Subscribe to wiki

Share wiki

Bookmark

Aegis

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Aegis

Aegis is a decentralized finance (DeFi) protocol that provides a Bitcoin-backed stablecoin system and an integrated trading platform. The protocol is designed around a delta-neutral hedging strategy to generate yield and aims for real-time transparency through a public dashboard. Its ecosystem includes the YUSD stablecoin, the staked sYUSD token, the AEG governance token, and the Aegis DEX trading platform. [1]

Overview

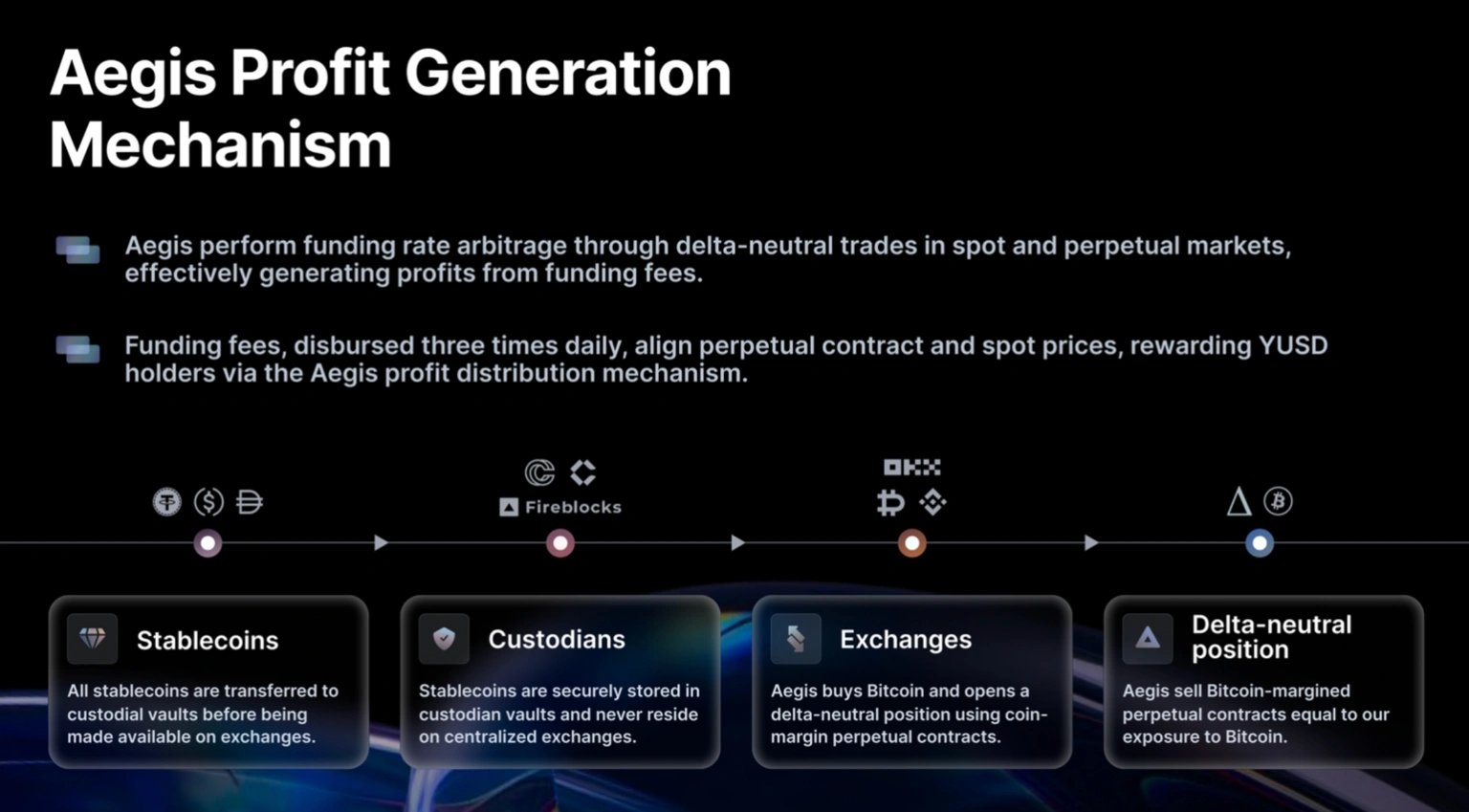

Aegis is a yield mechanism that uses a delta-neutral arbitrage strategy to generate stable on-chain returns. User deposits are held in custodial vaults and deployed to exchanges through off-exchange settlement, aiming to limit exposure to centralized platforms while keeping funds liquid. The system builds hedged positions by buying Bitcoin on the spot market and shorting an equivalent amount in Bitcoin-margined perpetual futures, removing price exposure and collecting funding-rate payments as the primary source of yield. Aegis positions this structure as a transparent model, offering visibility into reserves, positions, and yield calculations, and it operates independently of traditional stablecoins and banking rails by relying on BTC-margined contracts. YUSD, the stablecoin issued through this mechanism, is created only against deposited collateral and uses third-party custody and hedged futures positions to manage risks related to exchange failures, volatility, and depegging. [2]

Technology

Profit Mechanisms

Generation

Aegis generates returns through a delta-neutral structure collateralized by Bitcoin and using Bitcoin-margined perpetual futures. It opens hedged positions by holding Bitcoin while simultaneously selling an equivalent amount of Coin-M futures, offsetting price movements and keeping the system insulated from volatility. Because these futures are margined and settled in Bitcoin, the model avoids reliance on external stablecoins while maintaining liquidity. Yield comes from funding-rate payments exchanged between long and short positions in the perpetual markets; by positioning to receive these payments, Aegis converts funding accrual into steady returns for holders of its assets. [4]

