Subscribe to wiki

Share wiki

Bookmark

Canton Network

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Canton Network

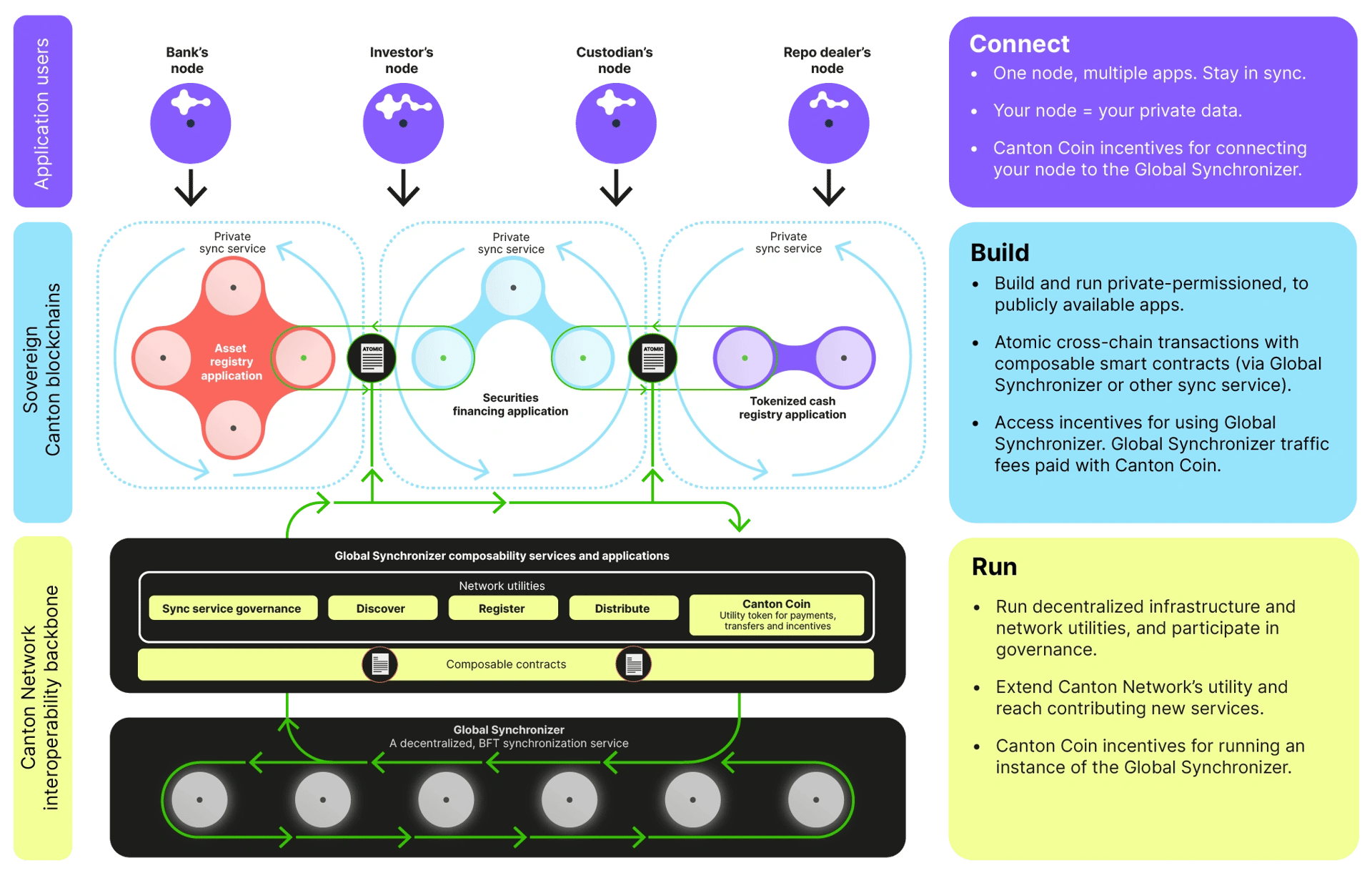

Canton Network is a layer-one, privacy-enabled, interoperable blockchain infrastructure designed for institutional finance. It enables regulated institutions to run applications and connect siloed financial systems while maintaining control over their data. Developed with technology from Digital Asset, the network provides a modular framework that allows otherwise separate ledgers, built with the Daml smart contract language, to connect when needed, facilitating coordinated financial workflows without exposing system-wide activity. As of early 2026, the network is live and onboarding major financial partners to support activities from digital asset custody to the tokenization of securities. [1] [9]

