Subscribe to wiki

Share wiki

Bookmark

DeSyn Protocol

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)

0%

DeSyn Protocol

DeSyn Protocol is a decentralized liquidity infrastructure on Web3 designed to facilitate collaborative investment, development, and management for investors, projects, and security firms. It provides open, transparent, and efficient asset management solutions, enabling pool managers to handle all stages of fund operations, from creation and fundraising to management and exit. [1]

Overview

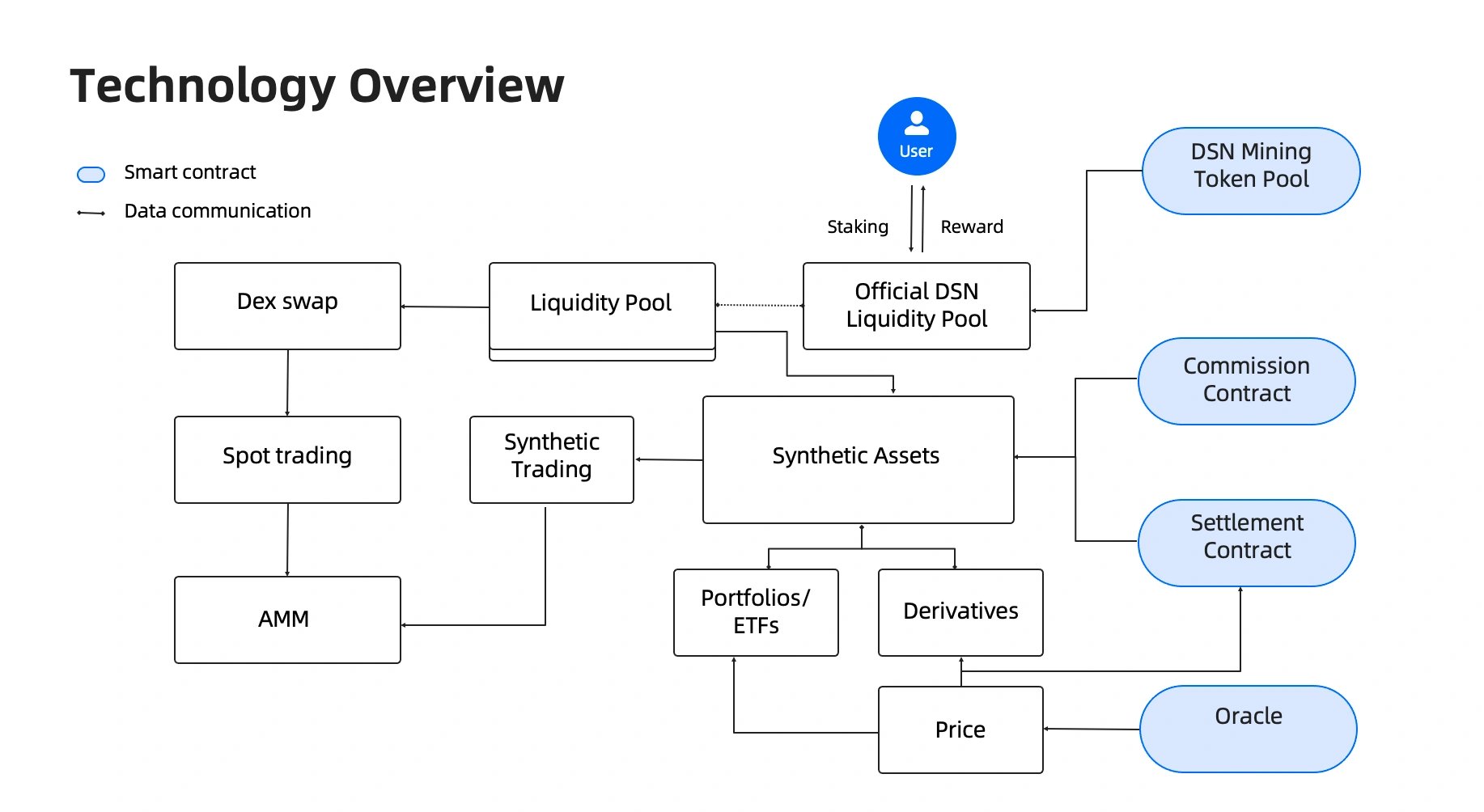

The DeSyn Protocol facilitates the creation, management, and trading of decentralized finance derivatives like ETFs and portfolios through smart contracts based on custom liquidity pools. Its core components include tools for managing ETFs and portfolios and offering functions such as creation, rebalancing, and redemption. Trading features integrate decentralized exchange (DEX) liquidity to enhance flexibility and support for transactions between ETFs, portfolios, and tokens in secondary markets.

The protocol also incorporates a price oracle using data from sources like Chainlink and major DEXs to provide pricing and settlement services. Settlement functionalities manage withdrawals and commissions via contracts on the Ethereum network. DSN tokens enable platform governance and transaction payments, supporting liquidity and mining operations within the protocol. [2]

Features

Smart Pool

DeSyn incorporates Smart Pools, which are smart contract-controlled pools capable of emulating finalized pools while enabling dynamic adjustments to balances, weights, and fees. These pools are created using factory contracts, allowing users to deploy new pool contracts by invoking creation methods on the factories. Deploying a Core Pool directly grants the user control over that pool, whereas deploying a Smart Pool involves linking it to a factory address. In this setup, the user controls the Smart Pool, while the Smart Pool governs the Core Pool, enabling advanced and flexible pool management. [2]

