Subscribe to wiki

Share wiki

Bookmark

GalaxyCash

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

GalaxyCash

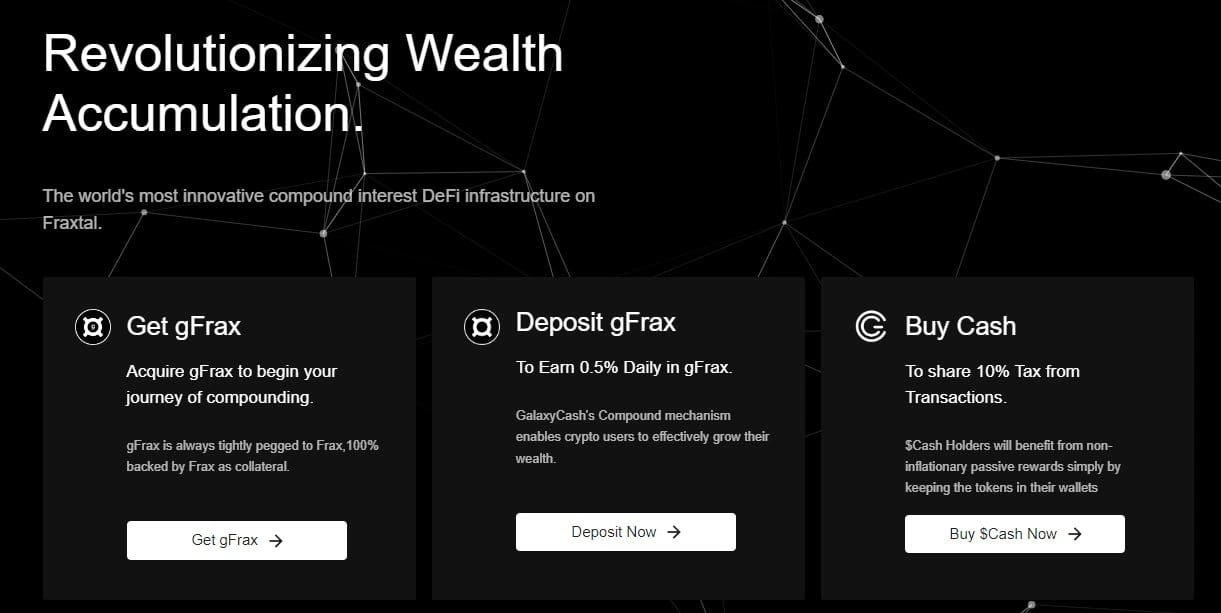

GalaxyCash is a decentralized financial ecosystem, the first to be deployed on Fraxtal, aimed at safeguarding and enhancing assets within the cryptocurrency and DeFi landscape.[1][2][3]

Overview

GalaxyCash, established in December 2023, positions itself as a secure financial ecosystem deployed on Fraxtal, an Ethereum Layer2 network. The GalaxyCash testnet officially went live there on February 19th.

With a focus on stability and growth, GalaxyCash aims to provide a reliable financial journey amidst market uncertainties, offering an accessible route for all to explore and prosper in the crypto universe.

On March 6th GalaxyCash completed the audit of all Smart Contracts through Beosin Blockchain Security. [1][2][4][5]

Key Components

Galaxy Vault

GalaxyCash introduced the Galaxy Vault, aiming to enhance cashflow efficiency using advanced algorithms. Users can employ different strategies to grow their Total Value Locked (TVL) and ensure cashflow stability.

With a minimum deposit of 200 gFrax, users aim to earn a daily yield of 0.5%. The $Cash token is supported by the Galaxy Vault to foster long-term stability and growth.

Operating tax-free and immutably on the blockchain, this smart contract-based system manages deposited gFrax automatically, trading $Cash tokens to maintain their stability and growth. Upon deposit, a portion of gFrax is allocated to automated trading and earnings distribution, with the rest reserved for future use.[1][6]

GFrax Pool

The gFrax Pool within the GalaxyCash ecosystem serves as a vital component for managing user earnings efficiently.

It is designed to allocate 85% of deposits for automated trading, retain 10% within the pool, and reserve 5% for future initiatives. This pool operates through a sophisticated contract mechanism within the GalaxyCash protocol, handling earnings from the Galaxy Vault.

Upon depositing Frax into the Galaxy Vault, 85% is directed towards automated trading, while 10% is allocated to the Frax Pool. An additional 5% is reserved for future use. The Frax Pool receives funding from two primary sources: 10% of all Frax deposits in the Galaxy Vault and liquidation of $Cash tokens by the automated trading contract.

Its main function is to facilitate a seamless process for users to access their earnings in Frax.[7]

Blackhole

The "Blackhole" is a vital component of the GalaxyCash network, holding a substantial portion of $Cash tokens and accruing rewards from transaction fees.

Initially securing 50% of the circulating supply of $Cash tokens, it gradually increases its holdings to 51% over time. As a major token holder, it collects half of all transaction fee rewards.

