Subscribe to wiki

Share wiki

Bookmark

bitsCrunch

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

bitsCrunch

bitsCrunch is an AI-powered, decentralized blockchain data platform that aims to enable developers to efficiently build reliable decentralized applications (dApps). [1]

Overview

The bitsCrunch network provides a decentralized, AI-enhanced platform for blockchain analytics, offering detailed forensic data on NFTs, wallets, and digital assets across multiple blockchains. It aims to simplify multi-chain integration through a single API, which can be beneficial for developers. The network is designed to be community-driven, encouraging contributions that are intended to enhance its capabilities. It seeks to ensure scalability through decentralization and predictable query costs with stablecoin payments, which may enable precise budget management. [2]

History

bitsCrunch was founded in 2020 with the mission to address key challenges in the blockchain space, including the lack of reliable on-chain data, NFT fraud, and unauthorized usage of intellectual property. Initially focused on providing analytics for NFT ecosystems, the company expanded its portfolio to include APIs covering DeFi, gaming, token, and wallet data.

In 2022, bitsCrunch gained recognition through its participation in Mastercard’s Start Path program, collaborating to deliver secure solutions for non-crypto users entering the digital asset space (Mastercard News [14]). This partnership marked a significant milestone, demonstrating bitsCrunch’s ability to bridge traditional finance and Web3 technologies.

In Dec 2024, the company made headlines with its BCUT token community sale on CoinList. The sale raised $3.85 million in just 24 minutes, attracting over 38,000 registrants from 163 countries (CryptoPotato Coverage [15]). The event set a record as the fastest sale in CoinList’s history and underscored the global demand for bitsCrunch’s solutions.

