Subscribe to wiki

Share wiki

Bookmark

ALEX

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

ALEX

ALEX, also known as Automated Liquidity Exchange, is a comprehensive DeFi platform explicitly tailored for Bitcoin through Stacks smart contracts. It enables users to participate in activities such as launching projects, earning interest, token swapping, and reshaping financial practices while influencing cultural shifts. Dr. Chiente Hsu, Rachel Yu, and Chan Ahn are the co-founders of ALEX. [1]

Overview

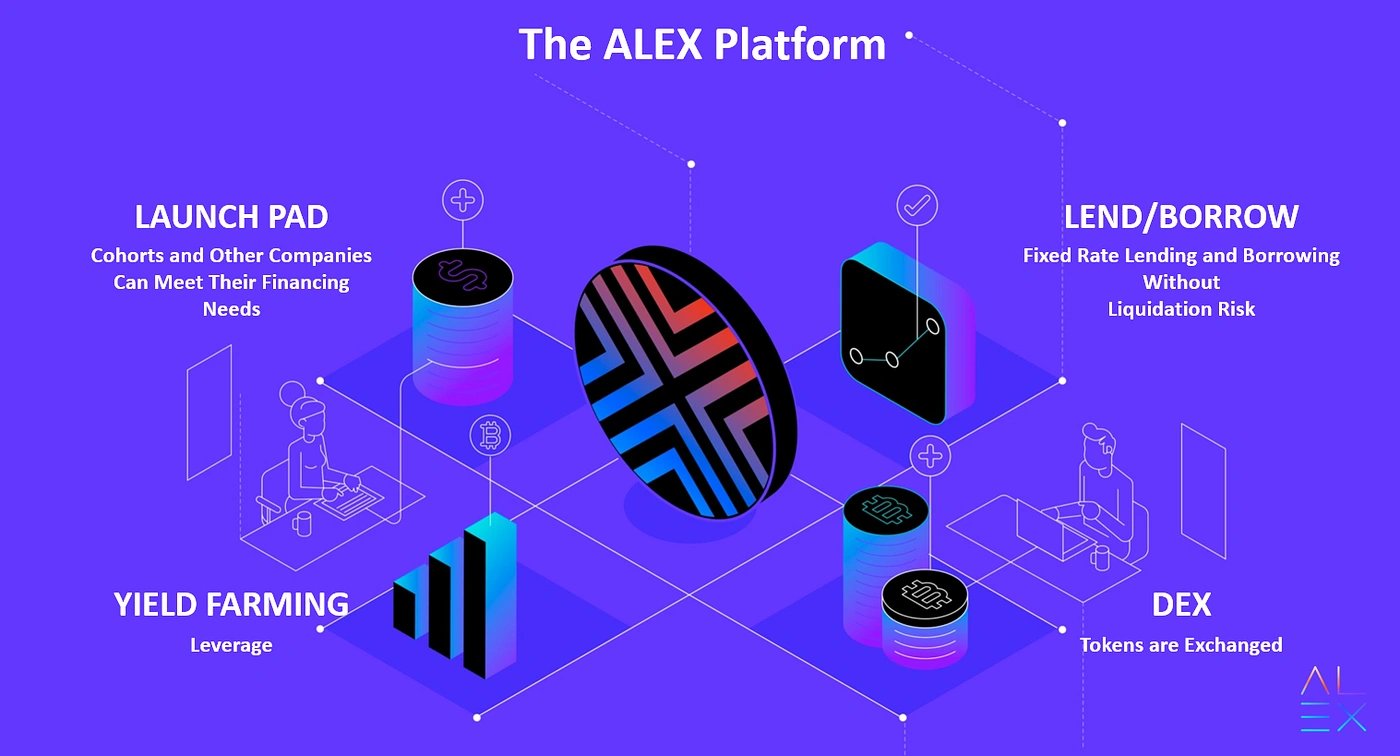

ALEX is a Bitcoin DeFi platform developed on the Stacks network, leveraging the security of the Bitcoin blockchain through its consensus mechanism, proof of transfer (PoX). ALEX operates as an open-source protocol mirroring traditional financial markets, aiming to democratize finance by empowering users with tools for decentralized financial management. The platform offers a range of functionalities, including swapping, yield farming, participation in Initial DEX Offerings (IDOs), and trading Bitcoin Layer 1 (L1) assets such as BRC-20 tokens, benefiting from Layer 2 (L2) programmability and scalability. Additionally, ALEX facilitates features like liquidity pools, staking, a launchpad for new projects, BRC-20 orderbook, lotteries, and cross-chain bridging. [1][2]

