Subscribe to wiki

Share wiki

Bookmark

Sperax (USDs)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Sperax (USDs)

Sperax is a DeFi ecosystem focused on simplifying decentralized finance for users. Its products, including the Sperax USD stablecoin and the Demeter protocol, offer accessible yield-generating opportunities without the typical complexities of DeFi. The platform incorporates automation and security to help users optimize returns while reducing risks, with governance handled through its native token, SPA. [1]

Overview

Sperax is a decentralized finance (DeFi) platform that simplifies user access to yield generation and liquidity management. It offers a suite of products, including the USDs stablecoin, which provides auto-yield without requiring user actions like staking, and the Demeter protocol allows DAOs to launch and manage decentralized exchange liquidity easily. Sperax utilizes a governance system driven by its native token, SPA, enabling the community to influence protocol decisions and parameters. The platform aims to balance automation, security, and scalability in its DeFi offerings. [2]

Products

Sperax USD (USDs)

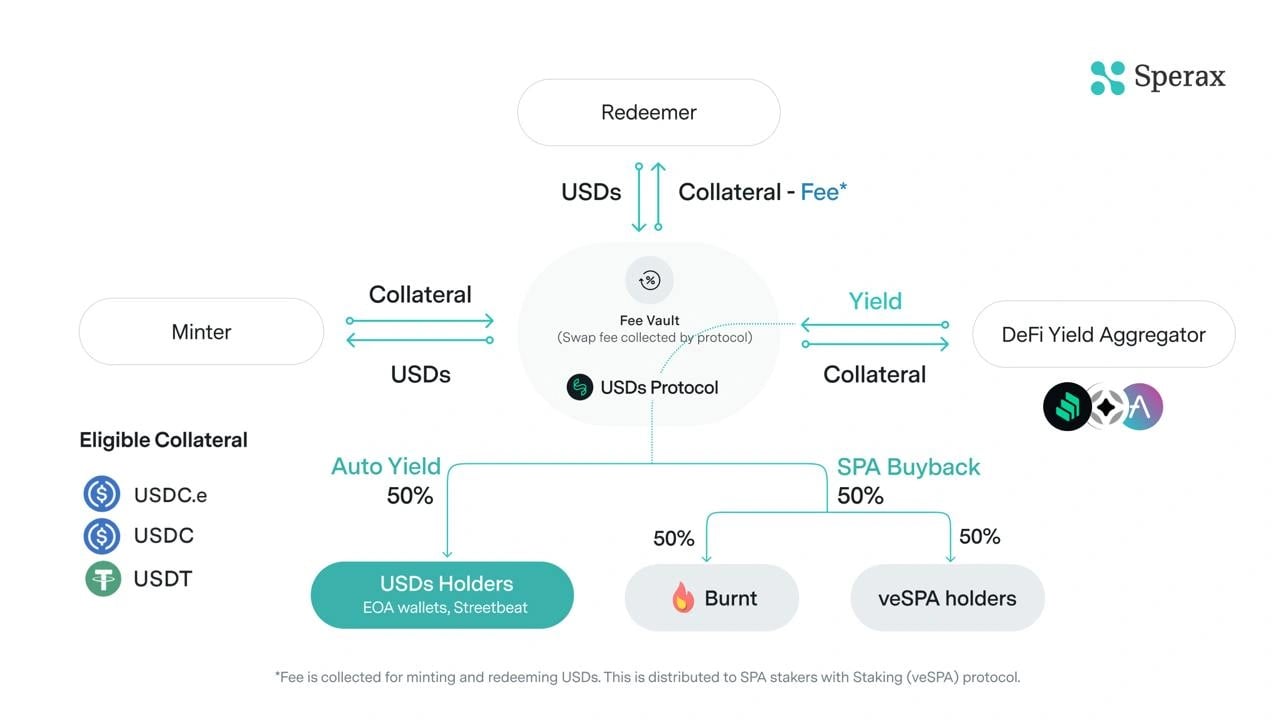

Sperax USD (USDs) is a stablecoin on the Arbitrum network that generates auto-yield without requiring user actions like staking or claiming rewards. The goal is to enable USDs across major blockchain platforms through interoperability. Users holding USDs automatically earn yield; no gas fees are needed to claim it. The stablecoin operates on Arbitrum for lower transaction costs and is fully backed by a basket of whitelisted crypto assets. USDs combines a 100% backed model with scalability benefits, unlike centralized stablecoins or algorithmic models. Its yield is generated from collateral sent to decentralized finance protocols, with 50% of this yield going to USDs holders. [2]

