Subscribe to wiki

Share wiki

Bookmark

Renzo Protocol

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Renzo Protocol

The Renzo Protocol is a Liquid Restaking Token (LRT) and Strategy Manager for EigenLayer, providing access to the EigenLayer ecosystem. It secures Actively Validated Services (AVSs) and simplifies collaboration between users and EigenLayer node operators. Lucas Kozinski, James Poole, and Kratik Lodha are the founders of Renzo. [1]

Overview

Launched in December 2023, Renzo, a Liquid Restaking Token (LRT) and Strategy Manager operates within the EigenLayer ecosystem. It simplifies user interactions and fosters seamless collaboration with EigenLayer node operators. It aligns with EigenLayer's mission of enabling permissionless innovation on Ethereum and establishing trust within the ecosystem. Renzo is the go-to platform for Ethereum restaking, offering a higher yield than ETH staking and promoting the adoption of EigenLayer. It achieves this by minting an equivalent amount of ezETH for every LST or ETH deposited. It uses smart contracts and operator nodes to secure an optimal risk/reward restaking strategy. [1]

REZ

Launched on April 30th, 2024, REZ serves as the native governance token within the protocol, allowing holders to vote on governance proposals encompassing diverse matters. These proposals may cover operator whitelisting, Actively Validated Services whitelisting, frameworks for overall risk management, community and treasury grants, and specifications regarding concentration amounts, collateral assets, and deposits. [1][2]

REZ Airdrops

The Season 1 airdrop followed a linear distribution based on a user's ezPoints balance. Renzo collaborated with a third-party data analytics company to identify sybil wallets and established a minimum ezPoints threshold per wallet as of the snapshot date for token distribution eligibility. Wallets with over 500k ezPoints were subject to a 50% unlock at the token generation event (TGE) and 50% linear vesting over three months. Season 1 concluded on April 26th. User eligibility was based on the ezPoints balance in their wallet at the time of the snapshot, regardless of their current ezETH balance. [10]

The Season 2 campaign, which started on April 26th, aimed to support ongoing growth, reward early users, and enhance the utility and distribution of ezETH across all supported networks. Season 2 featured boosted points for ezETH holders in user wallets and supported DeFi integrations. It distributed 5% of the total supply (500M $REZ) to the community over three months until July 26th. All Season 1 users received a 10% additional boost on their total ezPoint balance at the end of Season 2. [11]

Tokenomics

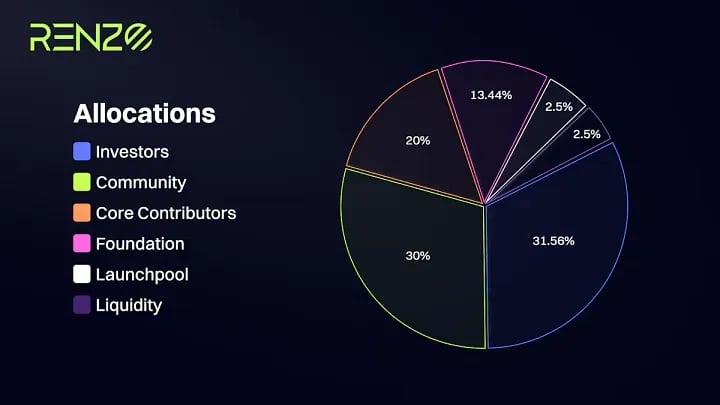

The maximum supply of REZ tokens is limited to 10B and has the following allocation: [1][2]

- Fundraising: 31.56%

- Intended for the project’s early investors.

- Community: 32%

- 7% allocated for Season 1 airdrop rewards based on earned ezPoints.

- Allocated for various community campaigns.

- 5% designated for the second season of incentives.

- Core Contributors: 20%

- Distribution to Renzo Labs’ team and advisors.

- Foundation: 12.44%

- Binance: 2.5%

- Liquidity: 1.5%

ezETH

ezETH functions as the Liquid Restaking Token (LRT) within the Renzo Protocol, symbolizing the user's restaked position. Participants can stake native ETH or liquid staking tokens (LSTs), like wBETH and stETH, and in return, acquire ezETH. Notably, ezETH is a reward-bearing token, implying that its value has the potential to surpass that of the underlying tokens due to its yield enhancement within Actively Validated Services (AVSs). [2]

pzETH

pzETH is a liquid restaking token representing a user's restaked position within the Symbiotic ecosystem. Users can deposit assets like stETH, wstETH, wETH, or ETH to receive pzETH, which secures Actively Validated Services (AVSs) and generates staking and restaking rewards. Upon deposit, pzETH automatically supports AVSs without requiring users to manage strategies or interact with smart contracts. Withdrawals are possible from day one, with full redemption available for the underlying collateral. Through Symbiotic, users earn rewards by restaking assets to support decentralized applications and services. [9]

