May 1, 2023, Y2K V2 went live on the platform with added features including an Improved UX with Carousel, New revenue streams, Open Builder Platform, and Expanded flexibility. The features aim to make Earthquake a more efficient product. Depositing, rollovers, and earning rewards can be better explored due to Carousel, and $vlY2K holders get an additional source of fees from the new information tax. Protocols can build Earthquake into their own products, and Y2K can start building its own in-house products on top of Earthquake. [18]

Y2K also released a 4-step user guide[19] to allow users to properly understand and interact with the markets on the V2 platform. [18][19]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)