Subscribe to wiki

Share wiki

Bookmark

ZeroLiquid

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

ZeroLiquid

ZeroLiquid is a decentralized protocol that facilitates interest-free, non-liquidation loans. It allows users to utilize Liquid Staking Derivative (LSD) assets as collateral to secure loans. [1][2]

Overview

The ZeroLiquid protocol allows users to acquire self-repaying loans at 0% interest using LSD tokens, eliminating the risk of liquidation. [3]

In September 2023, ZeroLiquid integrated Rocket Pool’s rETH liquid staking token into their platform, allowing rETH holders to access self-repaying loans. These loans have a 0% interest rate and come with the assurance of no liquidation risk. Users can borrow up to 50% of their rETH token value, based on the loan-to-value ratio (LTV). [4]

In August 2023, the ZeroLiquid mainnet was officially launched. Previously, the team executed a claim of 113 ETH generated by the ZERO/ETH LP position on Uniswap V3 since its inception. Of this, 85 ETH was allocated to initiate a zETH/WETH liquidity pool on Curve. With the mainnet going live, a liquidity mining program was introduced for the community's participation. [5][6]

In July 2023, ZeroLiquid announced a partnership with Rocket Pool to support Rocket Pool’s rETH liquid staking token. This collaboration granted early access to self-repaying loans for the Rocket Pool community. [7]

The public testnet was live during June 2023. Bug bounties on Immunefi and Code4rena were opened. Users could deposit Goerli WETH or Goerli wstETH, take out loans, enable self-repayment of loans over time, repay loans early, and self-liquidate loans using the ZeroLiquid protocol. [8]

The ZeroLiquid testnet round 1 was live from May 16th to May 28th, 2023. During this period, testnet competitions were run to audit and internally test the protocol. Users could engage in the testnet by depositing Goerli WETH, taking out loans, enabling loans to self-repay, repaying loans ahead of schedule, and self-liquidating loans. Another round of testing was undergone before the launch of the open public testnet. [9][10]

