Subscribe to wiki

Share wiki

Bookmark

Frax Price Index Share (FPIS)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Frax Price Index Share (FPIS)

The Frax Price Index Share (FPIS) is the governance token of the Frax Price Index (FPI), the second stablecoin launched by Frax Finance in April of 2022.[2]

Overview

FPIS is a linked governance token that is interconnected with the Frax Share (FXS) token. It specifically tracks the growth of FPI, a token representing the protocol's own specific economy. The Frax Collateral Ratio (FCR) plays a crucial role in calculating the value distribution to FPIS and veFPIS token holders, as it represents the ratio of FRAX stablecoins backing FPI tokens.[1][3]

Additionally, FPIS serves as the governance token of the system, allowing holders to participate in decision-making and receive seigniorage from the protocol. During periods when the FPI treasury yield is insufficient to maintain the increased backing per FPI due to inflation, new FPIS tokens may be minted and sold to bolster the treasury. As the protocol operates within the Frax ecosystem, FPIS also directs a variable portion of its revenue to FXS holders. FPIS is set to be phased out by March 22, 2028 and convertible thereafter to FRAX (prev. FXS). [3]

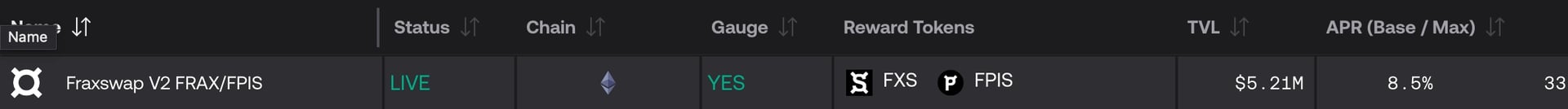

Frax Staking

Frax Finance protocol allows FPIS holders to lock up FPIS tokens to generate yield on Fraxswap.

Token Distribution

No FPIS tokens can be minted over the 100m genesis supply except to keep the FPI peg to the CPI rate and keep the CR constant at 100%.

- 30% Frax Finance Treasury 30,000,000

FXS voters have total control in voting on how to distribute these tokens through governance.

- 25% FPI Protocol Treasury 25,000,000

FPIS voters themselves have total control over how to distribute these tokens.

- 25% Core Developers & Contributors Treasury 25,000,000

4-year back-vested to start from February 20th, 2022 at the same time as airdrop genesis with a 6-month cliff. Distribution occurs on/around the 20th of each month. This treasury will be staked in the veFPIS system in 4-week intervals between monthly distributions when veFPIS is released.

- 10% February 2022 Airdrop to FXS Holders 10,000,000

Snapshot on February 20th 11:59:59 UTC 2022 and claimable until August 20th 11:59:59 UTC 2022.

- 10% veFPIS Emissions 10,000,000

As part of a planned phase-out, veFPIS emissions were discontinued in early July 2024. Remaining FPIS tokens are held in the FPI Protocol Treasury multisig and are intended to be burned. [6]

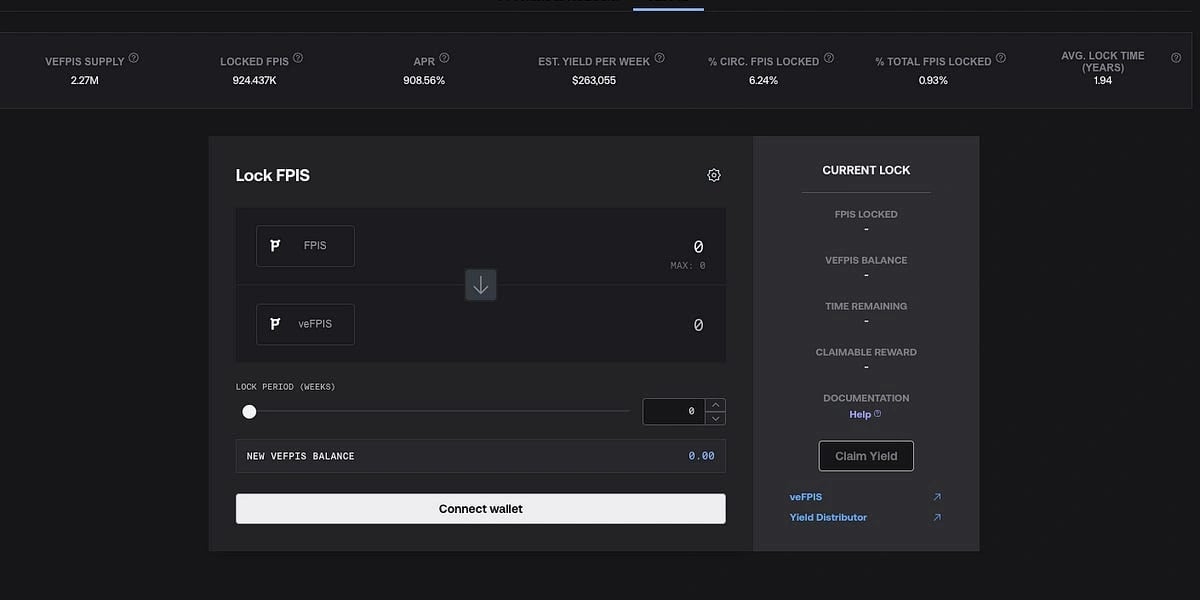

veFPIS

veFPIS is an updated and modular vesting and yield system designed for the FPIS governance token. Users have the option to lock their FPIS tokens for up to 4 years, receiving four times the amount of veFPIS in return. veFPIS is not transferable and does not trade on liquid markets. Instead, it functions as an account-based point system that represents the vesting duration of locked FPIS tokens within the protocol. The balance of veFPIS gradually decreases as tokens approach their lock expiry, converging to a ratio of 1 veFPIS per 1 FPIS at zero lock time remaining.[4]

Double Whitelist & Modular Functionality

veFPIS incorporates a "DeFi whitelist" for smart contracts that introduce modular functionality to the staking system. Each new whitelisted DeFi feature requires approval from governance. For example, a liquidation contract can be whitelisted, enabling the liquidation of a staker's underlying FPIS tokens if they borrow against their veFPIS balance. Users must individually approve each DeFi whitelisted contract in order to spend their FPIS tokens and unlock the new functionality. This ensures a fully trustless staking system, where no additional logic can access a staker's veFPIS balance without their explicit approval. By adopting this opt-in approach, governance can introduce iterative enhancements to veFPIS staking, such as "slashing conditions" and novel ways to earn higher yield, allowing veFPIS holders to participate in voting on CPI gauge weights, borrow FPI, or control liquidity deployment.[4]

Airdrop

On February 20th, 2022, the snapshot for the FPIS airdrop took place, where all members of the community that were veFXS, cvxFXS, tFXS stakers and/or were FRAX-FXS liquidity providers before 11:59:59 UTC were eligible to claim the free tokens. 10 million FPIS tokens were distributed to these FXS contributors based on their weight which was claimable until August 20th, 2022. The amount of FPIS received by each holder was determined by the formula: (individual weight * 10 million FPIS) / (total weight), ensuring a proportional distribution based on the weight of each participant. Additionally, veFXS stakers were also eligible to receive a portion of the FPIS supply, and the specific ratios were announced prior to the claimable airdrop. It's important to note that if holders had cvxFXS, the airdrop was directed to Convex since they are the ultimate owners of veFXS for distribution to cvxFXS holders.[5]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)