Overview

Canton Network is a public-permissionless blockchain designed to address the specific needs of regulated financial institutions for privacy, control, and interoperability. It functions as a "network of networks," allowing decentralized applications and siloed financial systems to connect and transact in real time, addressing the inefficiencies and risks of manual reconciliation processes. The network's architecture contrasts with traditional blockchains, where all applications must conform to a single, transparent public ledger. Instead, Canton provides each participant with a private, cryptographically verifiable projection of the ledger, ensuring they see only the data relevant to them. [2]

The core technology is developed by Digital Asset, and the network is built to run applications using the Daml smart contract language. Canton's model aims to combine the asset mobility of public blockchains with the configurable privacy and control required for institutional use cases like derivatives, syndicated loans, and the tokenization of real-world assets (RWAs). It is governed by a decentralized model supported by the Canton Foundation and managed by The Linux Foundation, with network participants collectively managing key protocol decisions. The vision for the network has been compared to the internet—a heterogeneous system where independently operated applications can coexist and interoperate securely. [5] [10]

Milestones and Recent Developments

Canton Network has demonstrated significant momentum through a series of successful pilots and key service launches from late 2024 into early 2026.

- July 2024: The Canton Network MainNet and its native utility token, Canton Coin (CC), went live. [5]

- December 2025: Digital Asset and The Depository Trust & Clearing Corporation (DTCC) announced a partnership to tokenize DTCC-custodied U.S. Treasury securities on the Canton Network. [10]

- January 2026: An industry working group successfully demonstrated expanded capabilities for 24/7 global collateral mobility on the network through cross-border repurchase agreements. [11]

- February 2026: The network powered the first private stablecoin payroll transaction for a global enterprise, in collaboration with payroll platform Toku and wallet provider Cantor8. [12]

- February 2026: Institutional digital asset platform Fireblocks launched full custody support for Canton Coin (CC), including qualified custody through its NYDFS-chartered trust company. [9]

- February 2026: Bloomberg and Kaiko announced a collaboration to deliver Bloomberg's institutional-grade financial data, such as reference data for U.S. Treasuries, on-chain via the Canton Network. [13]

- February 2026: Canton Coin (CC) was listed on Robinhood Crypto, making it available for trading to eligible customers, including those in New York State. [14]

Architecture and Technology

Canton’s architecture is a modular, two-tier system designed to provide privacy, control, and horizontal scalability for institutional applications. It separates the application logic layer (Daml) from the synchronization and execution layer (Canton Protocol). [3]

Daml (Digital Asset Modeling Language)

Daml is an open-source smart contract language purpose-built for multi-party business workflows. It allows developers to define shared data, permissions, and rules while preserving privacy and data consistency. A Daml model outlines the schema for a shared ledger, including which parties must authorize the creation of a contract (signatories), which can view it (observers), and which can exercise specific actions on it (controllers). The language is designed with a "confidential by default" privacy model, where authorization policies are defined directly within the contract code. In Canton's execution model, each party runs on a Validator Node that stores its individual, private projection of the ledger, ensuring participants only see the data and transactions relevant to them. [2]

Canton Protocol

The Canton Protocol is an open-source, privacy-enabled protocol that implements the Daml ledger model. It ensures that the partitioned views of all participants remain consistent subsets of a "virtual" global ledger, without any single party ever holding the ledger in its entirety. The protocol achieves horizontal scalability, as transactions with no data dependencies can be processed in parallel. It uses a two-layer consensus mechanism where, in the first layer, a contract is replicated only to its stakeholders for local validation. In the second layer, an encrypted transaction request is sent to a sequencing service (a Sync Domain), which assigns a timestamp to establish a definitive order and prevent double-spending. [2]

