Subscribe to wiki

Share wiki

Bookmark

Global Dollar Network

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Global Dollar Network

Global Dollar Network is a collective of cryptocurrency companies that promotes stablecoin adoption, particularly focusing on the USDG stablecoin. The network combines major cryptocurrency exchanges and financial technology firms to create a regulated stablecoin ecosystem across multiple blockchains. [3]

Overview

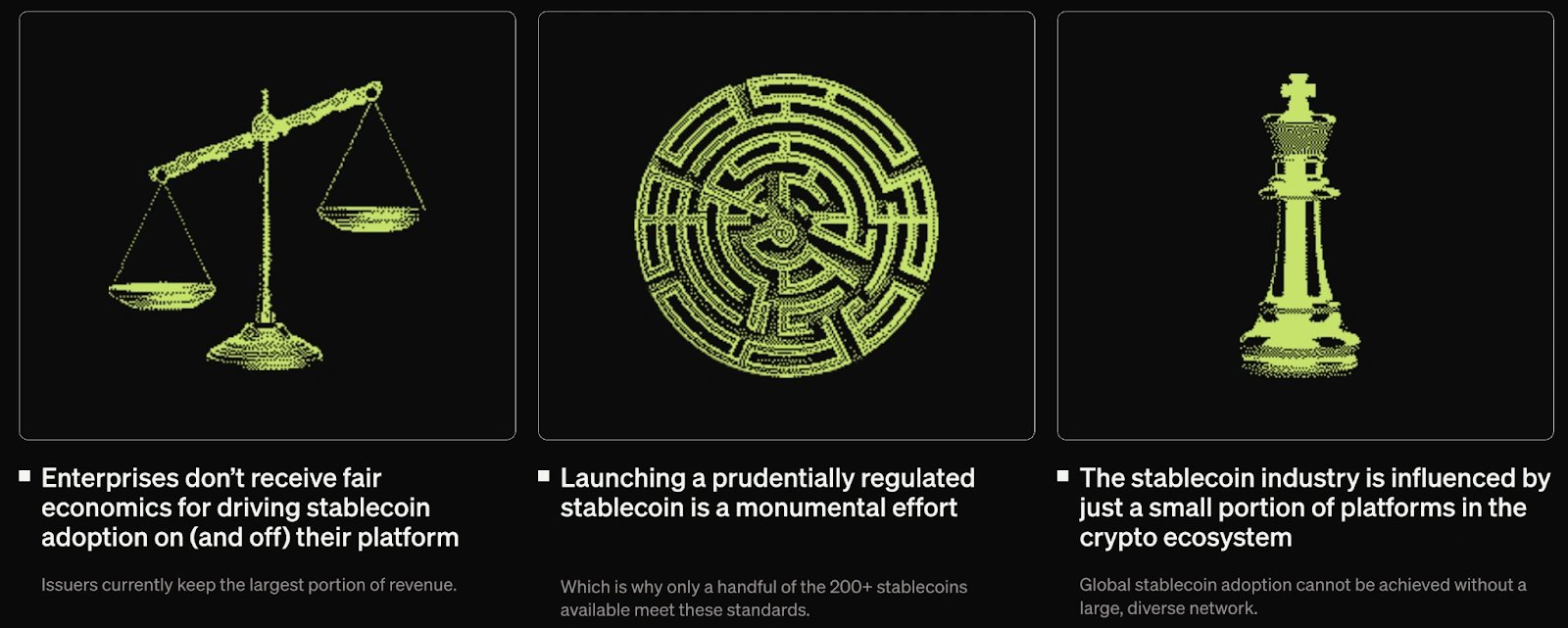

The Global Dollar Network is a consortium of major crypto firms—including Robinhood, Kraken, Paxos, Galaxy Digital, Bullish, Anchorage Digital, and Nuvei—collaborating to promote the adoption of USDG, a stablecoin issued by Paxos out of Singapore. Designed to comply with the Monetary Authority of Singapore’s upcoming stablecoin regulations, USDG stands out by redistributing nearly all yield from its U.S. Treasury-backed reserves to participating companies based on their network growth and liquidity contributions. Unlike traditional stablecoins such as USDT and USDC, which retain reserve interest for issuers, USDG’s model rewards infrastructure partners, not end users. The network aims to build a compliant, yield-sharing ecosystem, with DBS Bank as the initial banking partner for reserve custody and cash management. [2] [5]

USDG

Global Dollar (USDG) is a US dollar-pegged stablecoin issued by Paxos Digital Singapore Pte. Ltd. under Singapore's upcoming stablecoin regulatory framework. Designed for payments, settlements, and treasury functions, it is redeemable 1:1 for US dollars and backed by cash and cash equivalents held in segregated accounts. USDG also supports smart contract integration for blockchain-based applications. [1] [4]

Use Case

USDG offers various use cases, providing a flexible solution for different types of transactions. It can be used for seamless cross-border payments, offering faster and cheaper alternatives to traditional bank transfers, benefiting enterprises seeking to reduce transaction costs. Traders and investors can use USDG as a stable asset to avoid market volatility and maintain portfolio security. On decentralized finance (DeFi) platforms, USDG is available as an ERC-20 token, allowing users to stake, lend, borrow, or use it as collateral for smart contracts. Merchants can also accept USDG for payments, offering a low-fee alternative to credit card processing, while individuals can send remittances quickly and at a lower cost than traditional services. [6]

Backing

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)