Subscribe to wiki

Share wiki

Bookmark

SingularityDAO

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

SingularityDAO

Singularity DAO is a DAO (Decentralized Autonomous Organization) overseeing DynaSets, dynamically managed sets of crypto assets, which are adjusted and optimized using AI algorithms. It integrates AI-based risk management from SingularityNET, a decentralized marketplace for AI collaboration.[1][2]

Overview

SingularityDAO was introduced on April 28, 2021, with Marcello Mari serving as CEO and co-founder, alongside Ben Goertzel, who is the CEO and co-founder of SingularityNET. SingularityDAO employs AI for portfolio management, efficient asset allocations, and liquidity provision on decentralized exchanges (DEXs). It fosters a new ecosystem of digital asset managers, aiming to enable automated trading strategies through AI-enhanced data analytics services. In 2022, LDA Capital committed funds to support SingularityNET and SingularityDAO, intending to accelerate their product roadmap. A $25 million commitment was secured, with a focus on integrating AI tools into decentralized finance (DeFi) and expanding the ecosystem.[1][2][11]

SingularityNET is a decentralized platform that allows anyone to create, share, and monetize AI services at scale. SingularityDAO is a separate entity within the SingularityNET ecosystem, focusing specifically on the financial applications of AI and blockchain technology. SingularityDAO leverages AI to manage decentralized finance (DeFi) operations and portfolios, providing AI-driven financial tools and services. It utilizes the AI expertise and technology developed by SingularityNET.[9]

DynaSets V1

SingularityDAO offered three primary DynaSets. "dynBTC" and "dynETH" provide exposure to Bitcoin and Ethereum with the added benefit of reduced fees. "dynDYDX" offers an innovative approach by enabling the Dynamic Asset Manager to utilize dYdX derivative solutions, enhancing the management of cryptocurrency assets. This dynamic framework offers users versatile and efficient options for cryptocurrency asset management within the SingularityDAO protocol.

A DynaSet within the SingularityDAO protocol is intended to function as a user-shared vault, to maximize portfolio returns through customized strategies. It primarily focuses on the rebalancing of assets, with plans to integrate yield optimization strategies and interactions with third-party protocols in the future. There are two sections: "Dynamic," which is envisioned to feature a dynamically managed set of assets, and "DynaLab," where users are invited to participate in beta testing. As of early 2024, SingularityDAO offers three DynaSets: dynBTC, dynETH, and dynDYDX.[2][4][6][12]

DynaSets V1 Process

In the initial Launch Phase, users contribute funds to the Forge akin to bonded staking, and after the window, the Forge consolidates tokens into weighted assets, marking the start of DynaSet trading. The subsequent Trade Execution Layer involves the Dynamic Asset Manager monitoring prices and executing trades based on predefined criteria, utilizing smart contracts for analysis. This leads to the Contribution Phase, where users stake tokens in the Forge during a rolling entry window, incurring Performance and Management fees upon completion. The DynaSet protocol encompasses key phases, with users contributing tokens during the Contribution phase to match DynaSet weight and mint LP tokens. The subsequent Trading Window involves LP token allocation and rebalancing by the Dynamic Asset Manager through a chosen Decentralized Exchange Aggregator. The Redeem function allows users to burn LP tokens for underlying assets, and periodic fees, covering management and performance fees, occur during DynaSet's trading window, distributed among the DAM and DAO participants. Users interested in the DAO can stake SDAO tokens within the platform.[12][4]

