Subscribe to wiki

Share wiki

Bookmark

CEX (Centralized Exchange)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

CEX (Centralized Exchange)

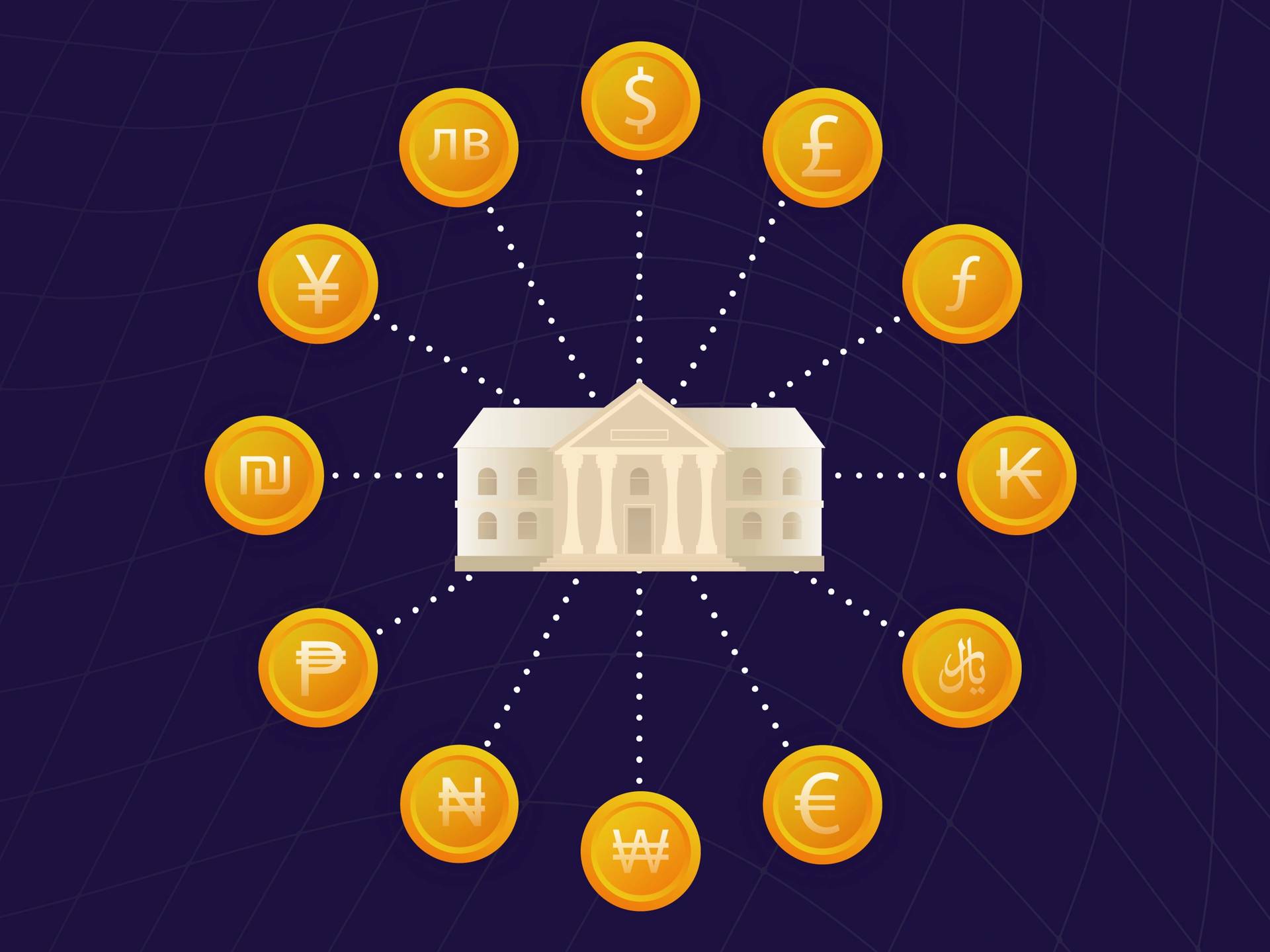

A CEX (Centralized Exchange) is a digital asset exchange platform used to buy and sell cryptocurrencies for fiat currencies, like the US dollar, or between digital assets, like Bitcoin and Ethereum through a centralized platform.

