Subscribe to wiki

Share wiki

Bookmark

Olympus DAO

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Olympus DAO

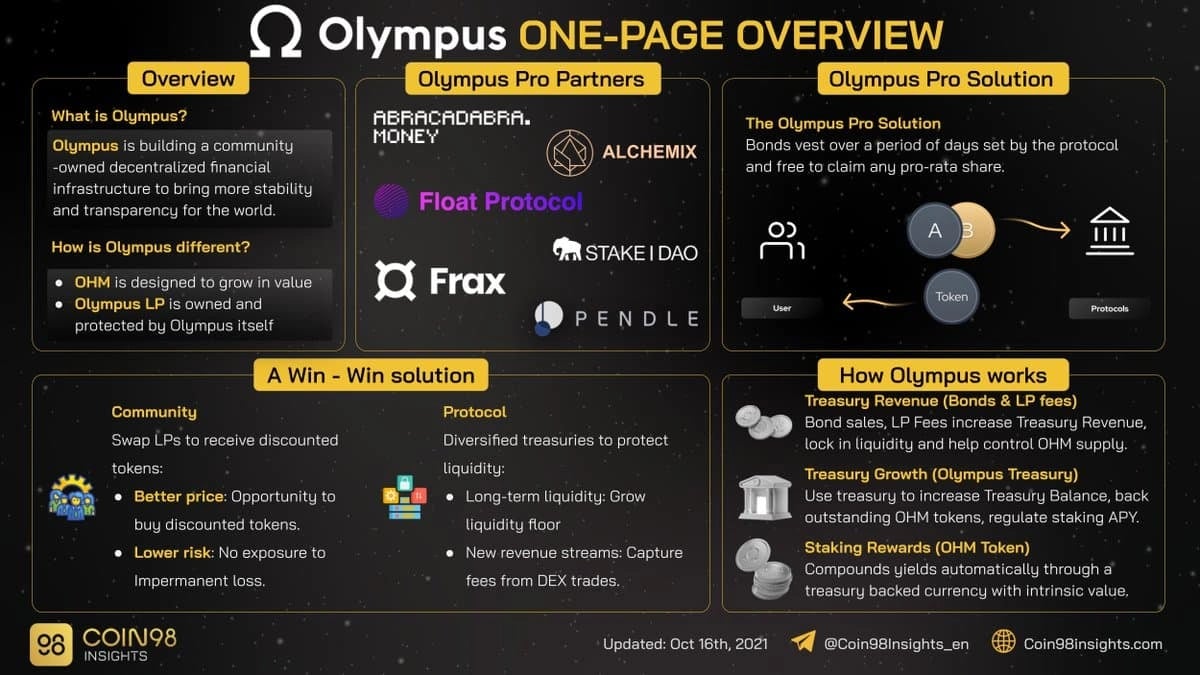

Olympus DAO is a decentralized financial (DeFi) protocol described as the world's first monetary computer. It supports OHM, a treasury-backed, liquidity-enabling token on the Ethereum network. The protocol aims to build a policy-controlled currency that preserves purchasing power, maintains reliable liquidity, and functions as a trusted, decentralized reserve asset in the Web3 ecosystem. Olympus leverages mechanisms such as Protocol Owned Liquidity (POL), Range Bound Stability (RBS), and Cooler Loans to create a robust and flexible form of smart money.[23][24]

Overview

Olympus is a decentralized reserve currency protocol based on the OHM token. Each OHM token is backed by different assets in the Olympus treasury. While it started with only holding DAI in its treasury, it evolved to include more coins such as FRAX, LUSD and ETH, as well as LP tokens such as OHM/DAI LP tokens from SushiSwap. Olympus also has staking and bonding features. Stakers stake their OHM tokens in return for more OHM tokens, while bonders provide LP or DAI tokens in exchange for discounted OHM tokens after a fixed vesting period. Governance participants can get involved on the Olympus and through discussions on the Olympus and servers.[1][12]

The main benefit for stakers comes from supply growth. The protocol mints new OHM tokens from the treasury, the majority of which are distributed to the stakers. Thus, the gain for stakers will come from their auto-compounding balances, though price exposure remains an important consideration. That is, if the increase in token balance outpaces the potential drop in price (due to inflation), stakers would make a profit. The main benefit for bonders comes from price consistency. Bonders commit capital upfront and are promised a fixed return at a set point in time; that return is in OHM and thus the bonder's profit would depend on OHM price when the bond matures. Bonders benefit from a rising or static OHM price.[12]

