Subscribe to wiki

Share wiki

Bookmark

Pump and Dump

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Pump and Dump

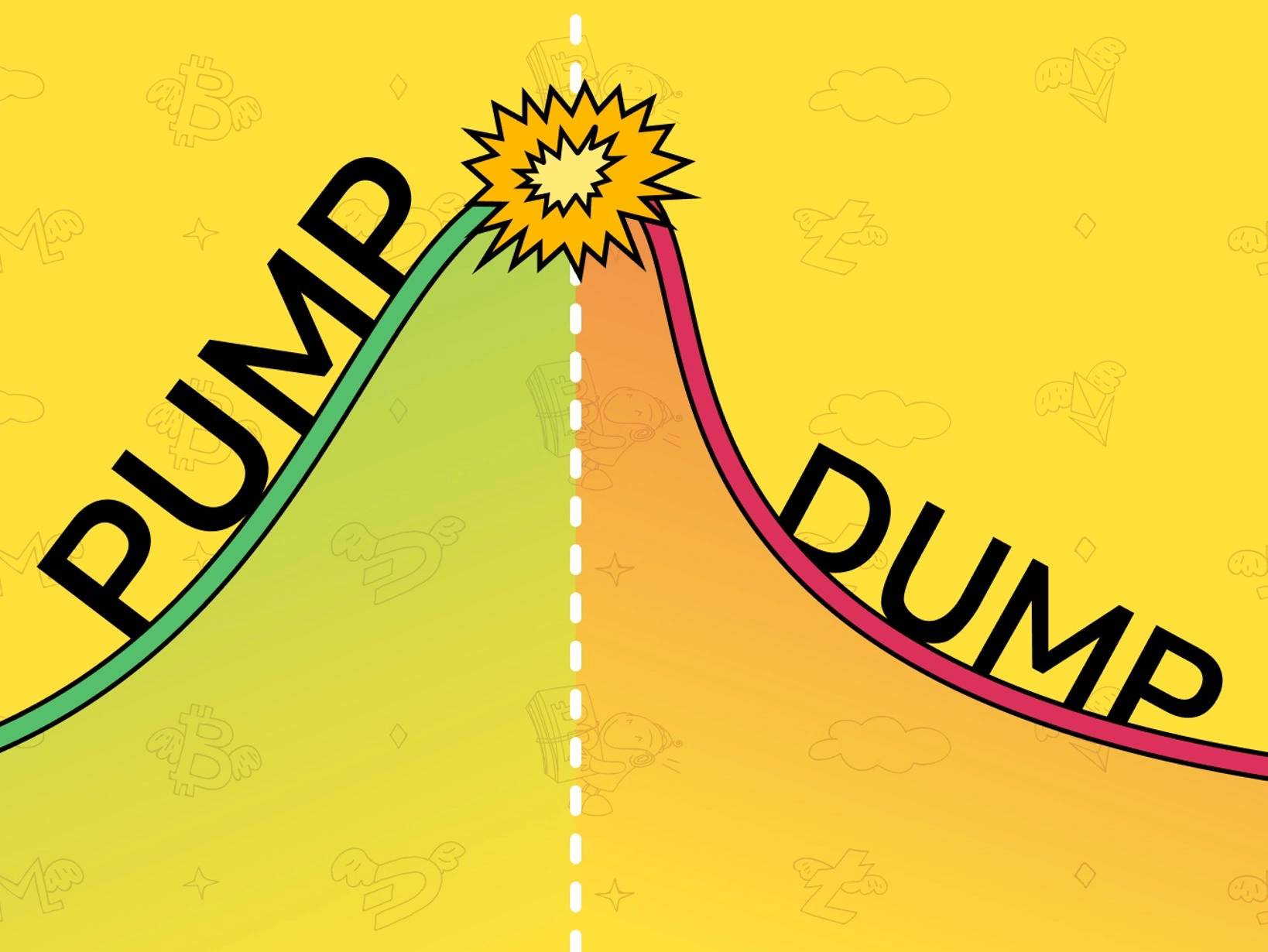

A Pump and Dump (P&D) is a manipulative scheme where individuals or groups artificially inflate the price of a cryptocurrency through coordinated buying and promotion, only to sell off their holdings at the inflated price, leaving other investors with losses.[2]

Phases

Accumulation Phase

In this phase, the attackers select an asset with low trading volume and price. They start accumulating a significant amount of the asset at a relatively low cost.[3]

Pump Phase

Once the swindlers have accumulated a substantial position in the chosen asset, they begin to spread false or exaggerated information about the asset's potential. This information is spread through various channels, including social media, online forums, etc. As more and more investors buy-in, the demand for the asset increases, causing its price to rise rapidly.