History

The history of Centralized Exchanges (CEXs) can be traced back to the early days of cryptocurrency, primarily with the emergence of Bitcoin in 2009. At that time, Bitcoin users sought a platform to exchange their digital coins for traditional fiat currencies, and the concept of cryptocurrency exchanges was born. The first CEX, BitcoinMarket.com, made its debut in 2010, ushering in a new era of cryptocurrency trading. However, the real growth of CEXs began in the early 2010s, with the rise of exchanges like Mt. Gox, which, despite its early success, suffered from security breaches and bankruptcy. [5]

As the cryptocurrency market expanded beyond Bitcoin, CEXs such as Bitstamp, Kraken, and Coinbase entered the scene, focusing on improving security and regulatory compliance to gain trust in the growing crypto community. The cryptocurrency market, particularly for Bitcoin, experienced a significant boom in 2017-2018, leading to the establishment of numerous other CEXs and the introduction of various altcoins and tokens. In response to this rapid growth and associated risks, many CEXs began to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. Today, CEXs are mainstays in cryptocurrency trading, known for offering advanced features, diverse listings, and enhanced security.[1]

Overview

Centralized exchanges (CEXs) are organizations that coordinate cryptocurrency trading on a large scale, using a similar business model to traditional asset exchanges like stock exchanges. This centralized model stands in contrast to decentralized exchanges (DEXs), which operate without intermediaries and allow users to retain control over their private keys and funds.[2][8]

Centralized exchanges offer a secure environment for buyers and sellers to make transactions, and also provide liquidity for supported tokens in their capabilities as market makers. The transactions in centralized exchanges are validated electronically and documented on the related blockchain that powers the involved digital assets in crypto transactions. In centralized exchanges, every token undergoes a comprehensive evaluation before being listed on a CEX. Most of the centralized crypto exchanges list tokens based on their reputation, market capitalization, and other utilities. Centralized exchanges also provide transaction-related data that help traders and users in investment analysis. [3][6]

CEX offers neutrality, security, and efficiency in the transactions of crypto assets among users. They allow users to deposit their funds into a digital wallet on the exchange. After taking custody of the funds, CEX issues users the corresponding number of IOUs or credits. These debt securities or loans are monitored by the CEX as transactions are executed, converting them into actual fiat currency at the point of withdrawal. [7] This is done through the maintenance of an order book, which records buy and sell orders between traders. The buy and sell orders are essentially requests by users to buy or sell cryptocurrencies at a specific price. The CEXs can calculate, match, and execute buy and sell orders between users.[2]

Use Cases

Trading and Speculation

CEXs are used to facilitate the trading and speculation of cryptocurrencies and digital assets. Traders and investors use these platforms to buy, sell, and trade a wide range of cryptocurrencies, including Bitcoin, Ethereum, and altcoins. CEXs offer advanced trading features like limit orders, margin trading, and chart analysis tools to assist users in making informed investment decisions. They can trade cryptocurrencies against each other or against fiat currencies, all while managing fees and utilizing advanced tools for analysis. Speculators aim to profit from cryptocurrency price fluctuations, employing strategies like short-term day trading or long-term asset holding, often with leverage. The speculation involves risk management, monitoring market news, and responding to the high volatility of the cryptocurrency market.[2]

Liquidity Provision

Centralized exchanges are known for their high liquidity, which makes it easier for users to execute trades quickly and at desired prices. Liquidity providers, such as market makers, often use CEXs to facilitate trading activities and profit from the bid-ask spread. They play a crucial role in identifying arbitrage opportunities, ensuring market stability, and enhancing the overall trading experience for users. Incentives and rewards often entice market makers to actively participate, further bolstering liquidity on CEXs.[9]

Onboarding New Users

CEXs often serve as the entry point for individuals who are new to the world of cryptocurrencies. They provide user-friendly interfaces and support for fiat-to-crypto trading, allowing newcomers to purchase their first cryptocurrencies using traditional fiat currencies like USD, EUR, or GBP. [12]

Cryptocurrency Conversion

CEXs typically offer a wide variety of cryptocurrencies and trading pairs, enabling users to access and trade numerous digital assets in one place. This variety allows investors to diversify their portfolios and explore different blockchain projects.