Products

Staking

Stakers stake their OHM tokens on the Olympus website to earn rebase rewards. The rebase rewards come from the proceed from bond sales, and can vary based on the number of OHM staked in the protocol and the reward rate set by monetary policy. When a user stakes, they lock OHM and receive an equal amount of sOHM. The user's sOHM balance rebases up automatically at the end of every epoch. sOHM is transferable and therefore composable with other DeFi protocols. When a user unstakes, they burn sOHM and receive an equal amount of OHM. Unstaking means the user will forfeit the upcoming rebase reward.[4]

Bonding

The bonding feature allows Olympus to acquire its own liquidity and other reserve assets such as LUSD (Liquity USD) by selling OHM at a discount in exchange for these assets. The protocol quotes the bonder with terms such as the bond price, the amount of OHM tokens entitled to the bonder, and the vesting term. The bonder can claim some of the rewards (OHM tokens) as they vest, and at the end of the vesting term, the full amount will be claimable. Bonding is an active, short-term strategy. The price discovery mechanism of the secondary bond market renders bond discounts more or less unpredictable. Therefore, bonding is considered a more active investment strategy that has to be monitored constantly in order to be more profitable as compared to staking. Bonding allows Olympus to accumulate its own liquidity, POL. More POL ensures there is always locked exit liquidity in Olympus trading pools to facilitate market operations and protect token holders.[5][25]

Governance

The Olympus protocol is governed and upgraded by its tokenholders. The system is transitioning from multisig management to on-chain governance, a process initiated by Olympus Improvement Proposal (OIP) 152 and first deployed with OIP-166. The governance framework consists of three primary components: the gOHM token, Governor Bravo, and multisig contracts.[26]

These components allow the community to propose, vote on, and implement changes to the Olympus V3 system. Proposals can modify system parameters, activate or deactivate policies, and add new features to the protocol.[26]

gOHM

gOHM (Governance OHM) is an ERC-20 token used for proposing and voting on upgrades to the Olympus protocol. It can be obtained by wrapping OHM and vice versa. Beyond governance, gOHM is also used as collateral for Cooler Loans.[26]

Delegation

gOHM holders can delegate their voting rights to any address, including their own. Key aspects of delegation include:

- A user can only delegate to one address at a time.

- The entire gOHM balance of the delegator is counted towards the delegatee's voting power.

- Changes in the delegator's token balance automatically update the delegatee's voting rights.

- Delegation is effective from the current block onward until changed.

- gOHM held in Cooler Loans is eligible for delegation.

Delegation can be managed through the Olympus governance frontend or by directly calling the delegate() function on the contract.[26]

Voting Eligibility

The eligibility of gOHM for voting in Snapshot (off-chain) and Governor Bravo (on-chain) varies depending on how it is held. The following table outlines the eligibility: | gOHM type | Snapshot eligibility | Governor Bravo eligibility | | --- | --- | --- | | gOHM | ✅ | ❗ (requires delegation) | | gOHM in Cooler Loans | ❗ (requires delegation) | ❗ (requires delegation) | | tokemak gOHM | ✅ | ❌ | | Arbitrum gOHM | ✅ | ❌ | | AVAX gOHM | ✅ | ❌ | | Polygon gOHM | ✅ | ❌ | | Fantom gOHM | ✅ | ❌ | | Optimism gOHM | ✅ | ❌ | This information is based on the Olympus governance documentation.[26]

Governor Bravo

Olympus uses a modified version of Compound’s Governor Bravo contract. The key modifications are designed to accommodate the elastic supply of gOHM:

- Percent-based submission threshold: A proposer must hold at least 0.017% of the total gOHM supply to submit a proposal.

- Percent-based quorum threshold: For a proposal to pass, it must receive "FOR" votes equivalent to at least 20% of the total gOHM supply.

- Net votes approval threshold: The percentage of the voting supply voting "FOR" must be 60% or greater.

