Subscribe to wiki

Share wiki

Bookmark

Blockchain

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Blockchain

A blockchain is a distributed ledger that connects a decentralized network on which users can send transactions and build applications without the need for a central authority or server. It is a continuously growing list of records, called blocks, which are linked and secured using cryptography.[3]

Overview

A blockchain facilitates secure online transactions. A blockchain is a decentralized and distributed digital ledger that is used to record transactions across many computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks and the collision of the network. This allows the participants to verify and audit transactions inexpensively.[15]

Transactions or codes are batched into blocks, verified, and subsequently accepted as part of the blockchain by a network of distributed users (nodes) through a consensus mechanism. Because each block of verified data contains a unique signature of data from the previous block, they are linked together into a "block-chain." A network-based consensus mechanism is a way a blockchain protocol agrees on how its underlying technical architecture will operate. Some blockchains create a new block as frequently as every five seconds.[15]

Structure and Components

Blocks

Block is a collection of data that contains a timestamp and other encrypted information about recent transactions that need to be validated by the network before being added to the chain. To preserve the transaction history, blocks are strictly ordered, every new block created contains a reference to its parent block, and transactions within blocks are strictly ordered as well. Except in rare cases, all participants on the network are in agreement on the exact number and history of blocks and are working to batch the current live transaction requests into the next block.[34][35]

Block Time

Block time is the measure of the time it takes the miners or validators within a network to verify transactions within one block and produce a new block in that blockchain. Cryptocurrencies can use different consensus mechanisms, which, among other factors, affect the time it takes to verify transactions and create new blocks. Each cryptocurrency has a different block time - Bitcoin takes around 10 minutes, while Ethereum takes around 14 seconds.[36]

Finality

Generally, transaction finality refers to the moment when parties involved in a transaction can consider the transaction to be completed. More specifically, this is the moment when it becomes impossible to revert or alter a transaction that has been added to the blockchain. Transaction finality can be either deterministic or probabilistic.[37]

Probabilistic finality takes place when a transaction’s finality increases as more blocks are added to the blockchain after the transaction. That is, as more blocks are added, the transaction is further referenced in the blockchain and becomes increasingly difficult to revert or alter as a result. For most protocols providing probabilistic finality, there is a recommended number of blocks to be added following the transaction until it can be considered complete. For example, it is recommended that one wait until six additional blocks have been added to the Bitcoin blockchain before considering a transaction to be final.[37]

Deterministic finality occurs when a transaction is immediately considered to be final once it is added to the blockchain. For this to happen, a "leader" must propose a block to be added, and then a specified portion of validators must approve it. Deterministic finality is less common and is only provided by Practical Byzantine Fault Tolerance-based (PBFT) protocols such as Tendermint.[37]

Nodes

A blockchain node is one of the devices that run the blockchain protocol software and usually stores the history of transactions. Full Nodes maintain a full copy of all the transactions. They have the capacity to validate, accept and reject transactions. Partial Nodes are also called Lightweight Nodes because they do not maintain the whole copy of the blockchain ledger. They maintain only the hash value of the transaction. The whole transaction is accessed using this hash value only. These nodes have low storage and low computational power.[23]

Ledger

A ledger is a digital database of information. There are three types of the ledger:

- Public Ledger – it is open and transparent to all. Anyone in the blockchain network can read or write something.

- Distributed Ledger – in this ledger, all nodes have a local copy of the database. A group of nodes collectively execute the job i.e verify transactions and add blocks in the blockchain.