SingularityDAO Pv2

DynaVaults

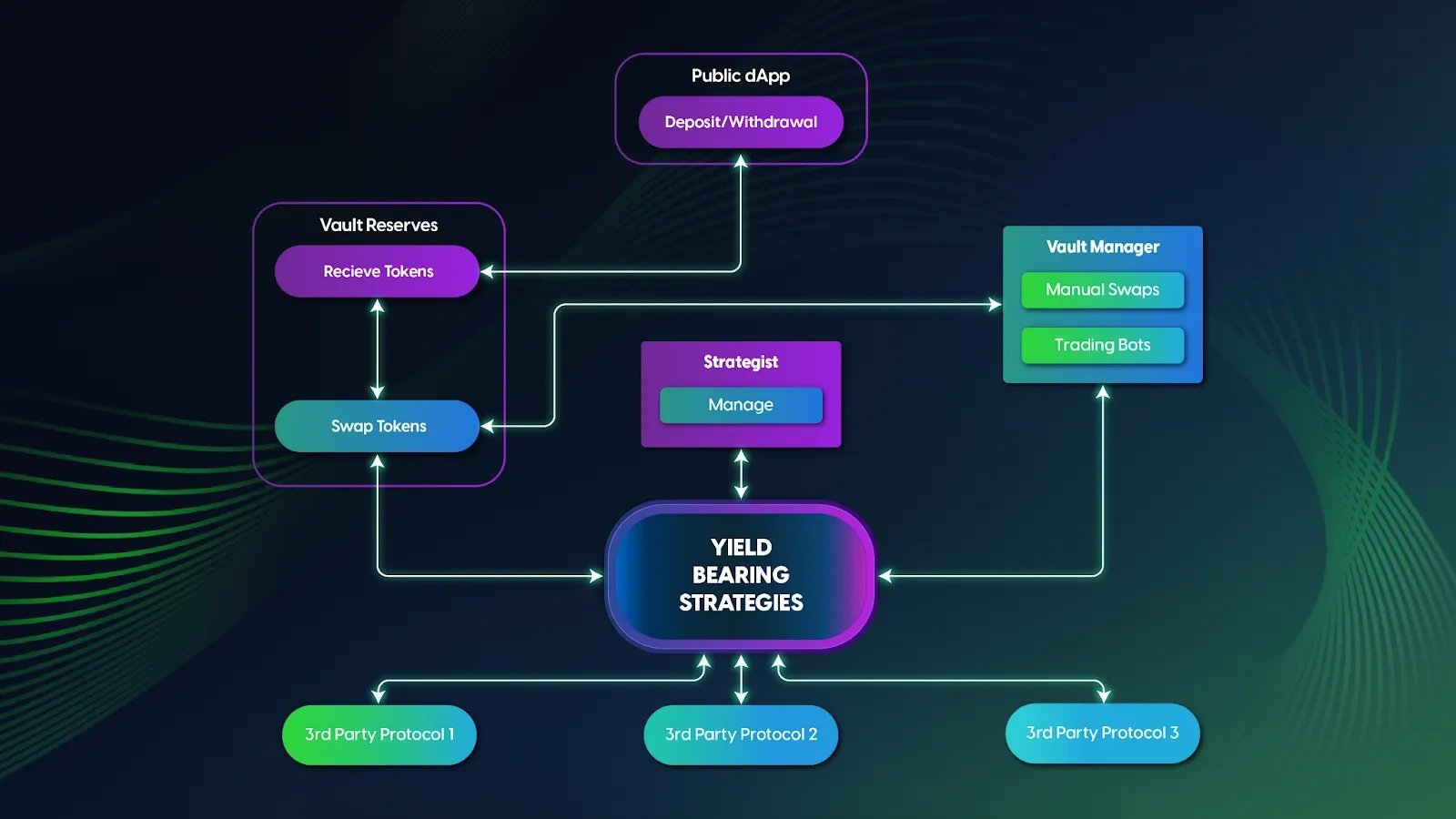

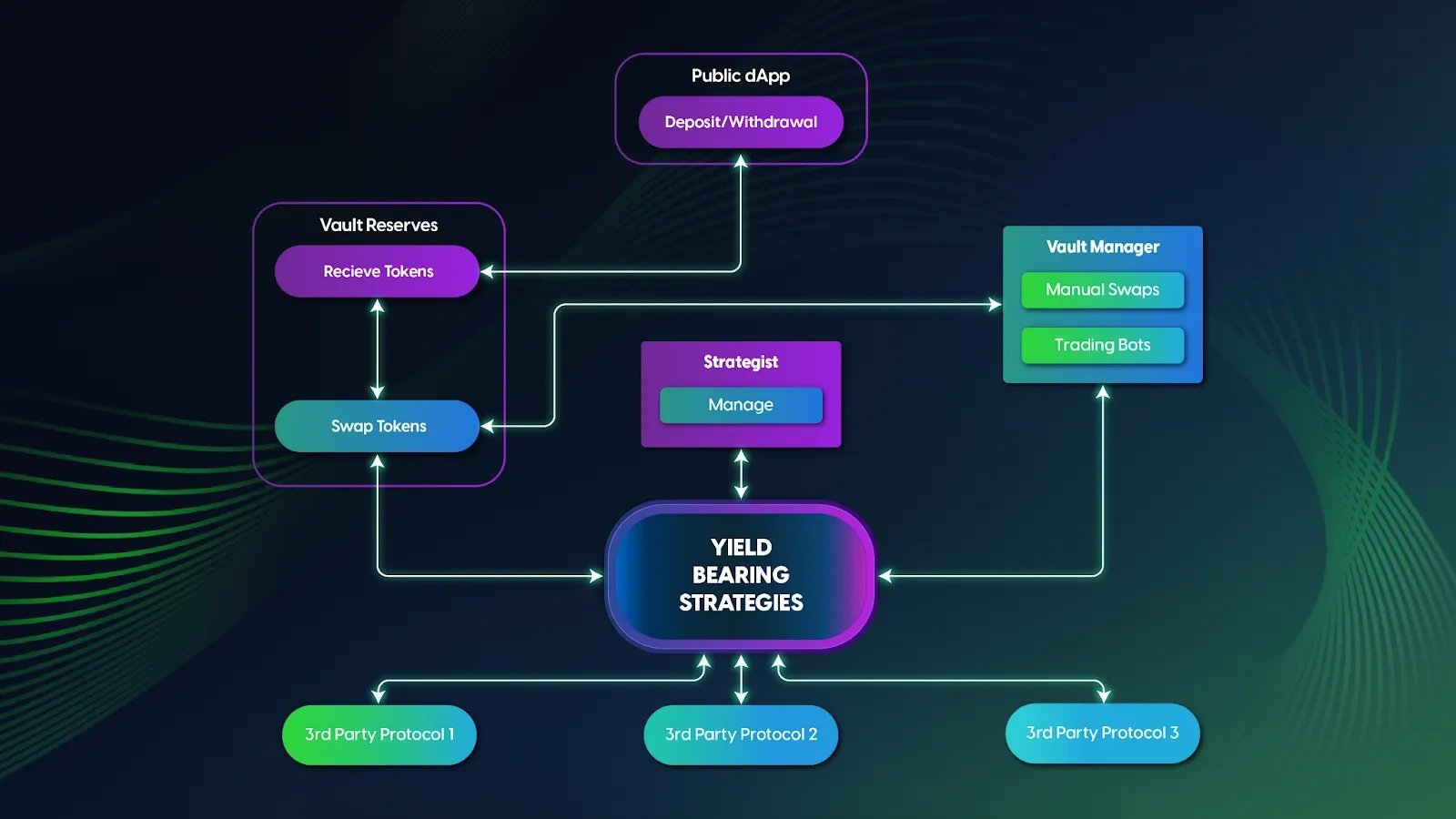

Within SingularityDAO's Pv2 framework, DynaVaults aim to function as advanced asset management systems driven by AI and machine learning models. The shift from static DynaSets to dynamic DynaVaults is intended to enhance their potential for executing strategies guided by AI. These vaults are designed to accommodate diverse assets and multiple strategies, utilizing signals from SingularityDAO's AI models, including price, volume, risk predictions, and sentiment analysis. To be flexible, DynaVaults allocate assets to impactful strategies without imposing limitations on 24/7 deposit/withdrawal activities. The generated yield across strategies is intended to be distributed to users based on their LP token holdings. Each DynaVault is assigned a vault manager, to avoid capital and risk management following community-approved guidelines.[13]

Predefined Dynavaults

In SingularityDAO Pv2, predefined DynaVaults, like dynETH and dynBTC on the Ethereum chain, aim to implement strategies such as spot trading and yield-bearing within the long-only category. For instance, dynETH endeavors to hold $ETH and stake during bullish markets, while diversifying into stable strategies like $USDC and Aave during bearish markets. The dynBNB DynaVault on the BNB chain utilizes $WBNB, aiming to employ similar strategies within the long-only category. dynL1BNB operates intending to serve as an auto-rebalanced index basket of L1 tokens, and dynSING focuses on SingularityNET ecosystem tokens, both incorporating spot trading, yield-bearing, and periodic rebalancing.[14]

Strategies

Strategies

SingularityDAO employs smart contracts, known as Strategies, linked to DynaVaults for asset allocation. These Strategies proposed and managed by individuals or AI agents, automate execution once assets are deposited into a DynaVault. They engage with financial instruments such as farming pools, lending protocols, and trading positions based on market conditions and risk tolerance.

