Subscribe to wiki

Share wiki

Bookmark

Meta Pool

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Meta Pool

Meta Pool is a multi-chain, liquid-staking based ecosystem. It supports liquid staking tokens on Ethereum, NEAR, Solana, and Aurora. The ecosystem also features liquidity pools for anyone to become a liquidity provider, a launchpad for launching new projects with staking rewards, and a bond market for trading locked positions. [1]

Ecosystem

The Ecosystem DApp of Meta Pool streamlines authentication for staking and bond purchases, eliminating the need for repeated wallet connections. NEAR, Aurora, ETH, and mpDAO token holders can interact with each DApp without friction and engage with the NEAR, Aurora, and Ethereum protocols on the same platform. [2]

Multichain Liquid Staking

Meta Pool allows staking NEAR, AURORA, wNEAR, and ETH. [3]

Liquid staking eliminates the lockup period, allowing users to stake NEAR without locking their tokens and without the need to wait approximately 48-72 hours (4-6 epochs) to unstake them. Additionally, users receive stNEAR, which can be utilized in various DeFi protocols such as lending, borrowing, and providing liquidity. In Meta Pool, tokens are delegated to a list of high-performance validators. Users can retrieve their NEAR tokens instantly from the liquidity pool by paying a fee. [3]

The minimum amount required to stake on Meta Pool is 1 NEAR. Meta Pool automatically distributes stakes across over 80 validator nodes through its staking smart contract, so users do not need to select validators manually. Meta Pool does not maintain a whitelist of validator nodes, as the NEAR Foundation's process for new nodes effectively filters new service providers. However, Meta Pool considers several criteria when staking on new nodes, including uptime and performance, the percentage of NEAR rewards (yield), and the fee charged by the validator, prioritizing those with low fees. [3]

Users have two options for unstaking: liquid-unstaking or delayed-unstaking. Liquid-unstaking allows for immediate conversion of staked tokens to their original forms, with a liquidity fee ranging from 0.3% to 5%. Alternatively, delayed-unstaking incurs no fees but requires a waiting period: 2-4 days for $NEAR, up to 4 days for $AURORA, and up to 9 days for $ETH. In both cases, users need a small amount of NEAR tokens for NEAR blockchain transactions and a small amount of ETH tokens for transactions on the Aurora and Ethereum networks. [3]

Institutional Liquid Staking

Meta Pool connects blockchain protocols and traditional finance and fintech organizations to provide Liquid Staking services. It partners with custodial providers like Fireblocks, Qredo, and Finoa. Finoa operates as a certified crypto-asset custodian under §64y Para. 1 KWG and falls under the supervision of the German Federal Financial Supervisory Authority (BaFin). It provides customers with secure access to custody, staking, trading, and DeFi services. [2][4]