- Decentralized Ledger – in this ledger, no one node or group of nodes has central control. Every node participates in the execution of the job.[23]

Smart contracts

Blockchain smart contracts establish the terms of an agreement between users and smart contracts’ terms are executed as code running on a blockchain. Smart contracts allow developers to build apps offering peer-to-peer functionality. They are used in everything from financial tools to logistics and game experiences, and they are stored on a blockchain like any other crypto transaction. Smart-contract-powered apps are often referred to as decentralized applications or dapps.[24]

Consensus Mechanisms

Consensus mechanisms (also known as consensus protocols or consensus algorithms) are used to verify transactions and maintain the security of the underlying blockchain. Consensus is the process by which a group of peers – or nodes – on a network determine which blockchain transactions are valid and which are not. Consensus mechanisms are the methodologies used to achieve this agreement. It is these sets of rules that help to protect networks from malicious behavior and hacking attacks. Proof-of-work (PoW) and proof-of-stake (PoS) are two of the most widely used consensus mechanisms.[25]

Proof-of-Work

Proof of work is a consensus mechanism cryptocurrencies use to verify new transactions, add them to the blockchain, and create new tokens. Proof-of-work requires computers to solve cryptographic puzzles, putting in "work" to be rewarded with the ability to verify or validate, transactions on the blockchain. It’s called cryptocurrency mining. The idea is that through a long string of numbers and letters, called hashes, it’s possible to stave off malicious attacks and verify that a transaction is valid. When someone puts data through a function on the network, which is the basis of transactions on the blockchain, it can only generate one hash. When transactions (like transfers of some cryptocurrency from one user to another) happen on the blockchain, the resulting hash is distributed across the entire network. Any change to the hash by tampering would be noticed and rejected. The Bitcoin blockchain was the first Proof-of-Work network. Since its inception, the PoW mechanism has been used by numerous additional blockchains, including Dogecoin, Litecoin, Monero, and Bitcoin Cash.[20][21]

Proof-of-Stake

In a proof-of-stake system, staking serves a similar function to proof-of-work mining. PoS relies on validators who own the coins associated with the blockchain. With proof-of-stake, a validator is chosen randomly, based in part on how many coins they have locked up in the blockchain network, also known as staking. The coins act as collateral and when a participant, or node, is chosen to validate a transaction, they receive some crypto in exchange. Proof-of-stake requires multiple validators to agree that a transaction is accurate, and once enough nodes verify the transaction, it goes through. PoS has faster transaction speeds in comparison to PoW and more efficient energy requirements that allow higher scalability and thus making it easier to adopt among new users. PoS is used by Ethereum, BNB Chain, Avalanche, The Graph, and others.[20][22]

Forks

Hard Forks

A hard fork term refers to a situation when a blockchain splits into two separate chains as a consequence of the use of two distinct sets of rules trying to govern the system. These rules create certain parameters and standards for mining, staking, node connections, transaction specifics, and more that must be adhered to by all participants. So there appear two networks running in parallel. All nodes had an identical blockchain until the point of the fork (and that history remains), but they have different blocks and transactions afterward.[19]

Cryptocurrencies like Bitcoin Cash and Bitcoin Gold evolved out of the original Bitcoin blockchain via a hard fork.[17]

In October 2022, BNB Chain, the smart contract-enabled blockchain of crypto exchange Binance, underwent a hard fork upgrade named Moran as a fix for the exploit that happened the same month.[18]

Soft Fork

A soft fork is a rule modification to the blockchain whereby newly implemented changes remain backward-compatible with older versions. A soft fork convinces the old blockchain network to accept the altered rules, thus allowing both the upgraded and old blocks of transactions to be accepted at the same moment.[16]

History

Early Beginnings & Bitcoin Development

In 1982, cryptographer David Chaum first proposed a blockchain-like protocol in his dissertation "Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups." Chaum has been referred to as "the father of online anonymity", and "the godfather of cryptocurrency". He is also known for developing ecash, an electronic cash application that aims to preserve a user's anonymity, and inventing many cryptographic protocols like the blind signature, mix networks, and the Dining cryptographers protocol. In 1995 his company DigiCash created the first digital currency with eCash.[45]

The first work on a cryptographically secured chain of blocks was described in 1991 by Stuart Haber and W. Scott Stornetta. [7] In 1992, Bayer, Haber, and Stornetta incorporated Merkle trees into the blockchain as an efficiency improvement to be able to collect several documents into one block. In 1993, Proof-of-Work (PoW) mechanism was proposed to protect against spam and other network failures.[8][10]