Governor Bravo's Timelock contract is responsible for assigning roles to policies within the protocol's Kernel.[26]

Multisig and Shared Roles

While governance transitions on-chain, multisig wallets continue to manage certain protocol functions. These multisigs execute on-chain actions approved by the community through off-chain Snapshot votes. Some roles are shared between the Governor Bravo Timelock and multisigs, while others remain under exclusive multisig control. As the on-chain governance framework matures, more roles are expected to be transferred from multisigs to the Governor Bravo Timelock.[26]

OHM Tokens

OHM is a decentralized reserve currency backed by other decentralized assets. Each OHM is backed by 1 DAI, not pegged to it. Because the treasury backs every OHM with at least 1 DAI, the protocol would buy back and burn OHM when it trades below 1 DAI. This has the effect of pushing OHM price back up to 1 DAI. OHM could always trade above 1 DAI because there is no upper limit imposed by the protocol. [12] [14]

sOHM

Users receive sOHM when they stake OHM at a 1:1 ratio.[12]

aOHM

When Olympus DAO first launched, alphaOHM (aOHM) was used as a pre-allocation token which allowed the early participants to lay claim to OHM. Moving forward aOHM served as the in-game currency of a community-led social game that runs on the blockchain. Other than that, aOHM is not relevant to OHM or the operation of Olympus DAO.

pOHM

pOHM, previously known as pOLY, is the presale token of Olympus. It was used to raise funds from private investors to bootstrap Olympus.[14]

Ecosystem

Olympus Pro

Olympus Pro is protocol-owned liquidity-as-a-service created by the Olympus DAO, providing a custom treasury and bonds optimized to individual needs. Through bonds, protocols can accumulate the crucial infrastructural liquidity that they generally service via liquidity mining. Instead of renting that liquidity (often at high-interest rates), they purchase it, turning a value-draining perpetual expense into revenue-producing assets that facilitate the functionality of the rest of the platform. [10] [27]

Partners are featured on Olympus Pro X, a unified marketplace for bonds from a multitude of protocols. The marketplace will become the default destination for DeFi investors looking for discounted exposure to various tokens through this unique mechanism. Additionally, Olympus will provide its partners with co-marketing services, leveraging their community and brand to highlight new projects.An end goal of Olympus Pro services is to promote OHM as a treasury asset and liquidity pair token for other protocols. Since the launch of Olympus Pro in September 2021, OP bonds have captured more than $9.35 million of liquidity from its first two cohorts of partners. The list of projects that used the Olympus Pro services includes Frax Finance, Alchemix, PoolTogether, BarnBridge, Thorstarter, and others. [10]

Olympus Grants

Launched in February 2022, Olympus Grants was designed to fill various gaps in the Olympus ecosystem by funding projects which support Olympus DAO’s initiatives but don’t fit into existing projects. Where a token swap, incubator investment, or yield-redirection is not quite appropriate, Olympus Grants will fill the gap. [16]

The OGP (Olympus Grants Program) is funded with $1.5 M of DAO approved $OHM and is built to bolster the objectives of other departments such as Partnerships, Olympus Pro, Incubator, and Give in ways that require a more flexible funding mechanism. Grants will promote the core values of OHM such as building an inclusive econOHMy. This will help Olympus DAO take the cooperative economics of Web3 and greatly expand the reach and user experience of the Olympus ecosystem. [17]

Olympus V2

In October 2021, Olympus DAO announced Olympus V2 introducing several new features.[8]

Staking for Bonds

- Bond payouts are staked at the time of purchase. Rather than requiring bonders to factor in missed rewards when considering a discount, they are now earned by default.

- Bonds no longer vest linearly. Instead, bonders must wait until the end of their term to redeem. This illiquidity is enabled by staking bond payouts and creates a form of locked staking that will save money by removing the incentive to incur wasteful gas transactions through frequent redemption.

- New bond types are created as isolated offerings. Each bond has a maximum amount of OHM that can be paid or a maximum amount of principal that can be purchased and, once exceeded, the bond is retired.

- Bonds can be held as [NFTs](https://iq.wiki/wiki/non-fungible-token-nft). This enables liquid secondary bond markets.

- Bonds can be both fixed-term (one that pays the same level of interest over its entire term) or fixed-expiration (where the maturation date is the same for all who buy that bond). Fixed-expiration bonds can be wrapped into a fungible token and traded like any ERC-20 token.

