Subscribe to wiki

Share wiki

Bookmark

Ribbon Finance

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Ribbon Finance

Ribbon Finance is a set of DeFi protocols designed to facilitate users' access to crypto-structured products. Through integrating derivatives, lending mechanisms, and an in-house on-chain options exchange called Aevo, Ribbon provides a comprehensive solution for individuals seeking to improve the risk-return profile of their portfolios. The company's co-founder and CEO is Julian Koh. [1]

Overview

Ribbon Finance is a decentralized finance (DeFi) protocol providing structured crypto products and investment tactics. Its DeFi offerings utilize one-click deposit "vaults" to automate intricate investment strategies and offer users insights into portfolio breakdowns based on current market conditions. Unlike early DeFi projects like Curve and Bancor, Ribbon's community vaults focus on sustainable yield generation rather than speculative token incentives. They achieve this by facilitating automated investments in derivative options, using funds contributed by users. [2]

Ribbon Finance also offers vault products emphasizing lower risk and consistent rewards through traditional finance strategies such as derivatives and covered call investments. This approach simplifies participation in robust yield strategies devised and vetted by financial experts while mitigating potential issues associated with newer DeFi products. By employing derivatives like options, Ribbon Finance aims to reduce user risk and allow smart contracts to manage the rest. [2]

Structured Products

Structured products are pre-packaged investments that typically involve assets combined with one or more derivatives. They are often linked to an index or basket of securities and are tailored to meet specific risk-return goals. Instead of traditional payment features like periodic coupons and final principal, these products utilize non-traditional payoffs derived from the performance of underlying assets rather than the issuer's cash flow. [3]

Aevo

Launched in April 2023, Aevo is a decentralized exchange (DEX) characterized by its high performance and order-book functionality, tailored to professional options traders' needs. It offers a comprehensive margining system, including portfolio margin, and supports a wide range of tradable instruments, including options with various expiration periods. Operating on a custom Ethereum Virtual Machine (EVM) rollup designed for scalability, Aevo ensures efficient operations while maintaining security through integration with the Ethereum blockchain. [4][5]