Crowdfunding Launchpad

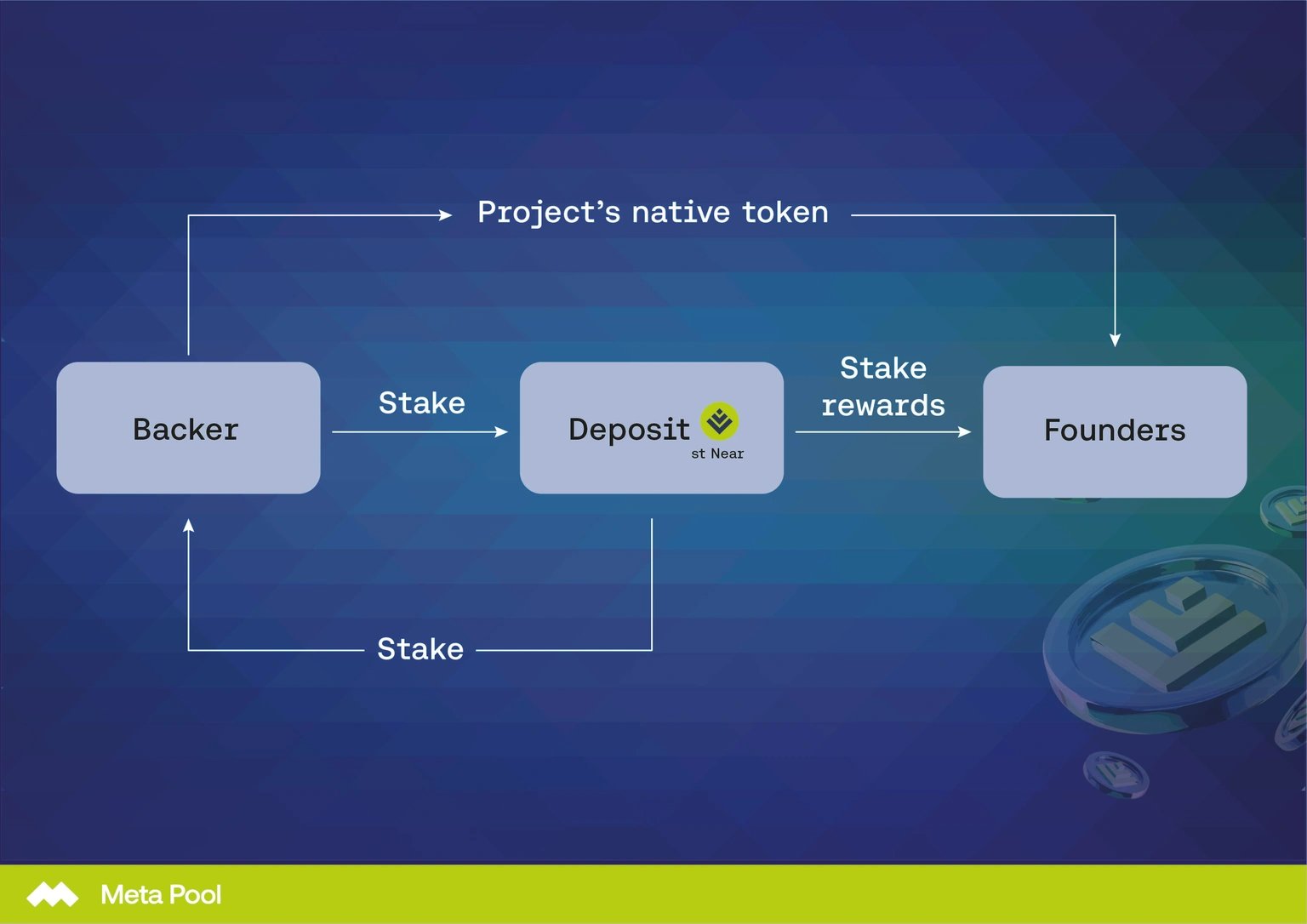

The Launchpad serves as a Web3 Crowdfunding platform for NEAR projects, utilizing lossless staking rewards to provide financial support and exposure to the NEAR community. The platform enables financial support for Web 3.0 projects on the NEAR protocol through liquid staking, using staking rewards exclusively. It offers a streamlined experience for backers and project stakeholders. [5]

The launchpad operates as it follows:

- Founders request a specific amount of $NEAR to fund their projects. Projects receive staking rewards, around 10% of the total amount backers commit.

- Users financially support projects through a lossless fundraising process based on NEAR staking rewards in the Web3 ecosystem. Backers receive tokens from new projects launched on NEAR or participate in an upcoming NFT drop.

- Backers lock their stNEAR tokens and allocate all their NEAR staking rewards to the project in exchange for the project's native tokens.

Users receive an IOU receipt for their $NEAR, allowing them to claim their assets once the project has earned all its rewards. Backers regain full access to their crypto assets at the end of the locking period, recovering 100% of their NEAR.

