Subscribe to wiki

Share wiki

Bookmark

Jupiter

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Jupiter

Jupiter is a decentralized exchange and liquidity aggregator on the Solana blockchain. It offers competitive trading prices, diverse trading options, and community governance through its native token, JUP. Meow is the founder of Jupiter. [1]

Overview

Jupiter, launched in 2022, is a decentralized exchange and liquidity aggregator. It consolidates liquidity from multiple DEXs and AMMs on Solana to offer competitive prices by linking these markets. In addition to token swaps, Jupiter supports "limit order" trading, decentralized perpetual and futures trading, and Dollar Cost Averaging (DCA) strategies. It also provides an in-house bridge for asset transfers between Solana and other blockchains. Initially focused on token swaps, Jupiter has expanded to include perpetual futures trading and plans to introduce its decentralized stablecoin to mitigate risks associated with centralized stablecoins. Governance is facilitated through its native token, JUP, which allows community voting on decisions such as liquidity plans and ecosystem projects that align with DeFi's decentralized principles. [2]

Features

Limit Order

Jupiter Limit Order simplifies placing limit orders on Solana, offering a broad selection of token pairs and utilizing available liquidity across the Solana ecosystem. Unlike traditional order book systems, it employs keepers to monitor on-chain token prices and execute orders when liquidity is present. Orders are executed based on specified price limits, with keepers continuously monitoring liquidity and fulfilling orders when market prices align. Users can set expiration times for orders, ensuring automatic cancellation of unfilled orders with refunds. This approach minimizes slippage and eliminates the risk of failed transactions during volatile periods. Jupiter Limit Order prioritizes user experience, simplicity, flexibility, and wide liquidity across Solana, with orders executed by keepers to ensure users receive their quoted prices minus platform fees. [3]

Jupiter DCA

Jupiter DCA provides a dollar-cost averaging solution, allowing users to automate the purchase or sale of SPL tokens at regular intervals over a set duration. Instead of risking buying near peaks with a lump sum, DCA spreads investments over time, smoothing overall costs and reducing potential losses while enhancing long-term profitability. This strategy is effective for gradually accumulating assets over time by dividing capital into smaller orders at fixed intervals, a process automated by Jupiter's DCA feature. [4]

Jupiter Bridge

Jupiter serves as a bridge aggregator, similar to its role as a DEX aggregator. It collects data from supported bridges and presents users with available routes, route details, and suggested routes based on current conditions for bridging transactions. Users select their preferred route and are redirected to the chosen bridge to complete their transactions. Supported bridging facilities include Mayan Finance and Debridge. Additionally, Jupiter supports Wormhole for asset bridging, utilizing its inter-network messaging protocol to enable communication between blockchain networks. Jupiter's Wormhole-powered bridge currently facilitates asset bridging between Ethereum and Solana blockchains. [5]

Perpetuals

Jupiter offers a decentralized perpetuals trading platform allowing users to take long or short positions with leverage up to 100x. Users can engage as traders or liquidity providers, with liquidity providers locking up assets in the perpetuals vault and earning from traders' usage of these funds. Currently, the perpetual vault supports five assets: WBTC, USDT, USDC, SOL, and ETH. Traders commit collateral and access funds from the vault based on their collateral and chosen leverage multiplier. The platform operates similarly to centralized derivatives trading platforms, with leverage funds provided by liquidity providers, ensuring zero price impact, slippage, and deep liquidity through LP pool liquidity and oracles, utilizing the Pyth network's oracle for price feeds. [5]

LFG Launchpad

On January 23, 2024, Meow announced the launch of LFG, a Solana project launchpad, via a post on X. LFG aims to assist new projects in entering the market, emphasizing community backing without incentives or price discovery systems. The Jupiter DAO will oversee the launchpad, approving projects through community votes. Approved projects will receive technological support from Jupiter, including customized launch pools, composable liquidity pools, and access to a network of bots. Jupiter's goal with LFG is to foster successful project launches while safeguarding buyers from hype, FOMO, and rug pulls. [5][6]

Ecosystem

Jupiter DAO

The Jupiter DAO is a key governing body within the Jupiter ecosystem, focused on fostering community engagement, executing initiatives, and setting strategic goals to enhance the platform's impact in the crypto world. With its structure, characterized by transparent governance, extensive liquidity, and a diverse token holder base, the DAO operates broadly, leveraging Jupiter's status as a decentralized trading platform. [7]

Beyond Jupiter, the DAO is committed to advancing growth within the decentralized ecosystem, supporting community-driven initiatives, and participating in ecosystem-wide decision-making processes. Equipped with a substantial budget, the DAO enables Jupiter to attract top talent and execute projects that contribute to the platform's long-term success. Through initiatives like Active Staking Rewards, the DAO incentivizes active participation, ensuring the sustainability and vitality of the Jupiter ecosystem. [7]

Jupiter Start

Jupiter Start is an initiative to promote awareness and traction for new projects while ensuring transparency and trust within the ecosystem. By striking a balance between highlighting promising projects and avoiding scams or biased endorsements, Jupiter Start seeks to enhance user experience and encourage safe, decentralized trading. The initiative, spanning a year, will involve community collaboration to vet and showcase new projects through five components: Community Intro, Educate, Pre-Listing, Launchpad (upcoming), and Atlas (upcoming). [8]

