Subscribe to wiki

Share wiki

Bookmark

Limitless Exchange

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Limitless Exchange

Limitless Exchange is a decentralized prediction market platform built on the Base network. It is designed for trading on event-based outcomes, with a focus on short-term asset price movements through nonstop hourly and daily markets for crypto and stock prices. The platform utilizes a Central Limit Order Book (CLOB) model for trading and supports the creation of markets based on natural language expressions. It aims to provide fast, low-cost trading with on-chain settlement, and has processed over $497 million in trading volume. [3] [7]

Overview

Limitless Exchange operates as a decentralized prediction market platform on the Base blockchain, emphasizing speed and reduced transaction costs through its order-book interface. The platform supports both market and limit orders, facilitating on-chain settlement without relying on Automated Market Maker (AMM) models or complex pricing curves, such as those based on the Logarithmic Market Scoring Rule (LMSR). By employing a hybrid architecture, Limitless seeks to lower gas fees and simplify the user experience compared to some alternative prediction market designs. Users buy shares in the outcomes of specific conditions, typically "Yes" or "No." For example, a user might buy "Yes" shares for the outcome "BTC will reach $65k" at a price of $0.15, implying a 15% probability. If the outcome is realized, winning shares expire at a value of $1 each, while losing shares become worthless after the market is resolved. A key mechanism of the platform is that prior to resolution, one "Yes" share and one "No" share from the same market can be redeemed for one unit of the collateral token, which is typically USDC or Wrapped ETH. [7]

The platform is designed for accessibility and capital efficiency, allowing for the creation of markets based on natural language conditions and minimizing barriers to entry. Users can trade directly from their cryptocurrency wallets without requiring extensive onboarding processes, and the platform has introduced a mobile-first trading interface to further enhance accessibility for a global user base. While primarily permissionless, the platform incorporates optional features to support regulatory compliance when necessary. Limitless also works to improve market liquidity and execution quality across various market types by potentially aggregating depth through cross-chain bridges and oracle integrations, aiming for tighter bid-ask spreads. [7] [1] [2]

