Subscribe to wiki

Share wiki

Bookmark

ether.fi

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

ether.fi

ether.fi is a non-custodial and decentralized staking protocol that prioritizes stakeholders' autonomy over their assets, utilizing permissionless decentralization. The protocol offers delegated staking services, ensuring security and ease of use while aiming for enhanced returns and reduced costs through innovative revenue models and operational efficiencies. Mike Silagadze and Rok Kopp are the founders of ether.fi. [1]

Overview

Ether.fi is a decentralized staking protocol designed to empower users with control over their staked ETH keys. Its unique feature is the issuance of NFTs for each validator launched via the protocol, introducing a programmability layer to staking infrastructure. The protocol operates in three phases: Delegated Staking, where stakers manage their keys and can delegate to node operators; Liquidity Pool and eETH, enabling users to mint eETH tokens without validator monitoring responsibilities; and Node Services, a speculative phase focused on enhancing node services, potentially through integration with EigenLayer. [2]

ether.fi Foundation

The ether.fi Foundation is responsible for executing the decisions made by token holders and managing the treasury and protocol. It pledges to uphold accountability by issuing regular transparency reports to token holders. The Foundation's governance will be guided by its constitutional documents. [3]

Features

Delegated Staking

The Auction Contracts within the ether.fi system facilitates auctions and manages bids from node operators to determine who will run a validator node. Node operators register their public keys and place bids in ETH, sharing auction revenue among protocol participants. When a staker deposits 32 ETH into the Auction Deposit Contract, the Auction Manager Contract triggers an auction to identify the winning bid and corresponding operator. In the future, stakers may be able to select their preferred node operator. Stakers generate and submit encrypted validator keys via an on-chain transaction, storing them in IPFS for efficiency. The node operator locates, downloads, and decrypts the keys. [1]

Upon the node operator's acceptance confirmation transaction, the Auction Manager Contract mints T

- and B-NFTs to the staker's wallet and establishes a Withdraw Safe Contract. The 32 ETH is transferred to the Ethereum Deposit Contract using the “withdraw safe contract” for credentials. Once the validator node is set up and activated, it begins earning rewards. Fees collected from the auction are distributed within the ether.fi ecosystem as eETH tokens, a rebasing token. Upon confirmation of accepting the validator, the node operator receives a predetermined amount of ETH proportional to their bid. [1]

T-NFT and B-NFT

When establishing a validator node, the staker obtains T-NFT and B-NFT tokens. While the T-NFT can be transferred, the B-NFT is bound to the staker and cannot be transferred. Based on the ERC-721 standard, these tokens contain metadata about the validator node's index, status, performance, the node operator, and other relevant information. Upon exiting the validator node, the T-NFT represents a claim of 30 ETH, while the B-NFT represents a claim of 2 ETH. This allows the staker to liquidate 93.75% of their staking position. The B-NFT acts as insurance against slashing and commits to exiting the validator node upon request from the T-NFT holder. [1]

If the B-NFT holder fails to honor an exit request, their ETH claims are penalized until they exit the validator node, incentivizing the node operator to exit the node instead. The penalty results in a daily decrease of 3% from the 1 ETH claim to 2 ETH. In exchange for the added responsibility, the B-NFT holder earns a 50% higher yield than the T-NFT holder and monitors the validator node's performance. In case of a slashing event, the B-NFT supplies the deductible for slashing insurance. [1]

Permissionless Withdrawals

Following the Shanghai and Capella upgrades on the Ethereum Execution and Consensus Layers, respectively, EIP-4895 introduces the capability for withdrawing staked ETH and validator rewards. Withdrawals come in two forms: Partial withdrawals for extracting rewards and Full withdrawals for unstaking. In partial withdrawals, excess balance (earned rewards) beyond the 32 ETH principal is sent to the withdrawal address while the validator continues to accrue rewards. Full withdrawals entail withdrawing the entire balance (32 ETH principal + rewards) after exiting the validator. [1]

With ether.fi's decentralized structure, the B-NFT holder can initiate the validator node exit, the T-NFT holder can request the exit to the B-NFT holder, and the node operator is motivated to exit the validator node if the B-NFT holder fails to respond to the exit request. Any party can trigger the redistribution of partially withdrawn rewards or fully withdrawn funds to interested parties (node operator, NFT holders). [1]

