Subscribe to wiki

Share wiki

Bookmark

Synthetix

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

Synthetix

Synthetix is a derivatives liquidity protocol built on Ethereum, facilitating the creation and trading of synthetic decentralized assets. The platform was founded in 2017 by Kain Warwick. [1]

Synthetic assets, referred to as Synths, are ERC-20 tokens designed to mirror the price movements of external assets. [1]

Overview

Synthetix launched in late 2017, originally under the name of Havven. The company was founded by Kain Warwick, who is based in Sydney, Australia. These synthetic assets are collateralized by the Synthetix Network Token (SNX), which allows the issuance of synthetic assets (Synths) when locked into the contract.[2]

On November 12, 2020, Synthetix began to offer users the ability to trade Brent Crude Futures Contracts on its platform. This was achieved by pulling syndicated data from the Intercontinental Exchange (through Chainlink for an undisclosed amount) and feeding the data through the new Synthetic Oil token (ticker symbol sOIL).[5][6] There is also a short crude oil future listing on the platform with the ticker symbol $iOIL, as $sOIL is for long crude oil futures. [7[8]

On November 30, 2020, Melon (MLN) announced that it would be supporting Synths on its protocol after the Melon Council approved this decision.[9] Assets such as synthetic fiat currencies, synthetic commodities, synthetic main cryptocurrencies, and various other assets that are on the Synthetix platform are to be supported on the protocol.[10] While not readily available, both firms and communities of the firms will be working together to promote the use of Synths on Melon's platform. [11]

Synths

Synths are tokens that provide access within the Ethereum blockchain to assets such as gold, Bitcoin, U.S. dollars, TESLA, and AAPL. Synthetix protocol's aim is to enable a variety of trading features including binary options, futures, and more. [3][4]

Synths are able to track the underlying asset price and they allow holders to gain exposure to different asset classes on Ethereum without having to hold the underlying assets themselves or trust a custodian. Synths are supported by the Synthetix Network Token (SNX), which is staked at a ratio of 750% as collateral. [1]

Synthetix DAO

The Synthetix Protocol incorporates several governing bodies and structures to maintain decentralization. Key decentralized councils and DAOs include the Spartan Council, Treasury Council, Ambassador Council, and Grants Council, all elected by Synthetix Stakers. The governance process involves artifacts such as Synthetix Improvement Proposals (SIPs) and Synthetix Configuration Change Proposals (SCCPs) outlining proposed protocol changes. Implementation is carried out by Synthetix Core Contributors under the management of the Core Contributor Committee. [23]

Spartan Council

The Spartan Council (SC) operates as a governing Decentralized Autonomous Organization (DAO) with 8 elected members overseeing Synthetix, elected by community staking participants for the duration of an epoch. Established through SIP-93, the SC conducts interviews for Synthetix Improvement Proposals (SIP) and Synthetix Configuration Change Proposals (SCCP). Their main tasks include discussing proposed changes, coordinating with the protocol DAO, and hosting regular governance meetings to represent and protect Synthetix stakeholders. SC members receive stipends from the Synthetix DAO for their services and conduct their duties using snapshot's IPFS signature voting on the staking governance site. [24]

In addition to voting on SIPs and SCCPs, SC members manage the signing keys for a multi-signature Gnosis safe containing the security bonds of all protocol DAO members. They have the authority to reduce a member's security bond if malicious behavior or bypassing legitimate governance processes is identified. Apart from these responsibilities, SC members engage in various protocol-related activities based on their expertise, including extended security research, testing, community engagement, and communication. [24]

Treasury Council

The Treasury Council's main role is to ensure resources are available for the protocol's growth. This involves managing the treasury to provide ongoing funding for protocol costs, council and Core Contributor stipends, ecosystem incentives (including Grants Council funding), and other discretionary incentives. Council members handle treasury management using a Gnosis-safe multi-signature system, requiring collective approval for key decisions. The focus is on maintaining financial stability, sustaining funding for essential needs, and strategically allocating resources to support the protocol's overall development. [25]

Ambassador Council

The Ambassador Council focuses on promoting Synthetix's interests in the DeFi ecosystem through governance and partnerships. In governance, they actively seek influence in protocols beneficial for Synthetix and vote on proposals for token holders. In partnerships, the Council collaborates with Synthetix integrators to facilitate integration within the Synthetix Ecosystem. Comprising five elected members, the Council stays informed about DeFi governance matters and promotes knowledge sharing through Spartan Town Halls on the Synthetix Discord platform. [26]

Grants Council

The Grants Council is responsible for distributing funds for public goods through grants, initiative bounties, or competition prizes. Its focus is on supporting projects that create valuable, high-quality work for the community, prioritizing impact over profit margins. Projects are chosen based on the value they can add to the community rather than the value they can extract. [27]

Synthetix v3

Synthetix v3 was deployed on Optimism and Ethereum Mainnet in February 2023 after a thorough audit from Macro, Iosiro, and Open Zeppelin. [14]

The deployment of V3 does not include any associated markets. Its main purpose is to generate a collateralized debt position that serves as a stablecoin denominated in dollars, to subsequently be utilized within integrated markets. [14]

The Synthetix v3 also includes Liquidity Providers (LPs) that can delegate collateral to Pools. LPs can mint sUSD by taking a loan against their collateral, which increases their rewards and the circulation of the native stablecoin. [14]