Features

CLOB

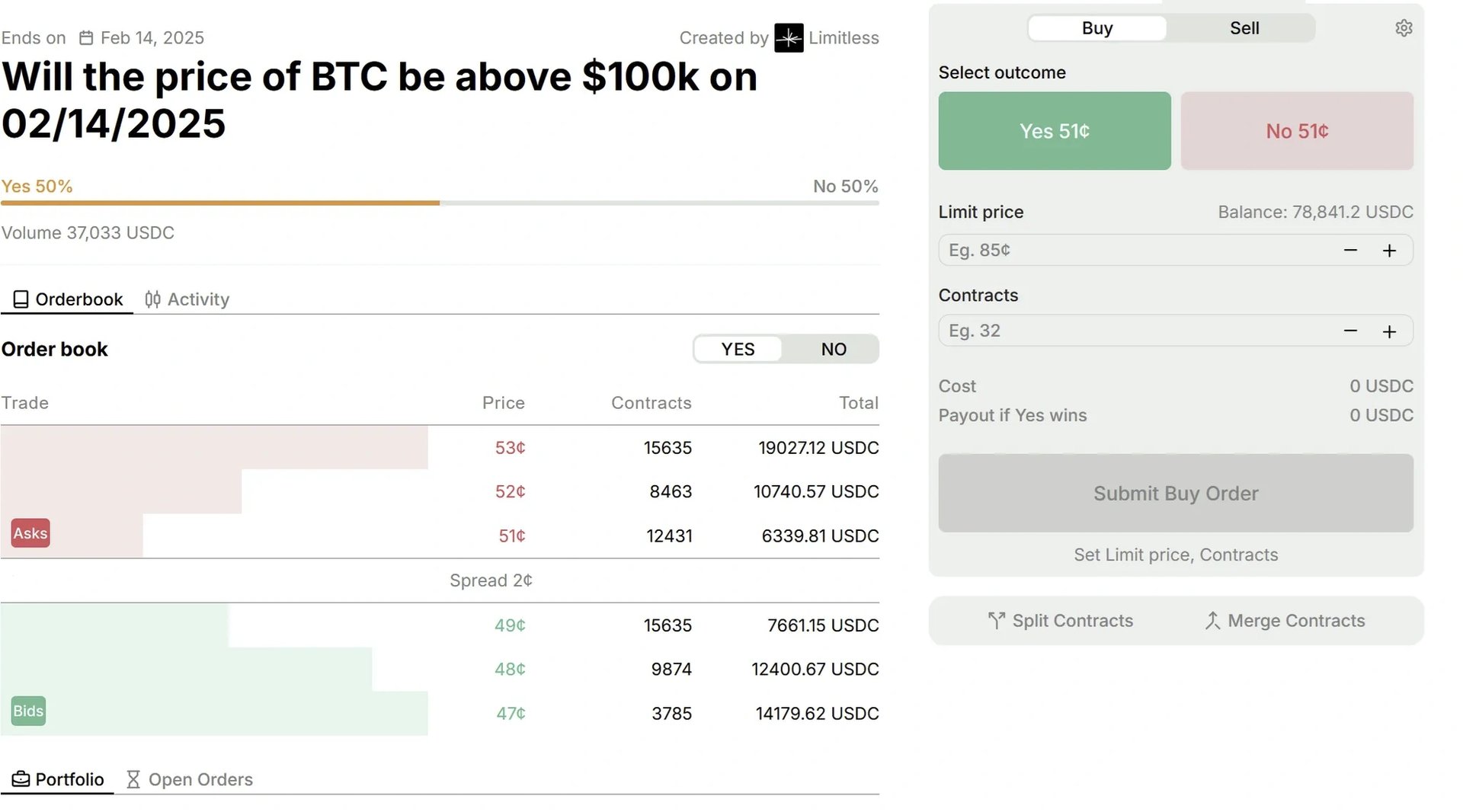

Limitless Exchange implements a Central Limit Order Book (CLOB) system to manage the trading of prediction market shares. This structure is similar to those found in traditional financial markets. Each market features separate "Yes" and "No" order books, which list all active Bids (buy orders) and Asks (sell orders). For instance, if traders are offering to sell "Yes" shares at $0.51 (the ask) and bidding to buy them at $0.49 (the bid), a market order to buy would execute at $0.51. The difference between the highest bid and the lowest ask is known as the spread, with a lower spread indicating higher market liquidity. [7]

Traders can place market orders for immediate execution at the best available price, or limit orders to specify the exact price at which they wish to buy or sell shares. Limit orders are added to the order book and are filled when a matching order is found. Orders placed closer to the prevailing market price generally have a higher probability of being executed. Users who contribute liquidity by placing competitive limit orders may be eligible for rewards through the platform's liquidity provider (LP) incentive program.

A unique feature within prediction markets supported by Limitless is the ability to merge and split shares. Users can, at any time, convert $1 of collateral into one "Yes" share and one "No" share for a specific market. Conversely, one "Yes" share and one "No" share from the same market can be combined back into $1 of collateral. This mechanism is designed to enhance capital efficiency for traders and help consolidate liquidity across opposing outcomes within a market, thereby contributing to improved order book depth and matching. [7]

Negrisk

Negrisk, also referred to as category markets on Limitless, represents a type of prediction market where multiple potential outcomes are defined, but only one can ultimately be true. This structure is analogous to a multiple-choice question. While each outcome within a Negrisk market has its own "Yes" and "No" order book, the "No" shares across all possible outcomes in that market are linked.

This interconnectedness enables a share conversion feature. A trader holding a single "No" share for one outcome (e.g., "ETH is NOT $2,000") can convert it into one "Yes" share for all other possible outcomes within that market. This is based on the logic that if one outcome is false, one of the others must be true. If a trader holds multiple "No" shares and there are not enough corresponding "Yes" shares available for a full conversion, the excess "No" shares can be converted directly into the market's collateral currency, typically USDC. This process functions as a built-in arbitrage mechanism that helps maintain price alignment across related outcomes.

