Subscribe to wiki

Share wiki

Bookmark

Frax Ether (frxETH)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Frax Ether (frxETH)

Frax Ether (frxETH) is a liquid ETH staking derivative and stablecoin system that aims to simplify and secure the Ethereum staking process. It leverages the Frax Finance ecosystem to provide a DeFi-native way for users to earn interest on their ETH holdings while maximizing their staking yield. [1][2]

Overview

The Frax Ether system comprises three primary components, Frax Ether (frxETH), Staked Frax Ether (sfrxETH), and the Frax ETH Minter:

Frax Ether (frxETH)

frxETH acts as a stablecoin loosely pegged to ETH, so 1 frxETH always represents 1 ETH and the amount of frxETH in circulation matches the amount of ETH in the Frax ETH system. When ETH is sent to the frxETHMinter, an equivalent amount of frxETH is minted. Holding frxETH on its own is not eligible for staking yield and should be thought of as analogous as holding ETH. [3] [2]

Staked Frax Ether (sfrxETH)

sfrxETH is an ERC-4626-compliant vault that captures staking rewards generated by Frax ETH validators. Users can deposit frxETH into the vault in exchange for sfrxETH, which represents a proportional share of the vault’s total frxETH holdings. As staking rewards accumulate, new frxETH is minted and added to the vault. This causes the exchange rate between sfrxETH and frxETH to increase over time, allowing users to redeem sfrxETH for more frxETH than initially deposited. The design mirrors other auto-compounding yield-bearing tokens, such as aUSDC or cUSDC, distributing staking rewards among holders based on their share of the total sfrxETH supply. [7]

Frax ETH Minter (frxETHMinter)

Frax ETH Minter enables exchanging ETH for frxETH. It brings ETH into the Frax ecosystem and mints new frxETH equal to the amount of ETH sent. The platform also sets up new validator nodes as needed. [2] [8]

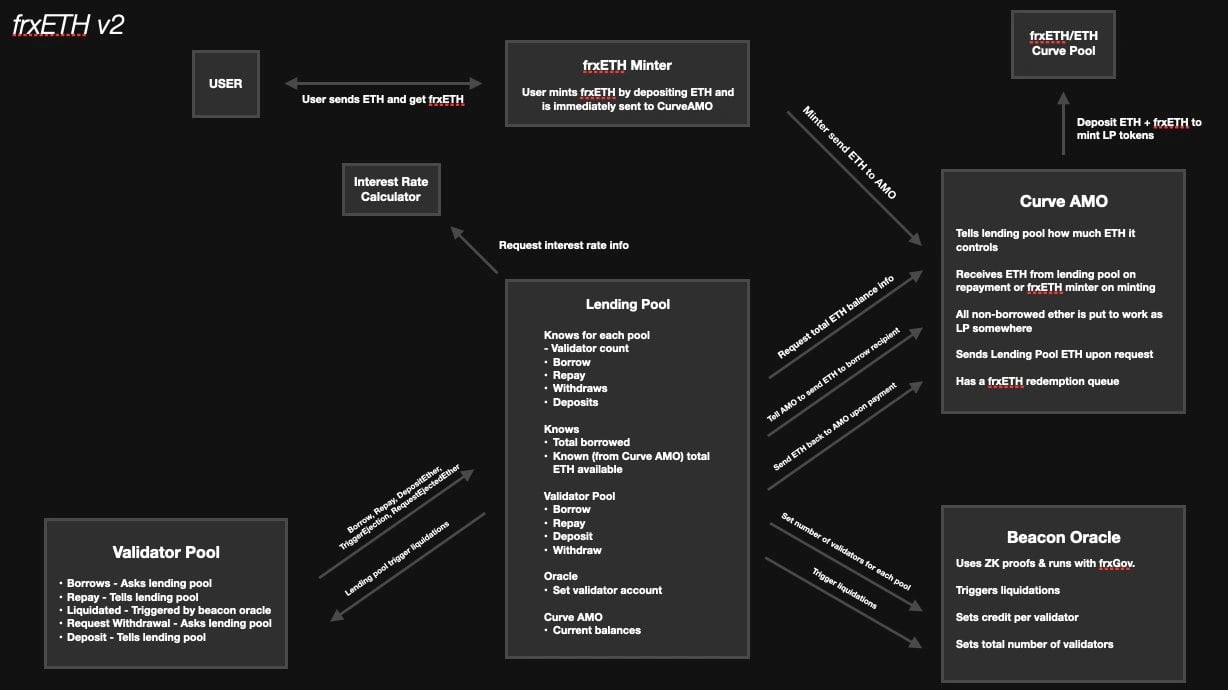

FrxETH v2

Launched in June 2023 by founder Sam Kazemian, the frxETH v2 protocol allows users to lend and borrow ETH. According to Kazemian, FraxETH v2 is designed to be more efficient and decentralized than other protocols. [4]

In an X thread, Kazemian explained that FraxETH v2 works by creating a peer-to-pool lending market: Users who want to lend ETH can do so by depositing it into the FraxETH v2 pool, and Users who want to borrow ETH can do so by taking out a loan against their ETH collateral. [4]

The interest rate for borrowing ETH is set by market forces and utilization rates. There are no hardcoded fees or commissions. This signifies a competitive interest rate and a high demand for ETH. [6]

“If you treat it like a lending market [frxETH v2 is] basically the most efficient LSD(Lending-Staking-Decentralized) protocol because everyone that is good at running a validator will want to borrow our ETH” at the lowest rates." - Sam Kazemian said in an interview[6]

In comparison, frxETH v1 allows users to deposit ETH and receive frxETH tokens. These frxETH tokens can be staked to earn sfrxETH tokens as staking rewards. Alternatively, users can also pair their frxETH tokens with ETH-frxETH on Curve Finance to participate in CRV mining.

In frxETH v2, users have the ability to borrow validators based on their loan-to-value (LTV) ratio. To “borrow” validators, users provide a specific amount of ETH as collateral, which can exceed 8 ETH. This collateral gives users the right to borrow and operate validators on Frax Finance. Simultaneously, the interest on the loan is directly deducted from the user’s ETH and validator rewards.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)