Products

Open-end ETF

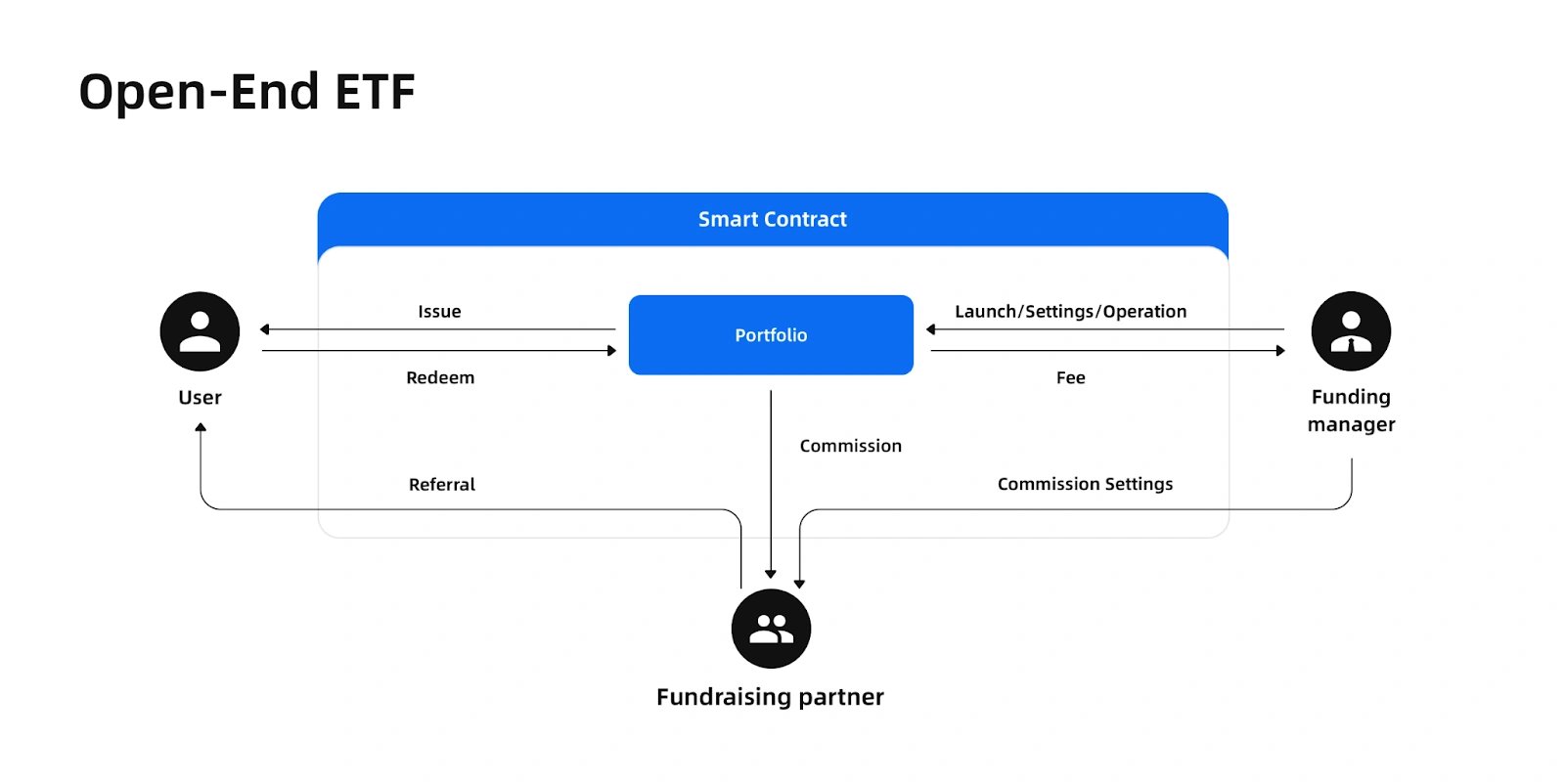

Open-end ETFs are designed for index-based strategies, allowing pool managers to allocate digital assets proportionally to build or track specific indices or sectors. Users can issue and redeem pool shares without restrictions. If they lack the necessary assets, they can use tokens like USDC or WBTC for intelligent issuance, with the contract optimizing exchange rates via platforms like Uni V2, V3, or 1inch to acquire target assets.

Fundraising partners can earn commissions through referral programs without time constraints, utilizing tools like "One-click forwarding" to share referral links. Commissions can be tracked and claimed at any time. When launching the pool, pool managers set parameters such as fees, commissions, and access permissions. Fee and commission distribution is automated via smart contracts, and managers cannot directly transfer assets from the protocol. [3]

soETH

The Semi Open-end 3x ETH Staking ETF (soETH) employs a leveraged liquidity staking strategy to enhance ETH staking returns while providing limited access to funds for three days each month (on the 5th, 15th, and 25th). This approach balances yield potential with liquidity management.

The fund utilizes DeSyn's decentralized asset management framework to implement leverage strategies, optimizing stETH returns while mitigating transaction costs and minimizing risks tied to liquidating AAVE-collateralized debt. It relies on interest rate differences between staking and borrowing ETH to manage systematic leverage risk.

Designed for affordability, soETH features low management and transaction fees. It aims to deliver returns significantly higher than direct Ethereum staking, supported by systematic monitoring and operational management. [4]

