Subscribe to wiki

Share wiki

Bookmark

FLOW Token

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

FLOW Token

FLOW Token is the native cryptocurrency on the Flow blockchain, a decentralized layer 1 blockchain created by Dapper Labs, the company behind CryptoKitties. FLOW is used for payments within decentralized applications (dApps) that are constructed on the network. Additionally, it facilitates the development, deployment, and creation of smart contracts, which are essential for building applications on Flow. [1]

Overview

FLOW is the native token of the Flow blockchain, used to support the network’s core operations, including transaction fees, staking, rewards, and data storage. It serves as the staking asset under Flow’s proof-of-stake consensus model, enabling validator participation and delegation. FLOW also functions as a medium of exchange within applications, collateral for secondary tokens, and a reserve asset for on-chain activity. Additionally, it is intended for governance, although full on-chain governance is not yet active. [2]

Utility

The FLOW token functions as the core utility asset on the Flow blockchain, supporting multiple critical activities across the network. It is used for staking by both validators and delegators, and serves as the medium for distributing staking and protocol rewards. FLOW is also the primary currency for paying transaction fees associated with smart contract deployment, account creation, and asset transfers. Additionally, users must hold a minimum balance of FLOW to reserve on-chain storage.

FLOW also serves as a medium of exchange within decentralized applications, acts as collateral on DeFi platforms, and is utilized for governance participation. It facilitates peer-to-peer payments and supports token creation, making it essential for developers building apps, games, and smart contracts on Flow. As a bridging asset, FLOW enables liquidity between less frequently traded token pairs. Its broad utility ensures that all network participants—whether developers, users, or validators—interact with FLOW across a wide range of network functions. [2]

Tokenomics

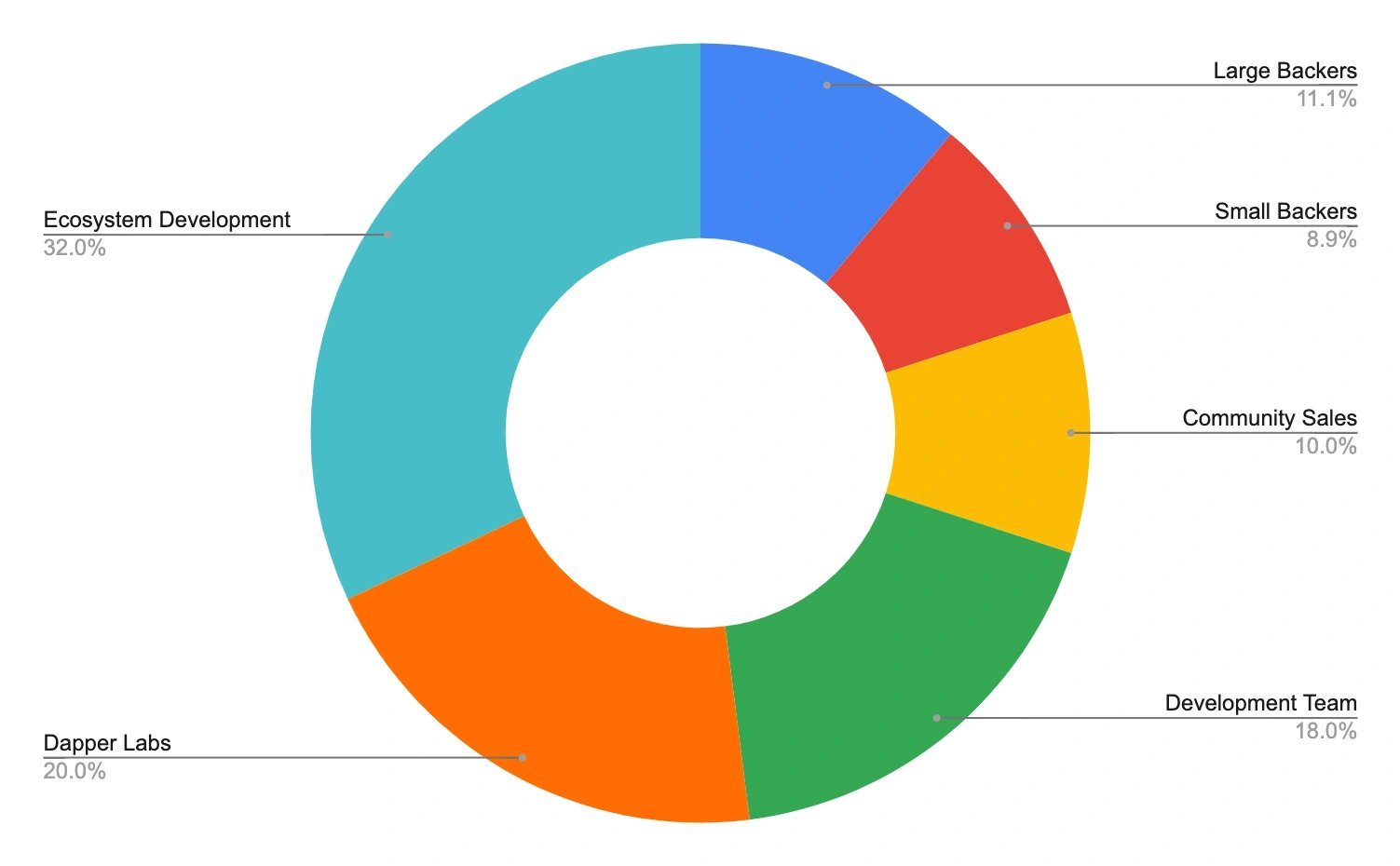

FLOW has a total supply of 1.25B tokens and has the following allocation: [6]

- Ecosystem Fund: 32%

- Pre-launch Backers & Community Sale: 30%

- Dapper Labs: 20%

- Development Team: 18%

Staking

Staking on the Flow blockchain requires validator nodes to lock FLOW tokens as a security deposit to participate in network operations. This bonded deposit can be slashed if a validator engages in malicious behavior, serving as a deterrent against attacks such as Sybil attacks, where one party tries to control the network by posing as multiple validators. This mechanism is essential for maintaining the integrity and decentralization of the protocol.

Flow distributes validator rewards through a combination of inflation and transaction fees. Rewards were introduced in December 2020 and are allocated entirely to stakers, preventing token dilution for those actively participating. The protocol uses role-based reward coefficients to balance the network’s needs—if certain node types are underrepresented, their reward rate increases until the appropriate stake distribution is achieved. Validators must follow operational guidelines to receive full rewards, with penalties in place for non-compliance. [6]

Governance

Flow governance combines off-chain and on-chain mechanisms, with a gradual shift toward full decentralization. Initially, development is led by core contributors, and node operators review proposed upgrades. Community members can submit improvement proposals via GitHub. While early on-chain voting initially began as non-binding signaling, it enables FLOW holders to express their opinions, informing future protocol development and informing future protocol development.

In the long term, governance will transition to a system involving DAOs and a representative council. Token holders will vote for council members who make operational decisions, though these decisions can be publicly challenged or overridden by the broader community. Governance decisions fall into three categories: ecosystem decisions (e.g., council elections), protocol parameters (e.g., validator seat counts), and protocol upgrades. While protocol upgrades are rare and require broad consensus, they allow for extensive changes to the network. [7]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)