Subscribe to wiki

Share wiki

Bookmark

Zyberswap

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Zyberswap

Zyberswap is a decentralized exchange (DEX) on the Arbitrum and Optimism networks. It offers automated market-making (AMM) and liquidity management features. It enables users to trade and provide liquidity with low fees while supporting governance participation through its sZYB token. [1]

Overview

Zyberswap is a decentralized exchange (DEX) with an automated market-maker (AMM) operating on Arbitrum and Optimism, offering low-fee crypto asset swaps. It provides lucrative rewards through staking and yield farming while involving users in governance decisions. The platform follows a fair launch strategy for token distribution, promoting decentralization and equal access. Zyberswap prioritizes security by partnering with SolidProof, ensuring robust auditing, and offering new projects the chance to have a free audit and KYC process. [2]

Related Topics

Features

Zyberswap offers several key features. It allows decentralized token swaps using an automated market-maker (AMM) with minimal fees, distributing trading fees to liquidity providers as incentives. The platform's liquidity pools let users deposit equal amounts of two tokens, earning ZLP tokens as proof of liquidity provision. A small fee is charged on each trade, part of which is returned to the liquidity pool. Yield farming on Zyberswap enables users to earn rewards by staking liquidity provider tokens and accumulating trading fees and $ZYB tokens. Additionally, Zyberswap supports cross-chain asset transfers via the Arbitrum Bridge, allowing faster, cheaper interactions on the Arbitrum sidechain while maintaining security with Ethereum. [3][4][5]