ALEX Labs Foundation

The ALEX Lab Foundation operates as a non-profit entity and serves as the hub for governing the open-source technology of the ALEX protocol. Acting as a neutral space, the Foundation facilitates collaboration among stakeholders to establish agreement on future directions. The Foundation aims to evolve into a fully functional DAO, empowering the ALEX community to oversee both on-chain and off-chain governance matters. [3]

Bridge Hack

On May 16, Alex Lab reported that attackers had exploited its BNB Smart Chain bridge, stealing approximately $4.3 million. The breach occurred through the attacker gaining control of a private key, though Alex's smart contract code and underlying infrastructure were not compromised. Alex Lab offered the attackers a 10% bounty for returning 90% of the funds and promised to cease legal action if the funds were returned, but the attackers did not respond. Additionally, the hackers exploited around $13.7 million worth of Stacks (STX) tokens, some of which were sent to centralized exchanges and subsequently frozen. [17]

By June 20, Alex Lab disclosed that the attacker had made over 11,800 STX transactions, using several DeFi protocols and bridges to off-ramp the stolen STX. The team froze over $3.9 million of the crypto assets exploited by its BNB Smart Chain bridge. [17]

On June 25, Alex Lab identified three wallet addresses used by hackers on May 16 to drain $4.3 million from its DeFi protocol. The team collaborated with independent blockchain investigator ZachXBT to gather evidence linking Lazarus to the exploit. Alex Lab also announced a collaboration with international law enforcement and cybersecurity experts to address the attack's implications and recover the lost assets. The platform is also enhancing its security protocols to prevent future incidents. The recovery announcement from May 16 stated that the funds were traced to various centralized exchanges, which cooperated to freeze the assets. The team reported recovering complete balances for 17 different tokens, including all aBTC, sUSDT, xBTC, xUSD, ALEX, atALEX, LiSTX, LUNR, SKO, CHAX, $B20, ORDG, ORMM, ORNJ, TRIO, TX20, and STXS. [17]

Products

ALEX Automated Market Maker (AMM)

ALEX's Automated Market Maker (AMM) operates similarly to a zero-coupon bond in traditional finance, offering borrowers and lenders fixed interest rates and durations upfront. This structure enhances financial planning by reducing uncertainty in loan agreements. Through extensive research, ALEX has refined the AMM concept initially proposed by YieldSpace, implementing modifications such as compounding interest rates and a novel capital efficiency scheme. These adjustments aimed to improve functionality and align with standard financial modeling practices. [4]

ALEX Launchpad

ALEX's Decentralized Launchpad operates with a transparent application and evaluation process, empowering the community of ALEX and atALEX token holders to make decisions collectively. Projects undergo meticulous scrutiny, ranking, and final selection by these token holders, fostering collaboration between emerging Stacks projects and the committed ALEX staking and yield farming community. To participate in IDOs on ALEX, validation through IDO tickets is required, which involves owning both ALEX or STX tokens and APower, an exclusive token earned solely through ALEX staking or yield farming. This process ensures that projects launching on ALEX engage with a dedicated cohort of long-term holders with established staking histories. [5][6]

Bitcoin Oracle

The Bitcoin Oracle is a decentralized tool that tracks and validates transactions involving Bitcoin-based assets. It overcomes the Bitcoin blockchain's limitations in handling complex token operations. Leveraging smart contract functionalities ensures the integrity of BRC-20 tokens and potentially other Bitcoin assets in the future. The Oracle was developed collaboratively by ALEX, Domo, and key partners. It is an infrastructure designed to secure Bitcoin Layer 1 (L1) assets, focusing on BRC-20 tokens. Unlike conventional off-chain indexers, this operates on-chain, providing more transparency and resilience against tampering. [7][8][9]

Functioning as an "Indexer of Indexers," the Bitcoin Oracle aggregates data from various off-chain sources, providing a consolidated and reliable source of truth. This approach reduces concerns related to centralized control and single points of failure, enhancing the security and efficiency of Bitcoin-based assets. The Bitcoin Oracle facilitates new DeFi applications anchored on the established blockchain. [7][8][9]