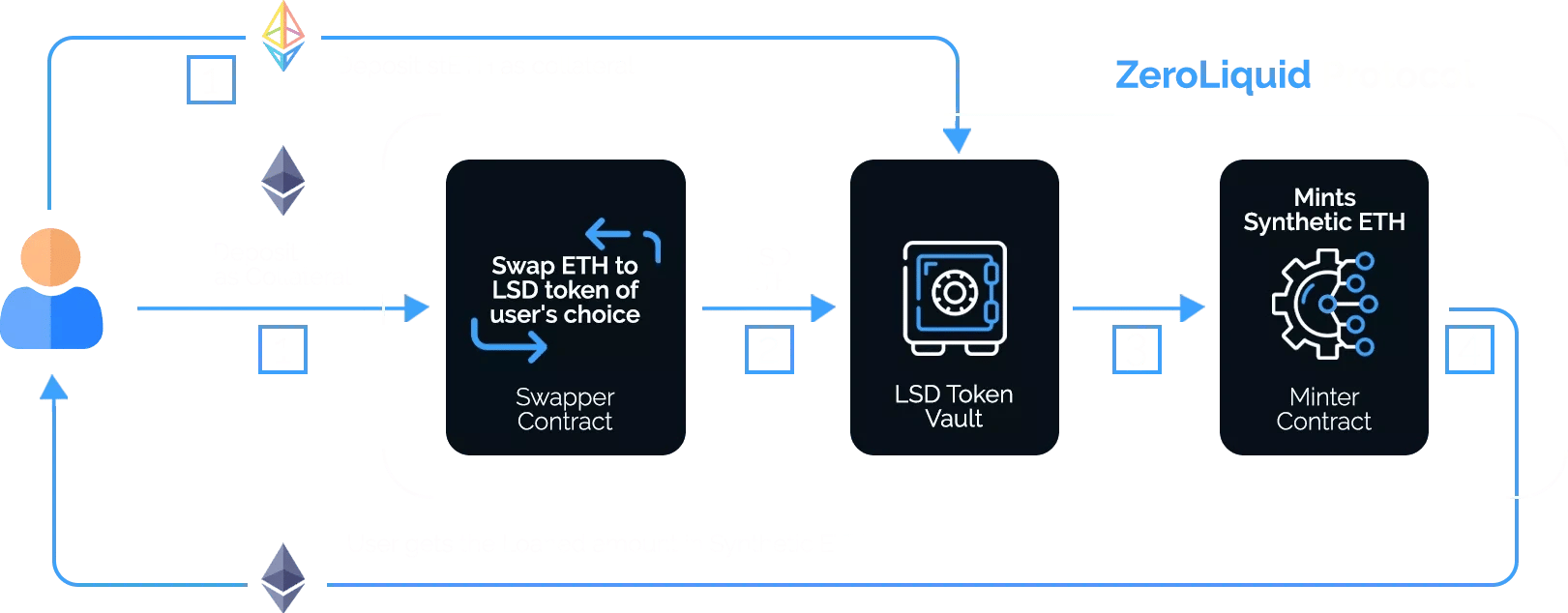

Architecture

ZeroLiquid allows users to deposit either an LSD token (like stETH) or ETH, which the protocol can convert into their preferred LSD token. They can then borrow up to 50% of their deposited assets in the form of zETH, a synthetic version of ETH. This zETH is tradable within ZeroLiquid's incentivized liquidity pools. Periodically, the protocol distributes staking rewards to users, reducing their outstanding debt. Users have the flexibility to repay their debt partially or in full at any time, using either the original LSD token or zETH as collateral. They also have the option to liquidate a portion or all of their collateral whenever they choose. [3]

Valve

The Valve is an internal mechanism that maintains the 1:1 peg between zETH and ETH. It allows any user, regardless of their loan position, to exchange zETH for ETH at a 1:1 ratio, which ensures that the value of zETH remains equivalent to that of ETH. In case the peg deviates, arbitrageurs can exploit the opportunity by obtaining zETH at a lower value and exchanging it back for ETH on the ZeroLiquid platform. [11]

Periodically, the yield generated from the LSD tokens deposited by users, after deducting a 5% protocol fee, is channeled into the Valve. This yield is then distributed proportionally to all the zETH submitted for swapping. When users claim or swap their ETH from the Valve pool, an equal amount of zETH is effectively removed from circulation (burned). [11]

ZERO token

ZERO token is the governance token for the ZeroLiquid protocol. Additionally, token stakers have the ability to claim a portion of the protocol's fees. [12]

Tokenomics

The ZERO token was launched on Uniswap on March 19, 2023, through a fair stealth launch. Initially, the maximum supply of ZERO was set at 100 million tokens. However, following approval from the community, a burn program was initiated. This program is designed to gradually reduce the total supply of ZERO over a period of 36 months. As a result, 69.420% of the total ZERO supply is scheduled to be burned, ultimately decreasing the total supply to 30.5 million tokens. This process is implemented gradually due to a vesting period associated with the burn program. [13][14][15]

Vesting

Development and Marketing

At the protocol's launch, 3% of the reserve tokens were made available. The rest are locked for three months and then distributed gradually over 30 months. These tokens are managed by the team for development, marketing, and other expenses to support the protocol's operations. [16]

Governance and Community Pool

All tokens in this reserve were initially locked for six months and then vest over a period of 30 months. The Community Pool is intended to finance projects and initiatives as determined by community or governance decisions. [16]

Staking, LP Incentives and Liquidity

Tokens from this reserve were locked for one month upon launch, with a vesting period of 30 months. Roughly 19% of the total token supply is allocated for future Liquidity Provider (LP) and Staking incentives. This allocation aims to ensure that LP incentives, generated from fees, will gradually cover the protocol's token emissions. [16]

Core Contributors

Tokens from this reserve were locked for one month at launch, and then gradually vested over a period of 30 months. About 19% of the total token supply is set aside for future Liquidity Provider (LP) and Staking incentives. This allocation is intended to allow LP incentives, generated from fees, to gradually cover the protocol's token emissions. [16]

ZERO Multisig

The ZERO multisig is managed by three core members. To process a transaction, it requires the approval of at least two out of the three designated signatures. Tokens from the vesting contracts will be directed to their corresponding multisig only if required. [16]

Tokens in this reserve were initially locked for one month after the launch and then vested over a 30-month period. Approximately 19% of the total token supply is reserved for future Liquidity Provider (LP) and Staking incentives. This allocation is designed to facilitate the gradual coverage of the protocol's token emissions through LP incentives generated from fees. [16]

ZERO Staking

Staking rewards are distributed in ETH, without any impact on the inflation of the ZERO token. [17]

Zero staking involves allocating 55% of the revenue generated by the ZeroLiquid protocol to stakers. This revenue includes the 5% fee directly earned by the protocol and profits from the protocol-owned Uniswap V3 ZERO/ETH liquidity position. Each month, the staking contract is replenished with ETH rewards, which are then distributed to stakers proportionally based on their share of the vault. The staking Annual Percentage Rate (APR) fluctuates based on factors such as the amount of ZERO staked, the price of ZERO, protocol revenue, and the price of ETH. [17]

Governance

ZeroLiquid's governance incentives community members to actively participate in shaping the project's future. They can propose improvements and share ideas through Discord. [18]

To submit a proposal, contributors can visit the designated governance section on Discord. If a proposal gains enough support, it will become an official proposal and undergo a community-wide vote. In recognition of community contributions, successful proposals will receive ZERO tokens. [18]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)