Subscribe to wiki

Share wiki

Bookmark

Kelp DAO

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Kelp DAO

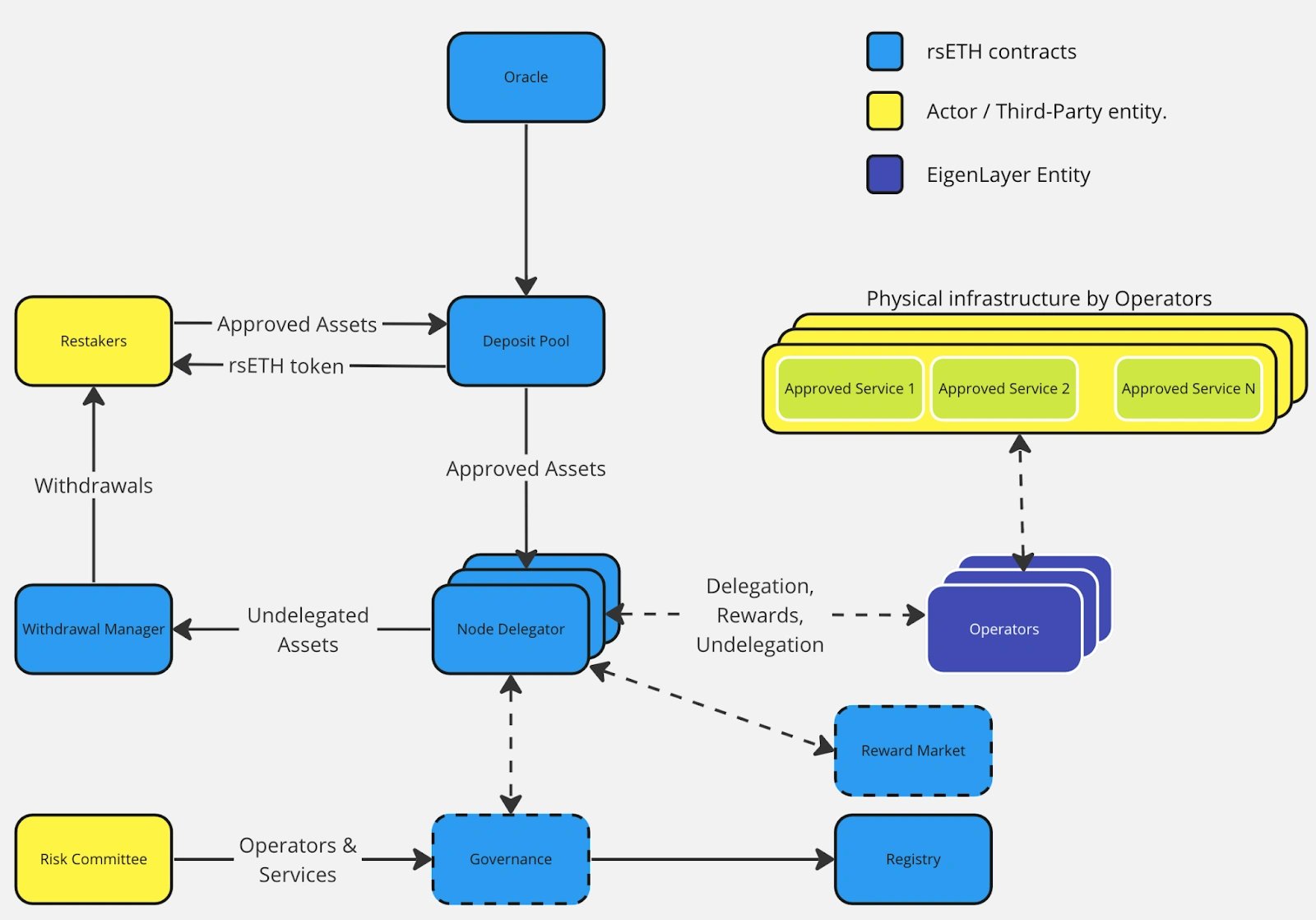

Kelp DAO is a cross-chain staking solution for Ethereum and EigenLayer. It concentrates on developing Liquid Restaking Solutions for public blockchain networks. The Kelp DAO team is constructing an LRT solution named rsETH for Ethereum on EigenLayer. Amitej Gajjala and Dheeraj Borra are the co-founders of Kelp DAO. [1]

Overview

Launched in November 2023, Kelp DAO is a cross-chain liquidity staking platform for Ethereum and EigenLayer. It facilitates the validation and security of EigenLayer modules by directing Ethereum validators' withdrawal credentials to EigenPods. This mechanism enables ETH tokenholders with less than the 32 ETH threshold for a validator node to stake ETH on Ethereum and restake it on EigenLayer. [2][3]

Kelp DAO streamlines the process for users to stake their cryptocurrency holdings. Traditionally, staking has been limited to a single blockchain, but Kelp DAO innovates by enabling multichain staking. It accomplishes this through wrapped tokens, representing cryptocurrencies on different blockchains, allowing users to stake assets across various chains. [2][3]

Kelp DAO pools together staked assets from users to form liquidity pools utilized for DeFi applications across blockchains. By contributing to these pools, users earn rewards from sources like trading fees and protocol incentives. [2][3]

On May 22nd, 2024, Kelp DAO announced it had raised $9 million in a private token sale round. SCB Limited and Laser Digital led the round with a combined $3.5 million investment. Other investors included Bankless Ventures, Hypersphere Ventures, Draper Dragon, DACM, Cypher Capital, GSR, HTX Ventures, and DWF Ventures. Angel investors such as Scott Moore, Sam Kazemian, Marc Zeller, Saurabh Sharma, and Amrit Kumar participated. Kelp began the fundraising in February and closed the round in March with a fully diluted valuation of $90 million. [11]