In 2004 Hal Finney, a computer scientist and cryptography expert developed a system known as RPoW (Reusable Proof of Work). The system created a transferrable verified and signed (RSA) token by receiving a non-exchangeable (or non-fungible) hash cash based on a proof-of-work (PoW) token.[11]

The first distributed blockchain was then conceptualized by an anonymous person or group known as Satoshi Nakamoto in 2008 and implemented the following year as a core component of the digital currency bitcoin, which served as the public ledger for all transactions. Through the use of a peer-to-peer network and a distributed timestamping server, a blockchain database is managed autonomously. The use of the blockchain for bitcoin made it the first digital currency to solve the double spending problem without requiring a trusted administrator.[39]

The words block and chain were used separately in Satoshi Nakamoto's original paper in October 2008, and when the term moved into wider use it was originally blocked chain, before becoming a single word, blockchain, by 2016.[9]

Blockchain 2.0: Ethereum Development

Around 2013, Vitalik Buterin, who was one of the first contributors to the Bitcoin codebase, felt Bitcoin didn't use the full capabilities of blockchain technology. He started working on his own project and Ethereum was born out as a new public blockchain in 2014 with added functionalities compared to Bitcoin. Buterin differentiated Ethereum from Bitcoin blockchain by expanding Ethereum functionalities from being a cryptocurrency to being a platform for developing decentralized applications as well. Ethereum featured a scripting functionality, called smart contracts which are programs or scripts that can be used to make a transaction if certain conditions are met. Smart contracts are written in specific programming languages and compiled into bytecode, which a decentralized Turing-complete virtual machine, called the Ethereum virtual machine (EVM) can then read and execute.[39][12]

It allowed programmers around the world to develop decentralized applications and software on the existing blockchain platforms. Soon, the industry saw a surge in growth in decentralized autonomous organizations (DAOs), redeemable tokens for ICOs or governance controls, and identifiers for unique items such as NFTs (non-fungible tokens). Examples of applications and platforms of this blockchain generation include crypto platforms such as Lisk, and Neo, dApps like MakerDAO and Uniswap, and crypto wallets like MetaMask.[13]

Blockchain 3.0

Blockchain 3.0 technology increases the transaction processing rate and eliminates block times. As a result, newer blockchain platforms can execute several thousand transactions every second, which is higher than Bitcoin and Ethereum do. Another significant change that the third-generation blockchains introduced is the popularization of the proof-of-stake (PoS) model. This consensus mechanism eliminated the use of highly-complex computing devices and the enormous energy consumption required to create new blocks. Examples of Blockchain 3.0 technology include Algorand, Polygon, and Optimism.[14]

Ethereum Merge & Ethereum Layer 2 Scaling Solutions

One of the major milestones in the development of Blockchain 3.0 is Ethereum Merge which took place on September 15, 2022. The Merge represented the Ethereum network’s shift from Proof-of-Work to Proof-of-Stake (PoS) consensus mechanism. Ethereum already had a PoS network called the Beacon Chain (introduced in 2020), but it was not used for processing transactions. Ethereum's full transition to PoS required merging the Beacon Chain (called the "Consensus" layer) with Ethereum’s PoW mainnet (the "Execution" layer). After the Merge, Ethereum received faster transaction confirmations, a reduction in energy consumption, and the ability to add more scaling solutions.[31][32]

Ethereum Layer 2 is a term used for solutions created to help scale an application by processing transactions off of the Ethereum Mainnet (layer 1) while still maintaining the same security measures and decentralization as the mainnet. Layer 2 solutions have increased throughput and also reduce the carbon footprint - they need less gas, which means less energy used, which equates to less carbon. Popular examples of Ethereum layer 2 solutions include Polygon, Arbitrum, and Optimism.[33]

Shanghai Upgrade

The Shanghai upgrade for Ethereum, also known as Shapella, took place on April 12, 2023. This significant upgrade enabled withdrawals for users who had “staked” their ether (ETH) to secure and validate transactions on the Ethereum blockchain. Prior to this upgrade, users were unable to withdraw their staked ether or redeem accrued rewards, which was a crucial feature missing from the proof-of-stake paradigm.[57]

Dencun Upgrade

The Dencun upgrade for Ethereum is a significant milestone that aims to reduce data fees and enhance scalability. The Dencun upgrade enables a new method called “blobs” for storing data on the Ethereum blockchain. These blobs have a dedicated space separate from regular transactions, resulting in lower costs. The upgrade is crucial for tackling Ethereum’s notoriously high transaction fees.

