Subscribe to wiki

Share wiki

Bookmark

Aave

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Aave

Aave (formerly known as ETHLend) is a DeFi lending protocol that allows users to borrow a wide range of cryptocurrencies, with the option to use both stable and variable interest rates. The lending Decentralized Application (DApp) allows borrowers and lenders to 'opt the terms and conditions for loans.' Said loans are held within smart contracts. Aave was founded by Stani Kulechov in 2017. [3][4] [1] [2]

History

Aave was founded by Stani Kulechov in 2017 under the name ETHLend, one of the first lending applications that were built on the Ethereum blockchain. The company rebranded from ETHLend to Aave on September 18, 2018, after wanting to expand beyond Ethereum (ETH) and start lending other cryptocurrencies. In an interview with Kulechov, he mentions;

"By integrating our innovative technology into the services already offered by traditional institutions, we can transform the way people interact and provide new products and services that will help them seamlessly achieve their goals at a lower cost, ultimately giving them access to new opportunities that have not been possible before." [25]

The name "aave" comes from a Finnish word that means "ghost" in English. According to their about page, "the ghost represents Aave's focus of creating a transparent and open infrastructure for decentralized finance."

On August 15, 2020, Aave became the second DeFi protocol to hit $1 billion in TVL (total value locked). The milestone meant Aave users had deposited $1 billion worth of assets into the protocol for lending and borrowing purposes. [26]

Funding

An initial coin offering was held on the 25th of November 2017, where $16.2 million was raised by selling one billion AAVE tokens at a rate equivalent to $0.0162 a piece. At the time, 23% of AAVE tokens were assigned to its founders and project.

On July 1 and July 8, 2020, Aave raised $3,000,000 from Framework Ventures and Three Arrows Capital and $4,500,000 from ParaFi Capital respectively.

On October 12, 2020, Kulechov announced that Aave raised $25 million from various investors, including Blockchain.com Ventures, Standard Crypto, Genesis One Capital, and Blockchain Capital. Discussing the investment, CEO Stani Kulechov stated,

Aave raised funds from strategic investors to bring DeFi closer to instituional use and to expand the team size to serve the growth in Asian markets,

He also added that the new stakeholders will participate in the protocol's governance and staking. [7] [22]

Partnerships

Axie Infinity

On November 5, 2020, Aave announced a partnership with Axie Infinity, a Pokémon-inspired video game where players are able to collect fantasy creatures known as "Axies." With this partnership, Aave tokens will be distributed to players who win battles in the game. Additionally, Aave token holders will be eligible for a special Aave NFT from the game, which will be a unique character that can be claimed and used within the Axie universe. [14]

Pixelcraft Studios

On November 23, Aave announced that it would invest in Singapore-based company Pixelcraft Studios, which is developing Aavegotchi, a Tamagotchi-inspired Non-Fungible Token (NFT) collectibles game that Aave's protocol would power. Aavegotchi is governed by AavegotechDAO through its own token GHST.

Balancer

On February 23, 2021, the Aave team announced its partnership with Balancer to build the first Balancer V2 Asset Manager, allowing idle assets in Balancer V2 pools to earn a yield on Aave. In essence, unused tokens in the Balancer liquidity pool will be lent on Aave to earn additional yield, with the automated Asset Manager facilitating the transfer of funds between protocols. [18]

AAVE Protocol

On January 7, 2020, Aave launched 'Aave Protocol', an open-source non-custodial protocol that allows the creation of money markets. It has 16 different assets; 5 of which are stablecoins. Within the first month of its debut, the protocol reached over 5 million USD in liquidity. It features a money lending market that is similar to Compound but focuses more on reusing locked assets within Ethereum's ecosystem. It also features flash loans, which are a tool that allows developers to borrow liquidity from the protocol without needing to add collateral, "provided that the liquidity is returned to the protocol within one transaction (a single block)." Aave also stands out for its ability to tokenize deposits as 'aTokens', which garner interest in real-time. Those who deposit earn interest while also adding liquidity to lending pools. Some of its Aave interest-bearing tokens, or 'aTokens', include LEND, Ethereum, DAI, USD Coin, TrueUSD, Basic Attention Token, Chainlink, and 0x Coin.