- Jupiter Community Introductions allow Jupiter community members to discover new projects and tokens within the Solana ecosystem. Each introduction spans about a week, during which the featured project shares details such as its concept, tokenomics, and ownership distribution on Jupiter's Discord forum. Community members engage in vetting, understanding, and discussing these projects. If the response is positive and no concerns arise, further promotion may include tweeting and featuring on Jupiter's homepage. Additionally, community members demonstrating expertise and thoughtful engagement over time can earn rewards and recognition. [8]

- Jupiter Educate is designed to provide qualified traders and users of Jupiter with insights into noteworthy projects within the Solana ecosystem. Featured projects and a dedicated section of Jupiter's website will be highlighted on social media. Qualified users and traders can earn points or tokens by engaging with educational materials and completing specified on-chain actions. This initiative aims to create a sustainable mechanism for informing users about promising new on-chain projects while fostering awareness and engagement for these projects. The selection process will be highly selective and tailored, with projects chosen based on clear community and ecosystem support as determined by community polls. [8]

- Jupiter Pre-Listing facilitates the safe trading of new tokens on the Jupiter platform, allowing users to access these tokens earlier in the token selector and set limit orders or perform Dollar Cost Averaging (DCA). Due to the initial thin liquidity of these new tokens, users will receive multiple UI reminders and prompts to ensure awareness. Projects must be well-known within the ecosystem to prevent scam tokens or undergo vetting in a designated Discord forum. Subjective factors like credibility will be considered, with tokens bearing misleading names or overlapping with a strict list not being approved. Iterative improvements will be made as needed. [8]

Jupiter Mobile

Jupiter Mobile is the mobile application of Jupiter Exchange, offering users the ability to trade Solana-based tokens directly from their smartphones. Initially released on iOS, with Android support forthcoming, the app features zero platform fees, integrated fiat on-ramps (including Apple Pay and credit card support), and streamlined one-tap swaps. It also includes Auto-Mode, which automatically manages slippage, priority fees, and transaction retries. Additional features include real-time DEX charts, token swaps across the Solana ecosystem, wallet functionality for major assets like SOL and USDC, and access to governance and staking through the broader Jupiter platform. [9]

JUP

Jupiter's native token, JUP, serves as a governance token, enabling community participation in platform decisions such as approving liquidity and emission plans, authorizing token mints post-genesis, and voting on ecosystem initiatives. A significant portion of JUP tokens is allocated for airdrops to active users, reflecting Jupiter's community-centric approach to token distribution. Holders of JUP tokens can influence the platform's development and operation by participating in decision-making processes related to functionality, updates, and other key aspects. [2]

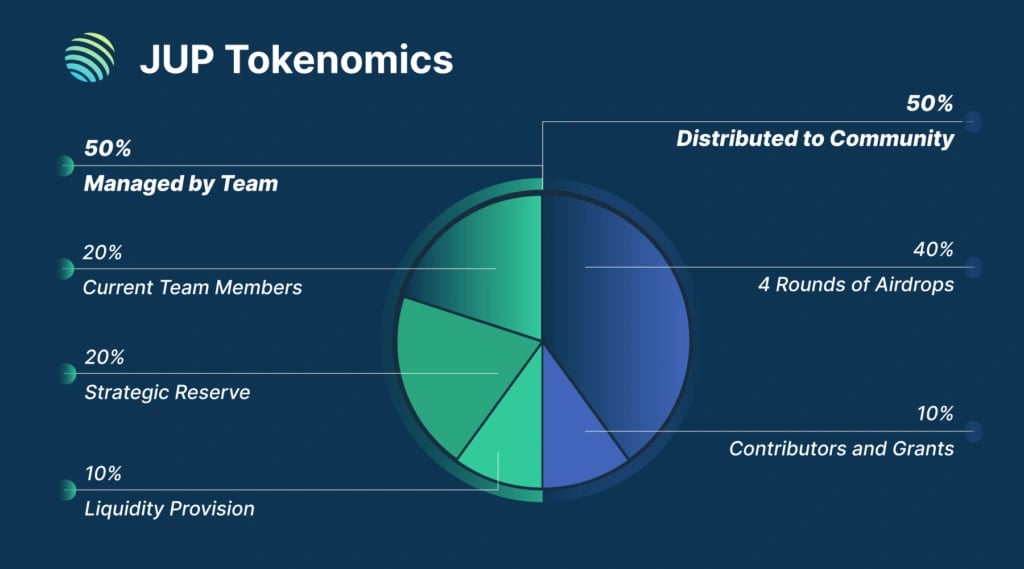

Tokenomics

The initial supply of JUP tokens totals 10 billion, with distribution structured to bolster the ecosystem and involve the community. 40% of the initial supply is designated for community airdrops, while another 40% is set aside for the team and strategic development. Initially earmarked for token sales, the remaining 20% has been redirected towards liquidity provision, community contributors, and grants. [2]

Partnerships

Some of Jupiter's partners include:

- Wormhole

- Marinade Finance

- Orca

- Bonkswap

- Helium Network

- Bonfida

- Hello Moon

- Samoyed

- Raydium

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)