- Bonds offer a front-end reward. This will incentivize third parties to run front-ends for Olympus, reducing single-point-of-failure risk.[8]

Inverse Bonds

Inverse Bonding is a new tool for Olympus DAO to increase $OHM’s liquid backing and absorb market volatility. Inverse bonds are part of an overarching strategy, defined in Olympus12, that seeks to produce value for Olympus holders through a strong Treasury. This cements Olympus DAO's position as the reserve currency and central bank of DeFi. Since its launch in March 2022, Inverse bonds allow Olympus to create a means to bring OHM out of circulation, which increases the backing per OHM on every inverse bond that is executed below liquid backing. [17][17]

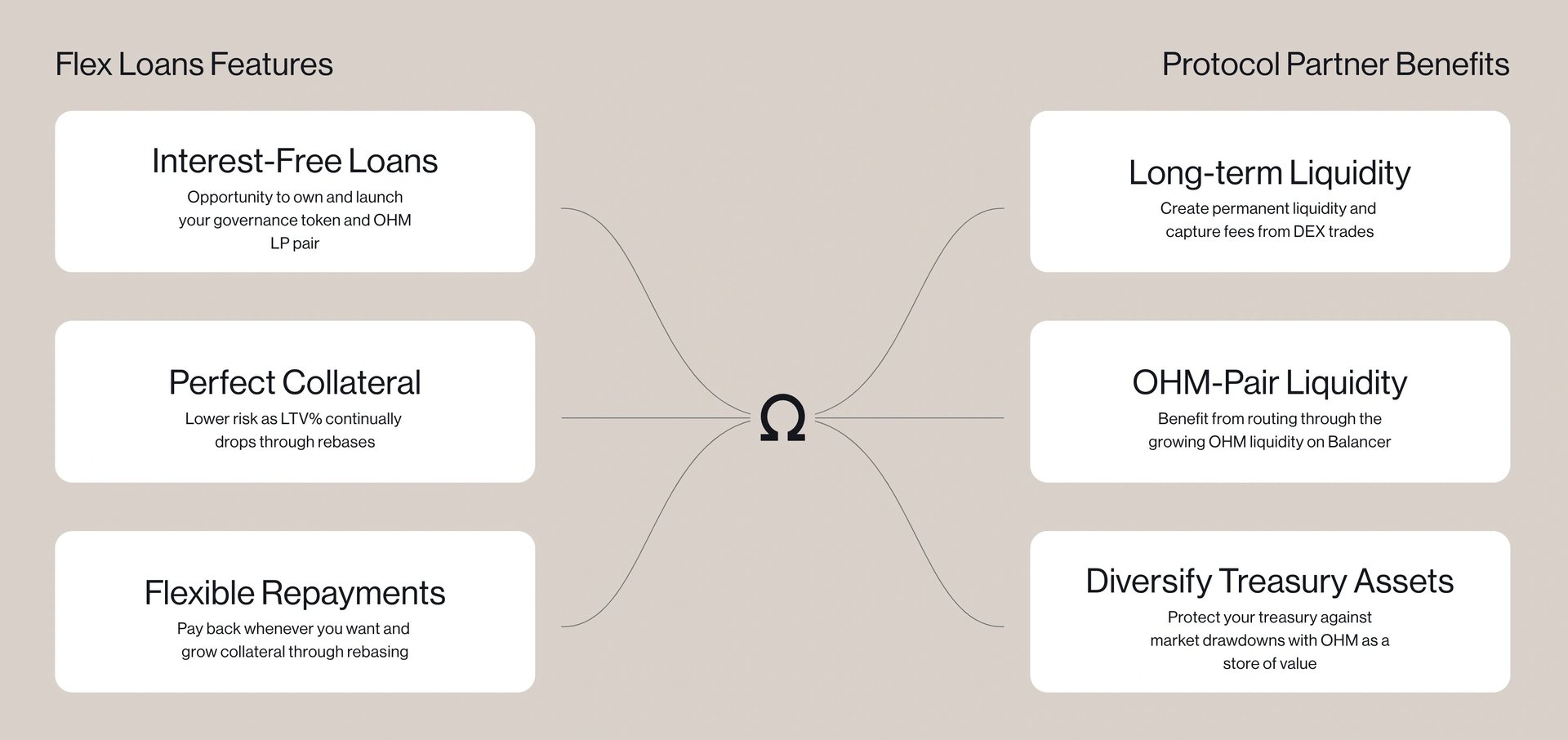

Flex Loans

Flex Loans is a whitelisted product offering for protocols to grow their protocol-owned liquidity through an interest free loan against perfect collateral. By depositing gOHM as a collateral asset, the borrower is able to borrow up to 100% LTV in OHM and pair this with another token to create a liquidity pair. Since the loan is in the same denomination, there is no risk of liquidation and the loan will lower in LTV% as the gOHM collateral continues to receive the underlying rebases.Once whitelisted by Olympus, the borrower deposits gOHM into Flex Loan contract along with the other half of the intended LP token. The contract then borrows against the deposited gOHM and pairs the resulting OHM with the provided token to create an LP pair at the designated Decentralized Exchange (DEX) of their choosing. At the moment, LP strategies for Balancer, Uniswap, Sushiswap and Curve are available.Repayment of the loan is possible at any moment and can either be done by paying back the OHM debt directly (from the LP position itself, or externally supplied) or by using part of the supplied gOHM collateral.Flex Loans partnered with FiatDAO and Redacted.[18]

