Subscribe to wiki

Share wiki

Bookmark

Alchemix

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Alchemix

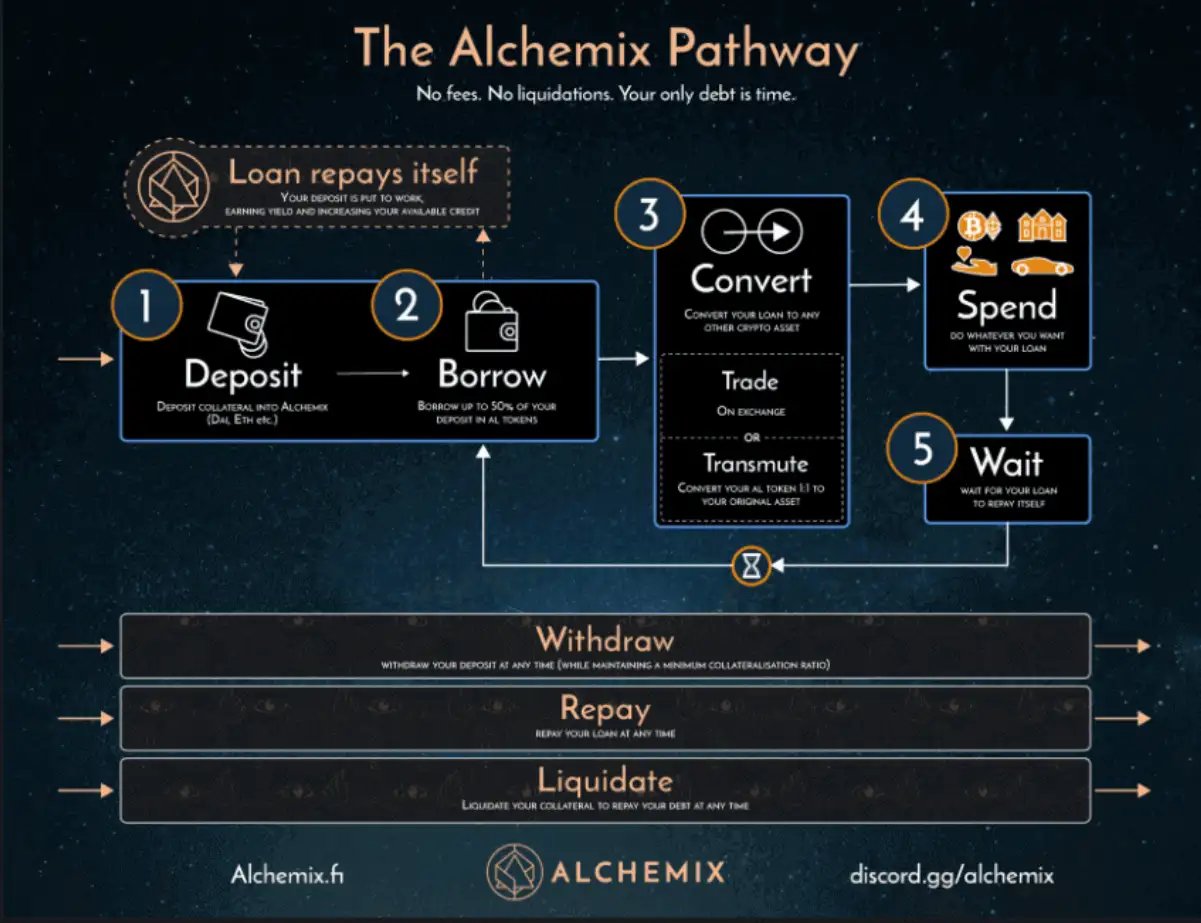

Alchemix is a DeFi application that allows the formation of yield-backed synthetic assets. With its ability to provide collateral that can also generate yield, Alchemix can offer a self-paying loan that has no risk of liquidation[1][2]. Alchemix was launched on February 2021.

Vaults are the centerpiece of the Alchemix ecosystem and use Yearn Finance as a building block for yield on underlying assets like DAI, with support for ETH and other cryptocurrencies.

