Subscribe to wiki

Share wiki

Bookmark

PYTH (Token)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

PYTH (Token)

PYTH is the governance token of the Pyth Network, a decentralized oracle that disseminates real-time financial market data across various blockchains. It launched in November 2023 alongside an airdrop aimed at rewarding early contributors and community participants. [1]

Overview

The Pyth Network uses a governance system defined by a formal constitution and on-chain mechanisms. PYTH is the network’s governance token, used solely for participating in on-chain voting on community proposals. To vote, tokens must be locked through the network’s staking program. The total maximum supply is 10 billion PYTH tokens. [9]

History

The PYTH token was launched on November 20, 2023, with an initial market capitalization of $468 million, following a community-focused airdrop. Designed as a governance token, PYTH allows holders to vote on proposals and influence the development of the Pyth Network. The airdrop, the "Pyth Network Retrospective Airdrop," was announced on November 1, 2023, to reward contributors and early supporters. A follow-up snapshot on November 15 expanded eligibility by adding 55 million tokens. The claim period opened on November 20 and closed on February 18, 2024. Eligibility included users who interacted with Pyth-integrated apps, held official Pyth NFTs, or held community roles in the Pyth Discord. At the time of the airdrop, the network had secured $1.5 billion in total value across 120 protocols, ranking as the fourth-largest oracle by TVS. [3][4][5]

Staking

Governance

PYTH token holders can vote on governance proposals by staking their tokens, with each staked token representing one vote under a 1:1 voting system. A holder must have at least 0.25% of the total staked PYTH supply to submit a proposal. Proposals are approved after a 7-day vote if they receive more yes than no votes and meet the required approval quorum—a defined percentage of staked tokens voting in favor. This quorum varies by proposal type and is outlined in the DAO’s governance parameters. The range of governance topics may expand if determined by the DAO or token holders. [9]

Oracle Integrity

Pyth Network's Oracle Integrity Staking (OIS) promotes high-quality data by aligning publisher incentives with data accuracy. Publishers can stake PYTH tokens as collateral and receive delegated stakes from others. If they provide inaccurate or inconsistent data, a portion of their stake may be slashed as a penalty. This system encourages accuracy through financial risk and reputation, as reliable publishers are more likely to gain trust and support. [9] [10]

Funding

In December 2023, the Pyth Data Association conducted a fundraising round, with contributions from industry entities such as Castle Island Ventures, Multicoin Capital, and Wintermute Ventures. The Pyth Data Association allocated PYTH tokens to the fundraising contributors, empowering them to potentially influence the platform's development. The fundraising round aimed to expand the Pyth community and enhance the network through increased access to capital, governance participation, protocol improvements, and strategic guidance. [8]

Token Distribution

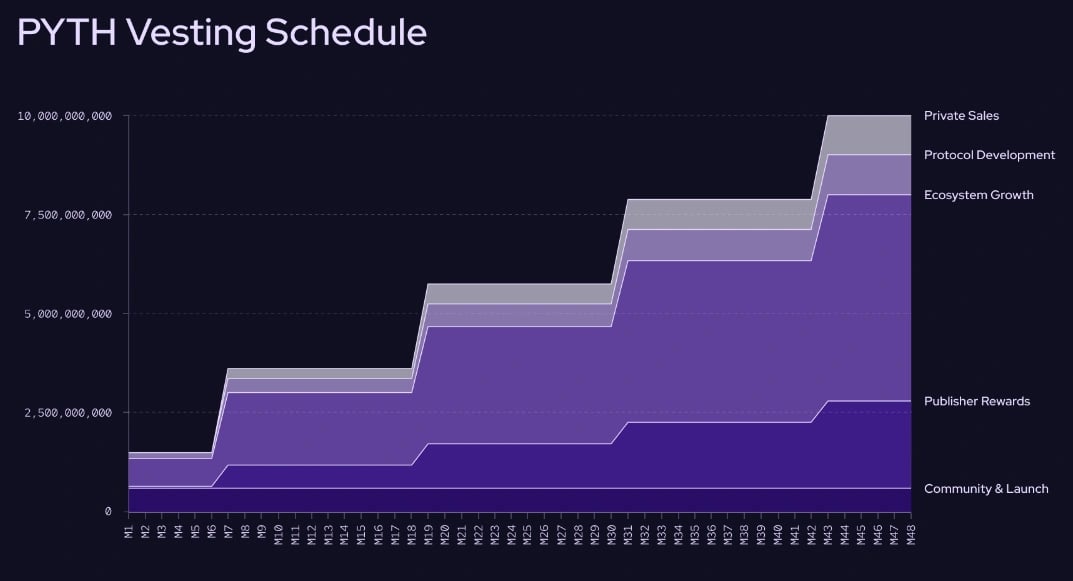

The PYTH token has a total token supply of 10,000,000,000 (10B) PYTH Tokens, and the distribution is structured to align with the strategic goals of the Pyth Network, fostering growth, supporting development, and rewarding contributions to the ecosystem. [7]

Initial Circulation and Lockup Schedule

The initial circulating supply comprised 1,500,000,000 (15%) PYTH Tokens. The remaining 85% was subject to a lockup schedule, with unlock periods occurring at 6, 18, 30, and 42 months following the initial token launch. [7]

PYTH Lockup Schedule

Ecosystem Growth (52% — 5,200,000,000 PYTH)

The "Ecosystem Growth" allocation, which made up 52% of the total PYTH token supply, was designated for contributors such as developers, educators, researchers, strategic partners, and early publishers. It supported research initiatives, developer incentives, and public education efforts. At launch, 3% (700 million) of the 5.2 billion PYTH tokens were unlocked, with the remaining 4.5 billion set to unlock according to a predefined schedule. [7]

Publisher Rewards (22% — 2,200,000,000 PYTH)

PYTH tokens were allocated for data providers, or "publishers," to incentivize delivering accurate and timely price data. Approximately 2% (50 million) of the 2.2 billion tokens were unlocked, while the remaining 2.15 billion followed a lockup schedule. Rewards were distributed to publishers as tokens were unlocked. [7]

Protocol Development (10% — 1,000,000,000 PYTH)

This allocation was designated for contributors developing oracle tooling, products, and infrastructure to support the Pyth Network's decentralized data services. At the time, 15% (150 million) of the 1 billion PYTH tokens were unlocked, with the remaining 850 million set to unlock according to a defined schedule. [7]

Private Sales (10% — 1,000,000,000 PYTH)

This allocation represented historical funding rounds and was designated for strategic contributors offering advisory and infrastructure support. The full 1 billion PYTH tokens in this category remained subject to the previously outlined unlock schedule. [7]

Community and Launch (6% — 600,000,000 PYTH)

This allocation was reserved for the initial launch phase and related activities, including distributions to DeFi participants, protocols, DAOs, and other launch initiatives. All 600 million PYTH tokens in this category were unlocked at launch. [7]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)