Subscribe to wiki

Share wiki

Bookmark

Ethena USDe

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Ethena USDe

Ethena USDe (labeled as 'internet bond') is a fully-backed on-chain stablecoin powered by the ETH staking yield and perpetual swaps. The issuance and redemption of USDe is managed by Ethena Labs. [2]

Overview

USDe is collateralized 1:1 by ETH LSTs like stETH from Lido while this exposure is hedged on perpetual futures by shorting the equivalent amount of ETH. As this generates a high yield, USDe is being labeled as ‘the internet bond‘. [3]

According to Ethena founder, Guy Young, USDe was developed to solve the stablecoin trilemma that states that a stablecoin can’t maintain a peg to the underlying asset, can't be decentralized, and can't be scalable. [3]

“The philosophy around the product is to try and make it as secure and safe at the base layer as possible. There are interesting things that you can start to do with leverage to try and juice up the returns in some ways, but we really just want to create a solid base which other people can go and build upon and start to use leverage in other interesting ways, whether that's in money markets or on perp dexs.” - [Guy Young] - (https://iq.wiki/wiki/guy-young) [3]

Users can acquire USDe in permissionless external liquidity pools, while approved parties from permitted jurisdictions, who pass KYC/KYB screening, can mint and redeem USDe on-demand through Ethena Labs contracts, exclusively available to market-making entities. With trustless collateral stored within the crypto-system, there is no reliance on traditional banking infrastructure, ensuring USDe is fully backed by users' deposits at all times. Additionally, users can engage in Cross Market Arbitrage by minting and redeeming USDe with Ethena and trading it in external markets like Binance or Curve pools to capture price dislocations. [2]

“We want to separate the most important instrument in crypto, which is the stablecoin, from the banking system. The point of everything we're trying to do is to create a self sufficient system, and yet the most important asset is completely centralized”. - Guy on core thesis of Ethena[3]

USDe Price Stability Mechanism

USDe derives its peg stability from executing automated and programmatic delta-neutral hedges with respect to the underlying collateral assets. Hedging the price change risk of the collateral asset in the same size ensures the change in value of the collateral asset is offset by the change in value of the hedging leg. This ensures the synthetic USD value of the collateral remains relatively stable in all market conditions. [2]

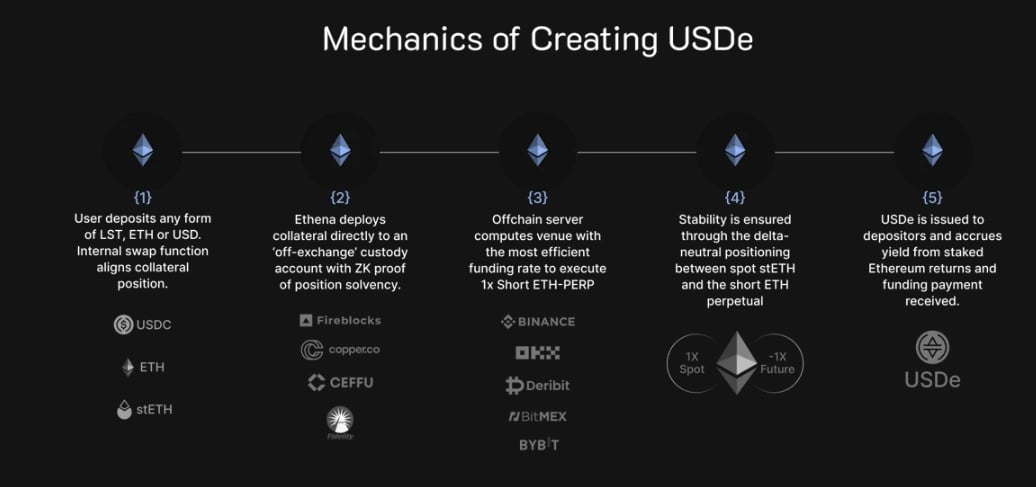

Mechanics of Creating USDe

USDe is generated through a user depositing either LST, ETH, or USD. The internal swap function harmonizes with the collateral position. Subsequently, Ethena directs the collateral to an off-exchange custody account, providing a ZK proof of position solvency. The off-chain server calculates the venue with the most efficient funding rate, executing a 1x short ETH-PERP. Stability is ensured through the delta-neutral positioning between spot stETH and the short ETH perpetual. [4]