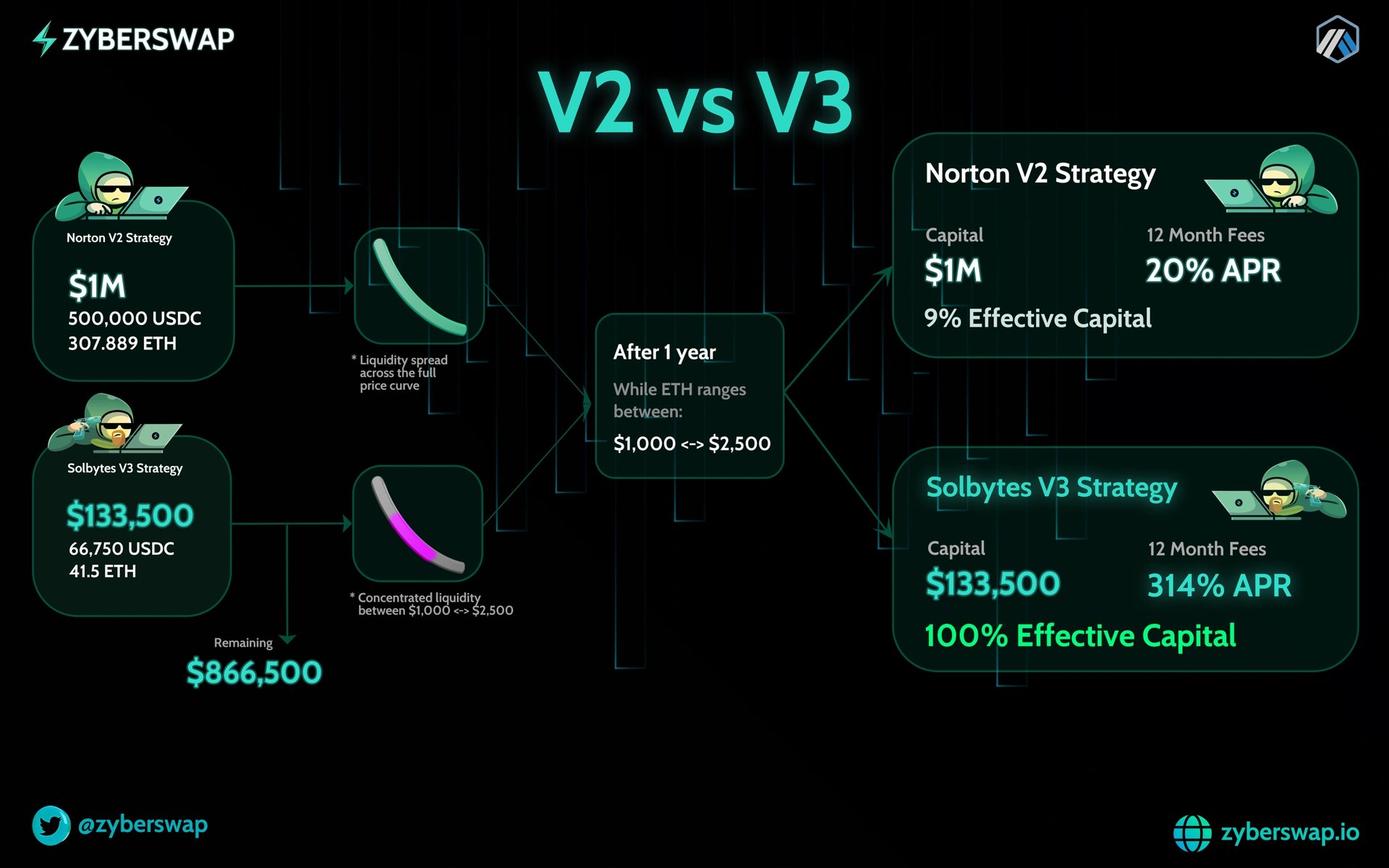

Concentrated Liquidity

Zyberswap’s Concentrated Liquidity feature allows liquidity providers (LPs) to optimize their capital by focusing liquidity within a specific price range, enhancing efficiency, and minimizing impermanent loss. LPs can stake token pairs in defined price intervals, where their liquidity is utilized once the market price moves into the selected range. This approach contrasts with traditional AMMs that spread liquidity across all price levels, resulting in lower fees and higher slippage due to underutilized liquidity. With this model, LPs can set multiple positions to align with their strategies, earning more fees when their liquidity is used. Traders also benefit from deeper liquidity and reduced slippage within these concentrated price ranges. [6]

Active Liquidity Management

Gamma provides Zyberswap users with tools for active liquidity management (ALM), automating the rebalancing of liquidity positions and compounding swap fees to enhance capital efficiency. It is a non-custodial protocol that manages concentrated liquidity without taking custody of assets. It handles rebalancing, setting positions, and processing fees using data-driven strategies. [7]

Active liquidity management is necessary for concentrated liquidity due to its complexity, increased risk of impermanent loss, and constant monitoring of price ranges. Users face higher risks of impermanent loss if the market price moves outside their liquidity range, requiring frequent adjustments. For projects managing their liquidity, concentrated liquidity requires more time and resources. [7]

Gamma's ALM automates these tasks, allowing users to outsource liquidity management and avoid the complexities of manual oversight. This system also enhances composability by representing LP positions as ERC-20 tokens, allowing them to be used in Zyberswap’s farms and other DeFi applications. [7]

ZYB

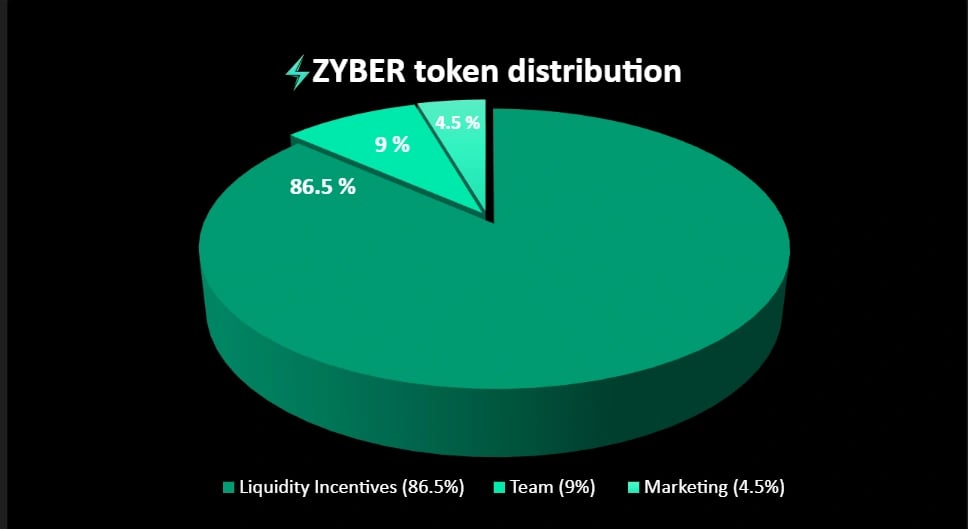

Zyberswap uses a fair launch model for its token distribution, with no presale and no team or investor allocations at launch. The token supply is fixed at 20M, and emissions follow a linear model, with deflationary mechanisms like token burning to reduce the overall supply. The token allocation is as follows: [8]