Pools accept collateral from LPs and can be configured by the pool owner to collateralize derivative markets. There can be a many-to-many relationship between Pools and Markets, as Pools can back multiple Markets, and Markets can be backed by multiple Pools. [14]

In Synthetix v3, Markets use a combination of price oracles and synthetic assets to create a product offering for end users. They charge fees for doing so and return earnings to Pools. Rewards Distributors are custom rules for additional incentives for Pools or other participants. It allows for customization and flexibility in incentivizing participation within the Synthetix ecosystem. [16]

v3 has the ability to accept SNX into a Pool, mint the newUSD stablecoin (also called snxUSD), and be traded to sETH on the Spot Market due to an agnostic Oracle Manager system. [16]

In July 2023, the protocol integrated the Chainlink Cross-Chain Interoperability Protocol (CCIP) into Synthetix V3. The initial integration of Chainlink CCIP enables V3 sUSD to move between Ethereum and Optimism but has been configured to allow transfers to any EVM-compatible chain if approved by the Synthetix Spartan council. [22]

Perps

Synthetix Perps is a decentralized perpetual trading protocol built on Optimism. It is designed to offer users an efficient trading experience with low fees. The platform provides the backend infrastructure that can be easily integrated by any protocol, such as Kwenta, Polynomial, and Decentrex. [17]

To minimize fees, risk, and increase scalability, Synthetix Perps utilizes a novel exchange engine to match traders with off-chain oracles provided by Pyth Network. It offers capital efficiency and leverage on more than 40 assets, allowing traders to use up to 50x leverage on positions. [17]

In August 2023, Synthetix announced the addition of Worldcoin (WLD) perpetual futures market for leverage trading via Synthetix Perps. [21]

Technology

Synthetix is composed of a smart contract infrastructure and a set of incentives that keep Synth prices. The value of the Synthetix Network Token (SNX) underpins that. SNX acts as collateral; mint Synths require the staking of a proportional value of SNX. Stakers are compensated with a pro-rata share of the fees created by operations inside the program to sustain the program. Therefore, the importance of SNX has a direct correlation to the use of the network it is collateralizing[5].

This mechanism allows Synthetix to support instantaneous, near-frictionless conversion between different Synths flavors without the liquidity and slippage problems that other decentralized exchanges experience. The resulting token network supports a wide range of use cases including trading, loans, transfers, remittances, eCommerce, and more. [5]

Synth Pegging Mechanism

The Synth peg is a system where traders require both liquidity and stability between Synths and other crypto assets to profit from the trading. Some Synths trade in the open market, so they can fall below par with the assets they are monitoring. Incentives are required to ensure minimal deviations from the peg and motivate actors to correct them. There are three methods to maintain the Synth peg, which include Arbitrage, the sETH liquidity pool on Uniswap, and the SNX auction. [1]

Synthetix Tokenomics

Synthetix was initially working on Havven stablecoin before pivoting to synthetic assets and their current model. Havven’s supply was 100 million, which converted 1:1 to SNX tokens. However, in 2018 it was decided that tokenomics would be changed. From March 2019 to August 2023, the total SNX supply increased from 100,000,000 to 260,263,816, with a weekly decay rate of 1.25%. After September 2023, there will be an annual 2.5% terminal inflation.[12]

Initial Coin Offering (ICO)

Synthetix's Initial Coin Offering was held between Feb. 26 and 28, 2018. The price of Synthetix during the ICO token sale was $0.67 per token and raised $5.3 million. [13]

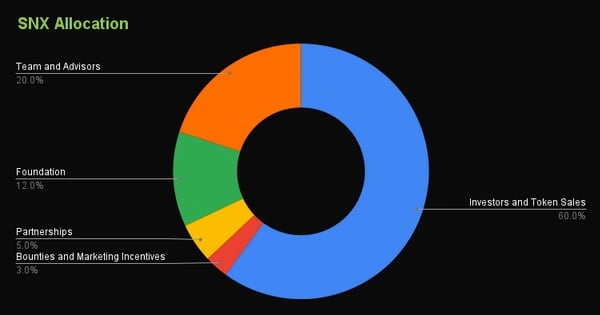

SNX Token Allocation

The allocation of the SNX token during its Initial Coin Offering (ICO) is as follows:

- 60.00% was allocated to Token sales and investors

- 20.00% was allocated to the Team and Advisors

- 12.00% was allocated to Foundation

- 5.00% was allocated to partnerships

- 3.00% was allocated to Bounties and Marketing Incentives [12]

Funding

In February 2021, Synthetix announced a successful fundraising round, securing $12 million in investments from venture capital firms including Coinbase Ventures, Paradigm, and IOSG. [4][19]

Arjun Balaji, Paradigm investment partner commented:

“We’re excited about supporting the SynthetixDAO as it builds the leading synthetic asset platform. Synthetix has one of the best communities in crypto and we’re glad to be a part of it. [4]

On March 16, 2023, DWF Labs, an investment firm and market maker, made a $15 million purchase of SNX, Synthetix's native token, with a $5 million further purchase planned. In order to increase Synthetix's trading volume, the perpetual futures product from Synthetix were incorporated into DWF Labs' trading operation. [15]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)