Depositors receive issued USDe, which accumulates yield from staked Ethereum returns and funding payments received. This process ensures a transparent and secure mechanism for creating and maintaining USDe within the Ethena ecosystem. Scalability is achieved by utilizing derivatives that allow for USDe to scale without significant over-collateralization since the staked ETH collateral can be perfectly hedged with a short position of equivalent notional, the stablecoin only requires 1:1 collateralization. [4]

Stability is provided through unlevered short perpetual positions executed against the collateral immediately on issuance which ensures the position is delta-neutral and that USDe is never issued to users without the initial notional balance being perfectly hedged. Censorship Resistance is achieved by separating collateral from the banking system and storing trustless crypto collateral outside of centralized liquidity venues in onchain, transparent, 24/7 auditable, programmatic custody account solutions. [4]

Technology

Generated Yield

Ethena Labs generates two sustainable sources of yield from the deposited assets. The returned yield to eligible users is derived from staking Ethereum to receive consensus and execution layer rewards, and the funding and basis spread from the delta hedging derivatives positions. [3]

Yield from staking Ethereum is floating by nature and denominated in ETH while the funding and basis spread yield can be floating or fixed depending upon if the protocol uses non-deliverable or deliverable derivatives positions to hedge the collateral's delta. [3]

Risks

The protocol is exposed to various risks including but not limited to Smart Contract Risk, External Platform Risk, Liquidity Risk, Custodial Operational Risk, Exchange Counterparty Risk, and Market Risk.

"Ethena Labs recognizes these risks and actively attempts to ameliorate & diversify these risks as much as possible. In practice, this means we use multiple providers for each step of the workflow and actively monitor all partners and market conditions" - USDe doc. points out[2]

Delta-Neutral Stability

"Delta" refers to the sensitivity of the derivatives contract to a change in the price of the underlying asset. [5]

"Delta-neutral" stability refers to a portfolio that has a delta of 0, indicating that it is not exposed to price changes in the underlying value of the asset. Being delta-neutral means that the value of the portfolio in USD terms remains constant regardless of market conditions, such as changes in the spot price of ETH. Even if the price of ETH experiences drastic fluctuations, the USD value of the portfolio remains unaffected due to the perfect offsetting of profits from the ETH price increase by losses from the equal-sized short perpetual position. Delta-neutral portfolios aim to mitigate the impact of market volatility on overall portfolio value. [5]

Recent Updates

USDe Integration with Hyperliquid and HyperEVM

In May 2025, Ethena announced that the stablecoin USDe is now available on Hyperliquid and HyperEVM platforms. This integration aims to expand the accessibility and utility of USDe within the decentralized finance ecosystem. The availability of USDe on these platforms is expected to enhance liquidity and provide users with more options for trading and utilizing the stablecoin. This move is part of Ethena's broader strategy to integrate USDe into various DeFi platforms, thereby increasing its adoption and use cases.

The integration with Hyperliquid allows traders and DeFi users to earn rewards, borrow, and trade using USDe. USDe liquidity will primarily exist on HyperCore at launch, which is Hyperliquid’s perpetual decentralized exchange (DEX). The activation also allows HyperEVM users to borrow USDe against assets supplied on DeFi protocols such as Euler and Felix Protocol and unlocks stable pair farming opportunities on eligible protocols.

Ethena has also launched USDe and ecosystem support on Telegram’s TON Network. This expansion allows USDe and sUSDe to be integrated into the TON blockchain under the name tsUSDe and can be used through Telegram wallets. This integration aims to bring the benefits of USDe to a wider audience within the Telegram ecosystem. [6] [7]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)