Subscribe to wiki

Share wiki

Bookmark

OpenSky Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

OpenSky Finance

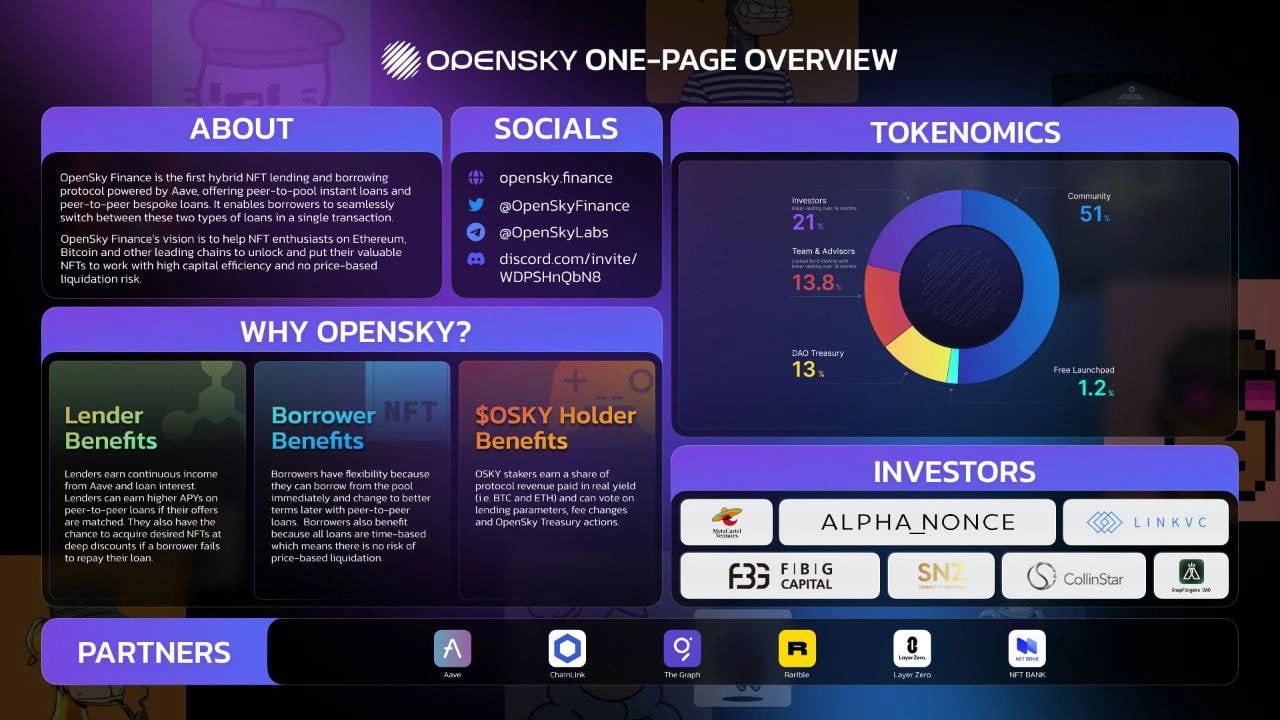

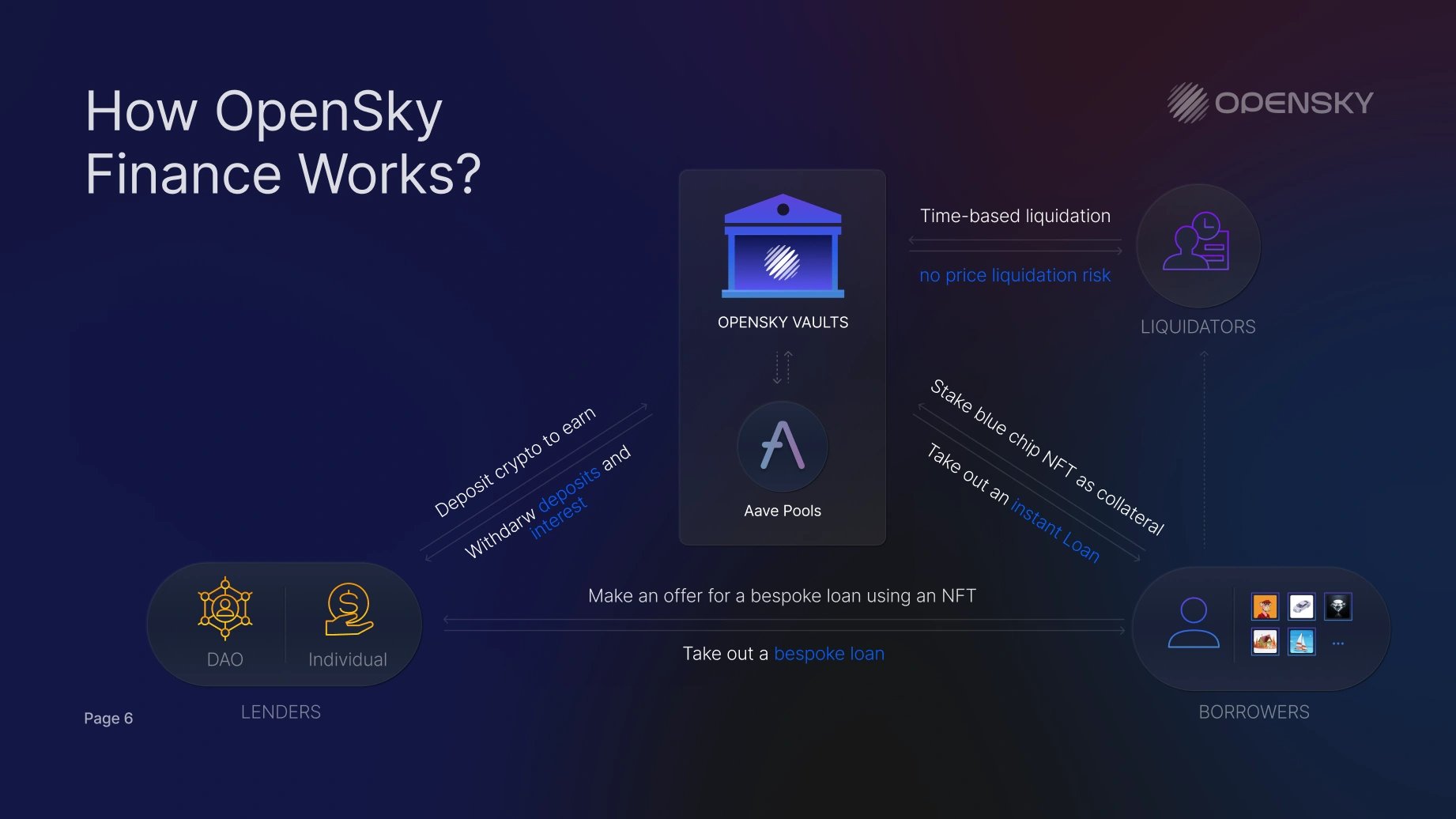

OpenSky Finance is a decentralized peer-to-pool NFT lending protocol where crypto lenders can earn safe passive income and NFT HODLers can borrow instantly using their NFTs as collateral. It is an omnichain NFT lending protocol powered by Aave, offering peer-to-pool instant loans and peer-to-peer bespoke loans.[1][3]

On January 23rd, $OSKY was officially listed on Gate.io, and simultaneously, the OSKY/USDT trading pair became available.[7]

Overview

launched in 2022, openSky Finance is an omnichain NFT lending protocol powered by Aave. It offers peer-to-pool instant loans and peer-to-peer bespoke loans, allowing borrowers to switch seamlessly between these two types of loans without needing a bridge loan.[1]

The vision of OpenSky Finance is to assist NFT enthusiasts on Ethereum, Bitcoin, and other major chains in unlocking and putting their valuable NFTs to work with high capital efficiency and no liquidation risk based on price. OpenSky has a discrete time-based liquidation (DTBL) mechanism that significantly enhances the borrower user experience while reducing the risk of bad debt. This is achieved through the discrete nature of the loans being made across time, meaning that only some loans may face liquidation at any given point in time.[2][3]

OpenSky Finance considers itself as the first NFT lending protocol to integrate both peer-to-pool and peer-to-peer lending functions. This integration allows lenders to utilize their Instant EARN pool deposit tokens (tokens) to make or accept peer-to-peer (Bespoke) loan offers. Even if no Bespoke loans are made, lenders will continue to earn continuously from the Instant EARN pool.[2]

How OpenSky Work?

