Subscribe to wiki

Share wiki

Bookmark

RedStone Oracles

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

RedStone Oracles

RedStone is a modular oracle specialising in yield-bearing collateral for lending markets, especially LSTs & LRTs. It offers gas-optimized data feeds across 50+ chains & all rollups. Trusted by Morpho, Venus, ether.fi & more [1].

Overview

RedStone addresses the problem of Oracle compatibility with protocols using its customizable models (at the time of writing 3 models: RedStone Core, Redstone Classic and Redstone X)[2] that allow for smoothening the process. RedStone provides price feeds across multiple EVM Ethereum, Optimism, Manta or Blast, non-EVM ecosystems, rollups and all kinds of appchains[3]. This makes RedStone a perfect partner for Rollup-as-a-Service Providers as well as Eigenlayer AVSs. Unlike the typical approach followed by most Oracles, RedStone Core doesn't continuously upload data onto the blockchain at regular intervals. Instead, its approach involves storing data on Arweave, which reduces gas costs significantly.

For developers working with RedStone, comprehensive documentation is available for each of its products, complemented by supplementary resources. These resources encompass guidelines for data providers, explanations of RedStone's operational procedures, metrics that showcase network adoption and expansion, and step-by-step tutorials that clarify the integration process.

RedStone Modular Design

RedStone's modular oracle system highlights its flexibility, with independent components enabling easy adjustments, changes and additions. This stands in contrast to traditional Oracles with interconnected infrastructure, simplifying upgrades and adaptation processes, including integration with new blockchains. Being modular means:

- Delivering Feeds Not Available Elsewhere: RedStone specializes in delivering yield-bearing collateral tailored for lending markets, particularly focusing on assets like LSTs & LRTs. Introducing price feeds for emerging assets necessitates innovative price discovery methods like slippage-based weighting. Our modular pricing engine undergoes constant refinement to ensure utmost accuracy and relevance.

- Deployable Everywhere: Our price feeds seamlessly integrate with all chains, whether EVM or non-EVM ecosystems, rollups, or various appchains. This versatility positions RedStone as a partner for Rollup-as-a-Service Providers and Eigenlayer AVSs. Integration with RedStone enables swift deployment on a new chain with Oracle capabilities from the outset.

- Supporting All DeFi dApps: RedStone supports a whole spectrum of DeFi applications, offering flexible data consumption options. Choosing the Classic (Push) model for frequent data updates across diverse assets or the Core (Pull) model for the most widely used Oracle interface. Regardless of the specific requirements, RedStone offers tailored solutions to meet everyone’s needs.

Depending on protocol needs RedStone could be integrated in different ways. In Q1 2024 there are 3 models available:

RedStone Core (Pull)

Incorporating all necessary data within a single transaction, including its injection and attachment to the initial user transaction, offers an efficient approach to bypass the complexities associated with generating numerous transactions that must sequentially wait for processing. This can be particularly advantageous in scenarios where a transaction's duration is prolonged due to a large number of preceding transactions. It also helps in reducing costs incurred when a transaction gets repeatedly processed across multiple layers[4].

RedStone Classic (Push)

RedStone Classic is a Chainlink-compatible interface. It is built upon the core model, efficiently distributing data to a relayer, which then the data on-chain when needed. It’s recognized as a more efficient and scalable option where data is pushed on-chain. This approach ensures that RedStone optimizes data handling, offering a balanced and effective solution. The presented model is most useful when the protocol operates on a private network or such with low gas fees[4].

RedStone X

RedStone X, designed based on GMX V2 architecture, introduces a deferred execution pattern, providing a mechanism to validate the data's integrity, ensuring it remains unaltered by potentially malicious actors. When all verification checks are successfully passed, the correct value will be provided to the user. In cases where the checks fail, the order will be temporarily locked, ideally with a notification mechanism in place to prevent further attempts by malicious actors. Incorrect data could potentially impact the functioning of an application.

Ecosystem

Data Sources

RedStone data sources include CEXs (e.g. Binance, Coinbase), DEXs (e.g. Uniswap, Curve), and broad market aggregators (e.g. Coingecko, Kaiko). These sources are integrated, with over 50 curated specifically to suit individual price feeds[5].