ezPoints

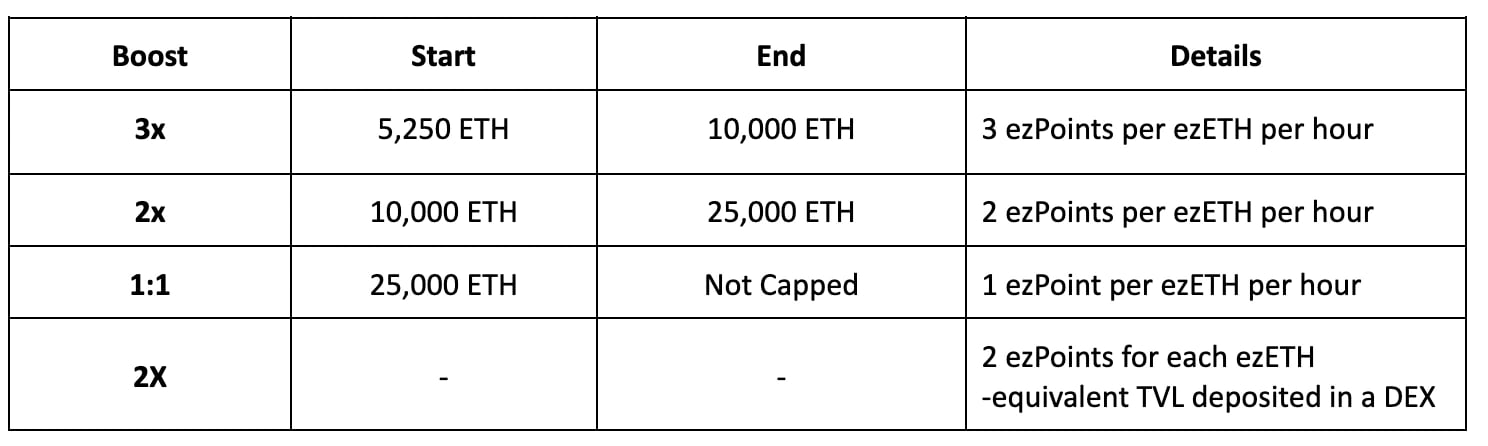

Renzo's ezPoints system aims to incentivize active participation and contribution to the protocol's success. Participants are rewarded with points based on their involvement, with the quantity varying according to the duration and nature of their engagement. Holding ezETH is one way to earn ezPoints, with holders receiving 1 Renzo ezPoint per hour for each ezETH held. Early participants and those with larger ezETH holdings receive additional points. [1]

ezEIGEN

ezEIGEN is a token designed to streamline the EIGEN restaking process. It automates reward claiming from multiple AVSs, including EigenDA, and auto-compounds those rewards to improve efficiency. The automation reduces gas fees and is built on the same secure technology as Renzo’s ezETH product. By simplifying key processes, ezEIGEN makes restaking more accessible, potentially encouraging wider adoption. [7][8]

Partnerships

Connext Network

Renzo Protocol has partnered with Connext Network to introduce cross-chain Native Restaking to Layer 2 networks. This collaboration enables ETH/wETH holders to restake on prominent Layer 2 chains supported by Renzo, offering increased liquidity and accessibility while simplifying the complexities of conventional restaking processes. Additionally, Renzo plans to extend support for LST restaking on Layer 2 networks. Integrating Renzo with Connext and Chainlink's Cross-Chain Interoperability Protocol (CCIP) ensures a smooth and seamless cross-chain Native Restaking experience for users. [1]

Pendle

On January 31st, 2024, Renzo unveiled its integration with DeFi yield protocol Pendle Finance. This integration operated through a single contract, the EIP5115 SY token, representing ezETH at a 1:1 ratio. The SY tokens could be tokenized into principal tokens (PT) and yield tokens (YT). [3]

Chainlink

On March 20th, 2024, Renzo announced its integration with Chainlink Price Feeds on Ethereum mainnet, Arbitrum, and Linea. This integration allowed Renzo’s ezETH to access reliable and tamper-proof price feeds, facilitating secure and expanded access to advanced liquid restaking strategies and providing users with industry-standard price data for Renzo DeFi integrations. [4]

Investors

- Binance Labs

- Maven 11 Capital

- OKX Ventures

- IOSG Ventures

- Bitscale Capital

- SevenX Ventures

- Robot Ventures

- Figment Capital

- Mantle

Seed Funding Round

On January 15th, 2024, Renzo raised $3.2 million in seed funding. Maven11 Capital led the round, which also included participation from Figment Capital, SevenX Ventures, IOSG Ventures, and other investors. [5]

June Funding Round

On June 18, 2024, Renzo announced it had raised $17 million in a funding round, according to a press release shared with CoinDesk. The funding, conducted over two rounds, was led by Galaxy Ventures in the first round and Brevan Howard Digital Nova Fund in the second. The capital will be used to expand the project's restaking services, including adding support for ERC-20 tokens. [6]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)