Bond Marketplace

Meta Bond Market is a platform that allows Launchpad investors to trade their investments and earnings in the form of bonds. The platform aims to provide a tool for acquiring and offering various types of bonds generated by supporting projects on Launchpad. [6]

Users invest in Meta Launchpad in early-stage projects. If these projects reach the first investment goal, supporters receive rewards in project tokens, gradually released for their locked investment. [6]

After the Fund Period ends, Meta Bonds generates two bonds for the supporter:

- The first bond is in NEAR tokens, corresponding to the stNEAR locked value at the Fund period's conclusion.

- The second bond equals the supported project's token amount, released gradually.

Supporters can choose to sell one or both bonds during the Lock Period. If not sold, bonds mature, and at the lock period's end, the investment is returned to the holder. [6]

Governance

The mpDAO token is the governance token enabling community management of the protocol. Token holders can participate in the voting processes for the mpDAO. Active voters receive compensation for their participation in governance. Each month, 65% of protocol fees are distributed to those with locked tokens and used voting power. Payments are proportional to the voting power used and are distributed on the third day of the following month. [7]

mpDAO Token

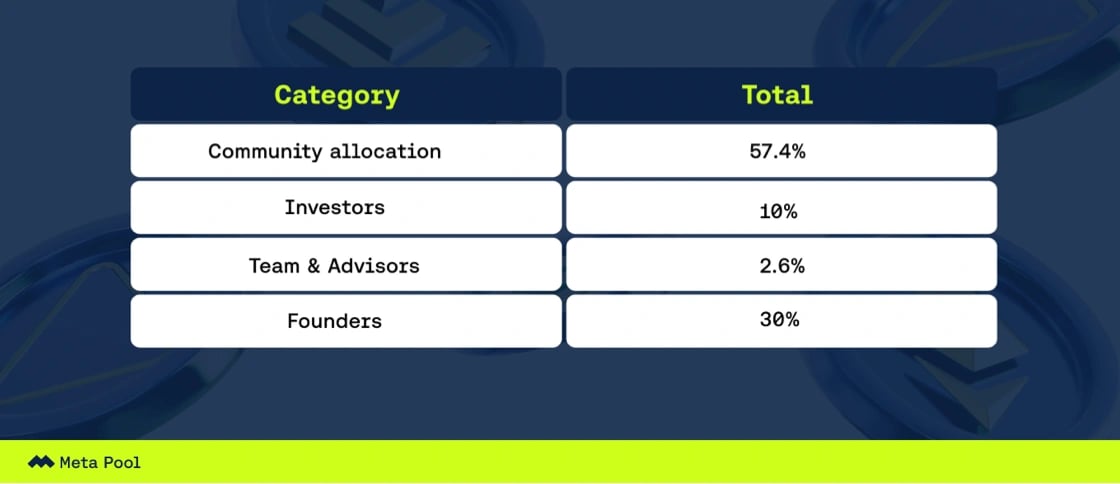

The mpDAO token is the governance token of Meta Pool, and it has a maximum supply of 1,000,000,000 tokens. It is available in two formats: NEP-141 on the NEAR Protocol and as a native ERC-20 token on the Ethereum network. The distribution of mpDAO is divided into four categories. [8]

The mpDAO token enables a governance system where token holders contribute to the development of a decentralized platform. Since its inception, Meta Pool has prioritized community involvement, shaping decisions accordingly. [8]

As builders, the team welcomes community members on this journey towards decentralization. The Meta Pool DAO will gradually assume greater responsibilities, including: [8]

- Adding and removing blockchain networks

- Updating smart contracts

- Adjusting fees across products

- Proposing projects and initiatives for support

- Enhancing token utility

Future plans involve sharing a detailed roadmap for the Meta Pool DAO and inviting active community members to join working groups, ensuring diverse perspectives guide the organization towards greater decentralization. [8]

Token Migration

In April 2024, Meta Pool announced the approval of Meta Pool Improvement Proposal 3, which entailed the re-launch of the governance token. This transition aligned with Meta Pool's vision of multichain governance, enabling users to control their assets and participate in shaping the protocol's future. [9]

The community completed several preparatory stages and entered the token migration phase, transitioning from the $META token to the $mpDAO token. The migration period was from April 15th to April 30th, 2024. [9]