History

Alchemix was founded by pseudonymous developers led by Scoopy Trooples. The only collateral accepted at launch was Dai, which could be used to mint synthetic alUSD tokens and had a collateralization ratio minimum of 200%. The team has since created a new vault to allow users to deposit ETH and mint alETH tokens with a collateralization ratio minimum of 400%.[3]

There was an incident involving the ETH vault shortly after launch in which users were able to withdraw collateral without repaying their loans, resulting in a loss of 2,200+ ETH. The Alchemix team organized a campaign encouraging users to return the lost ETH in exchange for exclusive NFT and ALCX rewards, eventually recovering more than half of the funds.

Curve Hack

On July 30, 2023, a significant exploit hit several DeFi protocols on Curve Finance, resulting in attackers stealing more than $24 million worth of cryptocurrencies. The attack was linked to a vulnerability in liquidity pools on Curve, and investigations pointed to issues with Vyper, an alternative programming language for Ethereum smart contracts, as the root cause of the exploit. The vulnerability in Vyper versions 0.2.15, 0.2.16, and 0.3.0 allowed attackers to manipulate the reentrancy guard, enabling them to execute multiple calls in a single function and trick smart contracts into calculating improper balances. JPEG’d, Alchemix, and Metronome DAO suffered significant losses, with $11 million, $13.6 million, and $1.6 million stolen, respectively. [17]

Stolen Funds Return

Following the July 30 Curve Finance attack, the attacker started returning some of the stolen assets on August 4, 2023. Approximately $8.9 million worth of cryptocurrency has been sent back to the affected platforms. This action is attributed to the attacker's intention not to negatively impact the exploited protocols, rather than being prompted by apprehension. The returned funds constitute around 15% of the total amount initially taken. Additionally, there are indications that an associated MEV bot might also return funds, though no verifiable returns have occurred yet. [18][19]

Overview

Alchemix has four main components. Vaults, transmuter, token distribution, and Alchemix Dao. The vault acts as the hub for generating yield advances. It shares similarities with lending platforms such as MakerDAO and AAVE. The transmuter allows users to stake their synthetic assets and, over time, convert them into their base assets[12].

The platform empowers users to get advances on their yield by minting a synthetic version of their DAI collateral and uses various mechanisms to peg the synthetic token to the deposited asset. The collateral will be to work earning yield in Yearn Finance Network (YFN).

The harvested yield helps pay off the user's debt in the system. A 10% cut is taken from the yield harvest, which goes into the treasury, and Yearn pays Alchemix affiliate fees for adding TVL to its protocol.

After the release of Alchemix V2, the team added multiple collateral types for alUSD, including USDC and USDT, along with the addition of al-Assets, such as alETH and alBTC. The same 10% fee applies to the harvests of these vaults.[4]

Services

Vaults

Vaults are how users manage their yield advance positions. First, users deposit DAI into the contract. DAI is then deployed by the Alchemix contract to earn yield in the Yearn yvDAI Vault.

Users can mint alUSD up to 50% of the amount of DAI they have deposited (eg. if a user deposits 1000 DAI, they can generate up to 500 alUSD). As yield is harvested from the yvDAI Vault, users will see their alUSD debt decrease, and if they wait long enough, it will be completely paid off by the Alchemix protocol[3][10].

In other words, the loan pays itself off. There are many options for users to manage their Vault once it is opened. If at any point user is more than 200% collateralized, they can withdraw DAI or mint alUSD until their vault reaches a 200% collateralization ratio. As the protocol repays users' debt, they can withdraw more DAI or mint more alUSD as desired.

The Alchemist.sol contract treats alUSD and DAI the same, so a 1000 alUSD debt could be paid with 1000 alUSD, 1000 DAI, or any mix of the two. Furthermore, if a user is short of funds to repay the debt, they can liquidate their collateral to pay off their debt. Once a user has 0 alUSD debt remaining, they are free to withdraw all of their deposited collateral, and if they forget to withdraw their collateral, they will be credited alUSD with the generated yield for that period until they withdraw.

Transmuter

The Alchemix dApp calls a harvest function on a regular basis, which collects the yield generated by all the deposits into the system. The collected yield counts towards the maturation of the Vault and is then transferred into the Transmuter pool. Users can stake alUSD in the Transmuter and their tokens will be converted into the base asset over time as the yield flows in.

When users go to transmute and claim their converted tokens, an equal amount of alUSD tokens will be burned. So if a user has 1200 alUSD staked and 400 DAI has been allocated to their staking position, when they claim this, 400 of their alUSD will be converted into DAI, resulting in a balance of 800 alUSD and 400 DAI for the user. In effect, staked alUSD behaves like a bond, and eventually matures into its base asset.