Redstone Oracle Nodes

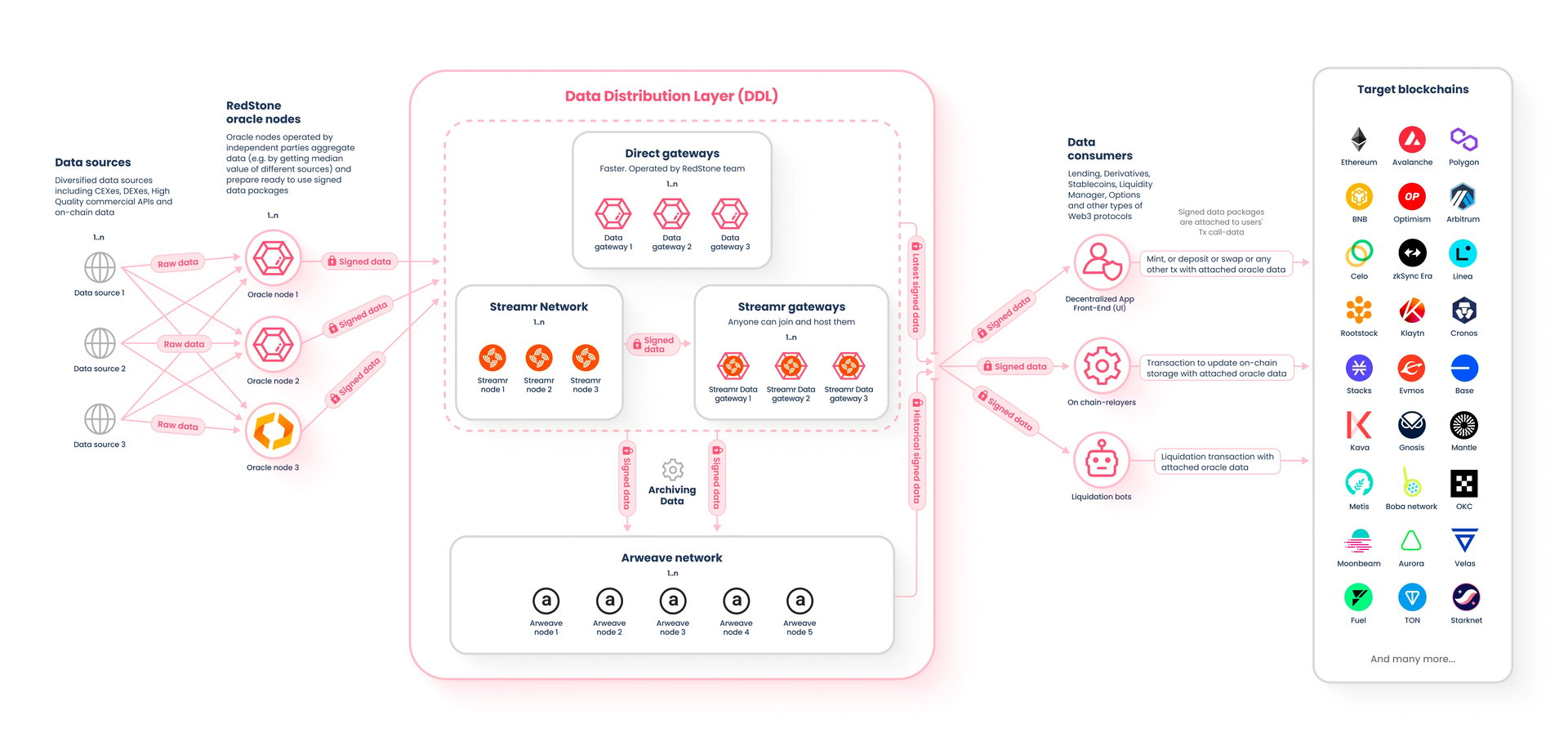

The system utilizes Oracle nodes for off-chain data aggregation, processing, and signing to a Distributed Data Layer (DDL). Aggregation methods, such as median value, volume-weighted average price (VWAP), or liquidity-weighted average price (LWAP), are configurable, although RedStone defaults to passing the median value. Currently, RedStone operates all five Oracle Nodes on the mainnet, although theoretically, they can be independent operators[6].

Data Distribution Layer (DDL)

RedStone's strategy goes beyond its internal structure to address how decentralized applications (dApps) utilize its data. Through its Data Distribution Layer (DDL), called a "decentralized cloud," the oracle securely and effectively stores price feeds off-chain. This design allows for diverse consumption approaches across numerous chains, catering to a broad array of dApps and their requirements[7].

Data Storage

Given the short-term storage of data in the cache layer, decentralized storage is essential for archiving historical data. Arweave, a blockchain specialized in data storage, is ensuring the accountability of data providers through the preservation of archived price feed data[7].

Relayers

Relayers use predetermined criteria, like a heartbeat or price deviation threshold, to push data onto the chain. Relays can be configured for each one of the price feeds. However, RedStone only uses whitelisted relays on the mainnet.

Data Aggregation

Redstone Oracle data collection process sources information from both on-chain and off-chain sources. That includes DEXs (Curve pools, Uniswap pools, Balancer pools etc.), CEXs( Binance, Bitget, Coinbase, OKX, Kraken and others), Oracle providers (Chainlink, Band protocol, DIA), Social Graph (Lens) and aggregators (like CoinmarketCap, Coingecko, Kaiko). RedStone has integrated 162 data sources.