Minting USDs requires eligible collateral, such as USDC or USDT. Collateral is pooled and used to mint USDs, which remains fully collateralized or over-collateralized. Sperax DAO governs mint fees and yield distribution, and yields are paid approximately every seven days in USDs. [2][3]

Demeter Protocol

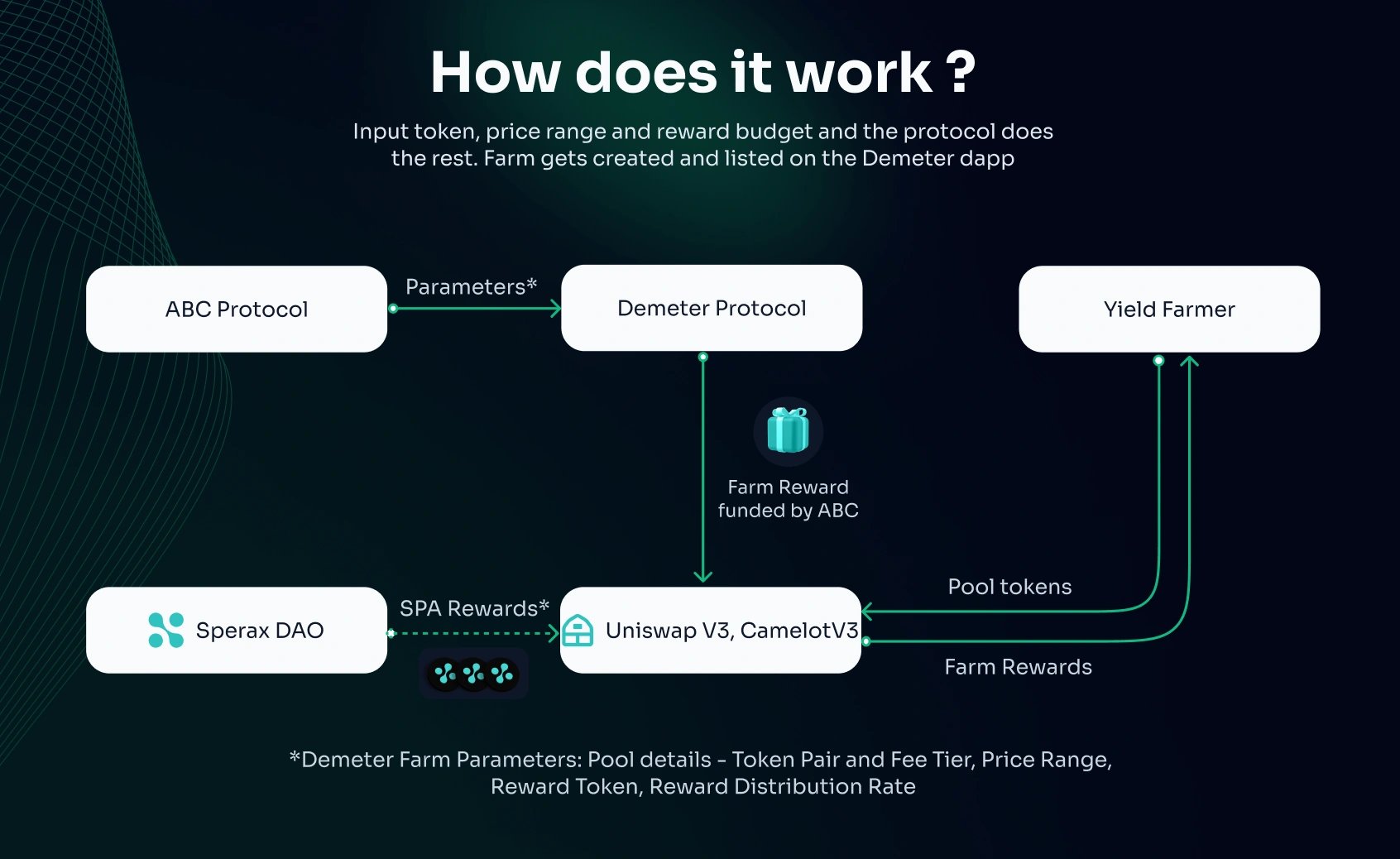

Demeter Protocol operates on various decentralized exchanges, including Uniswap and Camelot, and allows DAOs to launch and manage decentralized exchange liquidity without coding knowledge. It enables DAOs to create incentivized liquidity pools, currently on Uniswap V3 and Camelot V2, with plans to expand to other platforms and blockchains like Optimism, Polygon, and Ethereum. [4][5][6]

Demeter automates launching and managing liquidity for a DAO's native token, providing technical support through its audited contract system. It also offers marketing support by listing active farms on a dashboard that attracts users. By leveraging concentrated liquidity on Uniswap V3, DAOs benefit from reduced slippage and lower emissions budgets. Demeter simplifies the process for DAOs to launch liquidity pools without complex contracts and provides rewards in both SPA and Camelot tokens to reduce token spending and pressure. [5][6]

In Demeter Protocol V2, the focus shifted to a multichain approach, discontinuing incentives for pairing with SPA and USDs due to their limited availability across chains. [5][6]

SPA

SPA is the governance and value accrual token of the Sperax ecosystem. SPA holders can stake their tokens on Arbitrum or Ethereum to receive veSPA, which grants decision-making power. veSPA tokens are non-transferable, and their balance is proportional to the lockup period—longer lockups result in more veSPA, which determines the share of staking rewards and voting power. [2][7]

Staking rewards are distributed weekly based on the veSPA balance. Rewards come from 25% of the yield generated by the USDs protocol and 100% of fees from USDs mints and redemptions. Yield and fee income, originally in USDs, is swapped for SPA before distribution, simplifying the reward process and maintaining buying pressure on SPA. [2][7]