The upgrade incorporates several code changes, with the most significant being “proto-danksharding.” Proto-danksharding provides a dedicated space for data storage, improving efficiency and reducing fees.

Dencun upgrade went live on March 13, 2024.

Types

Public Blockchain

Public blockchain involves no gatekeeper, and anybody can engage with the consensus mechanism. This means that applications can be added to the network without the approval or trust of others, using the blockchain as a transport layer. Anyone can read, write, and audit the ongoing activities on a public blockchain network, which helps achieve a self-governed, decentralized nature. For example, Ethereum is one of the public blockchain platforms examples.[16]

Private Blockchain

A private blockchain network, similar to a public blockchain network, is a decentralized peer-to-peer network. However, one organization governs the network, controlling who is allowed to participate, execute a consensus protocol and maintain the shared ledger. A private blockchain can be run behind a corporate firewall and even hosted on-premises.

Permissioned Blockchain

Permissioned blockchains are blockchain networks that require access to be part of. In these blockchain types, a control layer runs on top of the blockchain that governs the actions performed by the allowed participants. A permissioned system makes networks highly by the owners.[16]

Consortium

The consortium blockchain blends elements from both public and private chains, bridging the gap between them. In a consortium chain, a few equally strong parties serve as validators as opposed to an open system where anybody can validate blocks or in a closed system where only a single company selects block producers.[16]

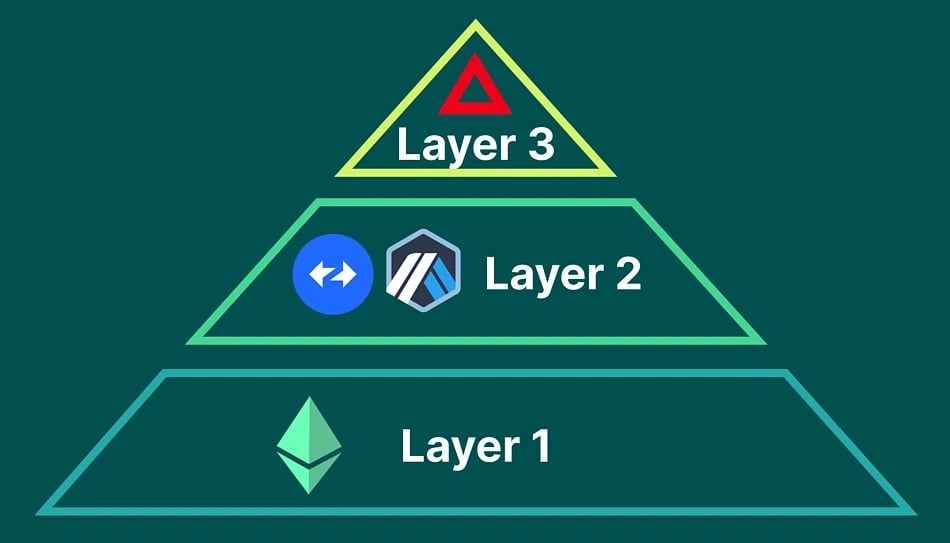

Layer 1 Blockchains

A layer-1 network refers to a base network and its underlying infrastructure. BNB Chain, Ethereum, Bitcoin, and Solana are all layer-1 protocols. Layer 1 protocols process and finalize transactions on their own blockchain. They also have their own native token, used to pay for transaction fees.[26]

Scaling

A common problem with layer-1 networks is their inability to scale. Blockchains that use the Proof-of-Work consensus tend to slow down when the volume of transactions is too high. This increases transaction confirmation times and makes fees more expensive. For layer-1 scaling, some options include:

1. Increasing block size, allowing more transactions to be processed in each block.

2. Changing the consensus mechanism used, such as with the upcoming Ethereum 2.0 update.

3. Implementing sharding. A form of database partitioning.[26]

Layer 1 improvements require significant work to implement. In many cases, not all network users will agree to the change. This can lead to community splits or even a hard fork, as happened with Bitcoin and Bitcoin Cash in 2017.[26]

Sharding

Sharding is a popular layer-1 scaling solution used to increase transaction throughput. The technique is a form of database partitioning that can be applied to blockchain-distributed ledgers. A network and its nodes are divided into different shards to spread the workload and improve transaction speed. Each shard manages a subset of the whole network's activity, meaning it has its own transactions, nodes, and separate blocks. With sharding, there is no need for each node to maintain a full copy of the entire blockchain. Instead, each node reports back the work completed to the main chain to share the state of their local data, including addresses’ balance and other key metrics.[26]

Layer 2 Blockchains

Layer 2 refers to a set of off-chain solutions (separate blockchains) built on top of layer 1s that reduce issues with scaling and data. This means that a decent amount of the work that would be performed by the main chain can be moved to the second layer. Layer 2 applications then post the data of transactions to layer 1 where it’s secured in the blockchain ledger and history.[27]

Layer 2s vary in accessibility - some can be used by a range of applications, while others only work for a specific project. Several of the key components that layer 2s leverage include rollups and sidechains.[27]

Rollups

A rollup is a specific layer 2 solution that executes transactions outside of layer 1, rolls them up into a single piece of compressed data, and then posts the data back to the mainnet for anyone to review and dispute if deemed suspicious.[27]

Optimistic rollups

Optimistic rollups are layer 2 (L2) protocols designed to extend the throughput of Ethereum's base layer. Users are incentivized to transact on these layer 2s due to the competitively low fees. If a fraudulent transaction is suspected, it can be challenged and assessed through fraud proofs. In this scenario, the rollup will run the transaction’s computation using the available state data. Several examples of Optimistic rollups include Arbitrum and Optimism.[27][28]

ZK rollups

In contrast to Optimistic rollups, ZK rollups generate cryptographic proofs to validate the authenticity of transactions. These proofs, posted to layer 1, are called validity proofs or SNARK (succinct non-interactive argument of knowledge), or STARKs (scalable transparent argument of knowledge).[28]

ZK-rollups can process thousands of transactions in a batch and then only post some minimal summary data to mainnet. This summary data defines the changes that should be made to the blockchain and some cryptographic proof that those changes are correct. Several examples of ZK rollups include dYdX and Loopring.[27][28]

Sidechains

A sidechain is an independent, EVM-compatible blockchain that runs parallel and interacts with the mainnet through bridges. Sidechains can have separate block parameters and consensus algorithms, which are often designed for the efficient processing of transactions.[27][29]

A sidechain is attached to its parent blockchain using a two-way peg. The two-way peg enables the interchangeability of assets at a predetermined rate between the parent blockchain and the sidechain. A user on the parent chain first has to send their coins to an output address, where the coins become locked so the user is unable to spend them elsewhere. Once the transaction has been completed, a confirmation is communicated across the chains followed by a waiting period for extra security. After the waiting period, the equivalent number of coins is released on the sidechain, allowing the user to access and spend them there. The reverse happens when moving back from a sidechain to the main chain.[30]

Layer 3 Blockchains

Layer-3 blockchains are built on top of Layer-2 solutions, providing additional functionality, interoperability, or performance enhancements to the underlying blockchain infrastructure.

Over the years, there has also been considerable interest in the mainstream adoption of blockchain technology, especially among enterprises. One of the most significant drawbacks standing in the way of greater acceptance of this technology and the crypto industry is the scalability of blockchains. The need for more efficient, scalable solutions has led to the development of various unique layers, namely Layer 2 and Layer 3.

