Subscribe to wiki

Share wiki

Bookmark

Almanak

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Almanak

Almanak is a protocol that utilizes artificial intelligence to create and deploy automated financial strategies within the decentralized finance (DeFi) sector. The platform aims to simplify the process of identifying, building, and executing complex trading and yield-generating strategies through AI-powered financial agents. [1] [2]

Overview

Almanak is designed to provide users with tools analogous to a quantitative trading desk by leveraging AI's capabilities in high-speed data processing, analysis, and coding. It seeks to automate the discovery of market inefficiencies and yield opportunities, the creation of corresponding strategies, and their subsequent execution on-chain. [1]

The platform is built on the premise that AI can significantly outperform human capabilities in processing vast amounts of market data and writing the necessary code to act on it. Almanak's core components consist of a multi-agent AI system, referred to as an "AI swarm," and a non-custodial infrastructure for deploying the strategies created by these agents. The system is intended for a wide range of users, from individual DeFi participants to professional traders and asset managers, by offering a no-code environment that abstracts away the technical complexities of strategy development. [1]

Key Features

Almanak AI Swarm

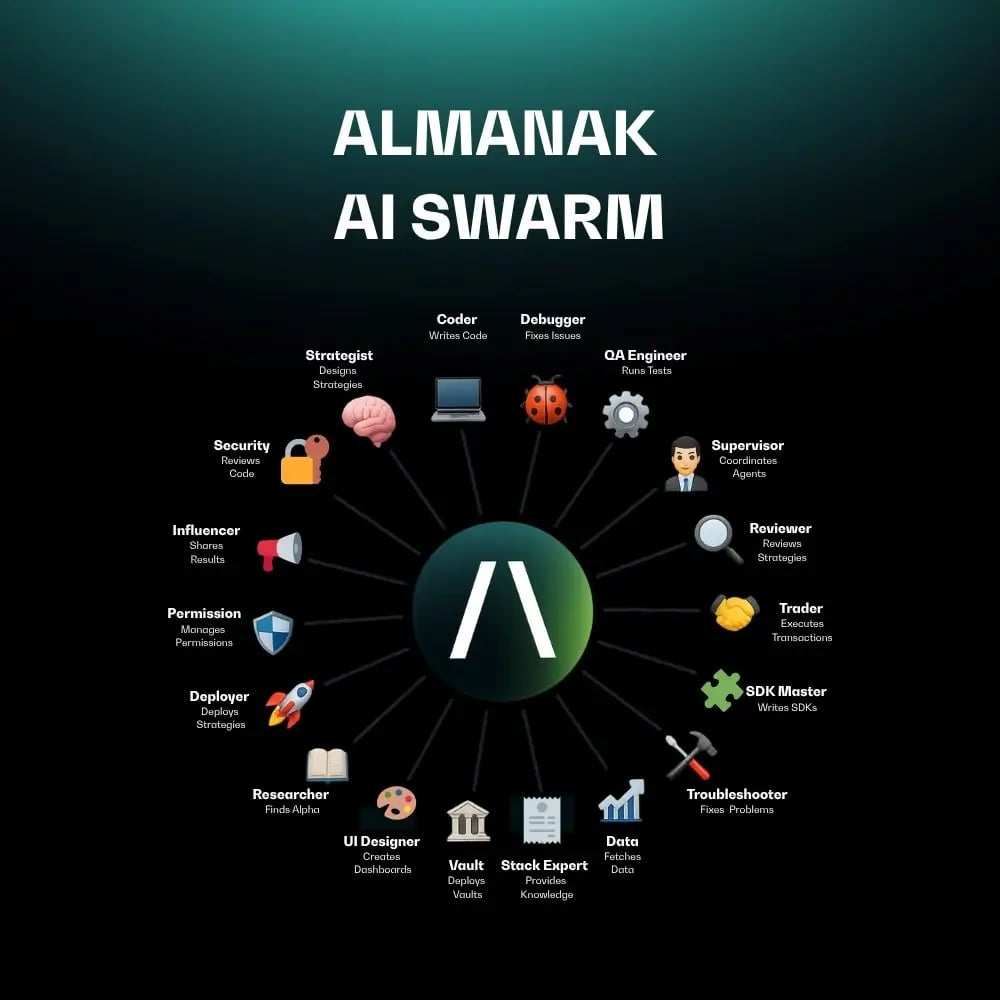

The Almanak AI Swarm is a coordinated network of 18 specialized AI agents that collaboratively execute automated financial strategies for users. Each agent focuses on a distinct role, ranging from coding and research to strategy development, trading, and security. All actions are logged for transparency, while users maintain full control over assets and final outputs.

The swarm is organized into three primary teams.

This team designs and deploys investment strategies based on user-defined parameters, converting logic into smart contracts, auditing code, testing performance, and providing dashboards for tracking.

The Alphaseeking Team continuously scans blockchain markets to identify inefficiencies, yield opportunities, and potential trades, feeding actionable insights to the strategy team.

This team evaluates and backtests strategies across historical and projected market conditions, suggesting improvements to enhance performance.