Hedging and Risk Management

Traders and investors use CEXs to hedge their cryptocurrency holdings against price volatility. They can enter short positions or use options and futures contracts to manage risk in their crypto portfolios. Traders often hedge by converting their holdings into stablecoins or using inverse futures and options contracts to offset potential losses. Risk management involves setting stop-loss orders, careful position sizing, assessing risk-reward ratios, and staying informed about market conditions. These strategies help traders preserve capital and mitigate potential losses while actively participating in the cryptocurrency markets on CEXs.[10]

Stablecoin Trading

CEXs facilitate the trading of stablecoins. Traders often use stablecoins like USDT (Tether) and USDC (USD Coin) as a stable store of value and a means to move in and out of volatile cryptocurrencies quickly. Traders frequently employ stablecoins to navigate volatile crypto markets, using them as a base currency in pairings, for arbitrage opportunities, and as a means of hedging and margin trading. The stability of stablecoins simplifies trading calculations, making them a valuable tool for both experienced and novice traders seeking stability amid cryptocurrency price fluctuations.[10]

Regulated Trading

Some users prefer to trade on CEXs that operate in compliance with local and international regulations. These exchanges often require users to complete KYC and AML checks, providing a level of security and regulatory oversight. Regulated CEXs also ensure asset listings comply with regulatory standards and navigate international regulations to provide users with a secure, legitimate, and compliant trading environment, promoting trust and integration with traditional financial systems.[11]

Types of Centralized Exchanges

1. Traditional Exchanges

These are the most common type of exchanges where users can buy or sell their cryptocurrencies at current market prices. Examples include Coinbase, Binance, and Kraken.

2. Margin Exchanges

These platforms allow users to borrow funds to leverage their trading positions, amplifying potential profits but also increasing risk. Binance and Bitfinex offer margin trading.

3. Brokerage Platforms

These are platforms are designed for beginners and offer user-friendly interfaces and guided processes for purchasing cryptocurrencies directly with fiat currency. The exchange sells cryptocurrency directly to users at a price set which is often slightly above market rate. Coinbase, Coinmama and CEX.io primarily offer brokerage services.

4. Derivatives CEX

Specialize in derivative products such as futures and options contracts, enabling users to speculate on cryptocurrency price movements without owning the underlying assets. BitMEX and Deribit are examples.

5. Peer-to-Peer (P2P) Exchanges

Some centralized exchanges offer a P2P service where users can directly trade with each other, and the platform acts as an escrow to ensure the safety of the transaction. An example is Binance P2P.

6. Derivatives Exchanges

Derivatives CEXs specialize in offering derivative products like futures and options contracts. Traders can speculate on the future price of cryptocurrencies without owning the underlying assets. BitMEX and Deribit are prominent examples.

7. Token-to-Token CEXs

These exchanges exclusively support cryptocurrency-to-cryptocurrency trading and do not handle fiat currency. They cater to experienced traders looking for a wide range of altcoins. Binance initially focused on token-to-token trading before expanding their scope.

Key Characteristics

1. Intermediary Control

Centralized exchanges are managed and operated by a central authority. This entity serves as an intermediary that facilitates order matching, trade execution, and the management of user accounts.[3]

2. Custodial Services

Most CEXs offer custodial services; they hold users' funds on their platform. When users create accounts on these exchanges, they typically deposit their cryptocurrencies into wallets controlled by the exchange. The exchange is responsible for the security and management of these assets.[3]

3. User-Friendly Interface

Centralized exchanges provide user-friendly interfaces and trading tools that cater to both novice and experienced traders. These platforms often offer features such as market orders, limit orders, and advanced charting tools to assist users in executing trades efficiently.

4. Liquidity

CEXs are known for their high liquidity. The presence of a large user base ensures that there is usually a significant volume of trades taking place at any given time. This liquidity allows users to execute trades quickly and at desired prices.

5. Regulatory Compliance

Some centralized exchanges operate under regulatory frameworks and require users to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) verification procedures. Compliance with local and international regulations is a priority for many CEXs.

6. Fiat-to-Crypto and Crypto-to-Crypto Trading

Centralized exchanges typically offer a wide range of trading pairs, allowing users to exchange cryptocurrencies for fiat currencies (such as USD, EUR, or JPY) and for other cryptocurrencies. This versatility attracts a diverse user base.

Most Known CEXs

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)