Layer 3 networks operate on top of Layer 2 solutions, connecting multiple Layer 2 networks and allowing transactions across different blockchains, which traditional Layer 2 solutions do not achieve. While both Layer 2 and Layer 3 solutions aim to scale the blockchain network, Layer 3 is more about connecting various blockchains and facilitating seamless communication between them. [60][62][61][63][64]

Key Features of Layer 3 Scaling Solutions

- Specialized Functionality: Layer-3 networks offer a stage for dApps to perform with unprecedented scalability and efficiency, hosting one dApp per network to ensure high performance without network congestion or computational bottlenecks.

- Enhanced Scalability and Efficiency: Layer 3 networks bring even greater scalability to blockchain systems. They achieve this by optimizing consensus mechanisms and data structures, enabling higher throughput and transaction processing capabilities. For instance, the Xai network, built on Arbitrum's Layer-3, powers Web3 games with increased efficiency, scalability, and reduced costs.

- Improved Interoperability and Accessibility: Layer-3 solutions like Arbitrum Orbit allow for easy deployment of dedicated blockchains, enhancing the accessibility and interoperability within the crypto ecosystem.

- Customization and Security: They offer unparalleled customization options for developers and robust security features for each hosted DApp, creating a secure and tailored environment for innovation and growth.

- Low Cost and High Performance: Layer 3 solutions are designed to be low-cost and high-performance, offering blockchain projects more choices for scaling. They aim to strike a balance between efficiency and affordability, making blockchain technology more accessible.

- Decongesting the Main Chain: Like Layer 2 solutions, Layer 3 solutions help decongest the main blockchain by processing certain transactions and operations off-chain. This reduces network congestion and transaction fees, improving the user experience.

- Enhanced Layering: Layer 3 solutions work in conjunction with Layer 2 protocols. They can resolve fragmentation issues in the crypto space by combining Layer 2 scalability solutions with Layer 3 protocols for enhanced interoperability.

- Rollups: Some Layer 3 solutions, like rollups, enable transactions outside the base layer and then upload them to Layer 2 blockchain protocols.

Use Cases

Supply Chain

Blockchain used in supply chain finance solutions can increase the efficiency of invoice processing and provide more transparent and secure transactions. For example, smart contracts can be applied to trigger immediate payments as soon as the product is delivered and signed for. Transactions can be verified, recorded, and coordinated autonomously without third parties–eliminating an entire layer of complexity from global supply chains.[38][39]

Food and pharmaceutical products often have similar storage and shipping needs. Blockchain allied to IoT sensors on products can record temperature, humidity, vibration, and other environmental metrics. The data is stored in a blockchain and smart contracts are applied to ensure automatic redress if any of the readings go out of range. One early example of blockchain for the food supply chain is Walmart’s use of technology to track the provenance and condition of its pork products coming from China.[38][39]

Banking and Finance

Traditional Finance

With blockchain, banks can have such benefits as a high level of security when transferring money, quick transactions all over the world, and the ability to serve around the clock instead of being time specific. For example, Australia's Westpac and Estonia's LHV banks integrated blockchain technology into their processes. JPMorgan Chase, Morgan Stanley, and Goldman Sachs are among the firms with dedicated groups for cryptocurrency and its underlying blockchain technology. JPMorgan has one of the largest crypto teams, with more than 200 employees working in its Onyx division. The JPM Coin digital currency is being used commercially to send payments around the world.[39][40][50]

Decentralized Finance

Blockchain technology can help in the decentralization of peer-to-peer transfer applications and allows for peer-to-peer transfers worldwide. Some known DeFi platforms are Compound and PoolTogether which allow borrowing and lending assets.[40][51]

Blockchain technology in banking can also be utilized to improve the lending and borrowing operations that banks support. Strong verification capabilities provided by the technology may lower the risk of defaulted loans. Blockchain can also verify that prospective customers are not dishonest, strengthening banks' know-your-customer (KYC) and anti-money-laundering (AML) defenses.[40]