Closed-end Fund

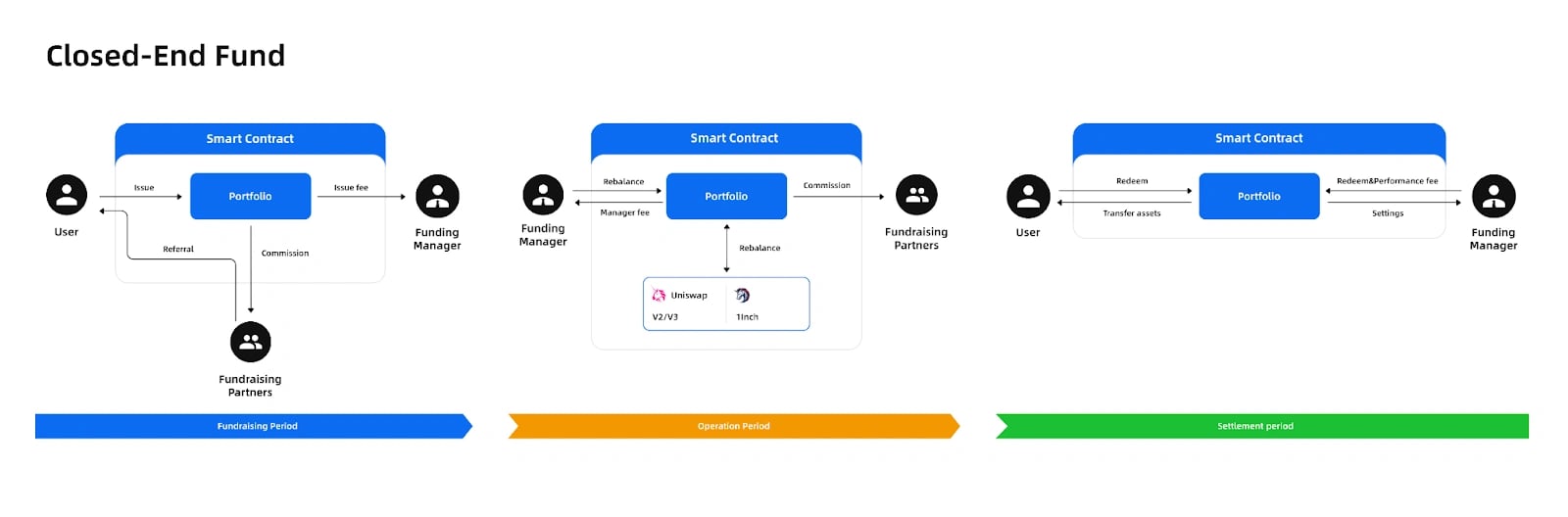

Closed-end funds are designed for implementing complex investment strategies through a three-step process: fundraising, operation, and settlement. Users can issue pool shares during fundraising but cannot withdraw them. The pool manager collects issuance fees, and fundraising partners participate in referral programs to assist with reaching fundraising goals, earning commissions pre-defined in the smart contract.

Once the fundraising goal is met, the operation phase begins. Users cannot issue or withdraw shares, and fundraising partners stop promoting but continue to receive commissions. The pool manager can only adjust the pool's position without transferring or withdrawing assets. Users can withdraw their pool shares in the settlement phase, receiving principal and interest. The protocol automatically allocates redemption fees between the pool manager and fundraising partners based on pre-determined ratios in the smart contract. [5]

erETH Fund

The erETH Fund enhances Ethereum restaking returns by integrating multiple Layered Restaking Token (LRT) protocols, including Eigenlayer, Ether.fi, and DeSyn. It combines staking and restaking yields, airdrops, and protocol-specific rewards to provide a comprehensive return strategy. The fund operates on an open-end model, enabling flexible issuance and redemption, and ensures asset security through DeSyn's decentralized management infrastructure. [6]