Peer-to-pool (instant loans)

Lenders can deposit their ETH or USDC into an OpenSky EARN vault and immediately begin earning AAVE deposit income and interest from Instant loans. They have the flexibility to withdraw their deposits at any time, and no specialized NFT knowledge is needed to earn safe and capital-efficient passive income.

Borrowers, on the other hand, can stake their whitelisted collection NFTs, such as BAYC, and instantly borrow a percentage of the floor price. These loans have fixed interest rates and due dates, allowing borrowers to repay them early without incurring penalties. OpenSky is also one NFT lending protocol to provide peer-to-pool loans without any liquidation risk based on the NFT floor price. Borrowers can only face liquidation if they fail to modify or repay their loan by the expiry of the grace period, initially set to 48 hours subject to DAO vote, at the end of the predetermined loan term.[4]

Peer-to-peer loans (Bespoke loans)

Bespoke loans give Borrowers the option to propose a loan for an NFT that isn't included in the Instant loan whitelist or for a high-value NFT like Alien Punk, which is part of a whitelisted collection such as CryptoPunks. Initially, only specific NFT collections will be eligible for Bespoke loans, with plans to open this up to DAO voting in the future.

Lenders have the autonomy to choose the desired borrowing amount, term, and APR. They can review the available Bespoke loan offers and utilize their Aave pool deposits to accept offers in the order they are received. This approach is highly efficient in terms of capital utilization because the pool deposits continue to accrue earnings until a Bespoke offer is accepted. Additionally, when a Bespoke loan is repaid, the funds are returned to the Aave pool, and lenders resume receiving Instant loan income seamlessly, without interruption.[4]

Benefits of OpenSky Finance

1. Lender Benefits

Lenders benefit from continuous income streams through Aave and loan interest. By participating in peer-to-peer lending, lenders have the opportunity to earn higher APYs if their loan offers are successfully matched. Moreover, if a borrower defaults on their loan, lenders may have the opportunity to acquire desired NFTs at significant discounts.

2. Borrower Benefits

Borrowers enjoy flexibility with OpenSky Finance, as they can quickly access funds from the pool and later switch to more favorable terms through peer-to-peer loans. Additionally, borrowers benefit from the time-based nature of all loans, eliminating the risk of liquidation based on asset prices.

3. $OSKY Holder Benefits

$OSKY stakers earn a share of protocol revenue paid in real yield (i.e. BTC and ETH) and can vote on lending parameters, fee changes, and OpenSky Treasury actions.

$OSKY

$OSKY serves as the governance token for the OpenSky Protocol, with a total supply of 100,000,000 tokens. OpenSkyDAO comprises $OSKY holders and delegators who collectively oversee the OpenSky Protocol. The governance mechanism employs a weighted voting system, where the voting power is determined by the quantity of $OSKY tokens held.[5][8]

$OSKY Use Cases

- Deployment and ownership of OpenSky smart contracts

- Vote on protocol parameters, such as interest fee changes and NFT whitelist inclusion and deletion

- Staking and Yield Farming

- Govern the DAO Treasury.

$OSKY Token Allocation and Distribution

- Free Launchpad: 1.2%; (Distributed at TGE)

- Team & Advisors: 13.8% (Locked for 6 months with linear vesting over 18 months)

- Investors: 21% (Locked for 3 months with linear vesting over 18 months)

- Community: 51% (Tokens will be allocated based on DAO governance votes with a preference for low token inflation. Tokens will be used for Airdrops, Staking, Farming, Business Development, KOLs, Referrals, etc.)