Synchronization Domains (Sync Domains)

The Sync Domains function serves as the core coordination and messaging layer within Canton. They are responsible for transaction sequencing, timestamping, identity management, and guaranteed message delivery for a group of participants. Each domain is operated by a Canton Service Provider (CSP), which can be a single, centralized organization or a decentralized consortium of Validators (a virtual CSP or vCSP) using a Byzantine Fault Tolerant (BFT) consensus algorithm. This flexibility allows developers to choose which sync domains to use based on specific privacy, regulatory, or performance needs. A single workflow can span multiple domains, and participants can reassign a contract’s synchronization from one domain to another to avoid lock-in. [2]

Global Synchronizer

The Global Synchronizer is a special, shared-key synchronization domain that serves as the decentralized interoperability backbone of the entire Canton Network. It links otherwise separate sync domains to enable atomic settlement and interoperability across applications handling regulated financial assets. It is operated collectively by a group of Super Validators, with no single entity controlling its sequencing or availability. The Global Synchronizer provides consistent ordering, guaranteed message delivery, and cross-domain transaction finality, supporting private workflows while connecting tokenized assets and cash across jurisdictions. The underlying technology is open-sourced through Hyperledger Labs as "Splice." [5] [4]

Network Participants and Governance

The Canton ecosystem involves several distinct roles, with governance managed through a decentralized framework involving key operator groups and a non-profit foundation. [7]

Infrastructure Operators

- Validators: These are nodes that participate in operating a distributed sync domain (vCSP). They use BFT consensus to order and confirm transactions within that domain. Application users run their own validator nodes to connect to the network, and these nodes only validate transactions to which they are a direct party, preserving privacy.

- Super Validators: A specialized class of validators responsible for operating and governing the Global Synchronizer. Their duties include validating all Canton Coin transfers, managing shared network infrastructure such as the Canton Name Service, and providing the on-chain oracle for the Canton Coin/USD conversion rate. They form the core of the network's governance body.

Governance Model

The network is governed by the Canton Foundation, an independent, U.S.-based non-profit entity managed by The Linux Foundation. As of late 2025, the foundation is co-chaired by two of the world's largest financial market infrastructures: DTCC and Euroclear. This leadership structure solidifies the network's position as an institutionally-focused blockchain. [10]

Key decisions, including protocol upgrades and fee adjustments, are voted on by the Super Validator Collective (SVC), the group of entities running the Super Validator nodes. Changes to the network are subject to a formal Canton Improvement Proposal (CIP) process before being voted on by the Super Validators. For example, in January 2026, CIP-0095 was passed to onboard a new Super Validator with performance-linked incentives. [14] [[canton.foundation/][Canton Foundation official website]]

Canton Coin (CC)

Canton Coin (CC) is the native utility token of the Canton Network, primarily used within the Global Synchronizer. It is designed to reward network utility and contribution rather than to encourage speculation. As of February 2026, CC was ranked among the top 15 cryptocurrencies by market capitalization. [5] [8]

Fair Launch and Distribution

Canton Coin was launched in July 2024 with an "earned-value" distribution model, in which 100% of tokens in circulation are added to the supply by being earned through verifiable contributions to the network. The launch involved no pre-mined supply, no pre-sale, no special reserves for the foundation, and no early-access allocations for investors or venture firms. This structure directly links token ownership to participation in the ecosystem. [5]