AAVE Token

Aave initially debuted its LEND token in 2017. The native token is used for protocol governance, but can also be staked for insurance as a way to earn protocol fees and AAVE rewards. In late 2020, the tokens community voted to change the ticker symbol to AAVE. The cryptocurrency operates on the Ethereum platform. It has accumulated a market size of over $1.8 billion. On October 29, 2020, Aave officially transferred governance to token holders. This move brings the firm a step closer to decentralization on the platform, something they have continuously pushed for[15].

Distribution

In 2017, Aave's founder, Stani Kulechov, held an ICO that raised $16.2 million at a rate of $0.016 per token. In July 2020, a token swap was conducted, which decreased the token supply from 1.3 billion LEND to 13 million AAVE, with holders able to exchange 100 LEND for 1 AAVE. An additional 3 million tokens were allocated to the Aave ecosystem reserve. [19]

The migration from LEND to AAVE enabled governance to be introduced to the protocol, allowing the community to propose AIPs (AAVE Improvement Proposals) and guide the project's development. As a result, governance became a defining feature and utility of AAVE. [19]

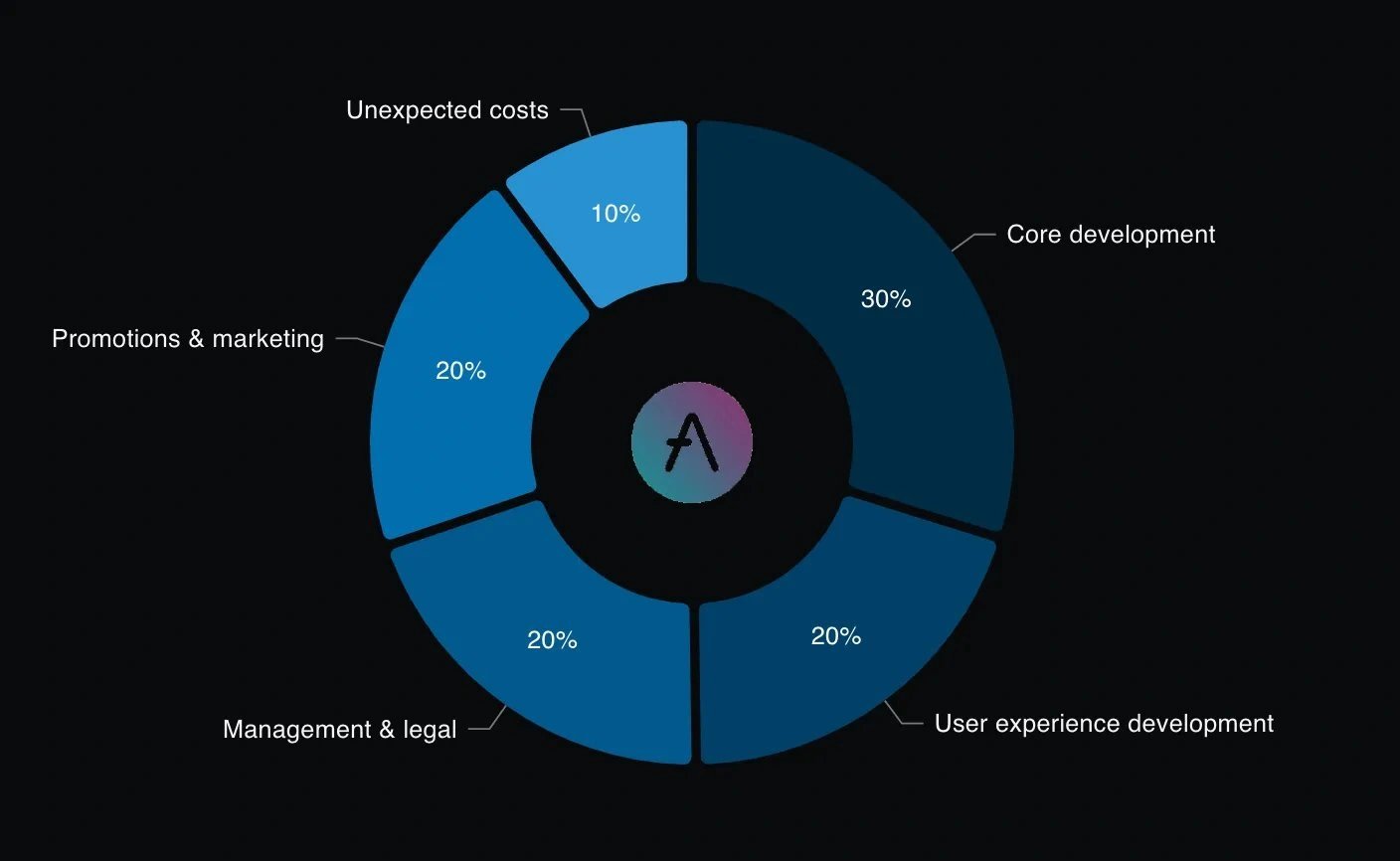

AAVE was distributed as follows;

- Core development - 30%

- User experience development - 20%

- Management and legal - 20%

- Promotions and marketing - 20%

- Miscellaneous costs - 10%

Governance

AAVE's governance protocol is conducted in a decentralized fashion, with AAVE holders able to vote on proposals and issue new proposals (AIPs). Proposals may affect the protocol, its risk parameters, incentives, improvements, and upgrades. All changes made to the protocol since its launch have been in support of the governance system.

AAVE holders are incentivized to vote on proposals that improve the protocol, with governance existing in a specified manner:

- AAVE holders discuss AIPs inside the AIP framework

- The AIP Framework receives community-approved AIPs from AAVE holders

- Holders submit and vote on proposals on Aave's governance portal [20]

Aave protocol contains a Safety Module component in its smart contracts, which allows users to deposit AAVE tokens. The Safety Module activates if a shortfall event occurs, leading to a liquidity provider deficit. The module mitigates the event by auctioning a portion of the locked AAVE tokens to reduce the deficit. This helps to prevent the protocol from becoming destroyed due to liquidity problems.

