Subscribe to wiki

Share wiki

Bookmark

JonesDAO

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

JonesDAO

Jones DAO is a yield, strategy, and liquidity protocol for DeFi options built on top of the Dopex options platform.[1][2] Jones Dao is available on Arbitrum, a leading L2 scaling solution.[3][4] Jones Dao is governed by JONES token.[1]

Overview

Jones DAO deploys vaults that enable one-click access to institutional-grade options strategies while unlocking capital efficiency and liquidity for DeFi options through yield-bearing options-backed asset tokens. Jones DAO allows users to earn multiple layers of yield on their assets of choice. Depositors can unlock a risk and yield profile unique to Jones DAO and their personal preferences by combining the power of jAssets, Synthetic LPs (SLPs), and JONES farming. The Jones Synthetic LPs replicate the payoff structure of a regular LP by writing options on the underlying assets.

jAssets

jAssets are fully composable yield-bearing tokens that aid tokens deployed in Jones yield strategies to gain liquidity and capital efficiency. These jAssets can only be minted when deposits are made to a primary Jones Vault, which is used to represent the deposit of a specific Asset e.g ETH.

The jAsset token is burned upon withdrawal, and the deposit made initially, including yield is returned to the depositor. jAssets also have incentivized liquidity pools. These liquidity pools enable users to swap out of their Jones Vault position and the underlying locked assets at any time.[3]

Vaults

Jones DAO provides vaults for a variety of assets and risk profiles. It generates yield by deploying options strategies on assets deposited in Jones Vaults. [9]

Jones has several vaults that cater to different risk profiles of traders, they include:

- ETH primary vault, risk-averse

- gOHM primary vault, bull long vault

- DPX primary vault, risk-averse

- rDPX primary vault, risk-averse

Each vault has a given period, a time window in which the vaults are open for individuals to deposit and withdraw. Users can deposit their tokens and for primary vaults mint jAssets throughout this time, or withdraw their tokens and claim their yield by burning their jAssets. When the Jones Vaults get locked, deposits are further closed till the next set time. During this time, the vaults can then be curated by the DAO's strategies. Also, deposits can not be transferred out of the vault, but jAssets can be exchanged for other tokens on SushiSwap through the DAO's jAsset liquidity pools.[11][5]

Primary Jones Vaults

The primary Jones Vaults aim to produce risk-averse and stable yields in all market conditions, as they are more safer and conservative. It is used to mint jAssets, with Metavaults for different risk profiles.

Most tokens deposited into this vault are used to earn yield by writing covered calls, and by supplying these Assets to other platforms that give out these call options.[10]

Auxiliary Jones Vaults

The Auxiliary Jones Vaults use more directional/aggressive options strategies to address various risk profiles. These vaults can not be used to mint jAssets as they have variable ratios of selling/buying options according to their risk profile.[12]

Metavaults

Metavaults can best be defined as vaults that hedge or lever Dopex LP tokens for impermanent loss protection or extra yield.[15] Users provide $DPX or $rDPX LP tokens obtained via DEX LPs and deposit those into the Metavault of their choice on Jones’ interface. Depositors decide their market sentiment and deposit into the directional vault that best suits their market outlook. Instead of the typical vault structure, users deposit at any time via an epoch that is one week long.[16]

Tokenomics

veJONES

veJONES are earned when a user locks JONES. The veJones design is based on the governance models implemented by Curve Finance, Badger, and Ribbon Finance.

- veJONES holders are able to vote on gauge weights for Jones Vaults and jAsset pools. This aligns the usage of the platform with long-term JONES holders. For example, depositors in the ETH Jones Vault can purchase and lock JONES, to vote for greater JONES emissions for the ETH Jones Vault.

- veJONES gauges on jAsset pools and Jones Vault allow the protocol to direct emissions only at the Vaults and Pools that people use and in this way nflation becomes optimized.

- Users can purchase and lock JONES for veJONES to earn a portion of protocol fees and additional JONES emissions.[14]

Users that have locked veJONES are also entitled to a rewards Boost.[16]