Depending on the amount of total alUSD staked in the transmuter, this conversion rate may be much higher than the generated yield from the protocol and presents a new DeFi primitive. The transmuter is mostly automated, but it does rely on users to make economic decisions to facilitate its smooth operation. This is mainly because a staking position can be overfilled.

When this happens, it presents an economic opportunity to other alUSD stakers by allowing them to force transmute an overfilled position. If a 1000 alUSD position is filled to 1050 DAI, then the person who forces that position to be transmuted will have the surplus 50 DAI instantly applied to their transmuter position. If the user who force-transmutes is not staking alUSD, then the DAI-overflow will be distributed globally to all stakers. This presents a win-win scenario, with baked-in incentives for cron-jobs and what amounts to gasless conversions for stakers should this happen to their staking position.

Farming

Alchemix offers yield farming to fulfill a number of objectives for the protocol. Farmers are rewarded with ALCX tokens, which have governance voting rights in the ecosystem. Additional utility for the ALCX token may be added by the community. The core team members strongly believe in the fair launch philosophy, and as such 60% of ALCX tokens went to the community.

The DAO receives 15% of the supply to be controlled by the community. The DAO also receives an additional 5% of the supply of ALCX tokens to be reserved for bug bounties. The rest of the token distribution is allocated to farming. Yield farming participants have 60% of the supply allocated to them for staking select tokens and LP tokens.

There are also four incentivized pools. The first one is a simple alUSD pool, where users can stake alUSD and receive ALCX tokens. This is to encourage the minting of alUSD, and gives users a very low barrier to entry to start earning ALCX tokens. The second pool is for alUSD-3CRV pool tokens.

This yield farming pool incentivizes having deep liquidity and a strong peg for alUSD on the popular Curve AMM DEX, thus maximizing its utility as a DeFi primitive in the greater DeFi ecosystem. The third pool is for ALCX/ETH Sushiswap tokens. The purpose of this pool is to bootstrap liquidity for ALCX. The fourth pool is just for simple staking of ALCX, and provides an opportunity for ALCX holders to accumulate more via holding.

AlchemixDAO

Alchemix DAO is the DAO behind the platform. Initially, the Alchemix DAO will operate as a multisig controlled by developers, with signaling carried out through the Snapshot app. Ownership of ALCX Tokens will confer governance privileges to token holders, granting them decision-making powers over the direction of the protocol and allocation of the treasury. Eventually, the DAO is slated to become fully operational with all features and functionalities, completing its transition to a fully-fledged decentralized autonomous organization. [15]

ALCX Token

ALCX token is an ERC-20 token used to govern and incentivize liquidity for the Alchemix protocol. Its primary use cases are governing the Alchemix decentralized autonomous organization (DAO) and rewarding network participants for providing liquidity.

ALCX can be staked within the protocol to earn additional ALCX tokens distributed as part of Alchemix's token emissions schedule. With the release of Alchemix V2, stakers began receiving a share of the yield the protocol generates. In exchange, ALCX stakers risk having their stake slashed in the event of a hack or exploit to help make the protocol whole after a loss.

Tokenomics

Alchemix had an initial pre-mine of 478,612 ALCX tokens, estimated to be 20% of the total ALCX tokens in circulation after 3 years based on the token's emissions schedule. All pre-mine tokens were sent to the treasury, with 358,959 tokens allocated for use at the discretion of the community and 119,653 tokens reserved for bug bounties. At launch, 32,000 ALCX tokens from the pre-mine were allocated to liquidity pools.

The original script to mint the pre-mine ALCX tokens was accidentally run twice, so 957,224 tokens were initially created. The excess 478,612 tokens were sent to a burner address in order to not impact the plan laid out by the team originally.

The token distribution is the following:

- The Alchemix DAO received a premine of 15% of the projected supply after three years. The usage of these tokens is completely up to the community's discretion.

- The Alchemix DAO has an additional reserve of 5% of the projected three-year supply for bug bounties.

- The remaining 80% of the tokens can be obtained by staking certain tokens and liquidity pool tokens in the Staking Pools contract.

- The Alchemix founders, onboarded developers, and community developers who built on Alchemix had access to an exclusive staking pool, which received 20% of the ALCX block reward. This equates to 16% of all emissions.