AAVE holders are granted a tokenized position of their staked assets upon depositing tokens to the Safety module. In exchange for providing security to the protocol, they are compensated with Safety Incentives, including AAVE and fees generated by the protocol. [19] [21]

Aave V2

On the 14th of August, 2020, Aave announced version two of its protocol. The update to the V1 included added features to the protocol such as: Repay with collateral where "Aavengers" could deleverage or close their positions by paying directly with the collateral in 1 transaction. [27][28]

Other V2 updates included added features in user experience; debt tokenization and native credit delegation, fixed-rate deposits, private markets, and gas optimizations. Native Trading Functionalities; debt trading, collateral trading, and margin trading. Governance updates; vote delegation, cold wallet voting, etc. [28]. On December 3, 2020, Aave V2 became available on the mainnet. [29][30]

Aave V3

On March 16, 2022, Aave announced the release of version 3 of its protocol across six networks, including Polygon, Avalanche, Arbitrum, and Optimism. The update included; Portals to facilitate cross-chain transactions, High-efficiency mode to unlock higher borrowing power, Isolation mode to limit exposure and risks to the protocol from newly listed assets, Gas optimization whereby gas costs of all the functions are reduced by around 20-25%, and Risk Management Improvements to provide additional protection for the protocol through various risk caps and other tools. [31][32]

Along with the launch of Aave V3, the Aave app on IPFS was also redesigned and refreshed for users to be able to access simplified transaction flows, faster load times, and gain enhanced visibility into their holdings. [33][34]

On January 7, 2023, Aave announced that Aave Protocol V3 had been deployed on Ethereum Mainnet. [35]

GHO Stablecoin

GHO is a decentralized multi-collateral stablecoin that operates within the Aave Protocol. It is designed to provide stability by being fully backed and transparent. On July 16, 2023, Aave made an announcement through a blog post about the introduction of their new stablecoin. The stablecoin is backed by a variety of digital assets, including ETH and AAVE. [36][37] GHO was launched on the mainnet following a community governance vote. The vote witnessed significant support, with nearly 100% of the 424 participating addresses favoring the introduction of the new stablecoin. [37]

All transactions are performed through self-executing smart contracts, and all data regarding GHO transactions is available and auditable directly from the blockchain or via numerous user interfaces. - Aave Protocol

GHO relies on arbitrages to maintain its stability, while the Aave DAO decides on its parameters.