When its holdings reach 51%, a Blackhole Rebalance is triggered, selling 0.5% of the total supply for Frax and allocating an additional 0.5% to enhance liquidity. This process ensures a fair distribution of rewards and contributes to liquidity growth in the ecosystem.[8]

GalaxyDAO Treasure

The GalaxyDAO (Decentralized Autonomous Organization) has 22% of the initial $Cash token supply allocated to support its functions. Through a unique transaction tax mechanism, a portion of every $Cash transaction contributes to the GalaxyDAO's treasury, ensuring both governance oversight and revenue generation.

These funds are essential for GalaxyCash's ongoing development and expansion, supporting platform improvements, user experience enhancements, and outreach initiatives.

Allocations for Marketing, Strategic Partnerships, Website Maintenance, and Future Development are earmarked, subject to community proposals and approvals, intended to foster a sustainable future for all $Cash holders.[9]

Key Mechanisms

Compound

In GalaxyCash, when users have existing Total Value Locked (TVL) and pending rewards, any new deposit triggers the reinvestment mechanism, combining unredeemed rewards with the principal amount.

This Compound mechanism aims to enhance DeFi interest rate protocols, providing users with the opportunity to effectively manage their TVL for optimized wealth growth. It offers strategic possibilities for efficient cash flow planning and continuous TVL growth.

Additionally, users have the option to manually redeposit unclaimed rewards to achieve a compounding effect on their earnings, enabling them to actively manage and maximize their investment growth within the GalaxyCash ecosystem.[2][10]

Limits & Payouts

GalaxyCash imposes various limits to streamline its operations effectively. These include a maximum individual Total Value Locked (TVL) of $1 million gFrax and a maximum individual payout of $2.5 million gFrax.

Additionally, users are subject to a daily withdrawal limit of $50,000 gFrax. The maximum individual accumulated rewards cap at $50,000 gFrax or when they match the individual's TVL, whichever is lower. These measures aim to maintain stability and liquidity within the platform while ensuring a balanced and sustainable environment for users.[11]

Adaptive-Rate-Limits

GalaxyCash implements Adaptive Rate Limiters to counteract the effects of hyper-compounding and promote its long-term sustainability.

This feature is designed to adjust the compounding rates based on users' compounded rewards compared to their fresh gFrax deposits, ensuring a balanced ecosystem.

There are five tiers of Rate Limiters, each with varying daily rates corresponding to different levels of compounded rewards. These tiers range from 50,000 to 249,999 with a daily rate of 0.45% to 1,000,000 and above with a daily rate of 0.25%.[12]

Transaction Tax

The transaction tax plays a crucial role in GalaxyCash's sustainability strategy. It applies a 10% tax on all $Cash token transactions, with the aim of encouraging long-term holding, discouraging excessive trading, and stabilizing token prices.

Half of the tax collected is distributed to $Cash token holders, including the Blackhole contract, without requiring active staking. The remaining 50% is allocated to enhance liquidity in the Cash-Frax LP pool, aiming to support market stability.[2][13][3]

Liquidity Provision

GalaxyCash prioritizes a stable market, dedicating 6% of the total $Cash supply for liquidity on Fraxswap. This, combined with Frax from the IDO, forms a substantial pool. Steps include pairing Frax with $Cash, creating the Cash-Frax pool on Fraxswap, and locking liquidity by the protocol.

Providing initial liquidity aims to build trust and minimize barriers for users, ensuring smooth transactions with minimal price impact. [14]

Tokenomics

GalaxyCash Token ($CASH)

The $Cash token serves as a core element within the GalaxyCash protocol, aiming to provide robust value storage capabilities.

Built on the Fraxtal platform and adhering to the ERC-20 standard, it employs equitable distribution methods and automated liquidity rebalancing to effectively encapsulate value.

Additionally, the $Cash token is designed to offer lifelong passive earnings within the GalaxyCash ecosystem. [15]

Allocation

The total supply of the $Cash token is 10 billion tokens.

- Blackhole: 50% allocation, totaling 5 billion tokens

- GalaxyDAO Treasury: 22% allocation, totaling 2.2 billion tokens

- IDO: 12% allocation, totaling 1.2 billion tokens

- Initial Liquidity (POL): 6% allocation, totaling 600 million tokens

- Airdrop: 2% allocation, totaling 200 million tokens

- Team: 8% allocation, totaling 800 million tokens[15]

GFrax

GFrax serves as the stablecoin for GalaxyCash, maintaining a consistent 1:1 peg with Frax and backed entirely by Frax collateral. Its core objective is to utilize treasury interest from Frax V3 to provide value for GalaxyCash users and foster the ecosystem's long-term sustainability.

Users have the ability to mint and withdraw gFrax at their convenience, converting it back to Frax when needed. The Frax used for minting is automatically staked as sFrax, capturing interest from U.S. T-bills. Staked FRAX (sFRAX) operates as an ERC4626 staking vault, distributing part of the Frax Protocol yield weekly to stakers in FRAX stablecoins. [16]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)