- Stakers and liquidity providers are eligible to obtain 80% of the ALCX block reward, equating to 64% of all emissions.

The pattern of the ALCX token distribution attributes more importance to those who contribute to the Alchemix protocol. The token distribution also ensures that no one from the development team will accumulate enough tokens to control the protocol while on the other hand, it rewards them for their work and encourages them to continue working on the protocol.

veToken Model Tokenomics

Alchemix announced a new tokenomics based on the ve token model. ALCX lockers are provided with the flexibility to lock their tokens for any period of time between two weeks and two years. Similar to the veCRV mechanism, lockers who opt for longer durations will enjoy higher rewards and greater decision-making power. The system includes a "rage quit" function, allowing veALCX lockers to exit from their locked position, albeit with a penalty. The penalty involves a reduction in the original deposit amount and the conversion of BPT tokens to permanent liquidity by means of a burn. [16]

Roadmap

Official Launch

On February 2021, the ALCX pre-mine was completed and alUSD vaults were launched on the Alchemix platform, allowing users to deposit Dai in order to take out a loan in the alUSD synthetic stablecoin.

alETH Vault

On June 2021, the alETH vault went live with a guarded launch. The vault was removed shortly after when a bug in the contract allowed users to withdraw their collateral without repaying their loans resulting in a loss of 2,200+ ETH but has since been redeployed.

Alchemix V2

On December 2021, Alchemix V2 created the DAO, introduced new asset vaults, such as BTC, allowed stakers to capture a share of protocol revenue, and provided users with customizable sources of yield.

Alchemix Fundraising

CMS, Alameda Research, and Immutable Capital led a $4.9 million funding round for the decentralized finance (DeFi) lending protocol Alchemix.

Alchemix sold the protocol's native ALCX tokens to investors for $700 each. As a reward for their contributions, the proceeds were distributed to the protocol's founders. Since this was the protocol's first round of fundraising, Alchemix noted that all previous testing had been done for free.

CMS, Alameda Science, Immutable Capital, Nascent, Protoscale Capital, LedgerPrime, eGirl Capital, Fisher8 Capital, Orthogonal Capital, and one person, whose name was not given, were the investors in order of investment size.

According to the protocol, the funding round was used for audits, consultants, recruiting, marketing, and community activities and allowed the founders to devote full-time to production.

Partnerships

Olympus DAO x Alchemix

Olympus DAO x Alchemix partnered to introduce new OHM reserve bonds utilizing the alUSD-3crv pool LP tokens. Olympus is entering a new phase as it seeks to bolster its treasury through partnerships with other protocols. Olympus can leverage its unique bonding mechanism, in which it acquires assets through the sale of OHM, to help partners achieve sustainable liquidity for their most important pairs[13].

Maintaining a 1:1 alUSD: USD peg is central to the Alchemix Dai vault. To date, the peg has remained strong due to a combination of robust liquidity, market incentives, and a backstop in the form of the Transmuter, which ensures that alUSD can be redeemed 1:1 for DAI. Much of the ~$400 million in liquidity in the curve pool is attributable to liquidity mining incentives, with the pool earning 2900 ALCX per week.

By creating OHM bonds that would allow Olympus to acquire alUSD-3crv LP tokens, Alchemix can reduce its reliance on liquidity incentives and ensure that substantial liquidity remains locked in the Olympus treasury. Furthermore, these bonds can serve as a test run for other LP assets in the future including alUSD/OHM, ALCX/OHM, alETH/ETH, etc.[13]

Alchemix x Chainlink

Alchemix has integrated Chainlink keepers into its ecosystem to allow for even more seamless services on its DeFi platform, the Chainlink team shared in a release with CryptoSlate[14].

Alchemix routes user-deposited collateral into Yearn vaults—on-chain yield aggregation strategies that chase the highest returns across the DeFi ecosystem. The returns generated are then used to repay user debt. As a result, users are effectively provided an advance on their future yield, increasing capital efficiency and resulting in a new “money LEGO” available for use in other smart contract applications.

Now, by using Chainlink Keepers, Alchemix is now truly set-and-forget, meaning a user can take out a DeFi loan, earn a DeFi yield, and pay the DeFI loan back over time with their yield without any manual input.

The Chainlink team has also sponsored the launch of a new Chainlink Price Feed for Alchemix native token ALCX and stablecoin alUSD to support their adoption as collateral across the DeFi ecosystem.[14]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)