Network Roles

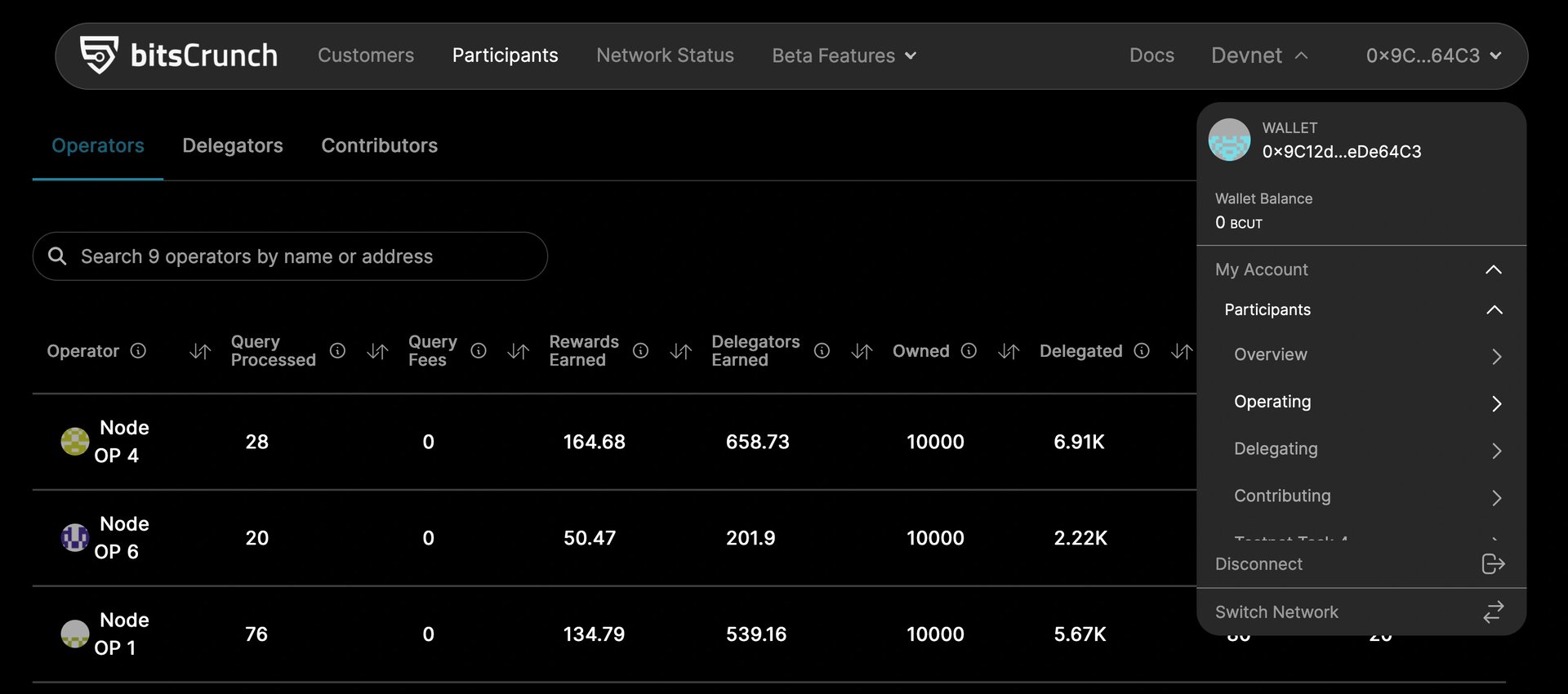

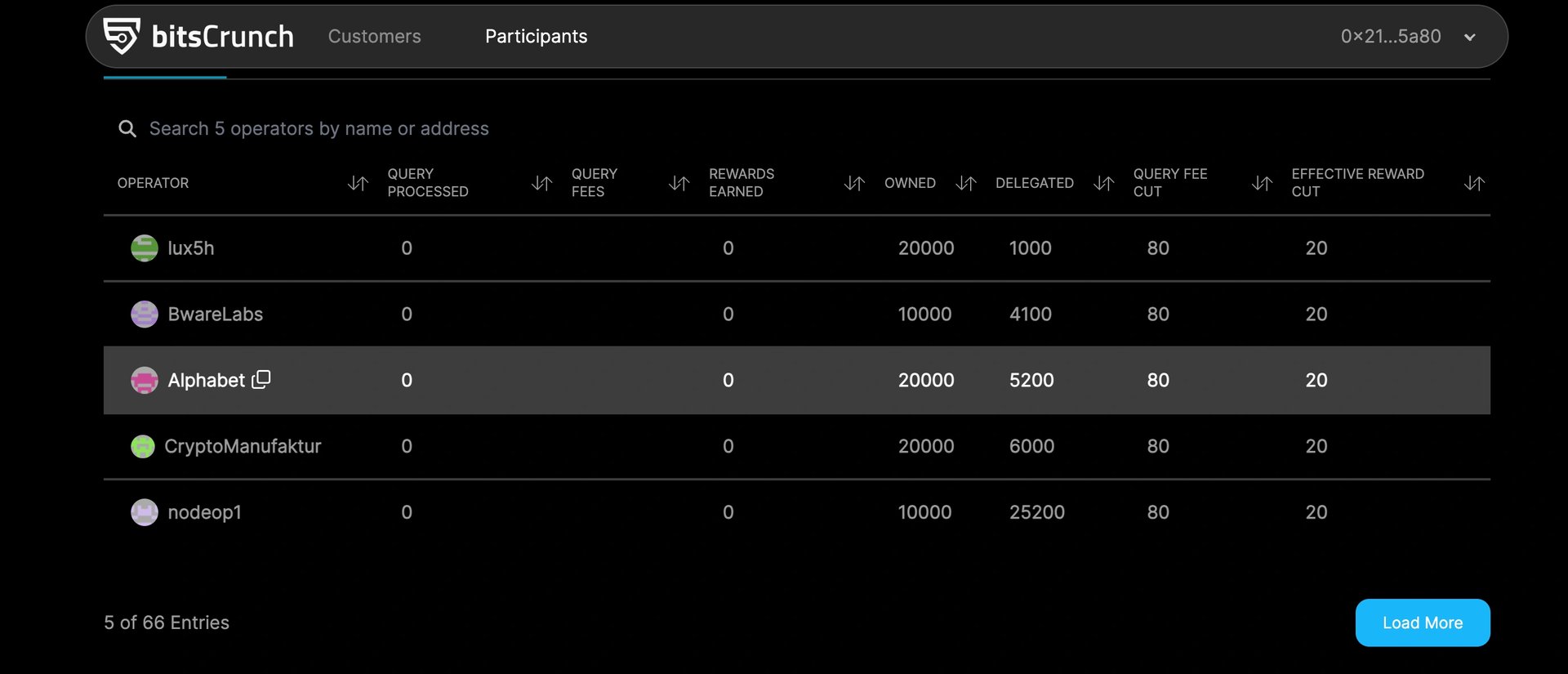

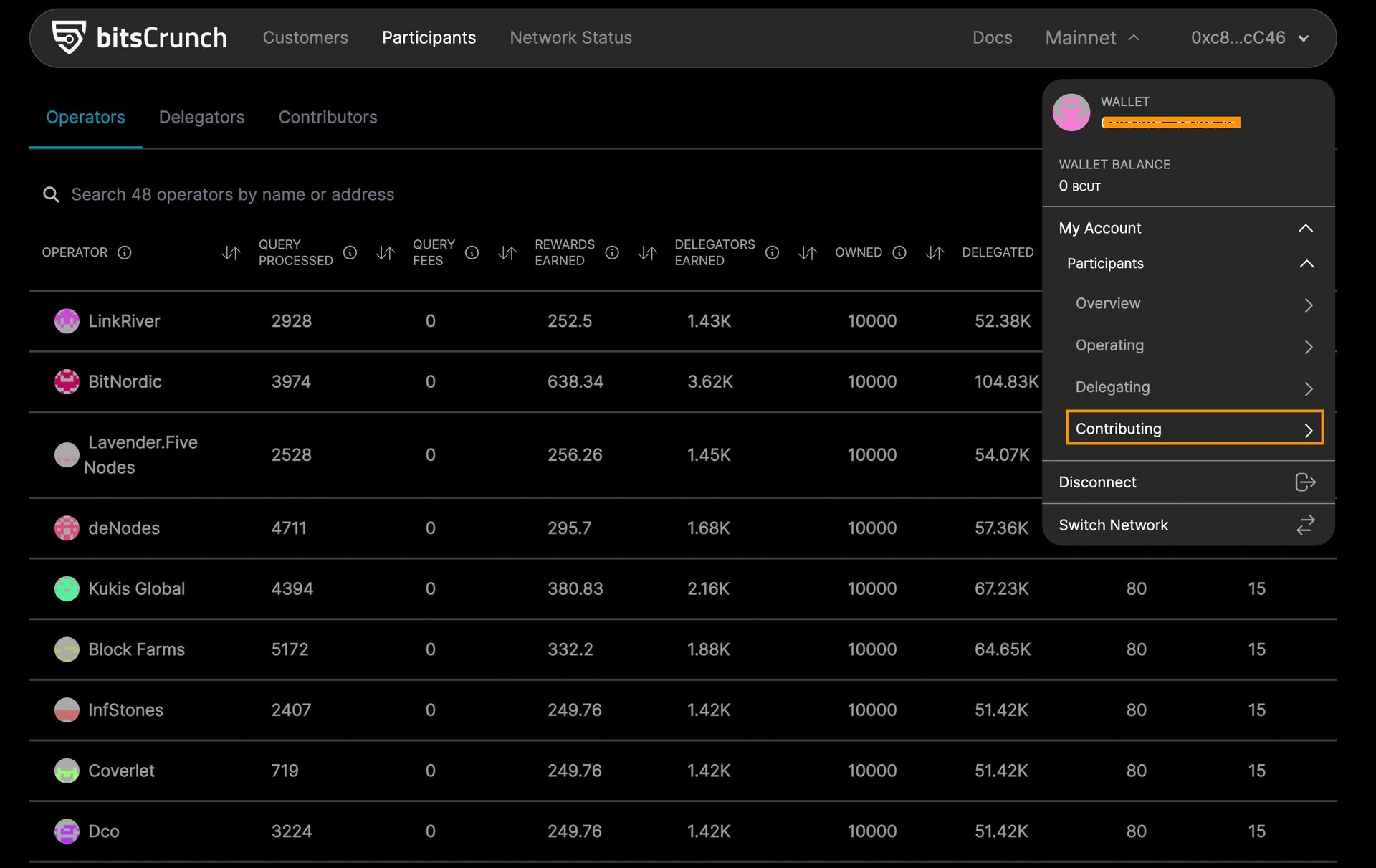

Operator

In the bitsCrunch network, operators function as node operators, initially handling query processing services and with plans to include data enrichment tasks. They are compensated through query fees and network rewards, which are intended to be distributed proportionally based on the volume of queries each operator processes. [3]

Delegator

Delegators are participants in the bitsCrunch network who stake BCUT tokens to one or more Operators. They aim to contribute to network security without operating a Node themselves. In exchange for their delegation, delegators are intended to earn a share of the Operator's query fees and rewards. [4]

Contributor

Contributors in the bitsCrunch network stake BCUT tokens to participate in various tasks, which may range from content enrichment and annotation to more advanced contributions like providing code, AI models, or tools. [5]

Query

Users can access data on the network by connecting a crypto wallet and creating an account. Credentials are obtained by staking stablecoins in a billing smart contract, with tokens intended to be deducted based on usage. Stablecoins are designed to help maintain a stable service price for