Subscribe to wiki

Share wiki

Bookmark

Tezos (XTZ)

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Tezos (XTZ)

XTZ is the native cryptocurrency of the Tezos blockchain. It was created in 2014 by Arthur and Kathleen Breitman. It pays transaction and smart contract execution fees in the Tezos ecosystem. [1]

Overview

XTZ is the native cryptocurrency of Tezos, a decentralized, proof-of-stake blockchain designed to support smart contracts, decentralized applications (dApps), and tokenized assets such as NFTs. The network features a self-amending governance system, where protocol upgrades are proposed, voted on, and implemented on-chain without requiring hard forks. This approach allows the platform to evolve securely and transparently over time, with community members actively participating in its development and decision-making processes. [4] [5]

Funding

The Tezos Initial Coin Offering (ICO) is considered one of the largest ICOs in history, having raised $232 million in 2018. [2]

At the end of its crowd sale, Tezos had raised 65,627 BTC and 361,122 ETH. The ICO, which started on July 1 and coincided with the passage of 2,000 transaction blocks on the Bitcoin network, did not have a cap on the total amount of tokens sold. This fundraising surpassed the previous record set by Bancor, a platform for launching new blockchain tokens, which raised $150 million in mid-June 2017. [3]

Tokenomics

The total supply of XTZ is unlimited. Inflationary rewards are issued to stakers. Assuming that not all XTZ is staked at any given time, stakers and delegators can expect their annualized rewards to exceed the issuance of new XTZ. Those who hold XTZ but choose not to stake or delegate their tokens will experience dilution over time due to new token issuance.

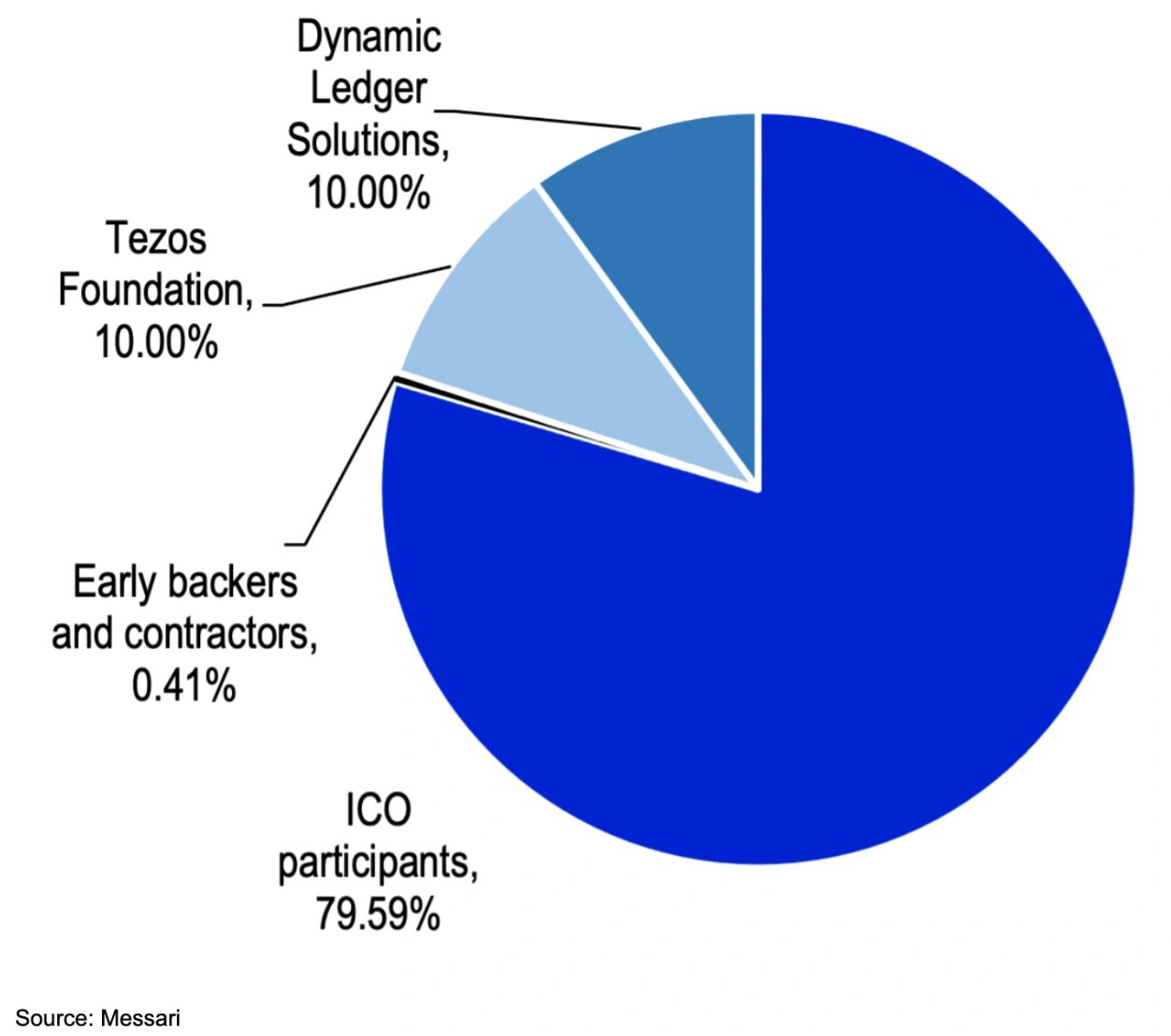

The distribution of the initial token supply was as follows: [1] [5]

- 79.50% was allocated to ICO participants

- 0.41% to early backers and contractors

- 10% to the Tezos Foundation

- 10% to Dynamic Ledger Solutions

Utility

XTZ is used to pay transaction fees and execute smart contracts within the Tezos network. Token holders can participate in securing the network by staking their XTZ, either by running validator nodes (bakers) or by delegating to other validators. Stakers earn newly minted XTZ as rewards, proportional to their contribution. The token also plays a central role in Tezos’ on-chain governance—holders can vote on protocol proposals or delegate their voting rights, allowing even non-technical users to influence the network’s direction. Additionally, developers who propose and successfully pass upgrades may receive XTZ rewards, further incentivizing community-led innovation. [4] [5]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)