Intellectual Property

Blockchain use in intellectual property can help with creatorship and registering and clearing of IP rights; digital rights management; establishing and enforcing IP agreements, licenses, or exclusive distribution networks through smart contracts; and transmitting payments in real-time to IP owners.[41][39]

In Europe, various governmental agencies and IP registries such as the European Union Intellectual Property Office (EUIPO) are involved in researching and promoting blockchain capabilities within the industry. In India, the IPO (Indian Patent Office) is working on using blockchain and other innovative technologies like AI and IOT to enable smoother patent processes.[41][39]

The security offered by blockchain technology is a tamper-proof method of data storing and sharing, with the owner traceable throughout the block height. Due to this, ownership can be recorded and preserved within the blockchain. Non-fungible tokens (NFTs), the digitally unique, non-tradable assets, act as a veritable copyright with the distributed ledger technology.[39]

Healthcare

A blockchain network can be used in the healthcare sector to preserve and exchange patient data through hospitals, diagnostic laboratories, pharmacies, doctors, and nurses. Healthcare blockchain applications can accurately identify severe mistakes and can improve the performance, security, and transparency of sharing medical data in the healthcare industry. An example is the Estonian X-Road solution that connects different information systems for various services.[42]

Retail & eCommerce

Using blockchain applications in retail can help with cutting costs, improving business processes, and making transactions faster. The most common blockchain technology used in e-commerce is the Ethereum virtual machine. Bitcoin also allows customers to make purchases on sites and apps that accept Bitcoin as payment. Nestle is offering more details on its production by adopting the IBM Food Trust’s blockchain technology platform. Through this partnership, Nestle provides a way for customers to locate the source of beans used in editions of its coffee brand Zoégas. Scanning a QR code on the package gives customers access to blockchain data, so customers can track their coffee beans and understand the harvest methods used for Nestle’s products.[42][52]

Property & Real Estate

Blockchain can improve transparency, regulatory compliance, and consumer protections across the property and real estate industry. It allows for direct transactions between sellers and buyers, without the need for an overseeing institution to verify the validity of those transactions. The process can be further improved by implementing smart contracts, which ensure that a seller-buyer transaction will only take place if certain conditions are met. In addition, the real estate market could benefit from joining the tokenization trend. Tokenization refers to the issuance of tokens acting as the digital representation of an asset or a fraction of an asset. Tokenizing properties can bring greater liquidity to the sector, increase transparency and make an investment in real estate more accessible.[43]

For example, RealT, a fractional real estate investment platform, allows users to invest in the U.S. real estate market through a fully token-based blockchain network. The platform lets investors buy tokenized properties on Ethereum and maintain access to cash flows and low-maintenance ownership via RealTokens. It gives owners access to rent payments weekly through US-Dollar stable coin, xDai, or Ethereum.[53]

Heavy Industry & Manufacturing

Manufacturing blockchain applications can scale transparency and trust through all stages of the industrial value chain, from sourcing raw materials to producing the finished product ready for supply chains. Furthermore, manufacturing blockchain applications can eradicate counterfeit production, engineer high-complexity products, identify management, asset tracking, quality assurance, and regulatory compliance.[42]

In 2020, General Motors filed a patent for a blockchain-based navigation map. The system uses blockchain to integrate data from vehicle sensors and build a reliable map for autonomous vehicles. General Motors’ solution was to distribute the process to many vehicles, which would collect data about their surroundings through sensors as they drive around. The real-time data was compared with a discrepancy detector, which analyzes the existing maps.[54]

Gaming

Players and the gaming industry developers usually face challenges in the form of high fees, unsafe data, centralized control, fraudulent activities, and hidden costs. However, blockchain resolves many of these problems. Blockchain platforms use data encryption technologies such as the private key-public key for securing crypto token transactions. With the technology, it's almost impossible to hack these data encryption techniques.[44][42]

In a typical online game, players have to pay fees to utilize online gaming. Moreover, although players can leverage fiat currencies, the transactions are not cost-effective. In this case, blockchain enables instant payments across the world without any restrictions.[44]