Technology

Ribbon Theta Vaults

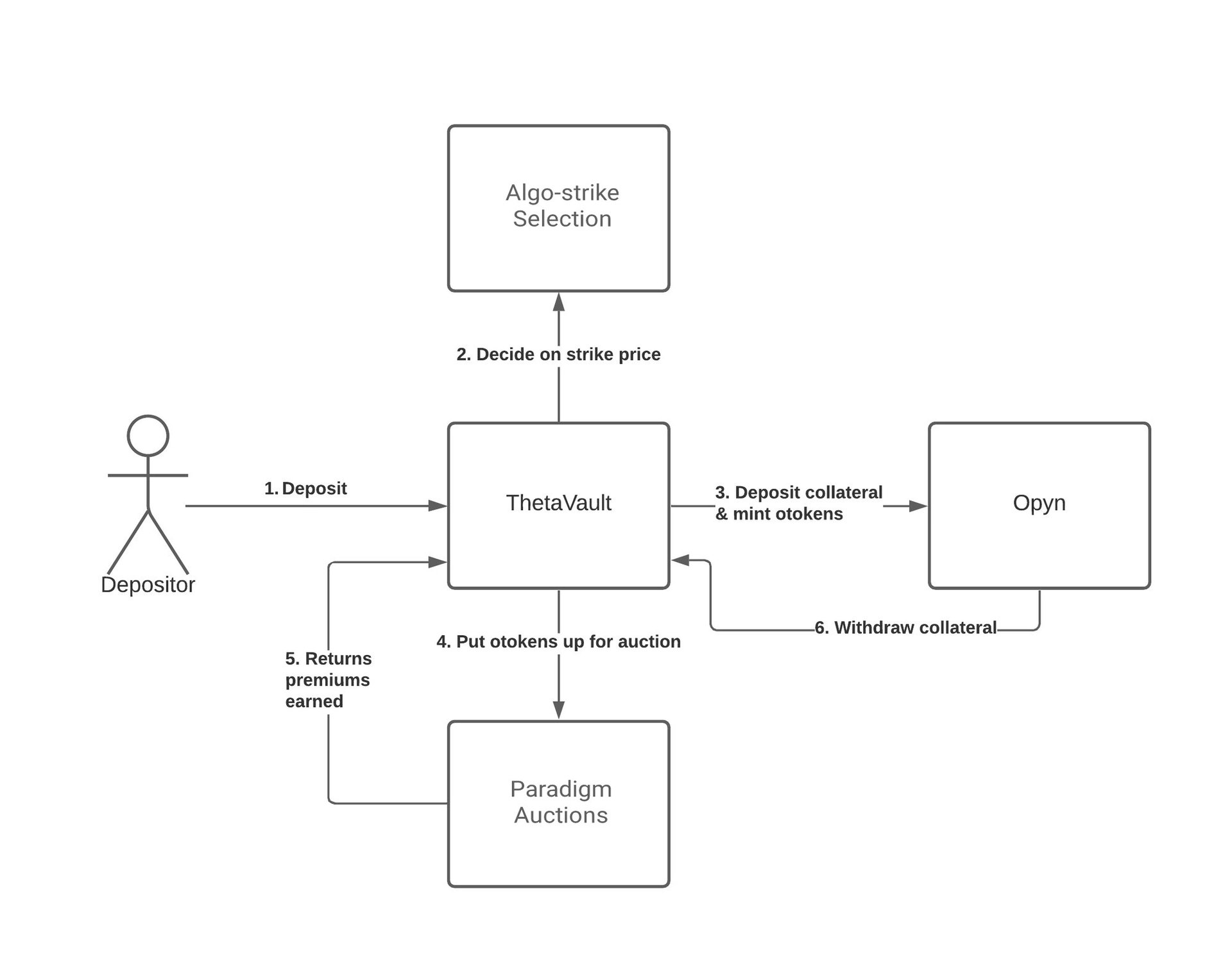

Theta Vaults employ an automated European options selling approach, generating weekly yield by writing out-of-the-money options and collecting premiums. The term "Vaults" signifies depositing assets and earning yield on them. With Theta Vaults, users can deposit their assets, and the vaults will automatically execute a specific option strategy. This approach mitigates gas issues by spreading the gas costs across all vault depositors, resulting in a streamlined and cost-effective user experience. Additionally, Theta Vaults offers a pause and resume feature, allowing users to choose when to participate in the weekly strategy based on their market expectations, thereby providing flexibility in usage options. [6]

There are two vault types: covered call selling and put selling.

- Covered call selling is a financial transaction where an investor who sells call options on a particular asset also holds an equal amount of the underlying security. In this strategy, the investor, who already possesses a long position in the asset, sells call options on that asset to generate additional income. The investor's existing long position serves as collateral (or "cover"), ensuring they can deliver the shares if the call option buyer decides to exercise it. [7]

- Put selling is a contractual arrangement offering the buyer the choice, but not the obligation, to sell or short sell a specified quantity of an underlying security at a predetermined price within a defined timeframe, known as the strike price. These options are traded across various assets like stocks, currencies, bonds, commodities, futures, and indexes. In contrast, a call option grants the holder the right to buy the underlying security at a predetermined price either on or before the option contract's expiration date. [8]

Options

Theta Vaults rely on Opyn oTokens in their current configuration. These oTokens, representing options contracts as ERC-20 tokens, are characterized by specific strike prices and expiry dates. Holding oTokens grants the holder the right to redeem a portion of the underlying asset if the strike price is met. To execute an options-writing strategy, the Vault must be able to mint and short oTokens. It achieves this by leveraging users' deposited funds to collateralize Opyn, enabling the minting of oTokens sold for a premium. The collateral remains locked until the oToken's expiry, serving as a reserve to cover potential payouts to oToken holders if the options expire profitably. [9]

Opyn options, being cash settled, do not involve the physical transfer of the underlying asset if they expire in the money (ITM). In such cases, the difference between the strike price and the market price at expiry is offset by liquidating a portion of the deposits. Additionally, Opyn options automatically self-exercise at expiry if they are ITM, further contributing to the operational dynamics of Theta Vaults. [9]