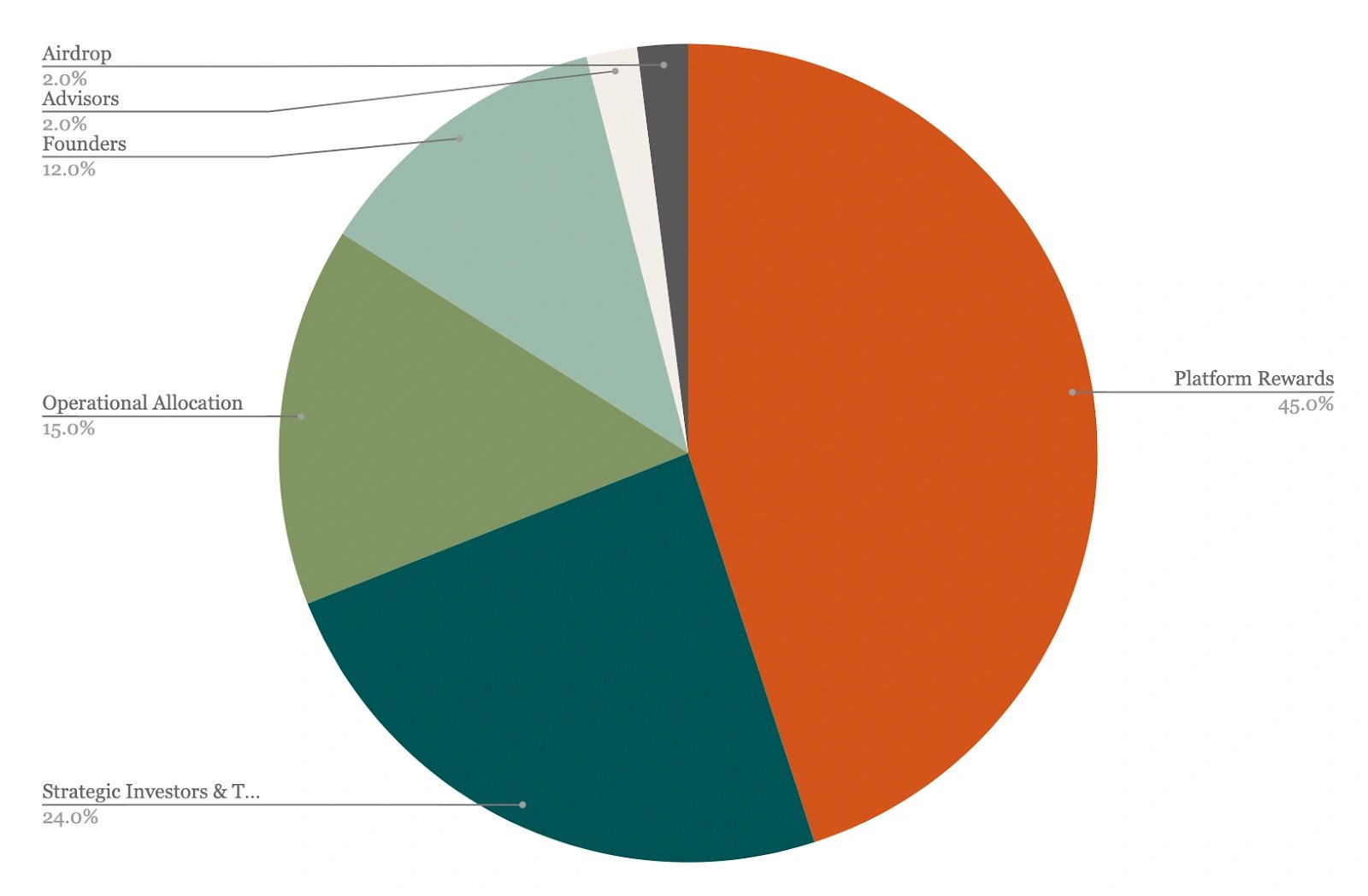

Token Distribution

The token has a total supply of 10,000,000 JONES coins.

| Allocation | Percentage% | Vesting Period |

|---|---|---|

| Operational Allocation | 15% | This allocation is used to handle governance, incentivize community contributions and strategists, help grow the platform and recruit talent, and account for operating and growth costs. |

| Platform Rewards | 42% | Distributed over approximately 5 years. These rewards will incentivize the use and upkeep of the Jones DAO platform. |

| Core Contributor Allocation | 12% | Vested for 18 months and distributed using a drip system via a smart contract. |

| Public Sale | 17% | |

| Private Sale | 9.67% | 3-month cliff, and then vested over 6 months. |

| Airdrop | 1% | Split between guarded launch members and Dopex SSOV users. |

| Olympus | 3.3% | The proposed allocation for OlympusDAO to be held in perpetuity.[17] |

Protocol fees

The current protocol fees are earned on total TVL, and on Jones Vaults' performance, which are:

- 2% annual fee on total TVL, applied at each epoch.

- 20% performance fee on yield generated.[17]

Partners

- Dopex

- Olympus Dao

- GMX

- PlutusDAO

Hat Council

- Tetranode

- DeFifrog

- Redacted

- Olympus Dao

- David Iach

- Small Cap Scientist

- Sami

- Dark King

- Revofusion

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)