Negrisk markets are designed to enhance capital efficiency for traders by enabling them to easily shift positions between related outcomes or take broader bets (e.g., predicting that a specific event will not occur, implying that one of the other possibilities will). The ability to convert excess "No" shares into collateral also provides a mechanism for unlocking capital. Furthermore, Negrisk markets can serve as a source of forward-looking data, potentially powering financial dashboards that provide insights into market expectations for various events, such as asset price ranges, interest rate changes, or company valuations. These data streams can be used to inform trading strategies, portfolio management, or risk assessment. [7]

LP Rewards

The Liquidity Provider (LP) Rewards program on Limitless is designed to incentivize users who contribute liquidity to the platform's markets by placing limit orders. Rewards are calculated and distributed based on factors including the proximity of the limit order to the market's midpoint price and the size of the order. To qualify for rewards, orders must meet or exceed a minimum size threshold specified for each market. The program aims to encourage the placement of competitive limit orders, which helps to reduce the bid-ask spread and increase the depth of the order books, contributing to a more robust trading environment.

Each market on Limitless has specific parameters that govern the distribution of LP Rewards. These parameters typically include the total daily USDC reward pool for the market, the maximum spread from the midpoint an order can have to earn rewards (e.g., 3 cents), and the minimum order size required to qualify (e.g., 100 shares). A bonus multiplier is applied to orders placed closer to the midpoint, further incentivizing tighter spreads. To promote balanced liquidity, rewards for one-sided liquidity provision are restricted to markets where the outcome odds are between 5% and 95%. The platform notes that these parameters are dynamic and may be adjusted to meet market needs. [7]

Points Program

In anticipation of a future token generation event (TGE), Limitless launched a points program to incentivize user engagement and platform growth. The program is designed to reward users for various activities, including trading, providing liquidity through limit orders, and referring new users to the platform. These points are intended to track user contributions to the ecosystem ahead of a potential token launch. [2] [3]

Team

Limitless Labs was founded in December 2023 by CEO CJ Hetherington, Roman Mogylnyi, Dima Horshkov, and Rev Miller [4].

Binance Listing Controversy

In October 2025, CEO CJ Hetherington publicly commented on the token listing process of the cryptocurrency exchange Binance. On October 14, Hetherington posted on the social media platform X what he alleged was a listing offer from Binance. The purported terms included requirements for the project to provide a significant portion of its token supply for airdrops and marketing, a $250,000 security deposit, and $2 million worth of BNB tokens as collateral for a spot listing [5] [6].

Binance publicly refuted the claims, stating that the exchange "does not profit" from its token listing process and that allegations of token dumping by the company were "untrue and unsubstantiated." In a statement, Binance characterized Hetherington's claims as "false and defamatory" and criticized the "illegal and unauthorised disclosure of confidential communications." The exchange clarified that it does not charge listing fees and that security deposits are typically refundable within one to two years to protect users. Binance reserved the right to pursue legal action in response to the disclosure [6] [5].

Funding

As of July 2025, Limitless Exchange had raised a total of $7 million across two funding rounds. The initial $3 million pre-seed round was led by 1confirmation, with participation from Paper Ventures, Collider, Public Works, Anagram, Figment Capital, and individuals from Polygon and Monad [4]. In July 2025, a subsequent strategic funding round raised an additional $4 million. This round included investment from Arthur Hayes, through his family office Maelstrom, who also joined as an advisor. Other participants in the project's funding include Coinbase Ventures, Node Capital, Punk DAO, and WAGMI Ventures, with individual investors also contributing via the Base Ecosystem Fund group on Echo [2].

The strategic funding round occurred after the platform gained traction with its short-term prediction markets, which allow users to speculate on asset price movements over short durations, including hourly expiries. These markets, described as similar in nature to 0DTE options but with a simpler trading experience, reportedly accumulated significant trading volume shortly after their introduction, with total platform volume later exceeding $497 million. [3] [2]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)