- DAO Treasury: 9% (Locked for 6 months with linear vesting over 48 months)

- Initial Liquidity: 4%.[6]

Technology

OpenSky currently leverages Aave, a decentralized, non-custodial liquidity protocol that allows users to participate as depositors and borrowers without requiring permission or trust. Depositors provide liquidity to the market and earn passive income, while borrowers can access funds either in an overcollateralized (perpetually) or undercollateralized (one-block liquidity or flash loan) manner.

By integrating with Aave, OpenSky enables lenders to earn attractive AAVE interest income and NFT loan interest from borrowers, contributing significantly to Aave's total value locked (TVL) and introducing NFT enthusiasts to Aave's renowned lending decentralized application (dApp).[9]

Partners

OpenSky Partners Include:

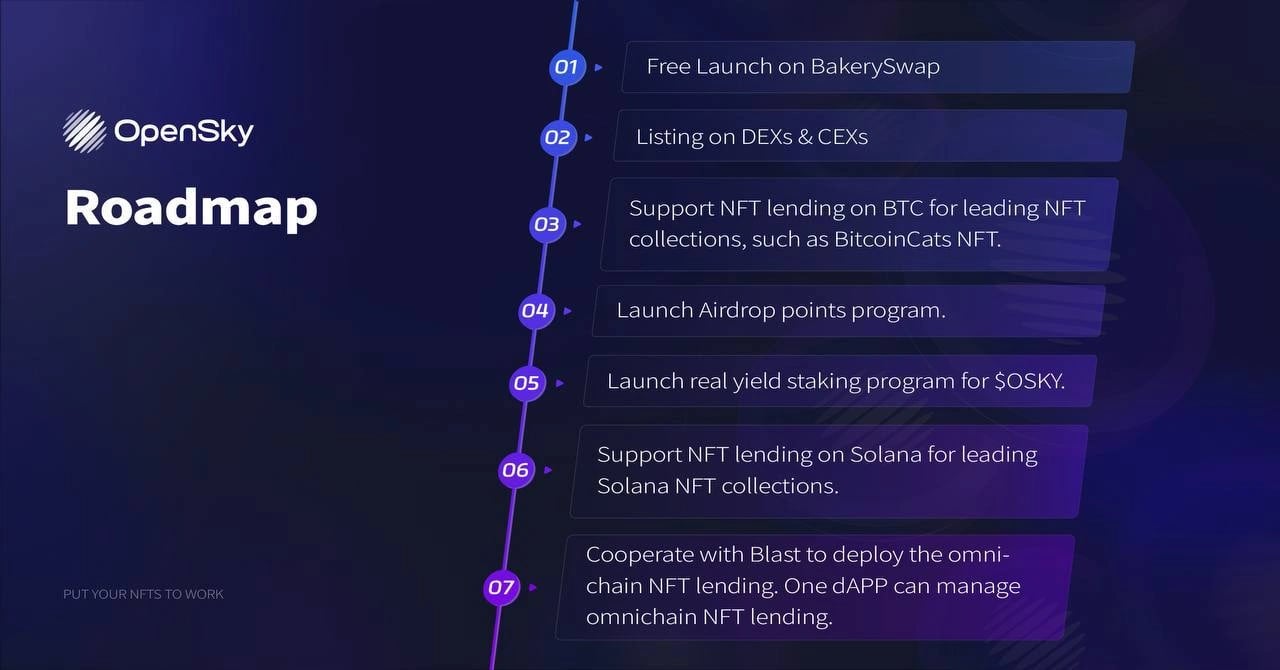

Roadmap

- Free Launch on BakerySwap

- Listing on DEXs & CEXs with the support of a professional market-making firm

- Support NFT lending on BTC for leading NFT collections, such as BitcoinCats NFT.

- Launch the Airdrop Points program. Lenders and borrowers can farm $OSKY and other partner tokens (e.g. $1CAT), and the treasury will earn BTC and ETH.

- Launch real yield staking program for $OSKY. $OSKY stakers can share BTC and ETH protocol revenue.

- Support NFT lending on Solana for leading Solana NFT collections.

- Cooperate with Blast to deploy our omnichain NFT lending to the Blast chain with low gas fees. One dAPP can manage omnichain NFT lending.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)