Functioning as a decentralized stablecoin within the Ethereum Mainnet, GHO is generated by users. Similar to any borrowing activity on the Aave Protocol, users are required to provide collateral at a specific collateral ratio in order to mint GHO. When a user repays a borrowed amount or undergoes liquidation, the corresponding GHO tokens are returned to the Aave pool and permanently removed from circulation. All interest payments earned by GHO minters will be directed to the Aave DAO treasury, diverging from the conventional reserve factor collected during the borrowing of other assets, with the principal amount being destroyed.

Minting

Borrowers and suppliers within the V3 of the Aave Protocol have the option to create GHO by utilizing the assets they have provided as collateral on Ethereum markets. [36]

Participants who have staked AAVE tokens in the Safety Module, known as stkAave, are entitled to receive a discount when borrowing GHO. For every stkAave token held, a discount will be applied to the borrowing rate of 100 GHO. The discount framework is flexible and subject to modification or replacement by The Aave DAO if deemed necessary. [36]

GHO on Arbitrum Layer 2

On July 2, 2024, it was deployed to Arbitrum, which is a Layer 2 scaling solution designed to improve the throughput of Ethereum transactions and reduce associated costs. Arbitrum operates by processing transactions off the Ethereum mainnet while still leveraging Ethereum's security features. This setup aims to enhance the scalability and efficiency of GHO transactions by offering reduced gas fees and faster processing times. [41][42]

Lens Protocol

On the 7th of February, 2022, the Aave DeFi lending platform launched the Lens Protocol on the Polygon blockchain to challenge centralized social media platforms. [24]

Lens Protocol is a composable, decentralized social graph on the Polygon proof-of-stake (PoS) blockchain that allows creators to control their content and data. [23]

"We wanted to build a social media protocol, or essentially a social graph, and make those profiles on-chain, following the relationships on-chain and creating a permissionless way to distribute content between a creator and the audience." - Stani Kulechov, Founder of Aave said in a Twitter space conversation. [24]

Avara's Rebrand & Acquisition

On November 16, 2023, Aave announced its rebranding to Avara and the acquisition of Los Feliz Engineering, a Los Angeles-based web3 startup. [38]

"Today, we proudly introduce ourselves as Avara. https://avara.xyz" - the team tweeted[39]"Avara is the home to some of the most innovative web3 brands: @aave, @lensprotocol, @ghoaave, @sonar, and now @family all building towards a people powered internet that benefits all."

Los Feliz Engineering, the acquired startup, is recognized for its development of the self-custody Ethereum wallet: Family and the developer library: ConnectKit. [40]

"We're thrilled to announce the acquisition of @family. With Family, led by @benjitaylor, we're reinforcing our commitment to making web3 accessible through world class product design."

The acquisition and rebranding makes Avara the parent company of Family, Aave Labs, Lens Protocol, Sonar, and GHO, Aave Protocol's stablecoin. [38]

"Our transformation to Avara and the integration of Family into our fold are not mere changes in name or structure. These are significant strides toward our ultimate mission: an open, decentralized internet that's equitable, inspires participation, and fosters innovation. Our objective is to disrupt a web landscape where the majority of power and control is held by a few internet giants.With the addition of Family and the LFE team, led by Benji Taylor, who takes up the role of our new SVP of Product & Design, we're solidifying our intent and capability to make web3 accessible to a larger audience." - Stani Kulechov wrote in the introduction blog. [38]

Integration of RLUSD into Aave

In April 2025, RLUSD, a U.S. dollar-pegged stablecoin developed by Ripple, was added to the Aave V3 protocol on the Ethereum network. The listing followed a governance proposal submitted and approved by the Aave community, enabling RLUSD to be included as one of the assets available for lending and borrowing within the platform.

The proposal considered factors such as the asset’s peg to the U.S. dollar, its technical stability, and backing by a known issuer. The integration aimed to expand the variety of stablecoins available on Aave and to provide users with additional options for collateral and liquidity provision.

RLUSD was introduced with the following initial risk parameters on Aave V3:

- Loan-to-Value (LTV): 75%

- Liquidation Threshold: 80%

- Liquidation Penalty: 5%

- Efficient Mode (E-Mode): Enabled under the stablecoin category

With this integration, RLUSD became available as both a collateral asset and a borrowing option within Aave’s Ethereum market. This development aims to reflect ongoing efforts to scale the stablecoin utility across decentralized finance protocols by incorporating assets issued by established entities. [43] [44] [45]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)