Tokenomics and Utility

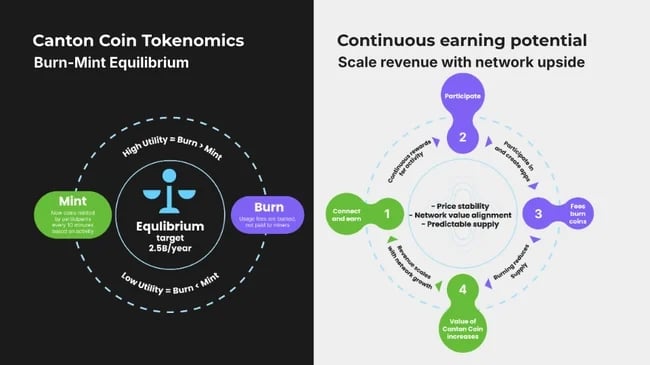

The primary utilities of Canton Coin are:

- Transaction Fees: Paying for traffic on the Global Synchronizer and other network services. Fees are denominated in USD to provide cost predictability for enterprise users but are paid by burning Canton Coin at the current on-chain conversion rate.

- Rewards: Compensating network participants, including infrastructure operators (Validators and Super Validators) and application providers, for their contributions.

- Governance: Supporting the decentralized governance of the network. [12]

The tokenomics are built around a Burn-Mint Equilibrium, a self-regulating mechanism that aligns the token's value with network utility. Fees paid in CC are burned, removing them from circulation, while new coins are minted as rewards. The long-term target is to reach a steady state where the amount of coin burned annually equals the amount minted. Approximately 100 billion CC are scheduled to be available for minting over the first ten years of operation, after which 2.5 billion CC will be available for minting annually. [6]

The reward distribution model is designed to evolve. In the initial phase after launch (July-December 2024), rewards were weighted towards Super Validators (80%) to bootstrap secure infrastructure. From 2025 to mid-2029, the focus shifts to application and user growth, with application providers becoming eligible for up to 62% of the reward pool. [8]

Use Cases

The Canton Network has been tested and validated across several key institutional finance use cases.

Tokenization of Real-World Assets (RWAs)

A primary use case is the tokenization of regulated securities. In a landmark partnership announced in December 2025, DTCC and Digital Asset began a project to tokenize a subset of U.S. Treasury securities on the Canton Network. The initiative aims to enhance liquidity and operational efficiency by bridging traditional market infrastructure with on-chain assets. [10] By early 2025, platforms connected to the Canton Network had already accounted for over $4.6 billion in digital bond issuances, representing over half the market since 2020. [15]

On-Chain Collateral Management

Canton supports applications for on-chain collateral and margin management for bilateral derivatives. In 2025, an initiative backed by liquidity providers including B2C2, Cumberland DRW, FalconX, GSR, Flowdesk, and QCP began building a solution on the network. The application automates margin calls and collateral movements 24/7, increasing capital efficiency and reducing operational risk while preserving privacy. [16]

Institutional Payments and Payroll

In February 2026, the network demonstrated its capability to handle private, secure payroll for a multinational corporation. The solution, built by Toku and Cantor8, used private stablecoins to offer instant settlement, reduce operational costs, and mitigate risks associated with the traditional correspondent banking system, showcasing its utility for enterprise-level payment applications. [12]

24/7 On-Chain Financing

The network facilitates real-time financing operations, such as repurchase agreements (repo), using tokenized assets. An industry working group has demonstrated 24/7 global collateral mobility through cross-border intraday repo transactions, using tokenized assets like U.S. Treasuries and UK Government Bonds (Gilts) to allow institutions to optimize liquidity across time zones. [11]

Partnerships and Ecosystem

Canton Network is supported by a broad coalition of financial institutions, market infrastructure providers, data vendors, and technology firms.