All available data sources are displayed on the RedStone dashboard with reliability metrics like "Incorrect Price", "Fetching Failed", "Success Rate" and "Stability Reports"[6].

Off-chain

Off-chain data aggregation involves independent node providers collecting data from various data sources. These nodes aggregate the collected data using methods like median, Time-Weighted Average Price (TWAP), Last Weighted Average Price (LWAP), or customized calculations (such as utilizing slippage instead of volume for wstETH price feed). Once aggregated and processed, the data is signed by the node operators, ensuring its quality and integrity..

On-chain

On-chain aggregation and verification then occur when this data is brought onto the blockchain, ensuring its validity and preparing it for use by smart contracts and end-users.

Use Cases

Venus integration

The Venus protocol, launched in 2020 on the BNB Chain, has integrated RedStone Oracles to enhance its Oracle infrastructure. This move aims to increase redundancy and security, safeguarding against Black Swan events. Venus, which amalgamates stablecoin minting and algorithmic money markets, boasts a significant Total Value Locked at $1,7b[9].

The integration with RedStone Oracles comes after Venus experienced losses due to an Oracle failure, highlighting the risks of relying on a single Oracle provider[8].

RedStone's implementation involved technical discussions with Venus's development team, leading to the adoption of RedStone's Classic model. This model was chosen for its compatibility with Venus’s existing Oracle interface, requiring no major code changes. Key features of RedStone Classic include customizable update parameters, transparency in data sources and aggregation methods, and complete infrastructure support.

The integration was solidified after a governance forum vote, leading to the setup of an on-chain relayer on the BNB Chain for Venus.

DeltaPrime

DeltaPrime, a platform that facilitates undercollateralized loans on the Avalanche network, and RedStone Oracles' partnership extends beyond their initial integration on the Avalanche mainnet in 2022. A key challenge was ensuring accurate valuation of diverse asset portfolios to maintain financial stability, a task complicated by the limitations of traditional Oracle models[10].

RedStone addresses this by providing off-chain, timely updates for a broad range of assets, thereby enhancing security and flexibility without incurring unnecessary gas costs. It includes LP and staked tokens not covered by other Oracles. This approach is not only cost-effective but also expands the possibilities for DeFi strategies and higher yields on a wider array of assets.

The ongoing partnership between DeltaPrime and RedStone is poised to further develop, with plans to broaden asset pricing coverage, potentially including Real World Assets (RWAs). This collaboration aims to solidify DeltaPrime's role as a key player in the DeFi space by providing users with advanced tools for investment management.

StakeWise

StakeWise, a staking protocol, working as a middleman between stakers and node operators, needed a dependable Oracle to connect the liquid staking token (osETH) with DeFi protocols. RedStone Oracles facilitates this by providing essential, reliable data, expanding osETH's utility and increasing trust in its use across various applications. This integration mitigates risks linked to data inaccuracies or manipulation. The inclusion of osETH in platforms like Gravita, Morpho Blue, and Enzyme is made possible by RedStone's osETH/ETH price feed.

Kirill Kutakov of StakeWise notes the shift from a near-exclusive reliance on Chainlink for Oracles, due to its high liquidity demands, to a more diverse ecosystem with providers like RedStone offering accessible, quality price feeds. This diversification helps protocols more easily secure necessary price data.

RedStone's implementation features a price discovery mechanism that sources from the three most liquid DEXes for osETH trading: Balancer (osETH-WETH), Uniswap V3 (osETH-USDC), and Curve (osETH-rETH). A liquidity monitoring service is also in place to adjust to token deployment shifts and deter price manipulation. The solution includes a comprehensive infrastructure of data provider nodes, relayer nodes, and monitoring services, ensuring reliable osETH price data feeds[11].

Funding

In July 2021 RedStone completed its pre-seed funding round, securing $525K in investments. The round was led by Maven 11 Capital, major investors in the private-placement SAFT-style round included Arweave, Collider Ventures and others. Subsequently, in August 2022 RedStone progressed to a seed funding stage, successfully raising $7 million[12]. Round was led by Lemniscap, Blockchain Capital, Maven11, Coinbase Ventures and other top-tier Web3 funds. In May 2023 RedStone announced an exclusive angel round. Undisclosed amounts were raised from Stani Kulechov (Aave Companies Founder and CEO), Sandeep Nailwal (Polygon Co-Founder) and other notable figures.

Team & Advisors[14]

1. Jakub - Founder, CEO

2. Marcin - Co-Founder, COO

3. Alex - Co-Founder, Lead Dev

4. Matt - Head of BD

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)