DynaVaults' operation hinges on these Strategies, providing flexibility in asset management. The process involves proposing, passing a technical audit, obtaining community approval, and integration into DynaVault. Deposited assets are then distributed to one or more strategy contracts, monitored by vault managers for optimal returns.

Strategies in SingularityDAO fall into Functional Strategies and Vault Rebalancing Strategies. The former, like Yield Bearing and Derivatives Strategies, maximize vault capital. Vault Rebalancing Strategies, such as Long Only Automation and Complex Quantitative Automation, automate rebalancing logic based on specific events. SingularityDAO is developing a Risk Engine to enhance these strategies, automatically triggering exits in response to predefined risk events on the blockchain, including changes in exit liquidity and drastic price variations.[13][14]

LayerZero Bridge

SingularityDAO has integrated the LayerZero protocol to enhance cross-chain communication. Unlike traditional bridges, LayerZero functions as a foundational layer, facilitating connections between diverse chains, and aligning with principles of decentralization and security. This integration introduces Omnichain Fungible Tokens (OFTs) within DynaVaults, with the intended purpose of allowing users to engage in activities like lending, borrowing, trading, and staking assets across multiple chains. The LayerZero Bridge aims to simplify the process of moving assets across chains, providing users with a more direct and streamlined experience within the LayerZero ecosystem.[15]

Tokenomics

SingularityDAO operates as a decentralized autonomous organization (DAO), governed by the SDAO token, an ERC-20 utility token on the Ethereum blockchain. SDAO token holders have the right to participate in governance voting events within the SingularityDAO protocol.

SingularityDAO's token allocation is distributed across various rounds and categories:

- Seed Round: Priced at $0.15, raising $500K, with a total valuation of $15M. Tokens are subject to a vesting period of 20.0%, released monthly at a rate of 6.67%.

- Private Round: Valued at $0.2, this round raised $2.26M, with a total valuation of $20M. Similar to the Seed Round, tokens undergo a vesting period of 20.0%, with a monthly release of 6.67%.

- Public Round: Priced at $0.3, this round raised $400K, resulting in a $30M valuation. All tokens from the Public Round are fully unlocked.

- Community Round: With a price of $0.2, this round raised $1.61M, contributing to a $20M valuation. Tokens are subject to a vesting period of 20.0%, released monthly at a rate of 6.67%.

- Team & Advisors: Tokens allocated to the team and advisors have no vesting period at the time of the token generation event (TGE), with a monthly release of 4.17%.

- Airdrops: Representing 25.0% at TGE, with a 2.08% monthly release.

- Rewards: Tokens for rewards have an 8.33% allocation at TGE, featuring a 9-day cliff and an 8.33% monthly release.

- Foundation: Allocated tokens have no vesting period at TGE, with a 2.78% monthly release.

- Farming: Accounting for 2.5% at TGE, tokens undergo a 4-day cliff, followed by a 24.4% monthly release.

- Ecosystem: Tokens for the ecosystem have no vesting period at TGE, with an 8.33% monthly release after a 12-month cliff.[2][8]

Governance

SingularityDAO relies on decentralized governance, fostering an inclusive environment for community participation. Using the SingularityDAO governance token (SDAO), community members can engage in discussions, provide input, and vote on protocol-related proposals.

Proposals are introduced and discussed within the DAO, with discussions conducted on the SingularityDAO Discord and Forum. Voting on proposals follows, and SDAO token holders are entitled to participate, regardless of their storage methods or blockchain network. The use of Snapshot, an off-chain multi-governance client, ensures transparency and verifiability in SingularityDAO Governance Votes. The protocol is committed to a gradual transition towards decentralization, allowing external developers to propose upgrades. The long-term goal is to transfer full control of the protocol to the DAO, a process that will be managed with active community input and any necessary adjustments addressed through governance proposals.[10]

Partnerships

Chainlink Labs

SingularityDAO established a partnership with Chainlink Labs, aiming to offer Chainlink BUILD members enhanced opportunities through its launchpad and incubation services. SingularityDAO, recognized for its decentralized AI-driven crypto asset management, seeks to support emerging blockchain projects via its Incubation program. This collaboration intends to provide developers in the BUILD program with favorable conditions for creating innovative Web3 applications. Chainlink, serving as a decentralized computing platform, has played a significant role in facilitating transactions in the industry. [16]

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)