Digital Asset

Digital Asset is the primary technology creator behind the Canton Network, having developed the Daml smart contract language and the core Canton Protocol that provide the network's privacy and interoperability features. The company is the key technology partner for DTCC's U.S. Treasury tokenization project and leads the development of an on-chain collateral management solution with a consortium of major liquidity providers. [10] [16]

The Depository Trust & Clearing Corporation (DTCC)

DTCC, the premier post-trade market infrastructure for the global financial services industry, is a foundational partner and a leader in the network's governance. In December 2025, DTCC announced a partnership with Digital Asset to tokenize a subset of its custodied U.S. Treasury securities on the Canton Network. The initiative, which follows an SEC No-Action letter, aims to bridge traditional and on-chain financial assets to enhance liquidity and operational efficiency, with a target for a minimum viable product in the first half of 2026. Additionally, DTCC co-chairs the Canton Foundation, playing a central role in setting industry standards for the ecosystem. [10]

Euroclear

Euroclear, a leading global provider of post-trade services, co-chairs the Canton Foundation alongside DTCC. Its leadership role solidifies the network's governance under established institutional financial market infrastructures, ensuring alignment with the needs of regulated markets. [10]

On-Chain Collateral Management Consortium

A significant initiative on the network involves a consortium of major liquidity providers building a solution for on-chain collateral and margin management for bilateral derivatives. Initial design partners Flowdesk and QCP were joined in July 2025 by B2C2, Cumberland DRW, FalconX, and GSR. The solution is designed to increase capital efficiency and reduce counterparty risk by automating margin calls 24/7. Its smart contracts align with ISDA CSA requirements and support novel collateral types like yield-bearing stablecoins. [16]

Bloomberg & Kaiko

In February 2026, Bloomberg and Kaiko announced a collaboration to deliver Bloomberg's institutional-grade financial data directly onto the Canton Network. Kaiko provides the secure on-chain data ramp, enabling applications to access critical information, such as reference data for U.S. Treasuries, from a single, verifiable source. The initiative aims to support tokenization and repo workflows by reducing operational friction from inconsistent data sources. [13]

Fireblocks

Fireblocks, an enterprise-grade digital asset platform, provides institutional custody, transfer, and settlement technology for the Canton ecosystem. In February 2026, the company launched support for Canton Coin (CC), including qualified custody through its NYDFS-chartered trust company, Fireblocks Trust Company. The integration gives institutional participants a secure and regulated environment to custody assets and engage with the network. [9]

Toku & Cantor8

Application-focused partners Toku and Cantor8 collaborated in February 2026 to power the first institutional private payroll transaction on the network. Toku serves as the payroll engine, integrating with corporate HR systems to manage payroll logic. Cantor8 provides the secure, self-custody C8 Wallet for employees to receive funds. The solution reduces operational costs and settlement times associated with traditional cross-border payments. [12]

World Liberty Financial

World Liberty Financial (WLFI) intends to deploy its USDL stablecoin on the Canton Network. USDL is a bankruptcy-remote, 1-to-1 U.S. dollar-backed stablecoin created specifically for institutional use. According to the announcement, USDL is fully reserved and backed by short-term U.S. government treasuries, U.S. dollar deposits, and other cash equivalents. Within the Canton ecosystem, USDL is set to function as a key liquid asset, facilitating the settlement of tokenized assets on the network. The deployment is significant as USDL is expected to be the first third-party stablecoin available on the Canton Network, marking a key step in expanding its capabilities for institutional-grade onchain finance. [17]

Chainlink

On September 24, 2025, the Canton Network announced a strategic partnership with Chainlink to accelerate the adoption of its institutional-grade blockchain. The collaboration involves integrating Chainlink's industry-standard oracle services, such as Data Streams and SmartData, to provide smart contracts on Canton with reliable, real-world data. Furthermore, the integration includes Chainlink's Cross-Chain Interoperability Protocol (CCIP), which will establish secure connectivity between the Canton Network and other public and private blockchains. This enhancement is designed to accelerate the broader adoption of tokenized assets by enabling seamless interoperability across different financial ecosystems. As part of the partnership, Chainlink Labs also joined the Canton Network as a Super Validator. [18]

Other Ecosystem Participants

Global banks like Goldman Sachs and BNP Paribas were among the early participants exploring the network's capabilities, signaling strong institutional interest from its inception. Other key infrastructure partners include Broadridge DLR, a founding member of the network's governing foundation, and Tradeweb, which serves as an execution platform for financial products like repo transactions.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)