Rewards Skimming

Users can skim rewards from their withdraw safe contract without needing approval from third parties like the Protocol or the Oracle, as long as the balance remains below 16 ETH. This feature reduces operational costs and ensures a seamless experience, thanks to smart contract optimizations that minimize gas costs. The only condition for successful rewards skimming is maintaining a balance below 16 ETH in the “withdraw safe contract.” Users can exit the node and withdraw all funds if the balance exceeds this limit. [1]

Full Withdrawal

If your withdrawal safe contract holds more than 16 ETH, it's recommended to exit the node and initiate the full withdrawal process. Upon completing the exit request for the validator node, your unstaked ETH, ranging from 16 to 32 ETH, will be transferred to your withdrawal safe contract. Subsequently, anyone can initiate the redistribution of the unstaked ETH to relevant parties. ether.fi facilitates the permissionless and oracle-less withdrawal of unstaked ETH, with payouts to individuals determined by the withdrawal safe contract balance. [1]

Sharing Protocol Revenue

ether.fi distributes its protocol revenue evenly among ecosystem participants. Revenue sources include auction fees, liquidity pool trading fees, and infrastructure service fees across Phases 1, 2, and 3. Presently, auction revenue boosts overall APRs for ether.fan holders. [1]

Ecosystem

Solo Stakers

Ether.fi implements Distributed Validator Technology (DVT) as a novel approach to staking to enhance the security and functionality of validators within the Ethereum network. This technology facilitates the participation of solo stakers interested in running nodes from various locations worldwide, thereby contributing to the decentralization of the Ethereum network and reducing reliance on centralized data centers. [4]

Traditionally, the substantial capital requirement to run a solo node, set at 32 ETH, has led to increased centralization within the Ethereum network. However, by leveraging DVT, ether.fi has managed to lower this barrier to entry to only cover hardware expenses and monthly utility costs. Participants in this program can either purchase hardware through ether.fi or utilize their equipment, seeking a protocol that enables them to support the network's security. [4]

Prospective solo node operators must meet specific eligibility criteria, including staking experience, a reliable internet connection, and compliance with ether.fi's disclosure requirements and acceptance of the program's terms of service. Once they acquire the necessary hardware and satisfy technical prerequisites during the testnet phase, these individuals can operate staking infrastructure for ether.fi from their preferred location without providing collateral, thanks to DVT. As part of their commitment to running a node, participants join a solo staking cluster, initially receiving 96 ETH to stake, from which they earn 5% of staking rewards. [4]

Liquid

Liquid is a DeFi vault offered by ether.fi, enabling users to automatically deploy their eETH, weETH, or WETH across various DeFi opportunities. As the number of eETH integrations increases, staying updated on the best options can be challenging, especially for complex strategies like LPing on Uniswap V3. The vault, managed by Seven Seas, aims to adapt by incorporating new integrations over time, ensuring competitiveness in the dynamic DeFi landscape. [5]

Tokens

ETHFI

The governance token ETHFI empowers community members to engage directly in ether.fi's development and ecosystem expansion. ETHFI holders can actively participate in pivotal decisions, including the launch of the ether.fi Grants Program, setting economic parameters, granting permissions to software developers, approving node operators, and engaging in token staking for additional incentives and treasury diversification efforts. [3]

Tokenomics

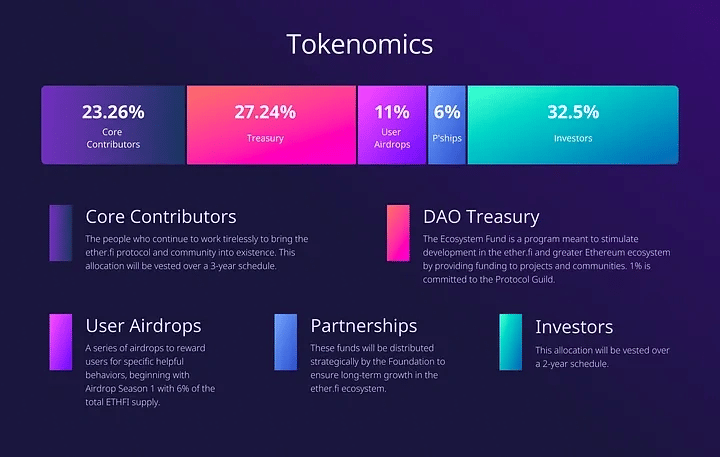

The allocation of resources within the ether.fi ecosystem is divided into several categories: [3]

- Core Contributors: 23.26%; Core Contributors consist of individuals actively developing and advancing the ether.fi protocol and community. Their allocation will be vested over three years to incentivize ongoing contributions.