As news of the asset's apparent success spreads, more investors flock to join the action, driven by the Fear of Missing Out (FOMO). The increased buying pressure perpetuates price inflation, creating a self-fulfilling prophecy where demand fuels demand.[3][2]

Dump Phase

When the asset's price has been artificially inflated to a desirable level, the attackers start selling off their holdings. This sudden surge of selling activity overwhelms the buying demand, leading to a sharp decline in the asset's price. Other investors who bought in during the pump phase are left with assets that have significantly decreased in value.

[1]

P&D Prevention

This scheme is prevalent across all highly liquid assets, including cryptocurrencies and NFTs. In order to deter such activities, regulatory bodies and cryptocurrency exchanges adopt measures like, monitoring abnormal trading patterns, promoting awareness and education about the assets people are trading, implementing trading halts on suspicious assets, and suspending accounts linked to fraudulent activities to detect and prevent market manipulation.[6]

Biggest P&Ds and their Legal Cases

In various instances, the Commodity Futures Trading Commission (CFTC) and the SEC have taken action against individuals and entities involved in manipulative trading practices, which can include P&D schemes in the cryptocurrency market. These actions typically result in fines and legal penalties.[11]

Centra Tech (CTR)

- In 2017, Centra Tech conducted an Initial Coin Offering (ICO) for its CTR tokens, claiming to offer a debit card backed by Visa and Mastercard.

- The founder & CEO, Sam Sharma and co-defendants, Robert Farkas and Raymond Trapani, duped victims into committing more than $25 million to develop that debit card. They created fake executives, fake business partnerships and fake licenses.

- The promotional content they displayed on its website was fictitious, and the price of its token, CTR was artificially inflated in order to attract investment. This was part of a ‘pump and dump’ scheme

- SEC filed an action against celebrities, Floyd Mayweather and DJ Khaled, for promoting Centra Tech’s ICO and its ‘Centra Card’.

- The SEC filed charges against Centra Tech for fraud, and the founders settled the charges by paying fines and agreeing not to promote securities for a certain period.

SafeMoon

- In 2021, SafeMoon founder and CEO Braden John Karony, and the SafeMoon execs marketed the token while failing to disclose their control over both the company and a significant amount of SafeMoon digital assets available for public trading.

- Upon SafeMoon’s launch, company execs actively recruited and retained celebrities such as Paul, Carter, Soulja Boy, Lil Yachty and Phillips to promote the asset, primarily through Twitter, Reddit and YouTube, the case relays. In exchange for their support, the celebrity defendants received SafeMoon tokens as compensation.

- The trading volume for SafeMoon tokens shot up a staggering 875 percent within nine days of starting the defendants’ celebrity-driven marketing. Over the next 10 days, however, the SafeMoon token trading volume began to die down, dropping from $43.9 million on April 5 to an interim low of $8.9 million on April 15.

- Meanwhile, investors who bought SafeMoon tokens since March 8, 2021 have suffered economic harm and losing investments, due to the successful 'misleading promotions' that the defendants used as their 'pump and dump' strategy. The lawsuit looks to represent and compensate all individuals who bought SafeMoon tokens, and were victims of the alleged rug pull attempt.

- Karony promised future success by advising that SafeMoon would be creating its own wallet in April 2021. But, never did the wallet launched, instead, SafeMoon hit the rock bottom by December 2021, while company execs and celebrity promoters slowly sold off their own holdings amid inflated trading volume.

- The bulk of the lawsuit was filed in California’s Central District Court on February 17, accounting the SafeMoon token’s release and social media-driven rise to its decline.

McAfee Legal Cases

- John McAfee, the controversial cybersecurity pioneer and his associates raked in a combined $13 million, which relied on using McAfee’s Twitter account to push niche cryptocurrencies or promote initial coin offerings without disclosing that he stood to profit, either through investment gains or promotional fees.

- McAfee and his associates used Twitter to promote seven initial coin offerings, a fundraising mechanism for new cryptocurrencies. It was said that, McAfee and his team members were paid a combined $11 million in Ethereum and Bitcoin, along with a chunk of altcoins, to plug those ICOs on Twitter.

- In mid-December 2017, he directed an associate to buy around $5,000 worth of tokens in XVG, also known as Verge. That same day on Twitter, McAfee described XVG, Monero and Zcash as a coin that “cannot lose.” Two days later, when a Twitter user suggested McAfee had pumped XVG, artificially inflating its value in order to sell high, McAfee responded with a simple “I own no XVG."

- The ICO indictment echoes charges with security fraud, that the SEC brought against McAfee in October 2020.