Ribbon Earn

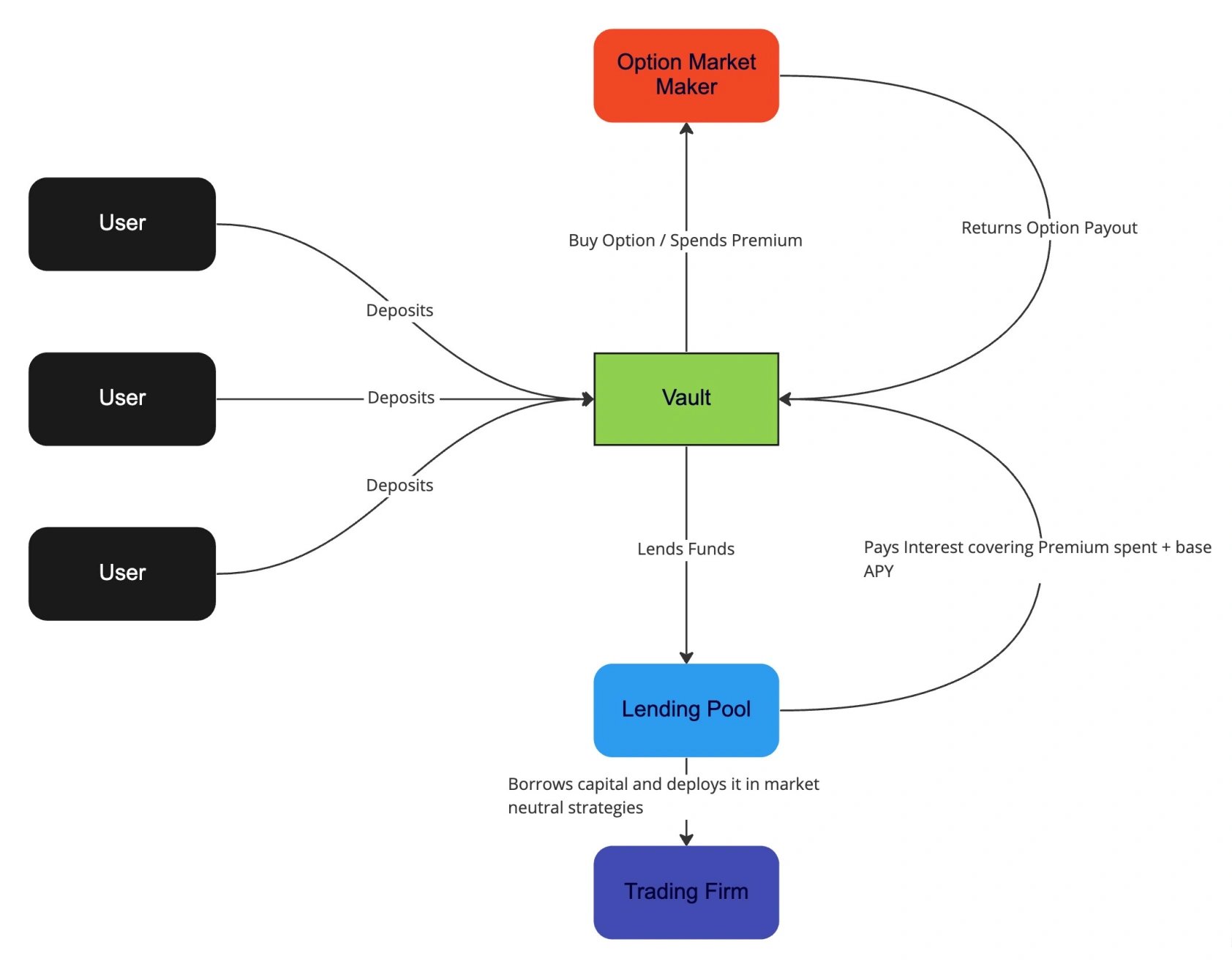

Ribbon Earn is Ribbon Finance's first structured product. It is a new category of yield vaults with risk characteristics that complement Theta vaults. This product provides consistent yields across varying market conditions while prioritizing principal protection. Leveraging a blend of lending mechanisms and other options, Ribbon Earn aims to boost yields by capitalizing on short-term market volatility. It employs fully funded strategies that enable depositors to benefit from intra-week movements in Ethereum (ETH) prices while safeguarding their invested capital. [10]

Ribbon Lend

Ribbon Lend is a decentralized finance (DeFi) platform focusing on unsecured institutional loans. Users can deposit their capital into single-borrower, insured pools facilitated by Ribbon Lend. Preapproved institutional borrowers like Folkvang and Wintermute establish and launch these pools. Lenders can earn attractive risk-adjusted interest rates by providing liquidity, while whitelisted institutional borrowers can access decentralized funding without requiring collateral. [11]

Ribbon Lend merges elements from traditional finance (TradFi) and DeFi, offering unsecured lending yields and flexibility in depositing funds into preferred pools based on individual risk/return preferences. There are no lockups, as users can withdraw funds at any time, limited only by the utilization rate of the pool. The platform incorporates off-chain enforcement, credit underwriting, and built-in insurance for added security. [11]

All loans originating from Ribbon's structured products, including Ribbon Earn and newly introduced vaults, are directed into Ribbon Lend pools. This integration allows Ribbon to utilize its structured products as a reliable and substantial source of lending deposits within the credit facility. Additionally, it enables structured products to be redeemed weekly or block-by-block, attracting more Total Value Locked (TVL) to the platform. [11]

Ribbon Treasury

Ribbon Treasury introduces specialized private Ribbon Theta vaults designed for DAOs to execute covered calls on their native tokens. These private vaults operate independently from the central Ribbon vaults and implement customized strategies tailored to each DAO's preferences. Each vault has several configured parameters: [12]

- Strike Selection Methodology: DAOs have the flexibility to determine the aggressiveness of the strike selection methodology according to their preferences.