oSTBT

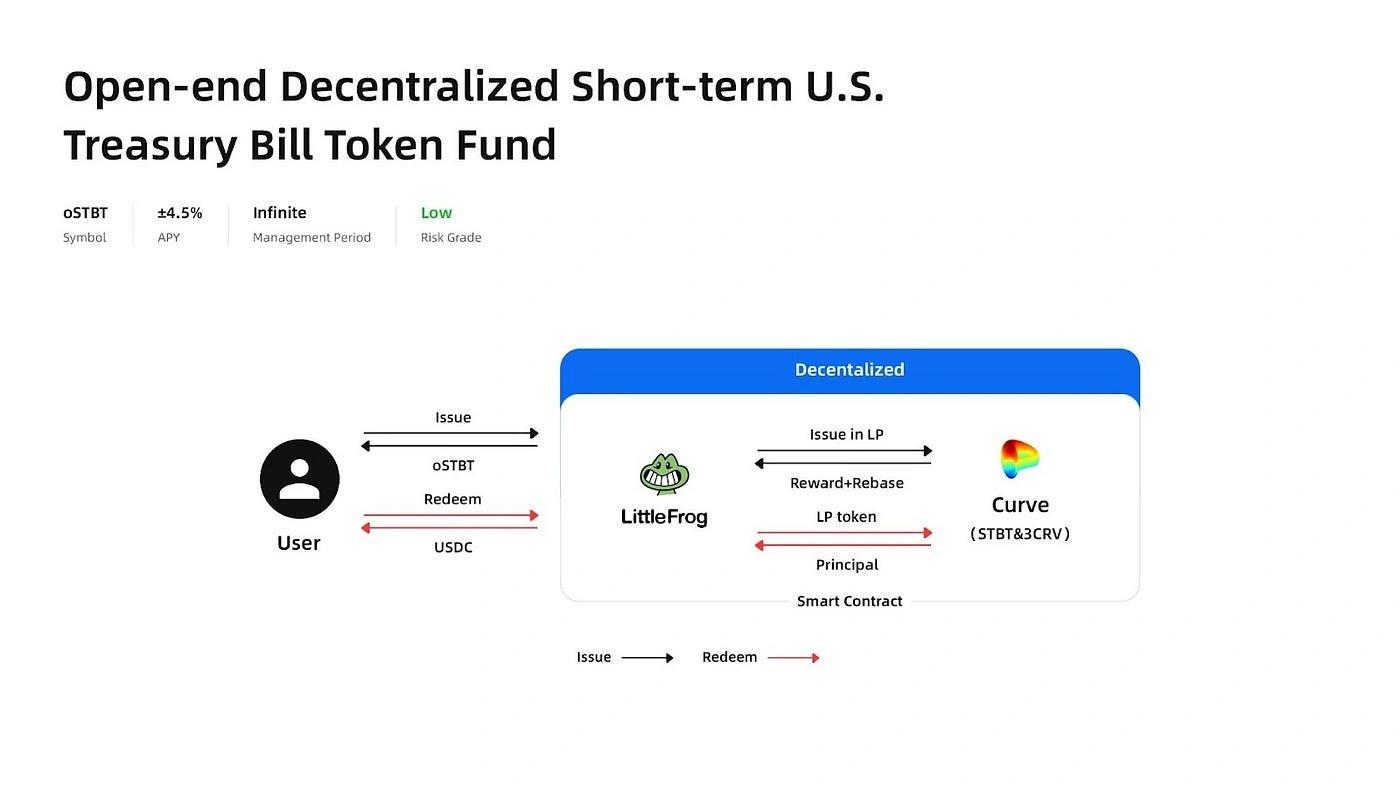

The RWA Fund oSTBT is an open-end decentralized fund based on the short-term US Treasury Bill token (STBT), allowing investors to deposit or withdraw anytime. Designed to offer stable and secure investment opportunities, it provides access to US Treasury bills with low risk, consistent returns estimated at over 4.5% APR, and high liquidity while prioritizing transparency and efficiency in fund management. [7]

dSTBT

The decentralized short-term U.S. Treasury Bill token fund (dSTBT) is a closed-end fund managed by Little Frog, a decentralized asset management DAO. It is based on the short-term Treasury Bill token (STBT), which adheres to the ERC 1400 standard and represents U.S. Treasury securities with low-risk yields. Each STBT token is pegged 1:1 with the U.S. dollar equivalent in stablecoin, backed by Treasury bills with maturities of six months or less and reverse repurchase agreements fully collateralized by U.S. government-backed securities.

