Subscribe to wiki

Share wiki

Bookmark

Staked Frax Ether (sfrxETH)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Staked Frax Ether (sfrxETH)

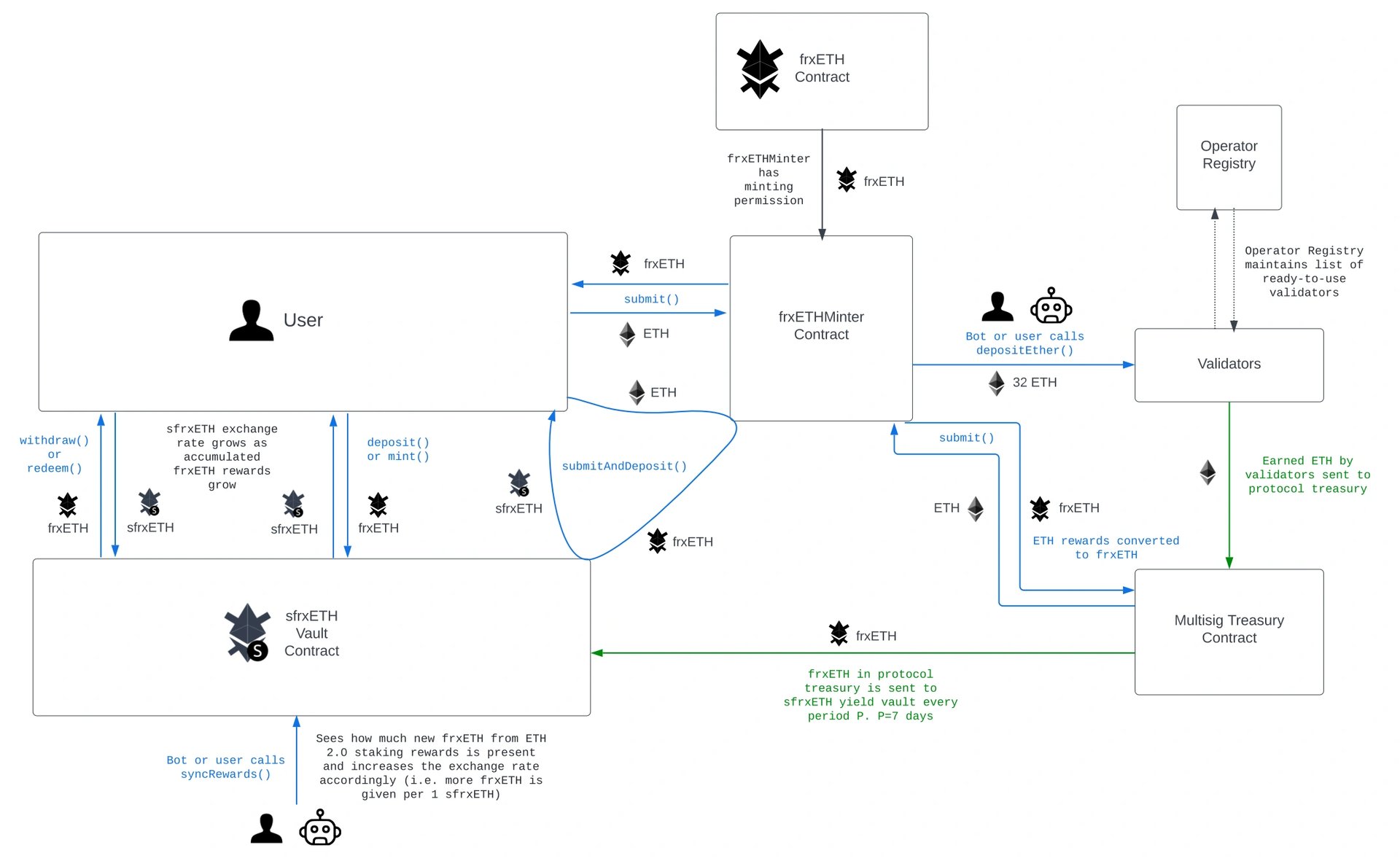

Staked Frax Ether (sfrxETH) is a liquid staking derivative stablecoin by Frax Finance. sfrxETH is the staked version of frxETH designed to accrue the staking yield of the Frax ETH validators. The exchange rate of frxETH per sfrxETH increases over time as staking rewards accrue to the vault.

Overview

The Frax Ether system comprises three primary components, Frax Ether (frxETH), Staked Frax Ether (sfrxETH), and the Frax ETH Minter:

sfrxETH

sfrxETH is the version of frxETH that accrues staking yield. All profit generated from Frax Ether validators is distributed to sfrxETH holders. By exchanging frxETH for sfrxETH, one becomes eligible for staking yield, which is redeemed upon converting sfrxETH back to frxETH. It is an ERC-4626-compliant vault and is obtained by first approving the sfrxETH contract as a frxETH spender. As validators generate staking yield, an equivalent amount of frxETH is minted and sent to the sfrxETH contract. This means that once rewards are synced, one's sfrxETH may be redeemed for a greater amount of frxETH than it took to mint.

frxETH

frxETH acts as a stablecoin loosely pegged to ETH, leveraging Frax's winning playbook on stablecoins and onboarding ETH into the Frax ecosystem.

Frax ETH Minter (frxETHMinter)

Frax ETH Minter (frxETHMinter) allows the exchange of ETH for frxETH, bringing ETH into the Frax ecosystem, spinning up new validator nodes when able, and minting new frxETH equal to the amount of ETH sent. [2]

Liquid Staking

Solo ETH staking requires the technical knowledge and initial setup associated with running a validator node, and also that deposits be made 32 ETH at a time. By opting to use a ETH liquid staking derivative instead of staking ETH in another form, staking yield can be accrued much more simply, abstracting the need to run validators, allowing yield to be earned on any amount of ETH, allowing withdrawals at any time and of any size, and allowing far greater composability throughout DeFi.

Technical Specifications

frxETHMinter: The frxETHMinter mints frxETH when it receives ETH either through the submit or receive function. Whenever a submission pushes the minter balance over 32 ETH, the contract pops a validator's deposit credentials off of a stack and passes the 32 ETH deposit along with the credentials to the ETH 2.0 deposit contract, automatically spinning up a new validator.

As needed, new credentials are added to the stack to ensure that there are always validators ready to take deposits. If at any time the contract runs out of validators, frxETH will continue to be minted as normal (unless paused) but no new validators will be spun up until more are added to the stack.The withdrawal credential is shared by all the validators on the stack, meaning all validators share the same withdrawal address. This address is set to the Frax Multisig at launch, so that withdrawals may be safely handled once live.

In addition, when adding validators it is necessary to pass the DepositDataRoot as provided when generating the deposit data, this is to provide redundancy in ensuring a validator with wrong parameters will not be accepted when ETH is deposited.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)