- Tenor: DAOs can decide on the frequency of strategy execution. While the current Ribbon Vaults operate on a weekly strategy with automatic re-rolling, DAOs can opt for longer tenors.

- Premium Currency: DAOs can choose the currency they wish to receive premiums. For instance, DAOs may receive premiums in USDC or ETH based on their treasury diversification objectives.

RBN Token

On May 25th, 2021, Ribbon Finance introduced the RBN token, a governance token with several primary use cases: stewarding the development of the protocol and gathering community feedback on crucial parameters like fee models; aligning incentives among Ribbon stakeholders, including product creators, users, and the team, through initiatives such as liquidity mining programs or grants; and unifying all existing and forthcoming Ribbon products under a single umbrella. [13]

Tokenomics

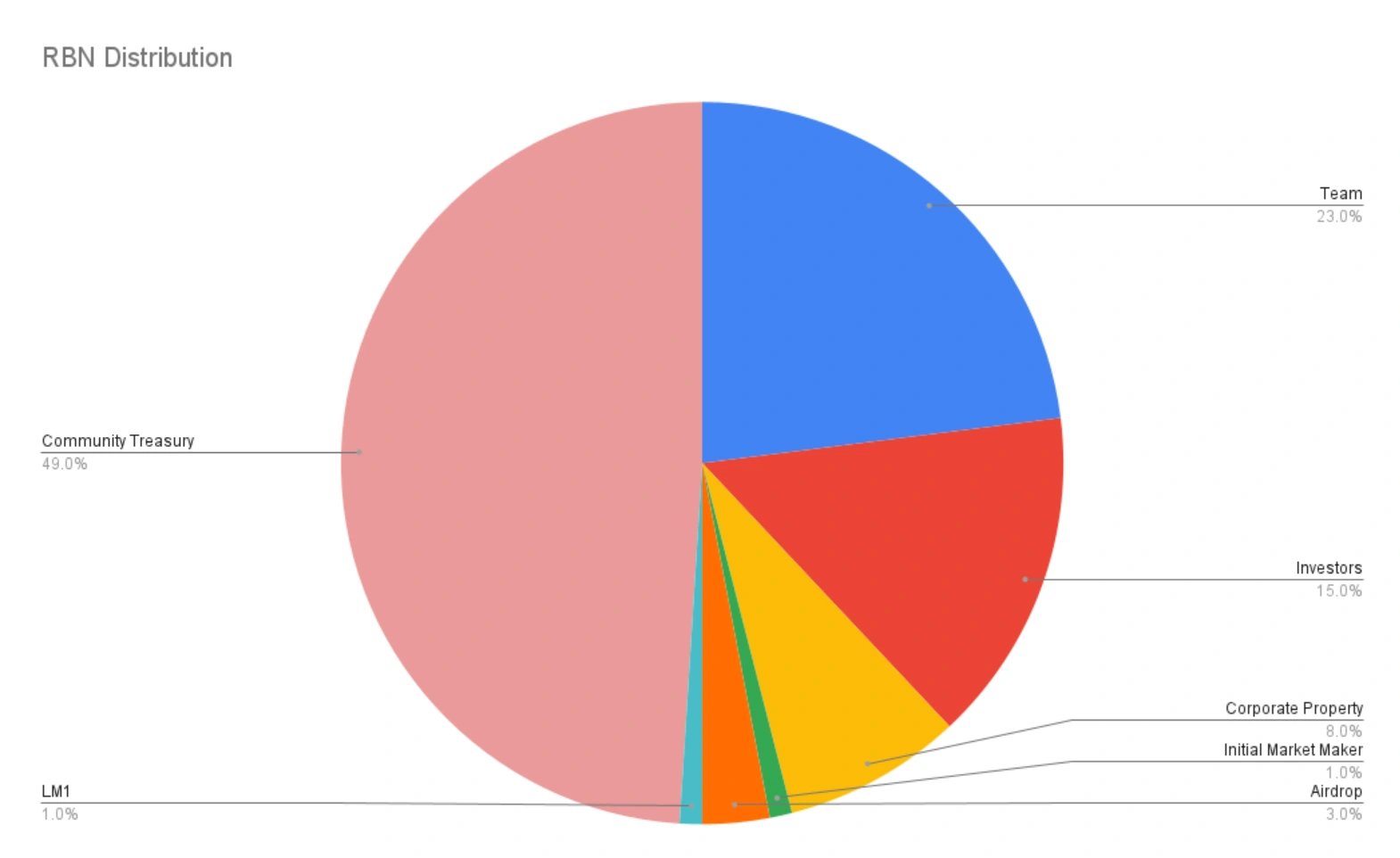

- 49% to Community Treasury: The RBN Governance dedicated this allocation to the Community Treasury. It served as a resource for incentivizing liquidity mining programs, offering grants to developers, and implementing initiatives to enhance the protocol. Twenty percent of this supply was immediately available, while the remaining portion vested linearly over three years, starting from May 24th, 2021.

- 23% to Current and Future Team: The team allocated these tokens to current team members and future team additions. The entire allocation followed a three-year vesting schedule, with a one-year cliff, from May 24th, 2021.

- 15% to Current Investors: Ribbon investors from two private funding rounds supported the project's development and were designated this portion. The entire allocation adhered to a three-year vesting schedule, which began on May 24th, 2021, with a one-year cliff.

- 8% to Corporate Property: The company responsible for developing the Ribbon protocol allocated these tokens. They earmarked them for advisors, future fundraising efforts, and prospective employees, all subject to a similar vesting schedule based on agreement execution dates.

- 3% to Retroactive Airdrop Recipients: On May 25th, 2021, Ribbon Finance designated this allocation for the RBN Retroactive Airdrop 71 recipients. The tokens in this category were not subject to locking.

- 1% to Liquidity Mining Participants: On June 16th, 2021, the first Liquidity Mining program, part of RGP-219, allocated tokens to participants. The program did not subject the tokens in this allocation to any locking.

- 1% to Initial Market Makers: The initial market-making firms that provided services from the first week of the Theta Vaults operations received an allocation in this portion. The entire allocation followed a one-year vesting schedule starting May 24th, 2021.

veRBN