KEP Token

$KEP, or Kelp Earned Points, is an ERC-20 token associated with EigenLayer Points earned through the Kelp platform. Each $KEP equals one EigenLayer Point. Users have full control over their accumulated EigenLayer Points, including storing, trading, and utilizing them according to their preferences. Restakers can claim their $KEP tokens via the Kelp decentralized application. Weekly, restakers can claim $KEP corresponding to the EigenLayer Points earned the preceding week. [4]

As an ERC-20 token, $KEP enables free transfer and trade, enhancing the liquidity of EigenLayer Points and potential restaking rewards. Restaking ETH or LSTs isn't the only method to acquire EigenLayer Points; $KEP offers an alternative, making restaking capital efficient and introducing segmentation among different user groups. These groups include Point Producers, who generate EigenLayer Points and $KEP, and Point Accumulators, who trade/buy/sell/long/short $KEP and may not necessarily possess ETH capital for restaking. [4]

Immediate use cases for $KEP encompass trading on Automated Market Makers (AMMs) and providing liquidity on Decentralized Exchanges (DEXs) with $KEP <> rsETH, $KEP <> USDC pairs to earn rewards such as kelp miles and swap fees. [4]

rsETH

rsETH is a unified liquid restaked token generated from LSTs approved as collateral on EigenLayer. It enables fractional ownership of staked assets, simplifies access to restaking and decentralized finance (DeFi), and utilizes composability within DeFi protocols. Additionally, it resolves issues such as intricate reward systems and excessive gas fees. [2][5]

Kelp Miles

Kelp Miles complements EigenLayer restaked points, providing extra incentives for restakers. They aim to enhance the rewards of restaking and offer proportional incentives based on restakers' contributions. DeFi participants using rsETH can earn Kelp Miles, EigenLayer points, and extra yields from DeFi activities. Kelp will further incentivize DeFi opportunities by offering boosted Kelp Miles, providing users with added benefits for engaging in DeFi. [6]

Pendle Finance

Kelp DAO users can use rsETH to engage with Pendle, a protocol that enables the tokenization and trading of future yield, through four main positions: [7]

- PT-rsETH: The PT position represents only the principal amount at maturity. It involves depositing rsETH into the Pendle protocol for a set duration, earning a fixed yield upon maturity. With this strategy, you receive PT-rsETH at a discounted rate based on the exchange rate. At maturity, you receive 1 ETH worth of rsETH for each PT-rsETH, constituting your yield. Notably, this position doesn't earn EigenLayer points or Kelp Miles; it's solely for securing a fixed yield. Additionally, PT-rsETH can be sold at any time before maturity.

- YT-rsETH: The YT position represents the yield of the underlying asset until maturity. Each YT-rsETH grants you all the yield and points generated by 1 ETH worth of rsETH until pool maturity. The price of YT is determined by market rates, reflecting how the market values it. For instance, if 1 rsETH trades for 10 YT-rsETH, users earn Miles and Points equivalent to 10 ETH worth of rsETH for each YT-rsETH. Speculation on the price of YT-rsETH can be based on factors like Long Yield APY, EigenLayer points, and Kelp Miles, but thorough research is advised.

- LP-rsETH: The LP position comprises PT-rsETH and SY-rsETH, with the SY portion earning yield. This setup minimizes Impermanent Loss (IL) by providing single-asset exposure. Benefits include EigenLayer Points, boosted Kelp Miles, staking/restaking yield, fixed yield from PT-rsETH, swap fees, and Pendle Incentives.

- Liquid Lockers: rsETH is accessible on Penpie and Equilibria, two of Pendle’s liquid lockers.

Partnerships

Integrations

Along with Pendle, Kelp DAO has also been integrated into Uniswap, Curve, and Balancer. Users who provide liquidity can earn 3x Kelp Miles and Eigenlayer Points. [7]

Polyhedra (ZK)

On April 16th, 2024, Kelp DAO partnered with Polyhedra (ZK), a next-gen Web3 infrastructure developer using zero-knowledge proofs (ZKP). With this partnership, Polyhedra received $300 million in staked ETH to bolster the security of its protocol. [8]

Laser Digital

On April 26th, 2024, Kelp announced a strategic partnership with Laser Digital, Nomura Group’s digital asset subsidiary. This partnership introduced restaking solutions to Laser Digital’s current and future digital funds, making rsETH the first LRT to be incorporated into a digital fund. [9]

Planar Finance

On May 12th, 2024, Planar Finance announced its partnership with Kelp DAO. Through this partnership, the goal was to optimize yield by harnessing various reward sources from both protocols. [10]

Anzen Protocol

In June 2024, Kelp announced a partnership with Anzen protocol to enhance payment optimizations between AVSs and restakers. [12]

On why the team partnered with Anzen, they responded:

"Anzen stands out as the first platform dedicated to optimizing payments for AVS-to-restaker interactions. Their system dynamically adjusts economic safeguards through a real-time ‘Safety Factor’ (SF), akin to a health metric in DeFi, ensuring stability and security."

The collaboration is expected to boost returns and fortify security for the community’s restaked ETH. [12]

Gain by Kelp

Introduced on August 13, 2024, Gain, powered by Kelp is a step forward in optimizing rewards for users. The program enhances earning potential by providing streamlined access to multiple Layer 2 (L2) airdrops and DeFi opportunities through a single, diversified strategy. [13]

"Gain acts as your degen concierge, offering access to multiple L2 networks and DeFi protocols all at once. It simplifies participation in airdrop opportunities and DeFi strategies without the need for constantly monitoring individual positions. With just one click, users can unlock a world of high-growth opportunities." - the blog mentioned[13]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)