- DAO Treasury: 27.24%; the DAO Treasury includes the Ecosystem Fund, which aims to foster development within the ether.fi and broader Ethereum ecosystem. A portion of this fund, 1%, is dedicated to the Protocol Guild.

- User Airdrops: 11%; User Airdrops are designed to reward users for specific beneficial actions. These airdrops commence with Airdrop Season 1, distributing 6% of the total ETHFI supply.

- Partnerships: 6%; Partnerships involve strategic distribution of funds by the Foundation to foster long-term growth in the ether.fi ecosystem.

- Investors: 32.5%; Investors' allocation will be vested over two years.

ether.fi Staked ETH (eETH)

ether.fi Staked (eETH) is a rebasing ERC-20 token introduced by ether.fi, representing a claim on an equivalent amount of ETH held by the ether.fi liquidity pool or staked in the Ethereum Proof-of-Stake system. A rebasing mechanism automatically distributes staking rewards to eETH holders, updating their balances across all addresses. As a Liquid Restaking Token, eETH allows users to stake their ETH for rewards and reinvest seamlessly in EigenLayer. Its non-rebasing counterpart, weETH, extends usability across the DeFi ecosystem. Collaborations with DeFi partners like Balancer, Gravita, Pendle, Aura, and Maverick are planned post-launch, along with integration into Layer 2 protocols. [1][6]

ether.fan

ether.fan is a platform where ETH can be staked to mint a fan NFT. This NFT earns membership points and boosts staking rewards. Traits are randomly assigned to the NFT, while flair reflects the staked amount and membership tier. Staking rewards are automatic, and the NFT participates in loyalty programs. All protocol revenue benefits stakers and solo node operators. [7]

Mining

For each deposit of ETH (minimum 0.1 ETH) via ether.fan, the funds are staked through ether.fi and distributed to solo node operators globally. A fan NFT representing the staked ETH is minted with each deposit, automatically accruing staking rewards. Each new deposit generates a new fan NFT, and there's no limit to the number you can hold. These fan NFTs serve various purposes, including potential participation in future games and activities. Additionally, they can be used as profile pictures to express support for Ethereum and decentralization, characterized by traits, flair, and membership tier. [7]

- Traits within the fan character represent distinctive features like eyes, hair, and skin alongside intangible qualities such as charisma or agility. These traits possess varying degrees of rarity and collectively shape the character's distinct persona. Determined randomly during minting, each fan holds an overall rarity score calculated from the rarity levels of its traits.

- The character's flair is determined by the quantity of ETH it holds, updating dynamically as more ETH is staked to reflect the total amount.

- The duration of staking predominantly determines each fan's membership tier. Longer staking periods result in higher tiers, leading to increased shares of staking rewards and protocol revenue. Fans begin at the Bronze tier and progress to higher tiers, eventually reaching Platinum status.

Upgrading

Users can upgrade their fan NFTs by depositing additional ETH, with a minimum of 0.1 ETH required for each deposit. Upon upgrading, the fan's flair is automatically updated. However, there are limitations on the rate at which ETH can be added to a fan NFT. Users can increase the ETH staked in their fan by a maximum of 20% per month without affecting their membership tier. Exceeding this limit will result in a decrease in membership tier. This restriction is in place to prevent potential abuse of the system. Without it, individuals could exploit the membership program by initially depositing a small amount, waiting for the fan to reach the Platinum tier, and then depositing a large amount of ETH to monopolize boosted staking rewards. [7]

Partnerships

Obol Labs

On February 23, 2023, when ether.fi introduced its platform on X, Obol Labs announced itself as an official DVT partner. Obol Labs is a developer of Ethereum-aligned Distributed Validator Middleware through the Obol Network and its ecosystem. [8]

Aethos

On March 26th, 2024, ether.fi announced a partnership with Aethos, a decentralized smart contract engine. While providing security support, ether.fi will be using Aethos’ AVS to ensure protocol security. [9]

Redstone Oracles

On April 12th, 2024, Ether.fi partnered with RedStone Oracles, allocating $500 million to secure data oracles, utilizing over 20,000 node operators and eETH tokens to protect against network vulnerabilities. [10]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)