To participate in Ribbon DAO governance, users must hold either vote-escrowed RBN (veRBN) or regular RBN. veRBN, a non-standard ERC-20 implementation, is utilized within the Governor Bravo voting system to determine the voting power of each account. Locking RBN is the only way to obtain veRBN, as it cannot be transferred like regular RBN. The maximum lock period for RBN is two years, and locking one RBN for this duration yields an initial balance of one veRBN. [15]

The veRBN balance of a user gradually decreases as the remaining time until the RBN unlock diminishes. For instance, a balance of 4000 RBN locked for six months yields the same amount of veRBN as 2000 RBN locked for one year or 1000 RBN locked for two years. [15]

Partnerships

Zeta Markets

On February 17th, 2022, Ribbon announced its launch on Solana in partnership with Zeta Markets, a leading options project on the Solana blockchain. This move represented the first transition of an Ethereum-first project to Solana, offering an application and interface that accommodated both Ethereum Virtual Machine (EVM) contracts and native Solana programs. Using a newly introduced network switcher interface, Ribbon users gained the flexibility to switch between EVM and non-EVM networks. Additionally, the updated interface supported EVM-based wallets like Metamask or Wallet Connect and Solana-based wallets such as Phantom and Solflare. [18]

Perpetual Protocol

When Ribbon Finance launched Ribbon Treasury, a product line tailored for DAOs/treasuries to generate income from their native tokens, Perpetual Protocol, an on-chain perpetual futures DEX, was the first launch partner. Ribbon Treasury offers strategies to suit the specific needs of each treasury. For example, the team collaborated with Perpetual Protocol to tailor parameters like monthly expiries, 25% OTM strike selection, and premiums paid in USDC. [16]

Paradigm

Ribbon Finance partnered with Paradigm as their first DOV integration to enhance the auction process. This collaboration revamped the flow by leveraging Paradigm's liquidity network for crypto options. Paradigm and Ribbon Finance shared the objective of achieving efficient auction settlement to serve the growing vaults better. This improvement in the auction flow led to more competitive pricing during vault execution, resulting in better user yields. The new auction flow was launched on May 13th, 2022, starting with the T-WBTC-C vault and subsequently introduced to other vaults in a phased approach. [17]

“We are delighted to bring Paradigm’s experience, expertise and network to deliver CeFi grade options liquidity to Ribbon’s vaults while maintaining the DeFi values the ecosystem has come to love” - Anand Gomes, Paradigm CEO.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)