budgeting. Upon login, users may receive a default billing account with a trial for testing. They can manage multiple integrations or resell services through different billing accounts. Activity is recorded to IPFS-backed storage, and data hashes are stored on the blockchain to help ensure integrity. The billing contract retrieves data from IPFS and deducts user deposits accordingly. [6]

Products

bitsCrunch offers a suite of decentralized API services and analytics tools designed for Web3 ecosystems:

UnleashNFTS

UnleashNFTs functions as an AI-driven analytics and forensic platform for NFTs, aiming to provide detailed insights into NFT collections, marketplaces, and the broader market. It offers analysis and statistics on key indicators like market capitalization and trading volume, which may assist users in making informed decisions on NFT transactions. The platform also tracks and reports on wash trading—a practice where traders artificially inflate demand by repeatedly buying and selling an asset. While regulations on NFT wash trading remain unclear, UnleashNFTs seeks to differentiate between genuine and suspected trading volumes. [7]

UnleashNFTs allows users to explore top NFT collections by volume, market cap, sales, or traders over various timeframes (24 hours, seven days, 30 days, or 90 days). The platform includes infographics that aim to provide analytics designed by data scientists and UX designers to support data processing. It also offers market reports covering trends in wash trading, trading activity, NFT marketplaces, and top collections. The platform’s wash trading feed tracks current levels, assets, and wallets, with the goal of providing technical and fundamental insights. This is intended to assist users in making informed NFT purchase decisions by presenting data in a more accessible format. [7]

Wash Trading

Wash trading involves traders creating artificial demand for security by repeatedly buying and selling it, which can inflate its price and volume. This practice may distort NFT projects' perceived value and trading volume in the NFT market, potentially affecting the reliability of marketplace metrics used to assess growth and reach. bitsCrunch has categorized different types of wash trading into the following: [8][9]

- Pattern A: This is the most common type, where an asset is repeatedly traded back and forth between the same set of wallets. Sometimes, multiple wallets are involved in a coordinated effort to conduct wash trading.

- Pattern B: In this pattern, a combination of wallets trades different assets from different collections within a single marketplace, primarily to collect rewards.