- Liquidity Incentives: 86.5%

- Team: 9%

- Marketing: 4.5%

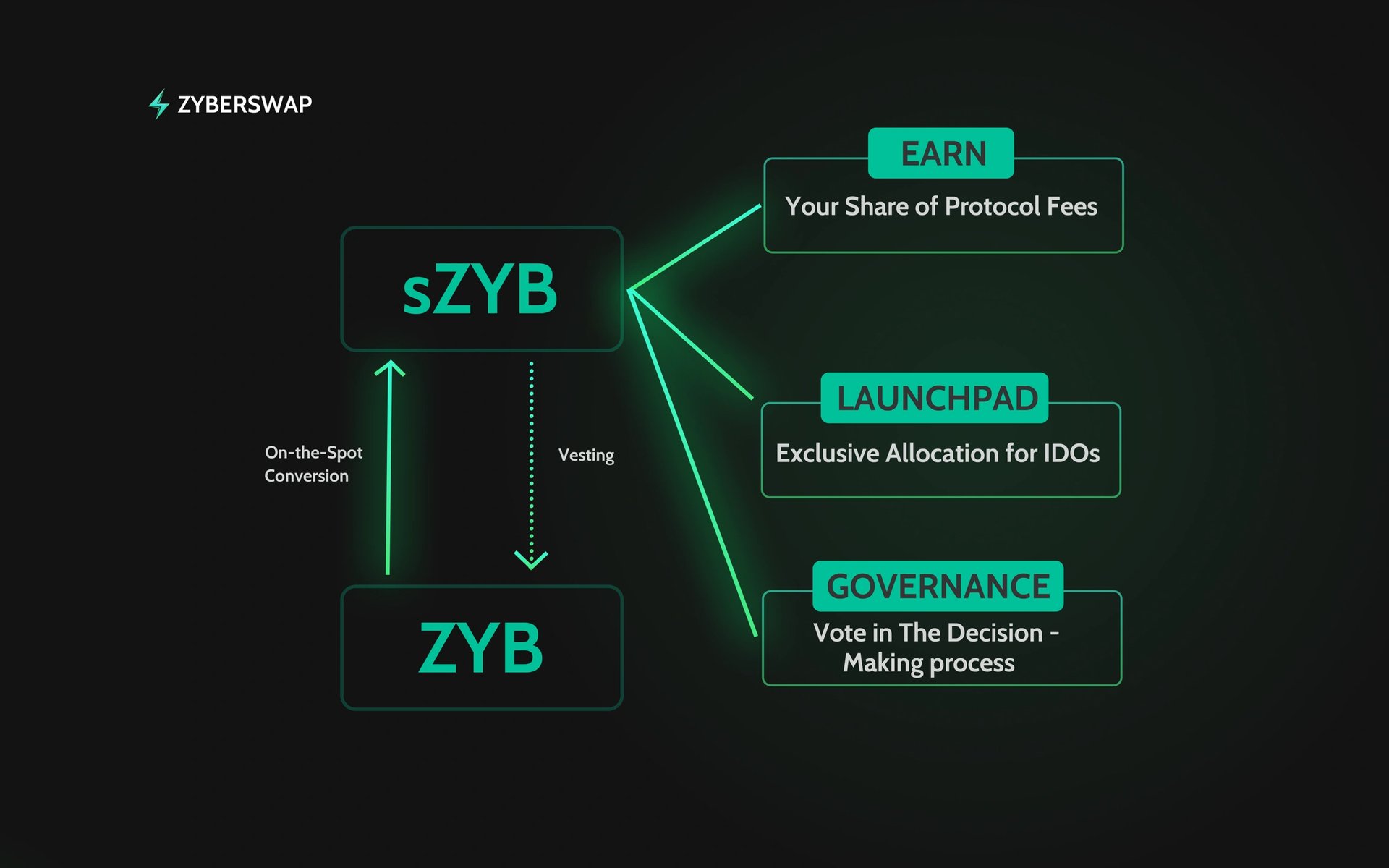

sZYB

sZYB is a non-transferable, escrowed token representing staked ZYB used for profit-sharing and governance. It can be obtained by converting ZYB tokens or as a reward from yield farming. Users can convert sZYB back to ZYB after a vesting period. Full vesting takes 180 days, allowing 100% conversion. After 14 days, early conversion returns 50% of ZYB, with the rest burned. The remaining tokens vest linearly if unclaimed after the minimum period. Holding sZYB offers benefits like sharing protocol profits, launchpad perks, and governance voting. [9]

Sharing Protocol Profits

sZYB represents a share of Zyberswap, entitling holders to a portion of the platform's earnings. The more sZYB owned, the greater the share of profits received. Earnings are distributed weekly, with the community deciding on the rewards for each cycle. [9]

Launchpad Perks

sZYB holders gain advantages in Launchpad projects using Zyberswap for fundraising. These benefits include discounted token prices, higher investment allocations, reserved timeframes for secured investments, and potential future perks from launched projects. Allocating sZYB tokens for Launchpad purposes maximizes these benefits during token sales on Zyberswap. [9]

Governance Voting

sZYB holders, as committed stakeholders, have voting power proportional to their holdings. This governance structure enables them to influence decisions and participate actively in the project's direction. [9]

Partnerships

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)