Voting & Government

Government blockchain applications can improve local political engagement, improve bureaucratic efficiency and accountability, and reduce financial burdens. Like Illinois, some state governments in the USA are already using the technology to secure government documents. Blockchain-based voting could also improve civic engagement by allowing voting to be done on mobile devices.[42][44]

Exchange-Traded-Funds (ETFs)

Blockchain technology expanded beyond just cryptocurrencies. Blockchain ETFs have the potential to benefit from the increased adoption and utilization of blockchain technology. Blockchain ETFs are funds that meet at least one of the following two criteria:[55]

- They are funds that invest in companies involved with the transformation of business applications though development and use of blockchain technology.

- They are funds that invest in futures and options pegged to the performance of Bitcoin, Ether and other cryptocurrencies, or in cryptocurrency investment products offered by asset managers like Grayscale or Bitwise.

Bitcoin ETFs

Bitcoin ETFs are exchange-traded funds that track the value of Bitcoin, providing traders with an opportunity to gain exposure to the cryptocurrency through traditional stock market exchanges. These ETFs aim to simplify the process of trading in Bitcoin by offering a regulated and transparent investment vehicle. Currently, there are two types of cryptocurrency ETFs in the US: Spot Market ETFs and Futures Market ETFs.

Until 2024, the US Securities and Exchange Commission (SEC) has approved Futures Market ETFs for Bitcoin and Ethereum, and, in January 2024, approved 11 Spot Bitcoin ETFs. As of mid-April 2024, the SEC has further delayed the decision on the Hashdex and ARK 21Shares Ethereum ETFs, extending the decision until May 2024.

Ethereum ETFS

Ethereum ETFs allow traders to gain exposure to the price movements of Ethereum (ETH) or a basket of cryptocurrencies that includes Ethereum without directly owning ETH. They are structured like traditional ETFs, where traders can buy and sell shares on stock exchanges throughout the trading day, a convenient way to trade Ethereum without dealing with the technical complexities of buying, storing, and managing it directly.

Some Ethereum ETFs are regulated financial products and available in certain jurisdictions where they have been approved by regulatory authorities. However, their availability may vary from one country to another.[56]

Energy

Bitcoin and other proof-of-work blockchains require large amounts of energy to perform the work associated with crypto mining. It’s estimated that Bitcoin consumes electricity at an annualized rate of 127 terawatt-hours (TWh) in 2022and reached 141.2 TWh as of Dec. 20, 2023. That usage exceeds the entire annual electricity consumption of Norway. Cryptocurrency mining also generates significant electronic waste, as mining hardware quickly becomes obsolete. According to Digiconomist, the Bitcoin network generates approximately 38 thousand tons of electronic waste annually.[46][48][58]

According to the Bitcoin Mining Council’s 2022 report, 59.5% of the total Bitcoin mining global energy came from renewable sources and it was increased to 63.1% in H1 2023.[59]

More and more mining companies are interested to make Bitcoin greener. Aspen Creek Digital Corp., a new bitcoin mining firm, began mining at a solar-powered plant in western Colorado. In addition, wind and solar energy are significantly utilized in Texas, an important place for bitcoin mining. Alps Blockchain, an Italian startup, has deployed the use of hydropower for Bitcoin mining in Borgo d’Anaunia.[49]

Ethereum was estimated to use 62.77 Terawatt-hours of electricity per year, based on energy consumption through July 9, 2022. The average Ethereum transaction required 163 kilowatt-hours of electricity. From the very beginning, Ethereum planned to implement a proof-of-stake-based consensus mechanism, but doing so without losing security and decentralization took years of research and development. Therefore, a proof-of-work mechanism was used to get the network started. Just before the switch to proof-of-stake, the energy consumption was closer to 78 TWh/yr, comparable to that of Uzbekistan, with a carbon emission equivalent to that of Azerbaijan (33 MT/yr). However, since Ethereum upgraded to a proof-of-stake consensus mechanism, using ETH instead of energy to secure the network, electrical energy requirements have dropped to 0.01 TWh per year.[46][47]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)