Subscribe to wiki

Share wiki

Bookmark

51% Attack

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

51% Attack

A 51% attack occurs when a blockchain is targeted by a coalition of miners who possess more than 50% of the total mining hash rate on the network. If this group gains ownership of 51% of the network's nodes, it theoretically grants them the authority to modify the blockchain.[1]

Overview

A blockchain achieves decentralization by ensuring that no single individual or specific group holds control over the network. This decentralized structure is crucial because all participants within the blockchain ecosystem must reach a consensus on the present state of the blockchain. This requirement for unanimous agreement among the widely distributed network participants establishes a high level of certainty regarding the authenticity of the block's state.[2]

A 51% attack refers to a deliberate attack on a blockchain in which a group gains control over more than 50% of the network's hashing power, which is the computational capability used to solve cryptographic puzzles. This group subsequently introduces a modified version of the blockchain into the network at a precise juncture. Theoretically, the network might accept this altered blockchain due to the attackers' majority control over the network.[1][2][3]

Impacts of 51% Attack

Reduced Miner Rewards

In a 51% attack, a transaction might be reversed even before it is verified. This results in double spending. As the attackers take their shares, legitimate miners also make less money updating the network.[4][2] A 51% assault on a blockchain could adversely impact a cryptocurrency's reputation, which would cause investors to sell their crypto, depreciating its value.[5][6]

Network Disruption

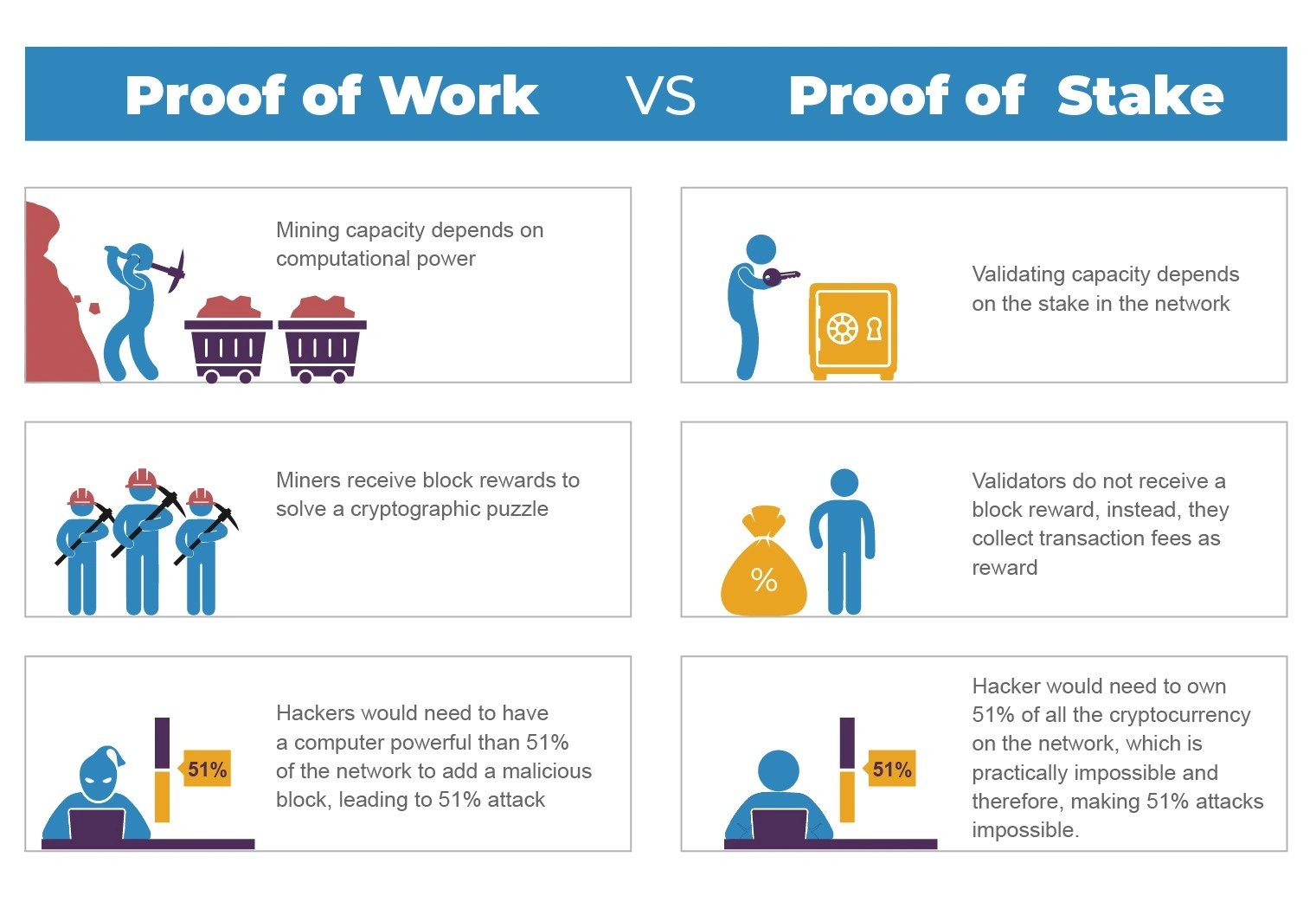

As long as a blockchain employs a Proof-of-Work (PoW) mechanism to validate transactions, perpetrators can intentionally disrupt the network by impeding the confirmation and sequential arrangement of blocks.[4] A 51% assault has a significant negative effect on the miner's computational capabilities. As a result, it takes longer for the transaction to be approved and recorded in a block. As a result, the blockchain network becomes compromised, enabling the attackers to execute transactions faster than the miner.[4]

51% Attack Prevention

Blockchains employ several strategies to prevent 51% attacks. One of such strategies is to incentivize a greater number of participants to join the network and operate their own nodes, thereby bolstering a strong network community. A higher number of participants contributing resources makes it more challenging for a sole entity to exert dominance over the network.[3][4]

In a small blockchain network, a single miner could potentially dominate as the majority participant. Blockchain networks employing the Proof of Work (PoW) consensus mechanism typically implement a requirement that miners regularly update their equipment. Neglecting this can result in them forfeiting block rewards and falling behind other miners within the network. [4]

To mitigate the risk of a 51% attack, blockchain networks can opt for the Proof of Stake (PoS) consensus mechanism, which is generally considered a more secure alternative to Proof of Work (PoW) because it is more challenging for an attacker to acquire the larger majority of the staked cryptocurrency compared to most of the mining power in a PoW blockchain.[4][5][8]

Past Examples of 51% Attacks

The majority of 51% attacks are directed towards smaller cryptocurrencies. Experts suggest that major cryptocurrencies are unlikely to fall victim to a successful 51% attack due to the substantial cost associated with gaining control of over half of the mining power. The following are blockchain networks that have experienced a 51% attack in the past:

- In 2018, an attack on Bitcoin Gold (BTG) led to the double spending of over $18 million worth of the currency. In 2020, BTG encountered another 51% attack. Within a span of two days, the blockchain underwent two reorganizations, enabling double-spending activities that resulted in substantial financial losses. However, this attack was quickly stopped to prevent further loss. [4][6]

- Ethereum Classic (ETC), a cryptocurrency that emerged from a hard fork of Ethereum in 2016, fell victim to a 51% attack in 2020. This incident resulted in the reported theft of several million dollars.[6]

- Bitcoin SV (BSV) faced three attacks in 2021. These attacks enabled hackers to manipulate or erase the most recent blocks by gaining control over the network.[6]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)