Tokenomics

Olympus DAO Token ($OHM)

Instead of renting exchange services Olympus directly issues its OHM token to buyers through a process called Bonding. This way the buyer offers Olympus money today and then in a few days she/he gets discounted OHM tokens. This mechanism is similar to how governments issue bonds. Buyers buy a bond now for some return in the future. It is raising funds for itself and many called this the beginning of a new era for DeFi and named it DeFi 2.0.

Once buyers have OHM, they can either sell them, hold them or stake them. They might sell them because they bought a bond a few days ago and now they want to cash out. Buyers might want to keep them because they expect the price to appreciate. But the most logical thing is to stake them. By staking OHM buyers earn a return for doing so. The word “staking” does not mean providing a token to a validator to support the proof-of-stake process. When they say staking, they just mean putting up your OHM in their pool of funds in return for a reward. Olympus DAO is not a blockchain. Rather, Olympus DAO is a protocol, a set of smart contracts, that sits on the Ethereum platform. Hence, all the validation of transactions and security checks etc. happen on Ethereum in the background. Olympus DAO incentivizes staking because not selling props the price of OHM up.[19]

Partnerships

Frax Finance

In June 2021, Olympus DAO announced a partnership with Frax Finance. This partnership allows Olympus DAO to accumulate OHM-FRAX liquidity through the sales of bonds, and build up the Olympus treasury in the process. A few initiatives have been launched in light of this partnership, including OHM-FRAX bond and FRAX bond.

Rari Capital

Olympus DAO collaborated with Rari Capital to create a Fuse pool that allows users to use their sOHM as collateral and borrow other assets against it. Fuse is an isolated interest rate market by Rari Capital. Each pool in Fuse can support different types of assets and use different interest rate curves. To lend out sOHM and/or use it as collateral, users can enter the. In this pool, several assets are supported:

- sOHM

- USDC

Abracadabra.money

Abracadabra.money is a lending platform that allows users to deposit interest-bearing tokens as collateral and borrow its native, USD-pegged stablecoin. On August 22, 2021, the platform started to accept wsOHM as collateral.

Vesta Finance

Vesta Finance is a lending protocol on Arbitrum based on Liquity, with the added feature of multi-collateral and a set of governable parameters. On January 31, 2022, Olympusannounced that Vesta Finance has joined Olympus Incubator, which will bring utility to Ohmies and bring further value to the backing of OHM. Vesta will provide Olympus with 6% of their governance tokens vested linearly over two years. In Q1 2022, Ohmies will be able to collateralize gOHM at 66% Loan to Value (LTV) and mint VST, Vesta’s dollar-pegged stablecoin at 0% interest with a small mint fee of 1.25%. [15][15]

Coinbase DEX Integration

In August 2025, Coinbase expanded its decentralized exchange (DEX) access on the Base network, officially adding support for the OHM token. This integration brought Olympus, which maintains one of the largest treasuries in DeFi, into the Coinbase ecosystem, providing direct exposure to a wider audience. OHM purchased on Base is backed by the same on-chain reserves as its Ethereum mainnet counterpart and can be bridged to interact with the full suite of Olympus's on-chain systems.[24][28]

Chainlink CCIP Integration

In June 2025, Olympus integrated Chainlink's Cross-Chain Interoperability Protocol (CCIP) to facilitate decentralized, cross-chain transfers of the OHM token. This was implemented using Chainlink's Cross-Chain Token (CCT) standard, with the initial deployment connecting to the Solana network. The integration, which passed with 100% approval in a DAO governance vote, enhances the security and flexibility of OHM's multi-chain presence. The protocol may explore support for additional chains, including Ethereum, Arbitrum, Base, and Optimism, through future governance processes.[29]

Zapper

Zapper is an asset management platform for the decentralized economy. Their mission is to make Web3 accessible and easy to use. To advance this goal, they provide a dashboard that can be used to track and exchange more than 3000 digital assets, earn passive income by staking their assets and invest into various DeFi investment opportunities, and they create and share educational resources on Zapper Learn to help demystify the complexities of the decentralized economy for newcomers. Zapper was founded in early 2020 by Seb Audet and Suhail Gangji.