Distribution

Aegis distributes profits to YUSD and sYUSD holders through periodic snapshots and funding-rate earnings. For YUSD, the system records balances every eight hours and directs arbitrage profits to the mint contract, which issues new tokens and sends them to a claim contract. Holders can collect these accumulated rewards weekly, paying only network gas fees. For sYUSD, balances are tracked on the same schedule, but funding-rate profits flow to a staking contract, where they are added directly to the asset’s backing rather than creating new tokens. Rewards accumulate automatically and are reflected in the token’s price, giving holders yield without requiring manual claims. [7]

Peg Stabilization

Aegis maintains YUSD’s peg through a mint-and-redeem arbitrage system that keeps the token’s market price close to $1. When YUSD trades above the peg, users can mint new tokens by depositing collateral, increasing supply and pushing the price downward; when it trades below the peg, users can redeem YUSD for collateral, reducing supply and supporting the price. Authorized users can also arbitrage price differences across markets by buying where YUSD is cheaper and selling where it is more expensive. The protocol continuously monitors prices, using these mechanisms to limit prolonged deviations and keep the stablecoin’s value aligned with its target. [9]

Off-exchange Settlement

Aegis uses an off-exchange settlement model, in which user assets are stored with external custodians rather than on centralized exchanges. This approach is designed to limit exposure to risks such as exchange insolvency, security breaches, and loss of custodial control. Deposited funds remain in custodian vaults and are only allocated temporarily for trade execution before being returned to secure storage. The system relies on institutional custodians such as Copper, Fireblocks, and CEFFU to provide secure asset management. This structure aims to improve safety, maintain regulatory alignment, and offer clear visibility into how assets are handled while still allowing transactions to be executed efficiently. [10]

