CryptoPulse.News

CryptoPulse.News is an online media publication focusing on the cryptocurrency industry. It provides news, market insights, educational content, press releases,...

Shape the future of crypto knowledge — with IQ in your hands.

You are seeing the wikis that are tagged with Glossary . If you are interested in seeing other topics in common, you can click on other tags.

CryptoPulse.News is an online media publication focusing on the cryptocurrency industry. It provides news, market insights, educational content, press releases,...

KRW-pegged stablecoins, tied to the South Korean won, are developed by tech and crypto firms navigating complex regulations to innovate in finance.

Non-USD stablecoins are cryptocurrencies pegged to fiat currencies other than the US dollar, such as the Euro or Yen. They aim to reduce USD exchange rate volat...

Proof of Intelligence (PoI) is a blockchain consensus mechanism that rewards network participants for performing valuable AI-related computational tasks. It aim...

Tether (USDT) is a stablecoin cryptocurrency pegged 1:1 to the US Dollar, facilitating stable transactions and arbitrage in the crypto market.

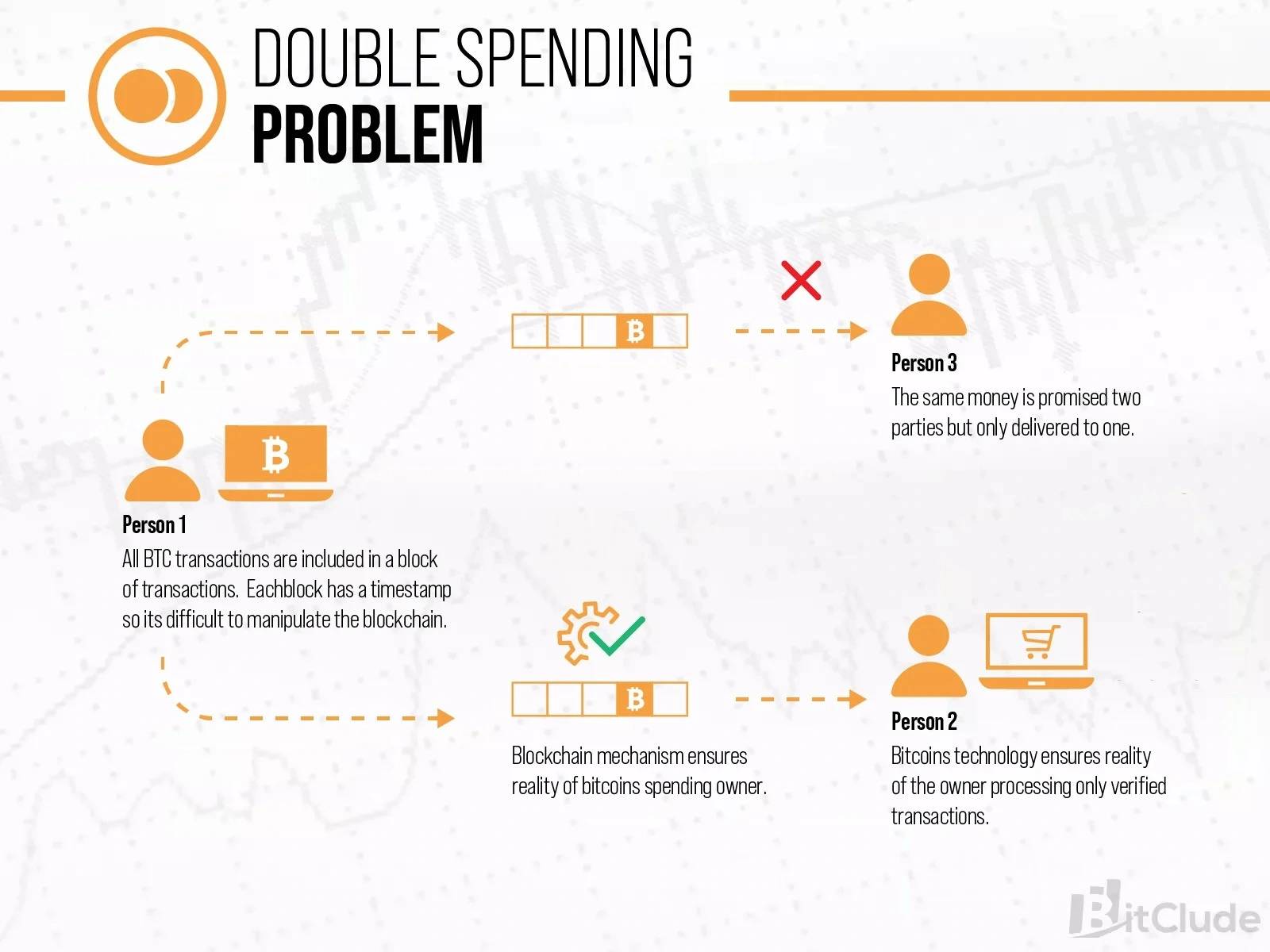

Double spending problem is a phenomenon in which a single unit of currency is spent simultaneously more than once. This creates a disparity between the spending...

The GENIUS Act (S. 1582) is a U.S. law, signed by President Trump in 2025, establishing a federal regulatory framework for stablecoins. It focuses on issuer req...

EIP-7805 is a Core Ethereum Improvement Proposal to enhance censorship resistance by using a committee of validators to create 'inclusion lists' (ILs) enforced ...

Hegota is a planned Ethereum network upgrade scheduled for late 2026. Following the Glamsterdam upgrade, it focuses on scalability by potentially implementing V...