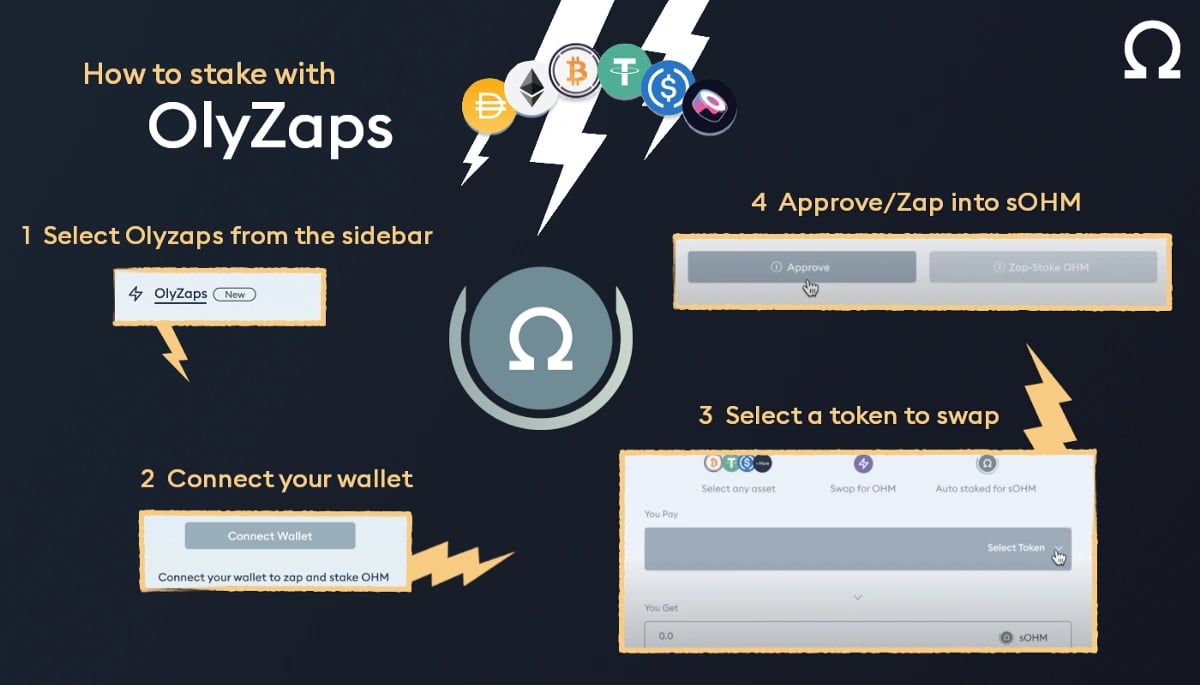

OlyZaps

To get OHM (or other assets to bond) you need to leave the Olympus app and buy OHM or other assets on a DEX, then return to the Olympus app to stake or bond. In December 2021, Olympus DAO introduced OlyZaps to swap any asset into sOHM directly through the Olympus App. Thanks to OlyZaps, new users can stake and bond directly in the Olympus app in fewer steps and without having to leave Olympus’ app. Instead of buying or exchanging tokens to OHM then staking, users can now do this all-in-one transaction using “zapping”, on the Olympus app. Zapping makes it easier for Olympus users to go from X to Y entirely within the Olympus app with:

- X is a token already held

- Y is the end result of staking (resulting in sOHM)

- Bond zapping will also be available in a future release (resulting in sOHM after 5 days and a selected bond LP-pair.)

OlyZaps V2

In March 2022, Olympus DAO introduced OlyZaps V2 with a bundle upgrades after Olympus V2 Migration in December 2021. OlyZaps dispenses V2 assets. Plus, as an added benefit, users have the choice between zapping to sOHM or gOHM. Olympus DAO added this flexibility to allow users to customize zapping to their specific needs.[20][21]

Peapods

Peapods Finance has partnered with Olympus DAO to introduce pOHM as a pairing asset for incentivized pod liquidity providers (LPs). This collaboration aims to enhance liquidity provision within the Peapods ecosystem. pOHM combines stability with growth potential, benefiting from Olympus DAO's Range Bound Stability (RBS) model. The integration of pOHM offers LPs reduced impermanent loss (IL) risks, enhanced yield opportunities through wrap fees, and the potential for increased rewards and burns. This partnership is designed to provide more secure and profitable liquidity options within the Peapods ecosystem. [22]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)