Proof of Reserves

Aegis is a yield-generating stablecoin protocol that uses a delta-neutral arbitrage strategy to deliver predictable returns while minimizing exposure to market volatility and centralized exchange risks. User deposits are secured in custodial vaults and deployed off-exchange, enabling Bitcoin-based delta-neutral positions by holding spot Bitcoin and shorting equivalent COIN-M perpetual contracts. The protocol captures funding rate payments from perpetual futures markets as its primary source of yield, which is distributed to YUSD holders through an eight-hour snapshot system and a weekly claim process. In contrast, sYUSD holders accrue yield automatically through the token price. Aegis maintains price stability through a peg arbitrage mechanism, allowing users to mint or redeem YUSD to correct deviations from the $1 peg, while continuous monitoring ensures transparency and operational independence. Funds are stored off-exchange with institutional-grade custodians, and all assets, positions, and collateral ratios are tracked in real time through a Proof of Reserves dashboard, providing ongoing verification of full backing, market neutrality, and insurance fund status. [12]

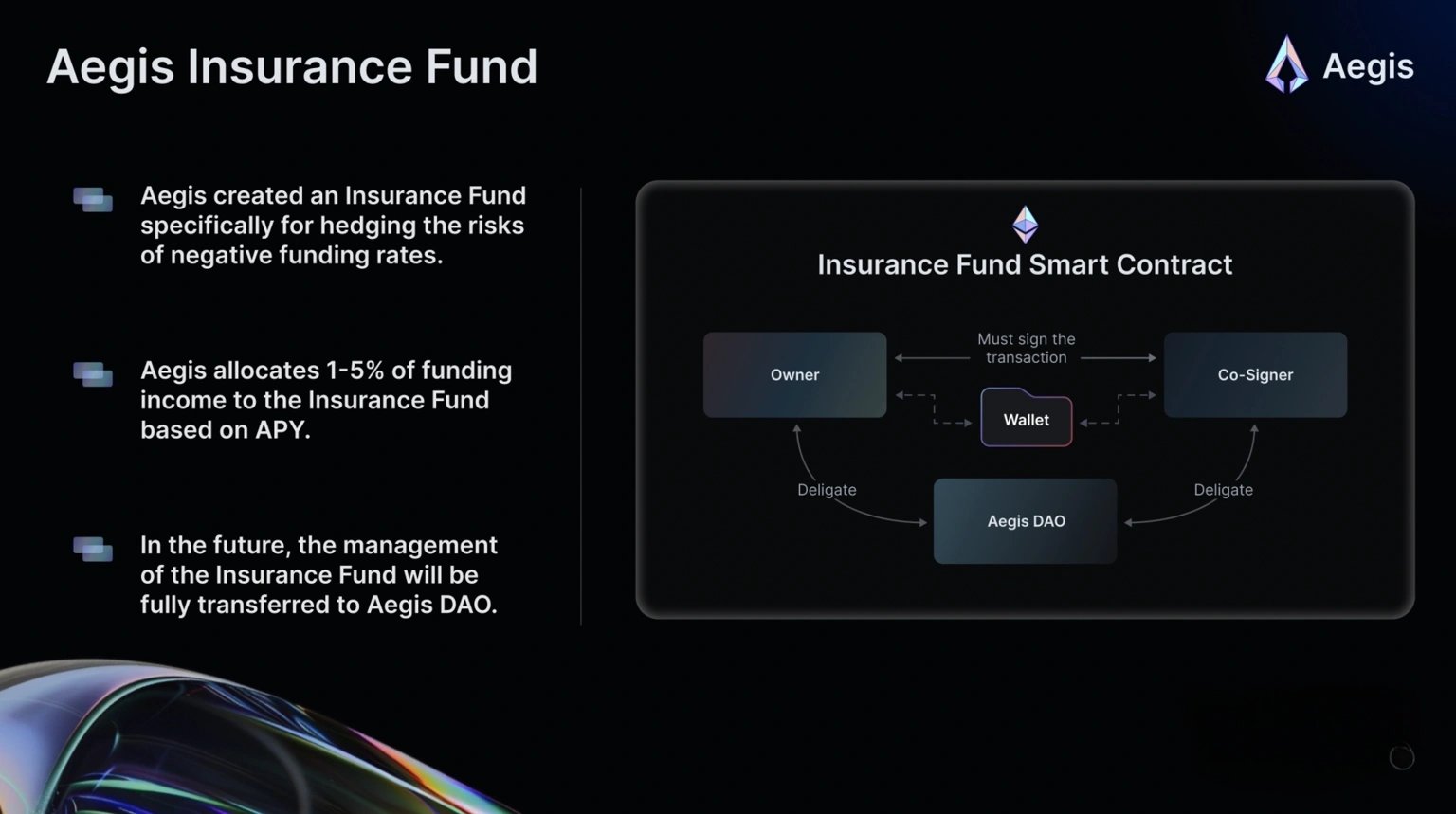

Aegis Insurance Fund

The Aegis Insurance Fund is a component of the protocol that provides a financial buffer to maintain the stability of the YUSD stablecoin. It covers costs during periods of negative funding rates and mitigates the effects of market volatility, particularly in Bitcoin, while maintaining delta-neutral positions. The fund is managed transparently, with all information available for monitoring on the public dashboard. [13]

Mint Security Layer

The Mint Security Layer in the Aegis Protocol ensures the security and integrity of the YUSD minting process. It verifies collateral in USDT, DAI, or USDC before minting, converts it to BTC via trusted OTC desks within a short timeframe to limit market exposure, and stores the BTC with third-party custodians that follow strict security protocols. Smart contracts govern the minting process, automating compliance with rules and preventing unauthorized actions. At the same time, all steps are transparently monitored on the public dashboard, ensuring accountability and protection for the protocol and its users. [11]

Aegis DEX

Aegis DEX is a DeFi platform that integrates trading, liquidity provision, and yield generation. It offers on-chain perpetual trading with a limit order book, vaults that deploy assets into strategies to earn yield, and gamified reward boosters for active participants. YUSD, a Bitcoin-backed stablecoin, can be used as yield-bearing margin collateral, allowing users to maintain yield while leveraging their positions. This integration improves capital efficiency, enables layering of protocol yield with trading opportunities, and transforms idle assets into productive, hedged positions, advancing DeFi yield architecture and liquidity utilization. [14]