Little Frog utilizes the DeSyn platform's decentralized smart contracts to create and manage funds, ensuring transparency, security, and accessibility. The fund features no minimum investment threshold, low fees, and real-time on-chain transaction monitoring. Its underlying assets, supplied by Matrixport, are backed by U.S. Treasury bills, offering investors a secure and transparent investment avenue. [8]

DIY Product

DIY products are tailored for advanced strategies and are designed for professional individuals or asset management institutions. Users can reference DeSyn’s interface documentation or consult the team to create products incorporating various DeFi strategies with complex calculations. The platform supports the development of customized strategy products, enabling pool managers to align offerings with their specific trading strategies. [9]

SLP Model Launchpad

The SLP Model Launchpad is designed to provide users with an open, transparent, and automated platform. It allows participants to access and manage multiple DeFi strategies while engaging with a centralized framework. The model integrates various DeFi strategies and opportunities in one system, offering a streamlined approach for users to pursue diverse financial goals efficiently. The three SLP Model products cater to varying risk tolerances and investment strategies: [10]

The Simple Deposit Product targets low-risk investors by allowing direct asset deposits on DeSyn’s platform, focusing on stable returns through Layer-1 reward tokens and airdrops from DeSyn, new chains, and partners, without involving other DeFi protocols.

The Liquid Pool Product suits medium-risk investors, deploying assets across DeFi platforms like DEXs and lending protocols, integrating strategies such as leveraged staking and restaking while maximizing rewards through ecosystem and protocol airdrops.

The Basis Trading Product emphasizes stability, combining structured basis trading on Binance with on-chain airdrops for predictable, low-volatility returns suitable for risk-averse participants.

SDT Model

The SDT Model introduces a decentralized approach to pool management, emphasizing safety, efficiency, and simplicity. This system automates the management process, reducing complexity for users while maintaining decentralized oversight. By utilizing the SDT Model, investors can engage with pool management in a streamlined manner, relying on an automated framework that prioritizes asset security and operational efficiency. [10]

Team Battle

The Team Battle feature within the SLP Model allows diverse entities such as fundraising teams, marketing firms, and security organizations to engage in farming campaigns through collaborative efforts. This structure encourages joint participation and resource pooling, enhancing opportunities within the DeFi ecosystem. By fostering collaboration, Team Battle enables participants to combine expertise and resources, creating a more dynamic and interconnected approach to achieving mutual goals in decentralized finance. [10]

Funding

First Round

In a July 2022 funding round, DeSyn Protocol secured $1.4 million in financing. The first round was led by Fenbushi Capital, SNZ Capital, Everest Ventures Group, Incuba Alpha, Bing Ventures, Lancer Capital, and TKX Capital, with participation from prominent individual investors in the crypto industry. [11]

Second Round

DeSyn Protocol completed its second fundraising round, raising over $5M. The project aimed to develop a new generation of DeFi derivatives protocols, enabling secure, transparent, and cost-effective creation and trading of financial products such as ETFs and portfolios. The fundraising involved various capital funds, including TPS Capital, LD Capital, Spark Digital Capital, Mentha Partners, Kosmos Ventures, Asymmetries Technologies, PAKA, Outliers Fund, CoinSummer, Consensus Lab, AZDAG, LucidBlue Ventures, Westlabs, Chiron Partners, Zonff Partners, TGE Capital, JDAC Capital, Ticker Capital, CatcherVC, EVG, TKX, Lancer Capital, TokenInsight Research, and A+CAPITAL. Exchange funds included OKX Blockdream Ventures, MEXC, Mirana Ventures, BitMart & Cipholio Ventures, and Bibox, while public chain funds included TRON and NEO ECOFUND. Individual investors included Joseph Eagan (co-founder and CEO of Acme Crypto Holding and former president of Polychain Capital) and Jeff Pan. [12]

Partnerships

AILayer

Avalon

IONIC

UniRouter

B2 Network

zkLink

Allora

Babylon

UXLINK

Eigenpie

Safeheron

Meta Trust Labs

VIP3

Halo Wallet

Realtize

See something wrong?

The Agent Tokenization Platform (ATP):Build autonomous agents with the Agent Development Kit (ADK)