Once on-chain governance is live, voting power will depend on the veSPA balance, with longer lockups granting more votes. veSPA balances decay over time, reducing rewards and voting power unless users extend the lockup period, stake more SPA, or re-stake rewards. [2][7]

Tokenomics

SPA has a max supply of 5B tokens and has the following distribution: [8][9]

- Foundation: 25.02%

- Treasury: 25%

- Private Sale: 15%

- Liquidity: 10%

- Staking Rewards: 10%

- Team/Advisors: 9.98%

- Others: 5%

xSPA

xSPA is a reward token in the Sperax ecosystem that can either be staked for veSPA with a minimum lockup of 180 days or redeemed for SPA within 15 to 180 days, providing 50% to 100% of SPA upon redemption. In early 2023, Sperax DAO determined SPA emissions through Gauge, with 2.9 million SPA emitted weekly and 383,000 SPA used as bribes for veSPA voters. However, since the SPA Gauge started, USDs total supply has decreased while SPA emissions have increased the circulating supply. [10]

To address this issue, the strategy for SPA emissions needs to shift toward driving USDs growth and adoption. The aim is to ensure emissions are reinvested in the ecosystem, increasing veSPA staking and SPA burning. The core team proposes introducing xSPA as a new reward token that can be either staked as veSPA or redeemed for SPA, encouraging more governance participation and supporting ecosystem growth. Technically, xSPA can be redeemed for SPA through a redemption contract or staked to increase the user's veSPA balance. [10]

Sperax DAO

The Sperax DAO governance process primarily operates through the Sperax DAO Governance Forum. Currently, governance is off-chain, with an on-chain governance protocol planned for the future. Through this system, the community can propose changes to USDs protocol parameters, establish new partnerships, and explore new yield opportunities. [11]

Partnerships

- Polychain Capital

- AMBER

- JumpTrading

- Outlier Ventures

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)