- Pattern C: This pattern involves certain wallets following a consistent trading pattern, with sales occurring weekly or daily.

bitsCrunch’s wash trade index measures the level of wash trading within a specific blockchain, marketplace, or NFT collection. The index is calculated by comparing the percentage of wash-traded volume to non-wash-traded volume, with the aim of providing a clearer understanding of overall trading activity. The index ranges from 1 (lowest wash trade activity) to 100 (highest wash trade activity). This index is designed to be a metric in the NFT ecosystem, offering insights into NFT trading and flipping. [8][9]

On-Chain Data APIs

These APIs provide developers with access to over 100 key metrics across NFTs, DeFi, gaming, tokens, and wallets. Supporting multiple blockchains such as Ethereum, Polygon, Solana, Binance Smart Chain, and Berachain, the APIs allow for integration of rich on-chain data into decentralized applications (dApps).

AI-Powered IP Protection

This service uses proprietary AI algorithms to scan blockchain networks for unauthorized usage of registered intellectual property. It alerts creators to potential infringements, enabling proactive enforcement in the decentralized space.

Wallet and Token Analytics

bitsCrunch provides wallet profiling, token reputation scoring, and historical transaction tracking. These tools enable businesses and platforms to monitor user activity, assess risk, and evaluate the performance of tokens in real-time.

Gaming and DeFi Analytics

Through specialized APIs, bitsCrunch supports game developers and DeFi platforms with engagement tracking, bot detection, revenue flow analysis, and liquidity monitoring.

Token ($BCUT)

BCUT is the native utility token of the bitsCrunch Network, intended to facilitate network operations and maintain security. It serves key functions, including aiming to align incentives among participants who stake tokens, which may promote collaboration and commitment. Staking is also designed to enhance network security by making malicious actions costly. The token aims to support the network's independence by reducing reliance on external cryptocurrencies and seeks to enable a tailored economic framework through governance decisions. BCUT also offers token holders potential discounts on query pricing by staking within the network. [10]

Tokenomics

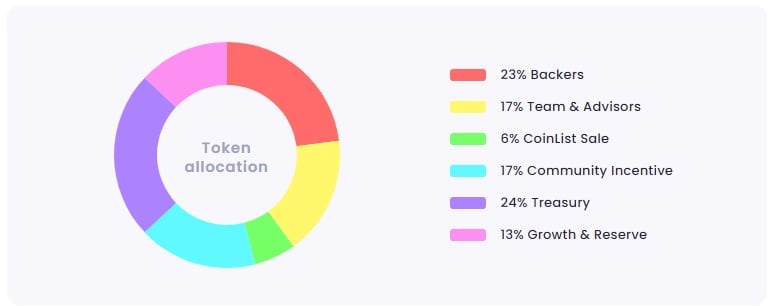

BCUT has a total supply of 1B and is allocated as follows: [11]

- Treasury: 24%

- Backers: 23%

- Team & Advisors: 17%

- Community Incentive: 17%

- Growth & Reserve: 13%

- CoinList Sale: 6%

Partnerships

Key collaborations include:

- Mastercard Start Path Program: Leveraging bitsCrunch’s tools for NFT security.

- Bitpanda: Staking campaigns and ecosystem support initiatives.

- DappRadar: Joint efforts in AI-powered NFT price estimation [21]

Other notable partnership includes

- Chainlink

- Polygon

- CoinTelegraph

- EY

- PWC

- Unstoppable Domains

- DappRadar

- PawnFi

- Mastercard

- Now Nodes

- Forward Protocol

- Pandora

- CorPa

- Coinvise

- DappLooker

- Levitate Labs

- NFTFN

- Octavia

- Orange

- BlockPI

- SINSO

- WizBuds

- Cros

- ArchiDAO

- xHashtag

- GenShards

Funding

bitsCrunch has raised over $12 million in funding from prominent investors and venture capital firms, including: [13] [12]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)