Supporting agents manage user interaction and troubleshooting, offering guidance and real-time status updates to ensure a seamless experience. [1] [2]

Strategy Deployment Infrastructure

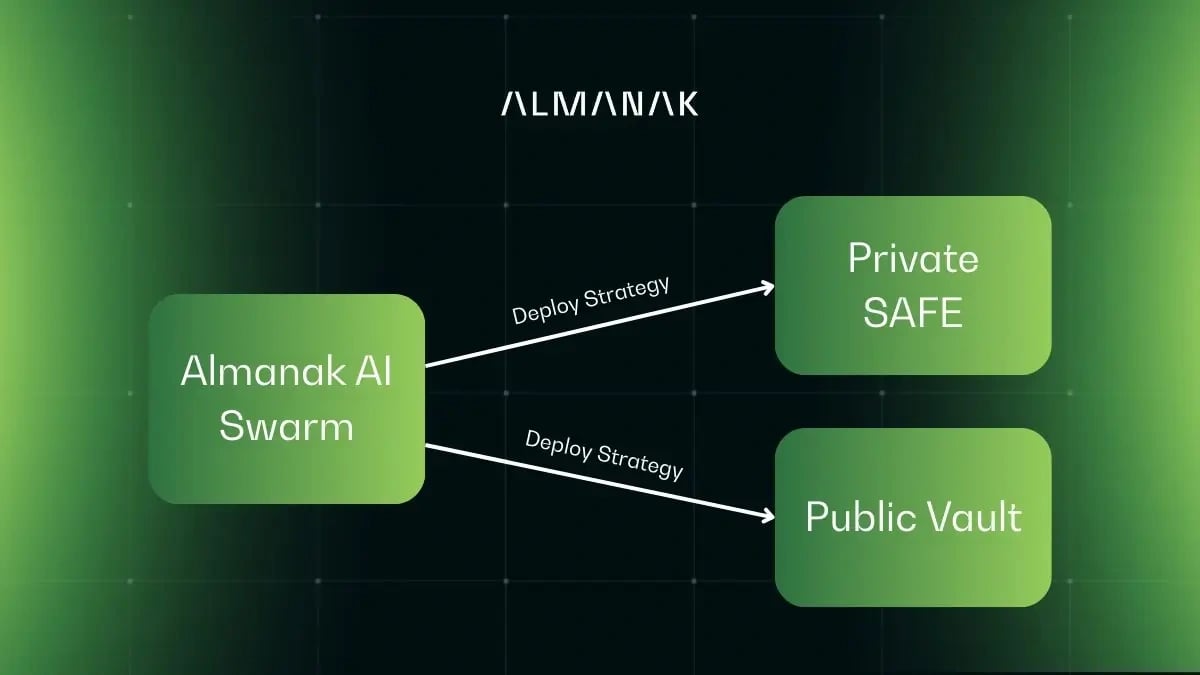

The feature of Almanak serves as the intermediary between AI-generated strategies and their on-chain execution, enabling secure, non-custodial, and efficient deployment. Strategies can be deployed 2 ways: Almanak wallets, which are private, multisignature smart accounts, or through public vaults, which allow external depositors and optional management or performance fees. Public vaults also support whitelisted deployments for closed groups, effectively creating tokenized AI strategies that function as on-chain investment vehicles.

Key features of the infrastructure include cross-chain composability, allowing deployment across multiple blockchains and applications; the ERC-7540 standard, which enables vaults to become tradable, liquid assets compatible with broader DeFi ecosystems; non-custodial design, ensuring users retain full control of assets while delegating permissions; a no-code interface, allowing users to deploy strategies without programming knowledge; and privacy protection through Trusted Execution Environments (TEEs), keeping strategies confidential and secure. [1] [2]

Use Cases

- Personal Strategy Automation: Individual users can define their financial goals, and the AI swarm will create, test, and deploy automated strategies to meet those objectives, such as generating yield on an existing asset.

- Alpha Discovery: The Alphaseeking team provides users with investment opportunities they may not have identified on their own.

- On-chain Fund Management: Experienced traders and asset managers can use the public vault infrastructure to create their own on-chain investment vehicles, complete with fee structures, powered by Almanak's AI.

- Tokenized Strategy Trading: By tokenizing vaults using the ERC-7540 standard, Almanak creates a new financial primitive that can be traded or used as collateral in other DeFi protocols. [1]

Tokenomics

The Almanak token is central to the protocol's governance and incentive mechanisms with the total supply listed as 1,000,000,000 tokens. [1]

Token Utilities

- Governance: Token holders can vote on protocol upgrades, parameter changes, and other strategic decisions.

- Incentives: The token is used to reward users who create successful vaults or deposit capital into them.

- Fee Payments: Platform fees can be paid using the Almanak token.

- Staking: Users can stake tokens to direct protocol emissions toward specific vaults, creating a competitive dynamic where protocols may be incentivized to acquire the token to route volume through their own systems.

- Community: 33%

- Innovation and Development: 20%

- VC Investors: 20%

- Team: 21%

- Legion Round 1: 2.1%

- Legion Round 2: 2.4%

- Advisors: 1.5% [3]

Partnerships

- Legion: Almanak partnered with Legion to conduct a token sale and to launch an "Attention Capital Markets" (ACM) campaign.

- Cookie: The platform collaborated with Cookie on the ACM initiative, which was designed to reward participants based on a combination of social engagement and capital investment in the protocol. [1]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)