During this time, users migrated their $META locked positions to the new mpDAO voting contract. Users with ongoing unlocking positions re-locked them to proceed with the migration. Even after migration, old locked META and votes remained valid until the end of April. All locking positions were preserved, ensuring that the mpDAO locking days in the new contract mirrored those in the old $META contract. [9]

Upon completing the migration, users received 1 locked $mpDAO token for every locked $META token. [9]

mpDAO

mpDAO (Meta Pool's Decentralized Autonomous Organization) is the core governance system of Meta Pool's ecosystem. It promotes transparency, inclusivity, and decentralization. Through mpDAO, the community participates in decision-making, proposal approvals, and resource allocation, shaping the development of Meta Pool's liquid staking and DeFi solutions. [10]

Partnerships

QiDAO

Meta Pool announced a strategic alliance with QiDAO, a leading decentralized finance protocol, to enhance the issuance of the MAI stablecoin using Meta Pool's liquid token, mpETH, as collateral. [11]

The partnership focuses on mpETH, which offers a 5% APY and accumulates staking rewards continuously, making it an ideal collateral option. The collaboration also reduces transaction costs through integration with Linea, a low-cost exchange platform. Meta Pool and QiDAO would work with Lynex to promote the mpETH<>MAI pool. [11]

Meta Pool users can receive variable monthly rewards, ranging from $3,000 to $4,000 USD, and can use mpETH as collateral to mint MAI, generating additional yield. [11]

The alliance supports the growth of Meta Pool DAO, improving the staking experience and strengthening the cryptocurrency ecosystem for a more inclusive digital economy. [11]

Linea

This partnership aims to provide an accessible liquid staking token for mass adoption on Linea. Drawing on past collaborations, such as with Aurora, the development team announced their plan to use a tested and audited contract to enable native staking on the Ethereum blockchain for wETH token holders on Linea, which eliminates the need for high gas fees. [12]

TENET

Through the partnership with TENET, mpETH holders can delegate their LST in a non-custodial way, either as validators or delegators to the TENET network. This allows them to earn staking rewards from the Ethereum network, along with additional block rewards and transaction fees from the Diversified Proof of Stake protocol. [13]

TENET proposes a cross-chain collaboration to enhance blockchain security, where Meta Pool DAO can contribute mpETH to secure their protocol. Once mpETH is delegated, holders can mint tmpETH, usable as collateral to borrow LSDC, TENET's native stablecoin, supported by a modified version of Liquity adapted for multiple collaterals. [13]

Ref Finance

The partnership with Ref Finance was announced to launch the first stNEAR pool on their AMM platform. Meta Pool, recognized as NEAR's initial liquid staking provider, introduced an stNEAR-wNEAR pair on Ref Finance. Through this collaboration, more than 2100 stNEAR holders utilizing the liquid staking platform have the option to engage with the Ref protocol, thereby earning REF rewards by supplying liquidity to the stNEAR-wNEAR pool. [14]

The Meta Pool Liquid Staking solution enables NEAR users to access staking rewards from the NEAR protocol while retaining stNEAR in their wallet for use. Moreover, Ref Finance is accepting stNEAR to pair with wNEAR in a newly incentivized liquidity pool, providing liquidity providers with the opportunity to utilize their stNEAR tokens to earn REF tokens. [14]

Funding

Meta Pool secured its seed round funding with the support of key backers. After a successful Community Launch, they engaged with long-term NEAR token holders. According to a Messari report, NEAR is among the top digital assets held by venture capital firms. [15]

This led to interactions with institutional investors, supported by Proximity Labs and advisors. Meta Pool welcomes Dragonfly Capital, A&T Capital, Move Capital, Blockwall, D1 Ventures, and Sky Vision Capital as new partners. These institutions would help develop a leading liquid staking solution on the NEAR Protocol and support the DeFi ecosystem, providing guidance to enhance the value of the NEAR Ecosystem. [15]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)