BitConnect

- In 2017, BitConnect (BCC) has a market capitalization of $3.4 billion. However, the prices soon collapsed within a few months causing massive losses to investors. According to the Department of Justice (DOJ), a San Diego-based federal grand jury specifically charged Kumbhani for orchestrating the alleged Ponzi scheme via BitConnect’s 'Lending Program', which is to generate substantial profits and guaranteed returns.

- The founder BitConnect, Satish Kumbhani, has been charged for allegedly misleading investors globally and defrauding them of $2.4 billion in the process.

- The indictment also alleges that Kumbhani evaded U.S. regulations by failing to register with the Financial Crimes Enforcement Network (FinCEN), as required under the Bank Secrecy Act.

- Kumbhani is charged with conspiracy to commit wire fraud, commodity price manipulation, operation of an unlicensed money transmitting business and conspiracy to commit international money laundering.

Laws in Different Countries

Authorities that work to prevent pump-and-dump schemes and other market manipulations are typically financial regulatory agencies. The exact name of the authority varies by country. Here are some of the regulatory authorities from various countries that monitor and take action against pump-and-dump schemes:

United States

- Securities and Exchange Commission (SEC):

Pump and dump schemes involving securities or tokens deemed as securities are subject to federal securities laws. The SEC takes a strict stance against fraudulent activities, including P&D schemes, and can bring civil enforcement actions against individuals and entities involved in such schemes.

- Commodity Futures Trading Commission (CFTC):

If the scheme involves commodities or derivatives, the CFTC may also become involved and bring enforcement actions.

Canada

- Canadian Securities Administrators (CSA):

Canada has provincial and territorial securities regulators that are members of the CSA. P&D schemes that involve securities fall under their jurisdiction. CSA members have the authority to take legal action against individuals or entities involved in fraudulent activities.

United Kingdom

- Financial Conduct Authority (FCA):

The FCA is the regulatory body overseeing financial markets in the UK. It has the authority to investigate and take legal action against those involved in fraudulent schemes, including P&D activities in the cryptocurrency space.

European Union

- European Securities and Markets Authority (ESMA):

ESMA coordinates the regulation of financial markets within the EU. Member states have their own regulatory bodies, and actions against P&D schemes may vary, but EU-wide regulations and directives may apply to protect investors.

Australia

- Australian Securities and Investments Commission (ASIC):

ASIC is Australia's financial regulatory agency. It has the authority to investigate and take legal action against individuals or entities involved in fraudulent activities related to securities and financial products.

Japan

- Financial Services Agency (FSA):

Japan's FSA regulates financial markets, including cryptocurrency exchanges. P&D schemes involving cryptocurrencies may be subject to penalties under Japanese law.

South Korea

- Financial Services Commission (FSC):

South Korea's FSC oversees financial markets, including cryptocurrency exchanges. The FSC has the authority to investigate and take legal action against fraudulent activities, including P&D schemes.

China

- People's Bank of China (PBOC):

China has taken a strict stance against cryptocurrencies and has implemented measures to prevent P&D schemes and other fraudulent activities. Cryptocurrency trading and ICOs have been banned in China.

Government Actions

Governments and regulatory authorities take various actions to combat P&D schemes in the financial markets, including cryptocurrency markets. These actions are designed to protect investors, maintain market integrity, and uphold the rule of law.

Here are some common actions taken by governments and regulators in response to P&D schemes:[10]

Civil and Criminal Enforcement

Governments may initiate civil or criminal enforcement actions against individuals and entities involved in P&D schemes. These actions can result in fines, penalties, and even imprisonment for those found guilty of fraudulent activities.

Asset Freezing

In cases where P&D perpetrators have profited from their schemes, governments may seek court orders to freeze their assets. This is done to prevent the individuals or entities from dissipating their ill-gotten gains.

Regulatory Warnings and Alerts

Regulatory bodies often issue public warnings and alerts to inform investors about known or suspected P&D schemes. These warnings aim to educate the public and deter participation in fraudulent activities.

Collaboration with International Authorities

P&D schemes can be international in scope, involving perpetrators and victims across borders. Governments may collaborate with foreign regulatory agencies and law enforcement organizations to investigate and prosecute offenders.

Enhanced Regulatory Frameworks

In response to emerging threats like P&D schemes in the cryptocurrency space, governments may enact or amend regulations to provide greater oversight of digital assets and related activities. This can include requirements for registration, reporting, and compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations.

Educational Initiatives

Regulatory authorities often engage in educational efforts to raise awareness about the risks associated with P&D schemes and provide guidance on how to avoid falling victim to them.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)