ALEX BTC (aBTC)

aBTC, or ALEX BTC, is an important component within the Bitcoin ecosystem, functioning similarly to WETH in the Ethereum network. Implemented as a SIP010 token on Stacks, aBTC maintains a 1:1 peg to Bitcoin, facilitated by the Bitcoin Oracle and the XLink Bitcoin Bridge. When users interact with the Bitcoin Bridge by depositing BTC, aBTC is minted, mirroring the received BTC and enabling engagement within the Stacks ecosystem through smart contracts. Conversely, when users seek to convert aBTC back to Bitcoin, the Bridge executes a burning process, removing aBTC from circulation and releasing the corresponding BTC amount to the user's Bitcoin Wallet, effectively managing the circulating supply of aBTC. [10]

$ALEX

The $ALEX token exchanges time value and risk/return preferences within the platform and protocol. It functions as the participation token, granting governance benefits to holders who participate in platform governance. Additionally, $ALEX incentivizes participants to engage in platform activities such as providing liquidity on the decentralized exchange (DEX) and staking. The token can be obtained through various methods, including trading on the DEX, participating in liquidity pools, and staking. $ALEX has three main functions: [11]

- $ALEX tokens incentivize participants to engage in platform activities, such as providing liquidity on the DEX and staking. This is achieved through sustainable emissions of $ALEX tokens, fostering user and partner engagement to drive adoption and ongoing participation.

- Staking involves locking $ALEX or Liquidity Tokens for a chosen period to earn additional $ALEX rewards. Half of the initial token supply is designated for staking, allowing participants to earn rewards by locking their tokens.

- $ALEX tokens also play an important role in governance and community participation within the ALEX platform. They serve as the means for entering and exiting the ALEX community and voting on platform governance matters.

Tokenomics

The Issuer Co introduces an initial supply of 1,000,000,000 (one billion) ALEX governance tokens, denoted as $ALEX. This supply was distributed as follows: [11]

- 20% allocated to the Foundation for the Community Reserve Pool to foster ecosystem growth, support early adopters, and facilitate future ALEX development;

- 50% reserved for community members staking $ALEX or Liquidity Tokens to earn $ALEX

- 30% designated for employees, advisors, early investors, and the founding team

ALEX Staking Power (APower)

ALEX Staking Power (APower) is an exclusive incentive for $ALEX stakers and yield farmers, granting special access to upcoming project initial decentralized offerings (IDOs) on Stacks through ALEX. APower is a non-tradable token obtained by staking $ALEX or LP tokens via Yield Farming on the ALEX platform. Each method has different multipliers: 1x for staking $ALEX and 0.3x for staking LP tokens. [12]

APower functions as a lottery ticket for participation in future IDO rounds on the Launchpad, with no limit on the amount of APower an address can accumulate over time. While staking $ALEX yields APower more rapidly, each IDO may impose a cap on the allocated APower to prevent domination by a small group of participants known as "whales." [12]

Partnerships

XLink

In November 2023, the majority of $ALEX and $atALEX token holders endorsed the evolution of ALEX Bridge into an independent entity named XLink. XLink is a native Bitcoin Bridge, facilitating seamless connectivity between Bitcoin and Ethereum's ecosystem. The ALEX Lab Foundation proposed the separation of the ALEX Bridge into XLink, suggesting that the validators and other key stakeholders governing the bridge would better ensure its security and efficiency. [10][13]

LISA

On February 1st, 2024, ALEX announced a collaboration with Ryder’s Fast Pool and Xverse Pool to create a new liquid stacking protocol called LISA. LISA integrates into the ALEX ecosystem, offering access to unified liquidity and connecting to the extensive Bitcoin DeFi ecosystem. [14][15]

Bifrost Network

On March 22nd, 2024, the Bifrost Network announced a three-way partnership with ALEX and XLink. Integrating ALEX enables users to easily access and utilize decentralized finance services within the Stacks and Bifrost ecosystem, including swaps, stacking, lending, borrowing, and yield farming. This integration also allows users to leverage assets from various blockchain networks. [16]

“Our collaboration with XLink and ALEX represents a significant step towards achieving true interoperability across blockchain networks, including that of Stacks and Bifrost. We are proud to contribute our capabilities to this partnership, unlocking new possibilities for BTC enthusiasts.” - Dohyun Pak, Founder of Bifrost Foundation.

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)