YUSD

YUSD is a stablecoin pegged 1:1 to the US dollar and backed by Bitcoin. Users provide collateral in stablecoins such as USDC, USDT, or DAI, which is converted into Bitcoin and secured with custodians, then used to create a delta-neutral position through COIN-M BTC futures contracts. By shorting these futures, YUSD hedges against Bitcoin price volatility, maintaining stability independent of market fluctuations. The protocol is governed by smart contracts that manage minting, burning, and profit distribution, and users can monitor reserves, market positions, and the Insurance Fund in real time via a public dashboard. By relying solely on Bitcoin and maintaining independence from other stablecoins and the fiat banking system, YUSD offers a transparent, secure, and resilient stablecoin framework. [15]

sYUSD

sYUSD is the yield-bearing, staked version of YUSD. Users deposit YUSD into a staking contract to receive sYUSD, which represents a proportional share of the staking pool and automatically accrues yield from Bitcoin funding rates, increasing in value relative to YUSD over time. The protocol uses the ERC-4626 Token Vault standard, enabling composability with other on-chain applications and supporting various deposit and redeem options, including slippage thresholds and ERC-2612 Permit approvals. Staking involves minting or swapping into YUSD, entering the amount in the Aegis app, and approving the transaction, while unstaking triggers a seven-day cooldown before conversion back to YUSD. sYUSD provides passive, auto-compounded yield, single-token simplicity for DeFi use, gas-efficient transactions, and eligibility for Aegis Points, while maintaining the same delta-neutral BTC hedging and audited smart contract risk profile as YUSD. [15]

AEG

AEG is the governance token of the Aegis Protocol, enabling holders to participate in key protocol decisions. Token holders can propose and vote on protocol upgrades, system parameter adjustments, treasury management, strategic partnerships, and asset management strategies, with each AEG token representing one vote. Proposals require a quorum of 4% of the total supply and a majority approval of 51% to pass, ensuring that significant changes reflect community consensus. The token supports a transparent, inclusive governance structure that aligns the protocol’s development and management with its users' interests. [16]

Partnerships

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)